Sample Letter To Irs For Correction In King

Description

Form popularity

FAQ

Your audit reconsideration letter should: Say that it is an audit reconsideration request. Identify the taxpayer, the tax period(s), the type of tax (such as income tax), and, if available, the name and contact information for the IRS auditor who previously worked the case. Explain the circumstances for the audit,

Visit the IRS contact page to get help using online tools and resources. Or: For individual tax returns, call 1-800-829-1040, 7 AM - 7 PM Monday through Friday local time.

Taxpayers may need to file an amended return if they filed with missing or incorrect info. If they receive the missing or corrected Form W-2 or Form 1099-R after filing their return and the information differs from their previous estimate, they must file Form 1040-X, Amended U.S. Individual Income Tax Return.

Sample Letter to the IRS Dear Sir/Madam, I am writing to request a correction to my tax return. My social security number is 123-45-6789, and I filed my tax return for the 2020 tax year. I received a notice from the IRS stating that I owe additional taxes due to an error in my return.

IRS mismatches often occur due to discrepancies between your tax return and IRS records, potentially caused by outdated personal information, transcription errors, or third-party mistakes. Resolving a mismatch requires reviewing your information, correcting any mistakes, and possibly filing an amended return.

What do I need to know? If you realize there was a mistake on your return, you can amend it using Form 1040-X, Amended U.S. Individual Income Tax Return. For example, a change to your filing status, income, deductions, credits, or tax liability means you need to amend your return.

Use Form 1040-X, Amended U.S. Individual Income Tax Return, and follow the instructions. You should amend your return if you reported certain items incorrectly on the original return, such as filing status, dependents, total income, deductions or credits.

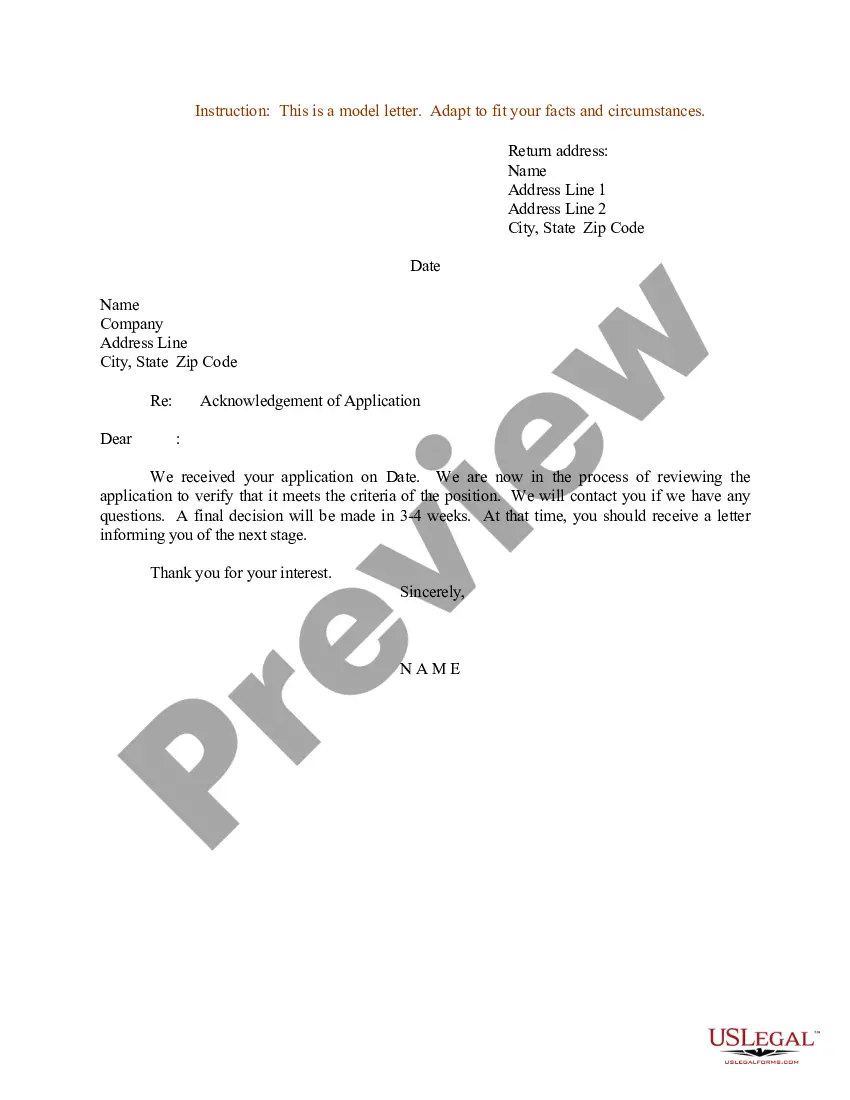

Elements: full mailing address of the sender. date on which letter is written. address of person to whom letter is addressed. subject line. salutation. body (the main message) complimentary closing. signature line (be sure to sign your letter)

Steps Format a business letter. Add the IRS address. Include your personal information. Insert your salutation. Include a copy of the notice you received from the IRS. Identify the information you are providing. Close the letter on a friendly note. Identify any enclosures.