Form Assignment Accounts With No Fees In Texas

Description

Form popularity

FAQ

In Texas, an individual who is not a certified public accountant (CPA) can own a CPA firm, but there are some restrictions and requirements that must be followed. ing to Texas Code 513.11, only a licensed CPA can sign or issue a report on a financial statement, with certain exceptions.

One of the benefits of starting an accounting firm is flexibility. So, the simple answer is yes — many accountants can and do work from a home office.

A firm that will be practicing public accountancy in the State of Texas as a limited liability company (LLC) must register with the Board unless the firm is an out-of-state firm that meets the requirements of Section 901.461 of the Public Accountancy Act (effective September 1, 2007).

Yes, a CPA can act as a registered agent for your finances.

Q. Does tax return preparation require a CPA license? A. You do not need to be a CPA to prepare tax returns; however, if you are a CPA you must have a current license to practice.

In addition, most states allow CPAs to assist clients in forming LLCs and do not require owners to use an attorney for business formation or compliance documents. However, CPAs cannot provide legal advice unless they are also a licensed attorney. Doing so could result in regulatory or legal consequences.

Can Form 05-102, Public Information Report, be electronically filed separately for a Texas Franchise Tax return in CCH Axcess™ Tax or CCH® ProSystem fx® Tax? For REPORT YEARS 2023 and prior, the Form 05-102 can only be e-filed as part of the Texas Franchise Tax return.

Can Form 05-102, Public Information Report, be electronically filed separately for a Texas Franchise Tax return in CCH Axcess™ Tax or CCH® ProSystem fx® Tax? For REPORT YEARS 2023 and prior, the Form 05-102 can only be e-filed as part of the Texas Franchise Tax return.

Amending a Return Follow the instructions on the form used to file the original return. Write "Amended Return" on the top of the form. You can also electronically file an amended return, even if it reduces the tax due of the original return filed. Additional documentation may be requested to validate your request.

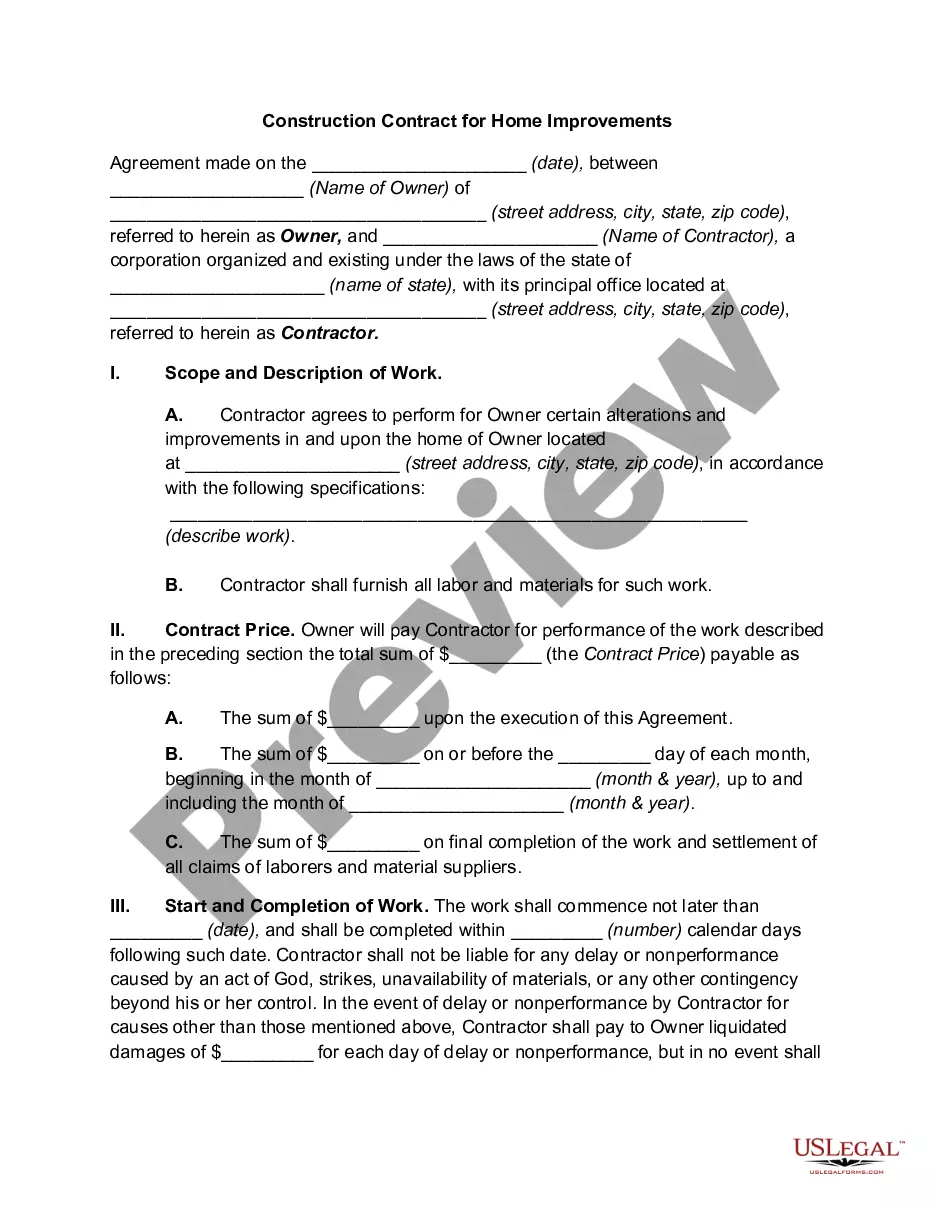

An assignment will generally be permitted under the law unless there is an express prohibition against assignment in the underlying contract. The assignor does not need the consent of the seller but will need to notify the seller of their intent to assign the contract.