In equity sharing both parties benefit from the relationship. Equity sharing, also known as housing equity partnership (HEP), gives a person the opportunity to purchase a home even if he cannot afford a mortgage on the whole of the current value. Often the remaining share is held by the house builder, property owner or a housing association. Both parties receive tax benefits. Another advantage is the return on investment for the investor, while for the occupier a home becomes readily available even when funds are insufficient.

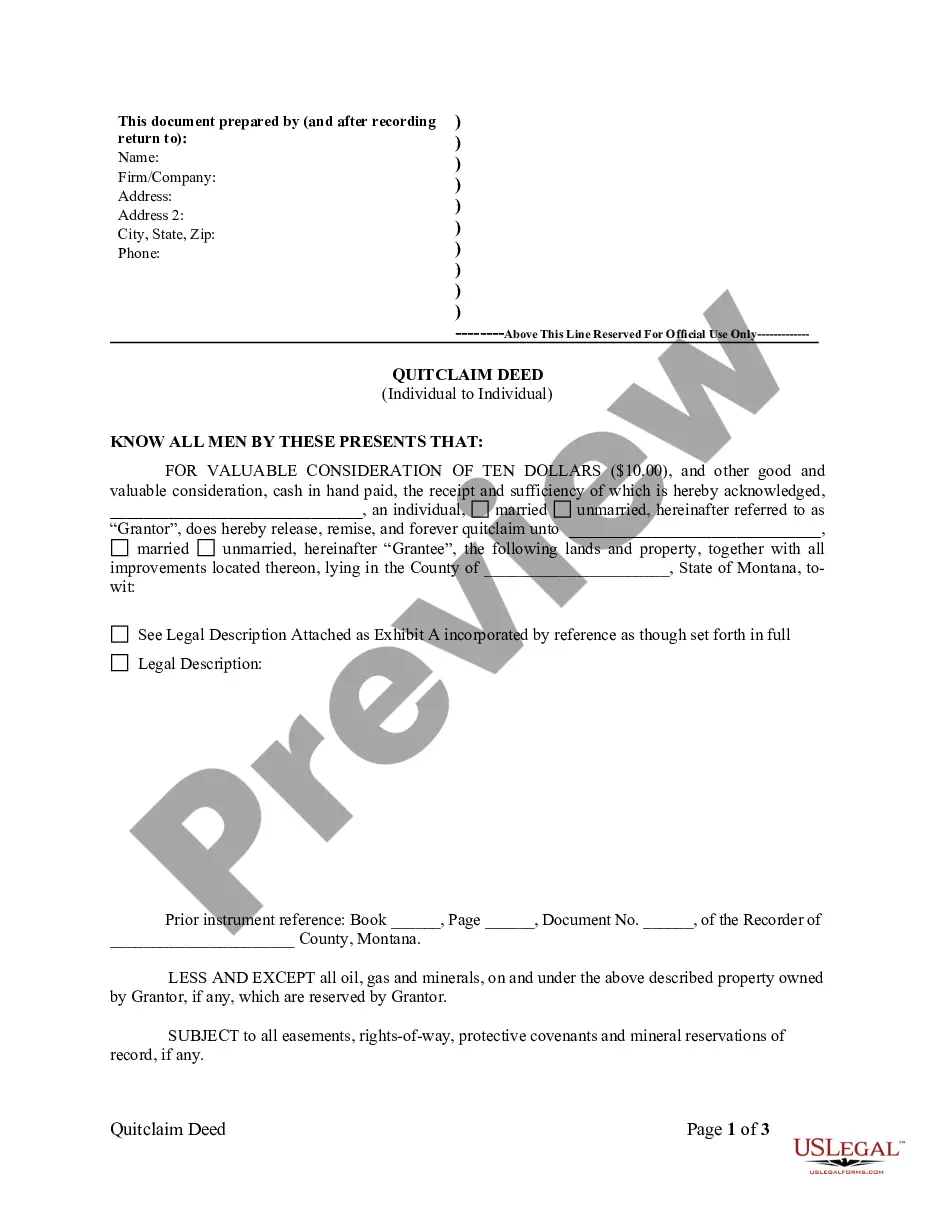

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Equity split agreement templates for real estate are legal documents that outline the distribution of ownership interests and profits among individuals or entities investing in a real estate project. These templates are designed to ensure fair and transparent arrangements while clearly defining the rights and responsibilities of each party involved in the property investment. The primary purpose of an equity split agreement template is to establish the percentage or proportion of equity held by each investor. This allocation generally reflects the contributions made by each party, whether in the form of capital investment, management expertise, or other resources. It also outlines the procedures for distributing profits, handling expenses, and resolving conflicts. There are several types of equity split agreement templates that can be tailored to suit various real estate investment scenarios. Some common types include: 1. Traditional Equity Split Agreement: This standard template allocates equity based on the proportion of the capital investment made by each party. For instance, if one investor contributes 60% of the total capital and another invests 40%, the template will outline a 60-40 equity split. 2. Sweat Equity Split Agreement: This template is suitable when one party — typically a developecontractto— - contributes expertise, labor, or services in lieu of capital investment. In such cases, the template determines how much equity should be allocated to the party providing "sweat equity" based on the value of their contributions. 3. Preferred Return Equity Split Agreement: This type of template prioritizes the return of capital to certain investors before others can receive their share of profits. Preferred return investors are entitled to receive their investment back with a predetermined rate of return before any profits are distributed to other equity holders. 4. Waterfall Equity Split Agreement: Primarily used in complex real estate deals with multiple investors or multiple tiers of returns, this template outlines a specific order of priority for the distribution of profits. It determines the sequence in which different parties will receive their respective shares of profits, considering various criteria such as preferred returns, capital return, and profit splits. These are just a few examples of the types of equity split agreement templates for real estate. It's important to remember that each agreement should be customized to meet the unique requirements and circumstances of the specific real estate project and the parties involved. Seeking legal advice is highly recommended ensuring compliance with local laws and regulations.