Simple Cost Sharing Agreement Withholding Tax In Allegheny

Description

Form popularity

FAQ

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).

Assets owned jointly between spouses, such as joint bank accounts and real estate owned jointly with right of survivorship, are not subject to Pennsylvania inheritance tax. Additionally, there is no need to even report property owned jointly between spouses on the Pennsylvania inheritance tax return.

The personal representative (executor or administrator) appointed by the Director of the Department of Court Records is responsible for filing the inheritance tax return.

Employers with worksites located in Pennsylvania, including residences of home-based employees, are required to withhold and remit the local EIT and LST for employees.

Pennsylvania income tax is required to be withheld at a rate of 3.07% on payments reported on a Form 1099-NEC of Pennsylvania source non-employee compensation or business income to a non-resident individual or a single member LLC with a nonresident owner.

You may have to report compensation on line 1a of Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors and capital gain or loss on Schedule D (Form 1040), Capital Gains and Losses and Form 8949, Sales and Other Dispositions of Capital Assets when you sell the stock.

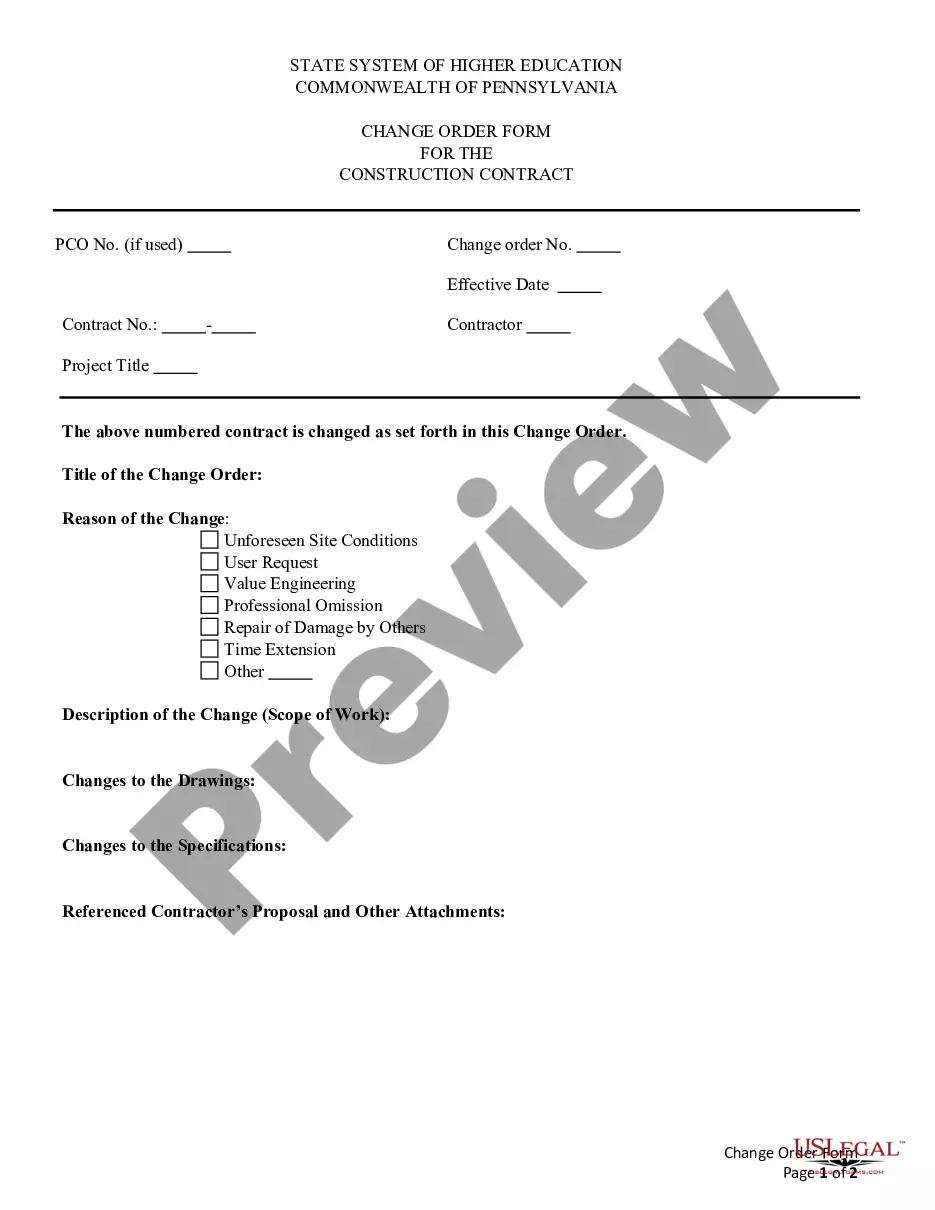

Governmental payors, including the Pennsylvania State System of Higher Education and its institutions, are exempt from the requirement of withholding on non-employee compensation and business income.

Form 8949 tells the IRS all of the details about each stock trade you make during the year, not just the total gain or loss that you report on Schedule D.

You may have to report compensation on line 1a of Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors and capital gain or loss on Schedule D (Form 1040), Capital Gains and Losses and Form 8949, Sales and Other Dispositions of Capital Assets when you sell the stock.

For more information on how to apply for a CWA, see Form 13930. A Central Withholding Agreement (CWA) is a tool that can help entertainers and athletes who don't live in the United States (U.S.) but who do plan to work here. A CWA is an agreement to have U.S. income tax withheld based on the non-resident's income.