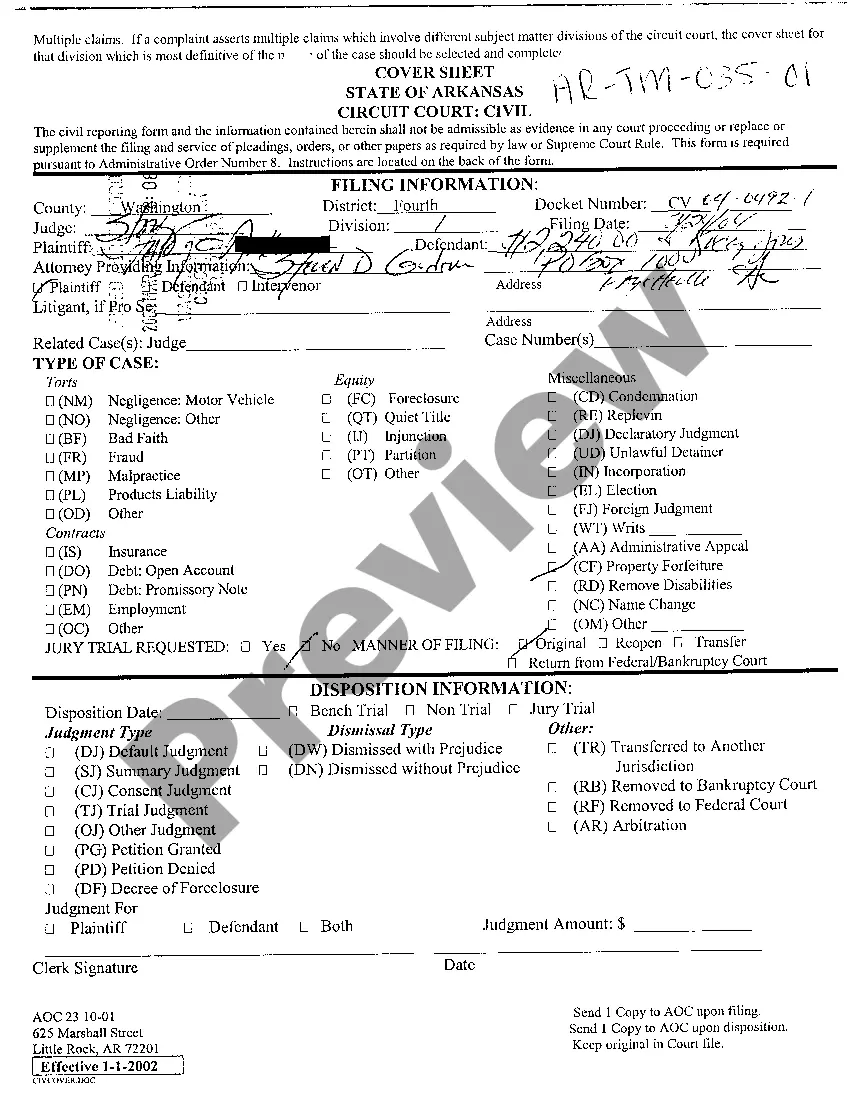

This form is a Complaint For Misrepresentation of Dairy Herd Feeding System-Jury Trial Demand. Adapt to your specific circumstances. Don't reinvent the wheel, save time and money.

Farm Would Business Formation In Houston

Description

Form popularity

FAQ

Register Your Farm Business Registering your business and becoming familiar with your federal and state tax responsibilities will help you file your taxes accurately, make payments on time, and avoid potential penalties.

Benefits of forming an LLC for your farm This means if the farm faces a lawsuit or debt, the owners' personal property is generally protected. Flexible management structure. LLCs offer more flexibility in management compared to corporations.

How to start a farming business Define your farming business concept. Conduct market research. Develop a business plan. Obtain licenses and certifications. Secure financing. Acquire land and necessary. Implement farming operations. Establish sales and distribution channels.

The highest-value crops produced in Texas Pecans. Watermelon. Onions. Potatoes. Peanuts. Rice. Wheat. Corn. You can find corn grown across the United States, and it's especially prominent in Texas.

B2B Profitable Small Farm Ideas Snail Farming. Heliciculture, or snail farming, can be a very lucrative business venture. Mushroom Farming. Mushrooms are relatively easy to cultivate, considering that they can grow in the wild, even in the harshest of conditions. Organic Farming. Poultry Farming. Plant Nursery. Hop Farming.

Steps to Form an LLC for Your Farm Choose a Business Name. As you consider a name for your LLC, check to make sure another LLC or corporation isn't already using (or has filed to use) your name. Apply for an Employer Identification Number. File Articles of Organization.

LLC and S are the best options for small businesses like farmers. You're taxed like an individual in these cases. C corporations are taxed as their own entities, so to speak, and that's where you hear the double taxation term come through.

The State of Texas does not require a general license. All entities that transact business in Texas are required to register with the Texas Secretary of State or county clerk's office.

Texas offers many advantages to LLCs formed in the state. Notably, its business environment and economic strength, asset protection for the members of the LLC, tax benefits, and a great deal of flexibility. If your business has a physical location in Texas, it is probably best to form your LLC in Texas.

Yes you can have a LLC without a business as well. There is no problem with that.