Partnering Angel Investor For Business In Wayne

Description

Form popularity

FAQ

Before you meet investors Document financial situation. Present financial documents and realistic financial projections for your startup. Highlight your founding team. Angel groups and investors want a team they can trust. Build a business pitch deck. Research the right angel investor.

You can find Angel investors on Linkedin, Angellist and Crunchbase. You can also go to Angel networks such as Keiretsu (search on Google based on your location). Another method is to participate in startup incubation, acceleration programs and competitions, angels are invited to these programs.

Here are a few tips: Do your research. Before you start reaching out to potential investors, it's important to do your homework. Use your networks. Attend industry events. Another great way to find potential investors is to attend industry events. Join an angel group. Use online resources.

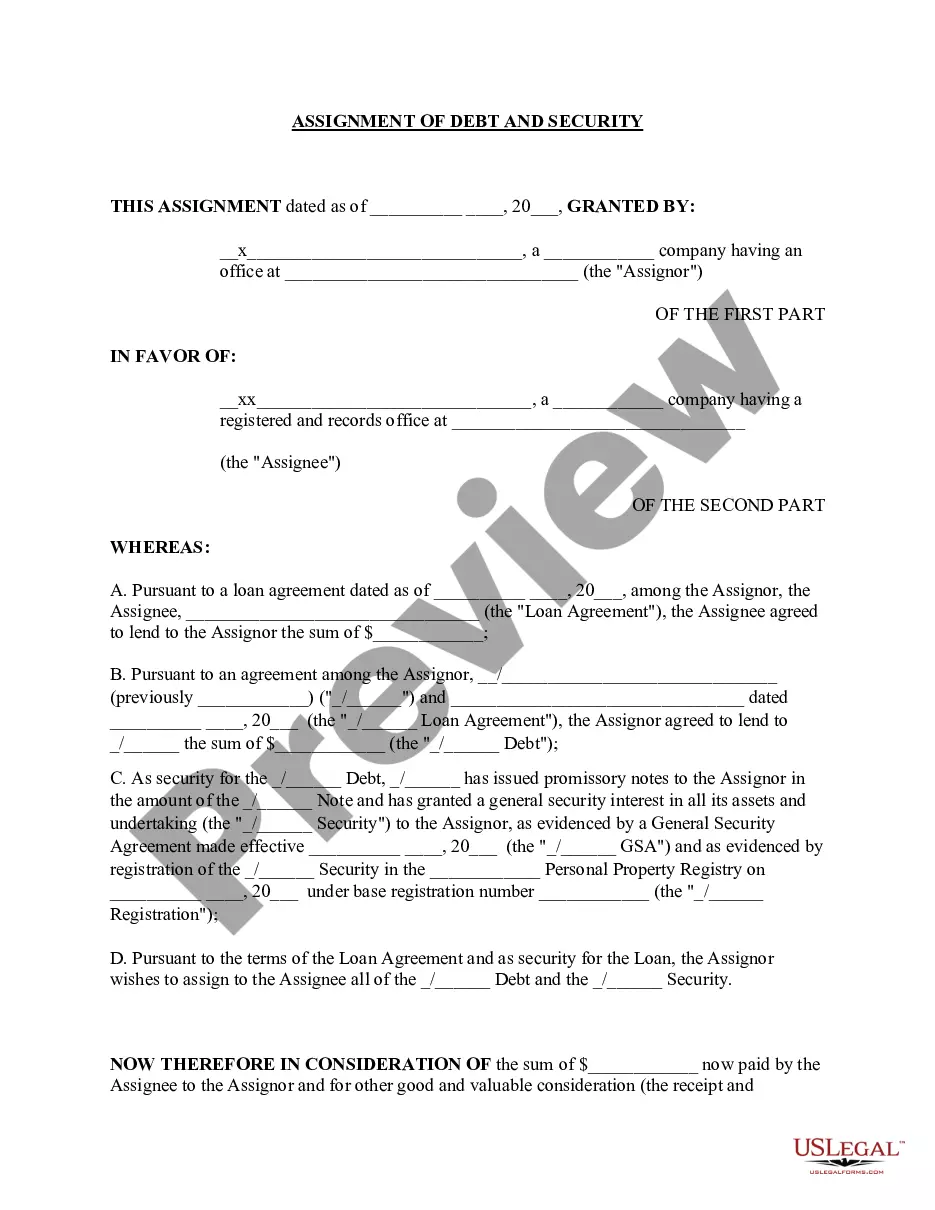

Some angel investors choose to invest through LLCs rather than as individuals. Generally, passively investing through an LLC rather than as an individual offers no tax advantages.

The tax laws that govern non-profits (such as pension funds) that often invest in VC funds make it difficult for those funds to invest in LLCs. Professional investors also generally want to see you giving stock options to employees which is much easier to do with a C-corporation (more about that below).

Different LLCs can have very different fundraising needs, and there are many different options and types of investors for raising capital that an LLC's members can consider. You can consult with a legal or financial advisor for more context on what types of funding might be most appropriate for your LLC.

THE FIRST REQUIREMENT FOR BEING AN ANGEL INVESTOR IS YOU HAVE TO BE AN ACCREDITED INVESTOR. The Securities and Exchange Commission (SEC) first developed these accredited investor rules back in 1933 to protect potential investors.

One of the best ways to find investors for your business is by networking within your industry. Attend conferences, seminars, and trade shows related to your field, as they are excellent opportunities to connect with potential investors who have a keen interest in your niche.

Angel investors typically seek a 10%-30% equity stake in a company. This percentage is negotiated based on your startup's valuation, the funding amount and the perceived risk. It's essential to strike a balance that reflects your company's current value and future potential.

Attend networking events. Look for industry events and conferences to meet like-minded professionals and angel investors. Remember, it's not just about what you know—it's also about who you know. When attending industry events, take advantage of networking opportunities.