Angel Investment Form With 2 Points In Wake

Description

Form popularity

FAQ

However, successful investments in early-stage companies can provide substantial returns. On average, angel investors and venture capitalists aim for ROI in the range of 20% to 30% or higher. But remember, these figures can vary greatly depending on the specific investment, industry, and market conditions.

Angel investors look for companies that have already built a product and are beyond the earliest formation stages, and they typically invest between $100,000 and $2 million in such a company.

Several variables, including the type of investment, the level of risk, and the expected return, will affect what constitutes a fair percentage for an investor. For angel investors, the typical standard is to provide between 20-25% of your company's profits.

The amount invested during an angel round typically ranges from $25,000 to $1 million. This funding is crucial for startups as it helps them move from the idea phase to a stage where they can develop their products or services, build a team, and start generating revenue.

Angel investors typically invest between $25,000 and $100,000 in a project. On the other hand, seed firms usually invest a larger amount, typically between $250,000 and $1 million.

While there are no hard and fast rules, the most common ways to structure an angel investment is by taking on board a minority stake in the company, or investing in convertible debt.

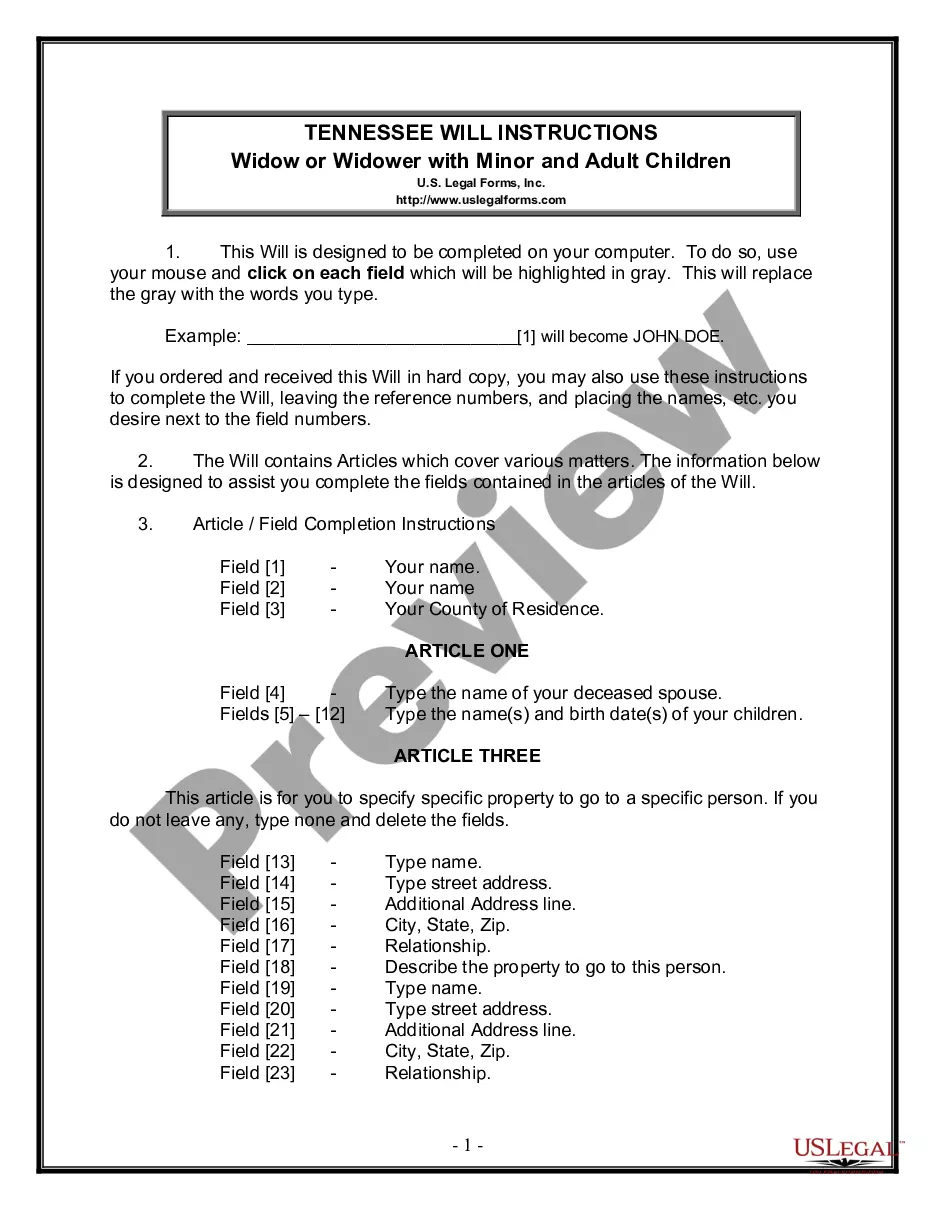

The program provides a taxpayer investor a credit of 20% of the qualifying investment, or 30% if the business is located in a gateway municipality, in a business that has no more than $500,000 in gross revenues in the year prior to eligibility.

Hi There - If completely worthless, then you can write off stocks as if sold by completing IRS form Schedule D, calculating loss (Cost less Sales Price $0) and deducting a capital loss of up to $3000 per year and carrying over any remainder of loss (if applicable).

Disadvantages of using angel investors Equity dilution: In exchange for funding, business angels usually get a portion of your company's ownership. Loss of control: Angel investors have vested interests in your company's growth. They may request board seats and take an active role in business decision-making.