Investor Term Sheet Template For Lease In Collin

Description

Form popularity

FAQ

How to Make a List of Target Investors Decide how much capital you need. You need to assess your immediate, short-term, and long-term growth needs. Research startups in your space. Research potential investors. Get an introduction. Stay organized. Learn from an expert.

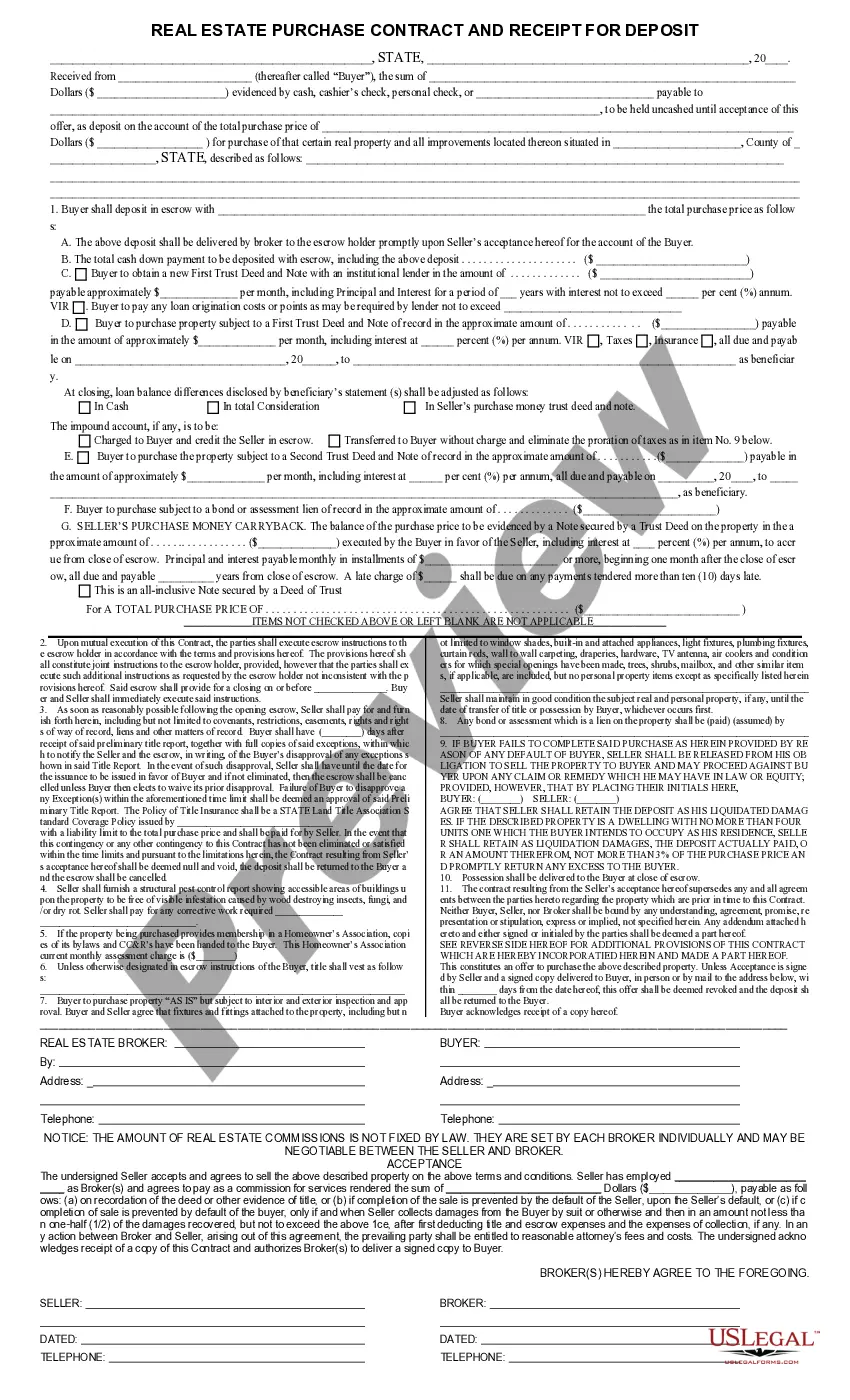

Also known as a letter of intent or memorandum of understanding. A term sheet is a document which sets out certain terms of a transaction agreed in principle between parties, and is typically negotiated and signed at the beginning of a transaction.

6 Tips for Writing a Term Sheet List the terms. Summarize the terms. Explain the dividends. Include liquidation preference. Include voting agreement and closing items. Read, edit and prepare for signatures.

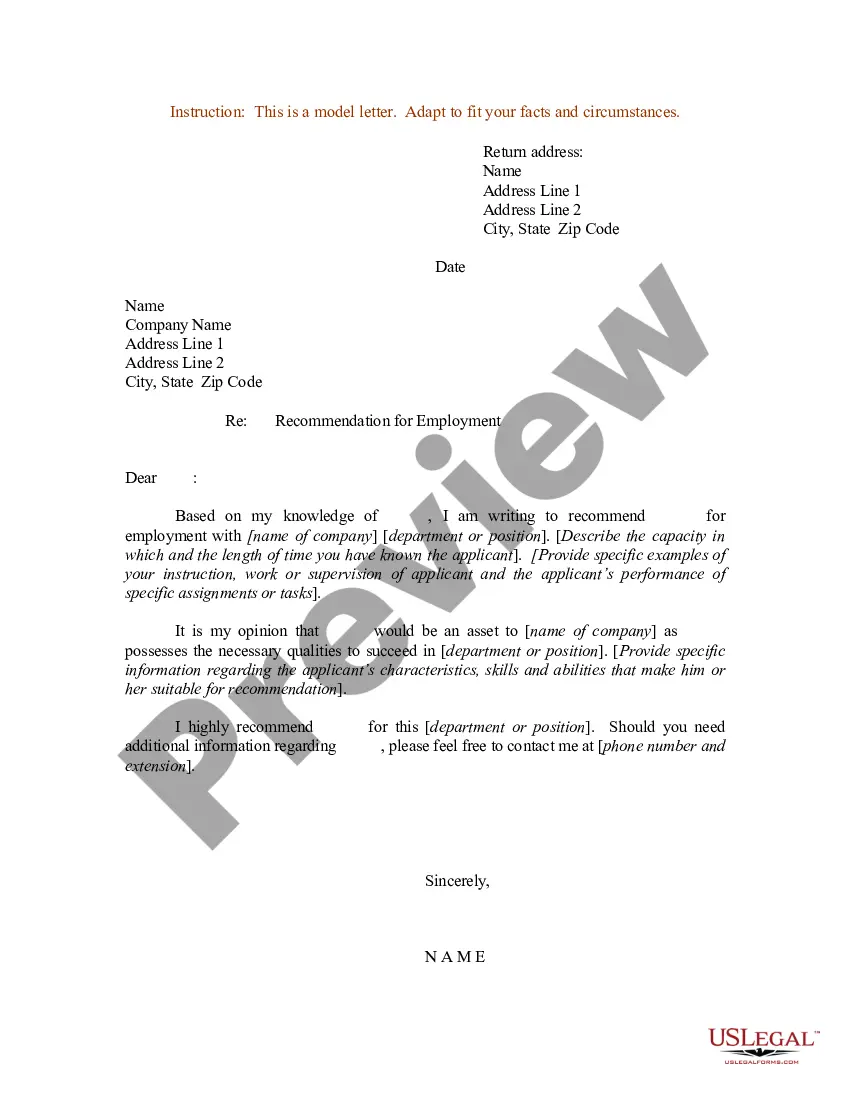

How to Draft an Investor Agreement Step-by-Step Preliminary Considerations. Define the Terms of the Investment. Outline Rights and Obligations. Include Key Provisions. Draft Protective Clauses for Both Parties. Finalize the Agreement.

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters.

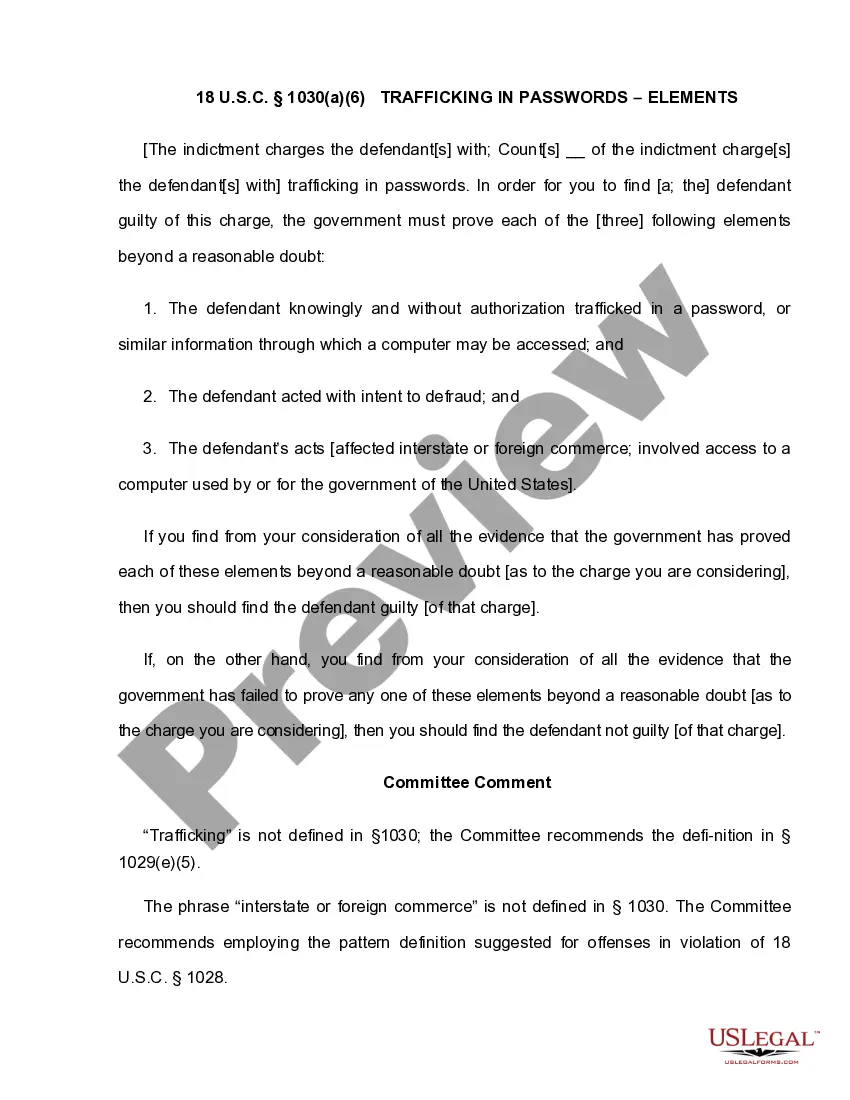

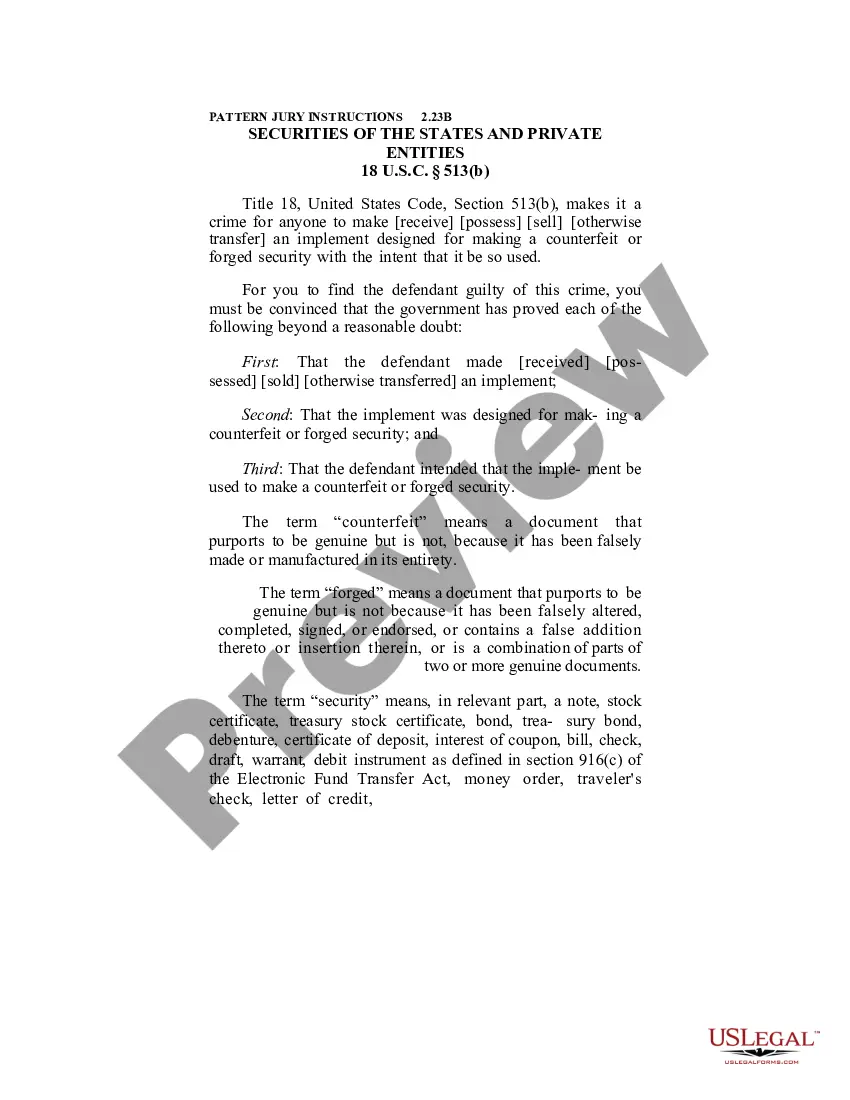

“Term sheets”, “letters of intent”, “memoranda of understanding” and “agreements in principle” may constitute an enforceable agreement if the writing includes all the essential terms of an agreement. This is so even if “the parties intended to negotiate a 'fuller agreement'”.

Whereas the term sheet is the starting point, the investment agreement is sort of the final step. The investment agreement is the document that sets out the investment details. It includes the actions required to close the investment and the structure of the investment itself.

Legal counsel is essential when creating or reviewing a term sheet to ensure that the terms are clear, fair, and protect your interests. An experienced attorney can help identify potential issues and provide valuable negotiation advice.

In simple terms, a term sheet is a non-binding agreement that outlines the basic terms and conditions of a potential business deal. An agreement, on the other hand, is a legally binding contract that both parties have agreed upon. The purpose of a term sheet is to establish a framework for negotiations.