Using Debt To Pay Off Debt In Miami-Dade

Description

Form popularity

FAQ

Specifically, the rule states that a debt collector cannot: Make more than seven calls within a seven-day period to a consumer regarding a specific debt. Call a consumer within seven days after having a telephone conversation about that debt.

The statute of limitations in Florida on debt is five years. This means that once the five-year timeline has expired, creditors can no longer file a lawsuit against the borrower to try and recover the debt.

The phrase in question is: “Please cease and desist all calls and contact with me, immediately.” These 11 words, when used correctly, can provide significant protection against aggressive debt collection practices.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

The statute of limitations in Florida on debt is five years. This means that once the five-year timeline has expired, creditors can no longer file a lawsuit against the borrower to try and recover the debt. This is only true of debts that include a written agreement, though.

The phrase in question is: “Please cease and desist all calls and contact with me, immediately.” These 11 words, when used correctly, can provide significant protection against aggressive debt collection practices.

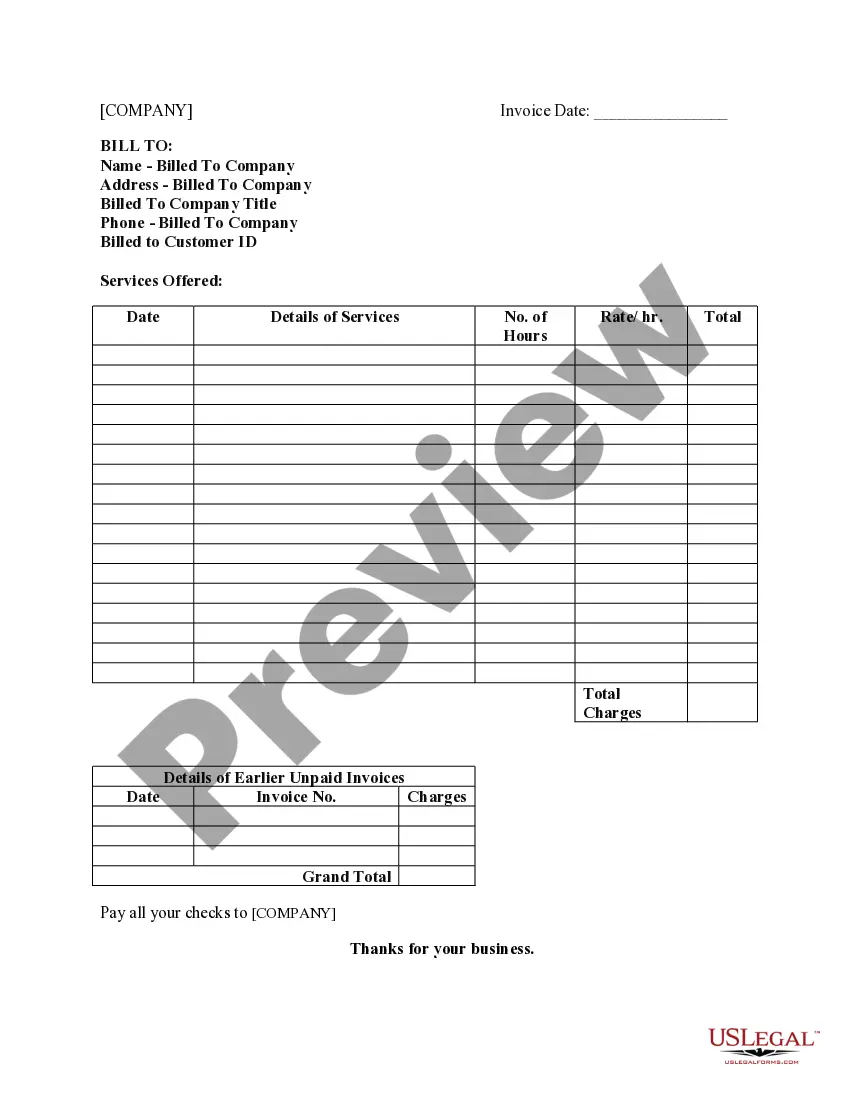

Here's a step-by-step guide that outlines the actions a business should take before moving forward with a collection agency. Contact the Debtor. Send a Demand Letter. Consider Negotiation. Hire a Collection Agency. Provide Documentation. Monitor Progress. Consider Legal Action.

Here's a step-by-step guide that outlines the actions a business should take before moving forward with a collection agency. Contact the Debtor. Send a Demand Letter. Consider Negotiation. Hire a Collection Agency. Provide Documentation. Monitor Progress. Consider Legal Action.

Here are crucial steps to follow in the debt collection process. Step 1: Contact the Debtor. Step 2: Send a Demand Letter. Step 3: Consider Negotiation. Step 4: Hire a Collection Agency. Step 5: Provide Documentation. Step 6: Monitor Progress. Step 7: Consider Legal Action.

If you have unpaid past-due debt, your original creditor will typically contact you first. For example, if you have an old student loan you stopped paying, your lender will attempt to contact you to bring the account current. If those attempts are unsuccessful, the creditor may send the debt to a collection agency.