Spousal Support Calculator In Ontario In Travis

Description

Form popularity

FAQ

Both forms of support are critical in ensuring a fair and equitable resolution following a separation or divorce. There exist two distinct types of spousal support: compensatory and non-compensatory.

For marriage/cohabitation periods of more than 20 years, or where the marriage is longer than 5 years and the age of the recipient plus the years of marriage is 65 years or more, (“Rule of 65”), support duration will be indefinite.

It is important to note that there is no limitation period to bring a claim for either spousal or child support as long as the person is legally entitled to such support under the applicable legislation; however, applicants are unlikely to successfully claim retroactive child support once they no longer fit under the ...

The “rule of 65” takes into account not only the duration of the marriage but the individual's age at the time of the separation. It allows for indefinite support in cases where the marriage lasted at least five years and the age of the individual plus the number of years of marriage equals or exceeds 65.

You are not legally obligated to support her. If a divorce is filed the court could make alimony retroactive.

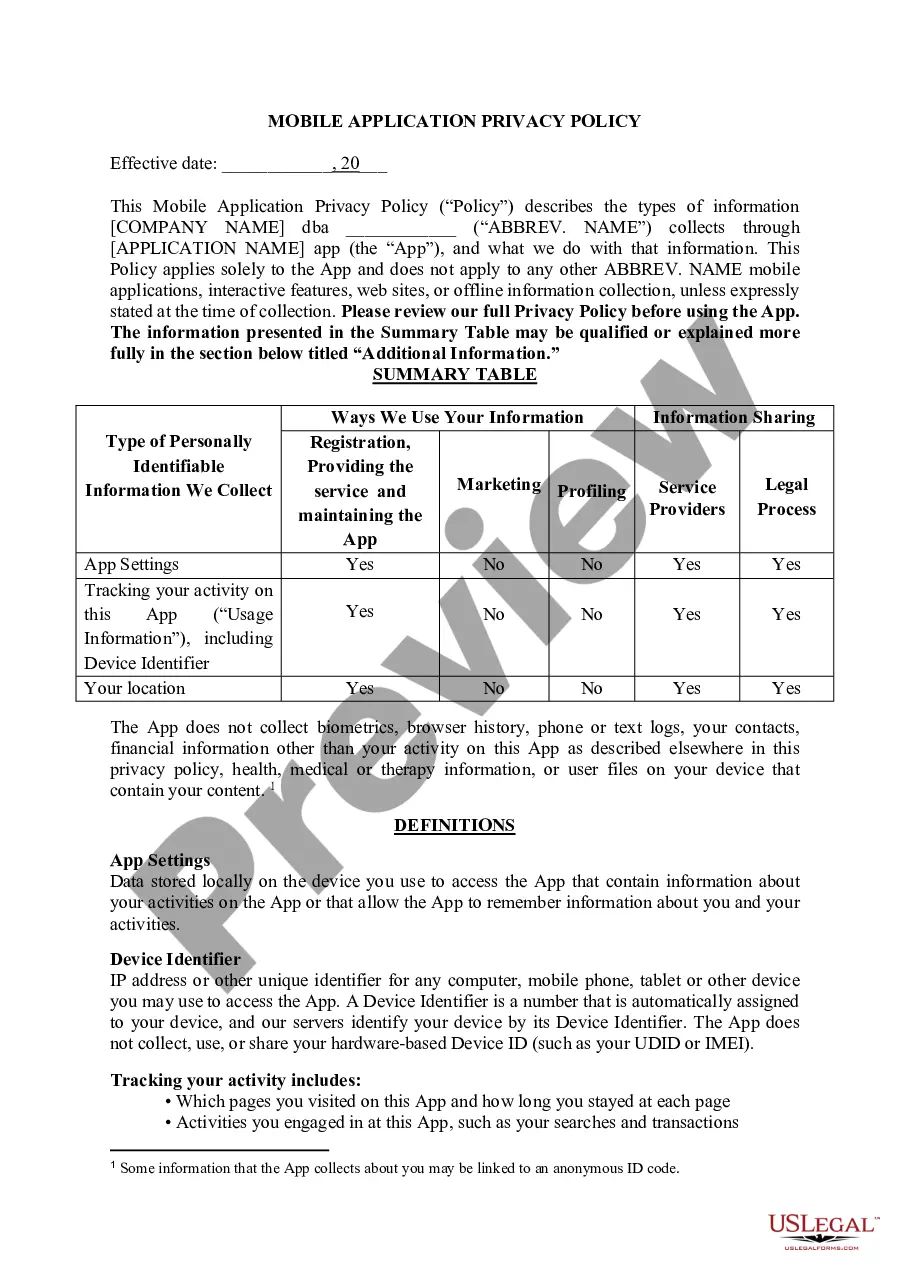

The amount of support ranges from 1.5 to 2 per cent of the difference between the spouses' gross income amounts for each year of marriage or cohabitation, up to a maximum of 50 percent, (where 50 percent represents an equalization in income).

Without Child Support Formula The amount of support ranges from 1.5 to 2 per cent of the difference between the spouses' gross income amounts for each year of marriage or cohabitation, up to a maximum of 50 percent, (where 50 percent represents an equalization in income).

The guideline states that the paying spouse's support be presumptively 40% of his or her net monthly income, reduced by one-half of the receiving spouse's net monthly income. If child support is an issue, spousal support is calculated after child support is calculated.

Social Security benefits for a divorced spouse are calculated based on the ex-spouse's earnings record or their own earnings record, depending on which one is higher. You're entitled to half of your ex's benefits if you start collecting once you reach your full retirement age (FRA).