Alimony And Child Support In Tennessee

Description

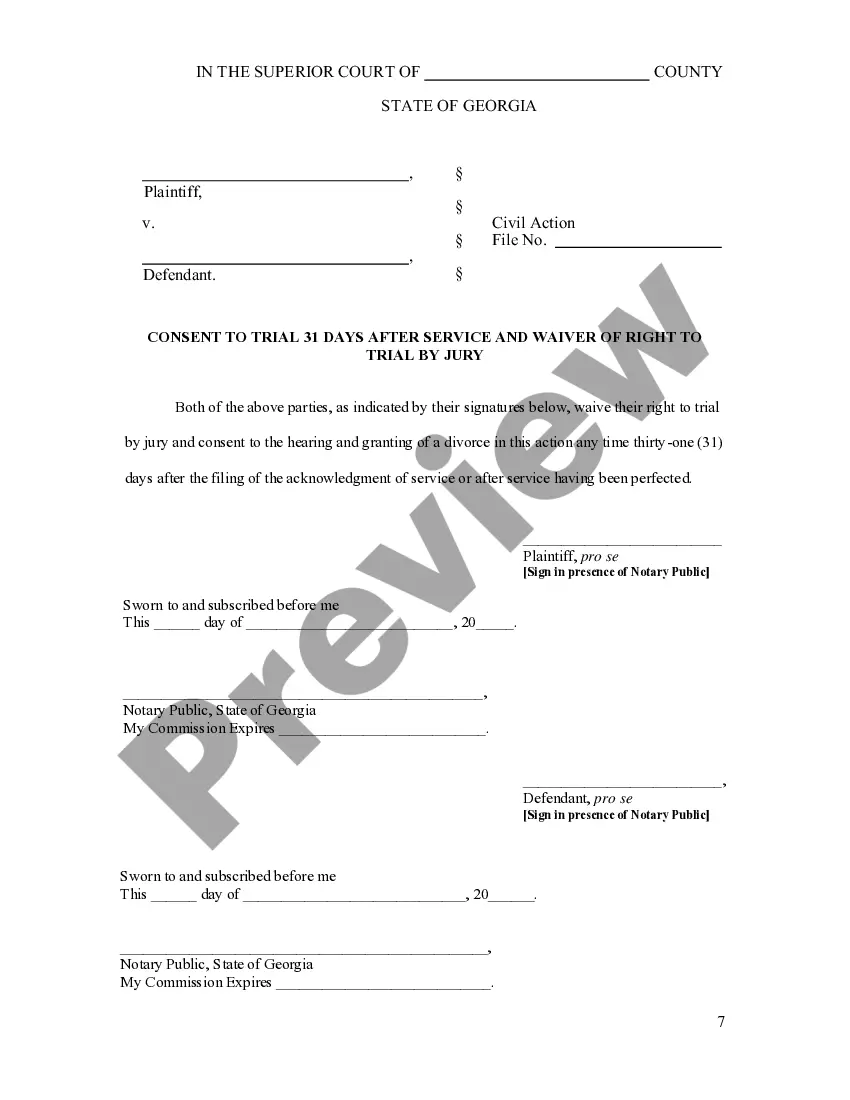

How to fill out Affidavit Of Defendant Spouse In Support Of Motion To Amend Or Strike Alimony Provisions Of Divorce Decree Because Of Obligor Spouse's Changed Financial Condition?

It’s no secret that you can’t become a law expert overnight, nor can you learn how to quickly prepare Alimony And Child Support In Tennessee without having a specialized background. Putting together legal forms is a long process requiring a particular education and skills. So why not leave the preparation of the Alimony And Child Support In Tennessee to the specialists?

With US Legal Forms, one of the most extensive legal document libraries, you can access anything from court paperwork to templates for internal corporate communication. We understand how important compliance and adherence to federal and state laws are. That’s why, on our website, all forms are location specific and up to date.

Here’s start off with our website and get the document you need in mere minutes:

- Find the form you need by using the search bar at the top of the page.

- Preview it (if this option provided) and read the supporting description to determine whether Alimony And Child Support In Tennessee is what you’re searching for.

- Start your search over if you need a different form.

- Register for a free account and select a subscription option to purchase the template.

- Choose Buy now. Once the transaction is complete, you can get the Alimony And Child Support In Tennessee, fill it out, print it, and send or mail it to the designated people or organizations.

You can re-access your forms from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your forms-whether it’s financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

Is there a statutory maximum for Child Support in Tennessee? Yes these are: $2,100 per month for one child. $3,200 per month for two children.

The Guidelines are based on an Income Shares model that establishes the dollar amount of child support obligations based on the amount of parents' combined adjusted gross income and the number of children for whom the child support order is being established or modified.

On its own, remarriage doesn't usually affect child support, because your new spouse doesn't have an obligation to support your children from a previous relationship. However, when you remarry, you may have additional income available for support.

When combined monthly parental income is greater than $28,250, the guideline says parents should pay the highest basic child support obligation (listed on page 71 of the Child Support Guidelines), plus a percentage of their income over $28,250: One child: 6.81 percent. Two children: 7.22 percent.

When combined monthly parental income is greater than $28,250, the guideline says parents should pay the highest basic child support obligation (listed on page 71 of the Child Support Guidelines), plus a percentage of their income over $28,250: One child: 6.81 percent.