Alimony Spouse Support Withholding

Description

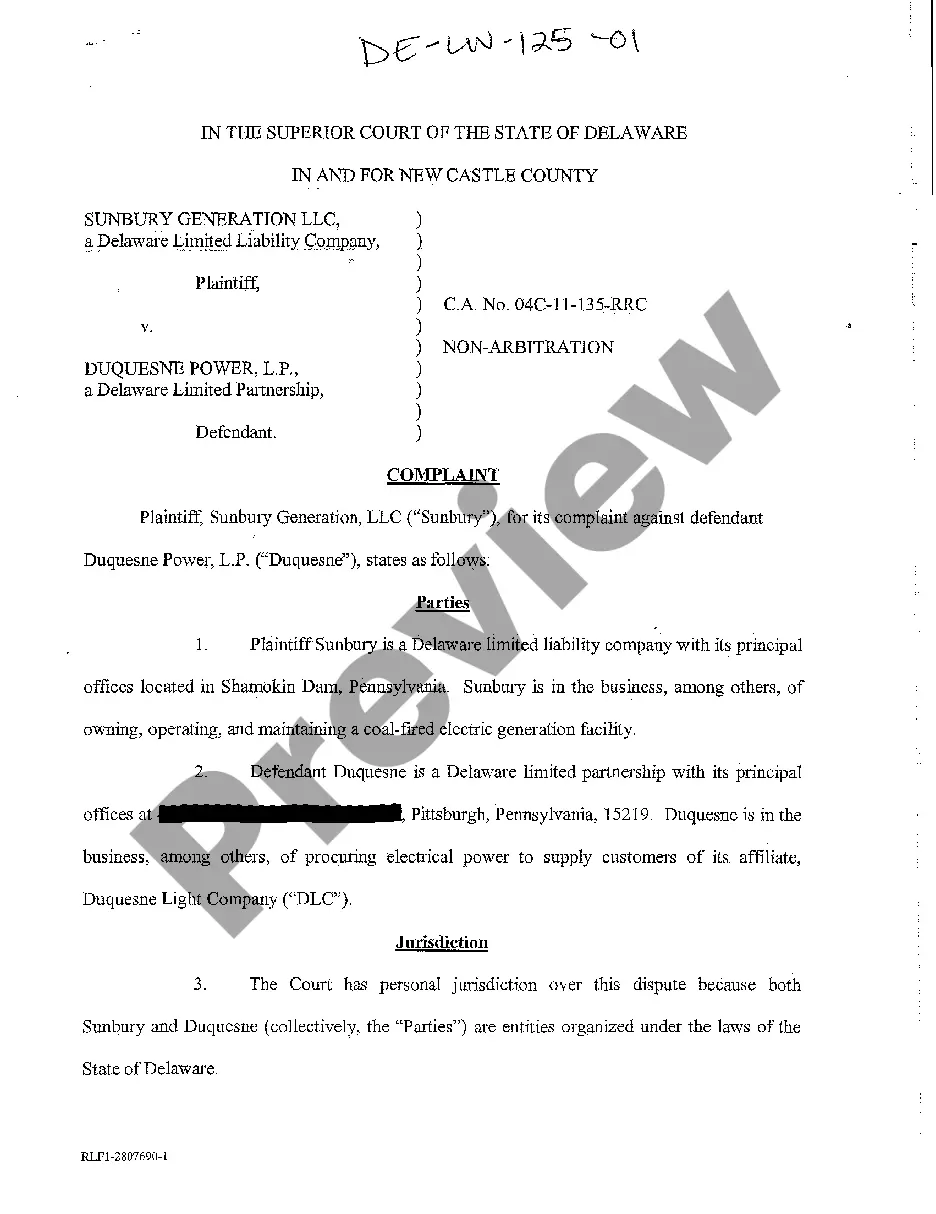

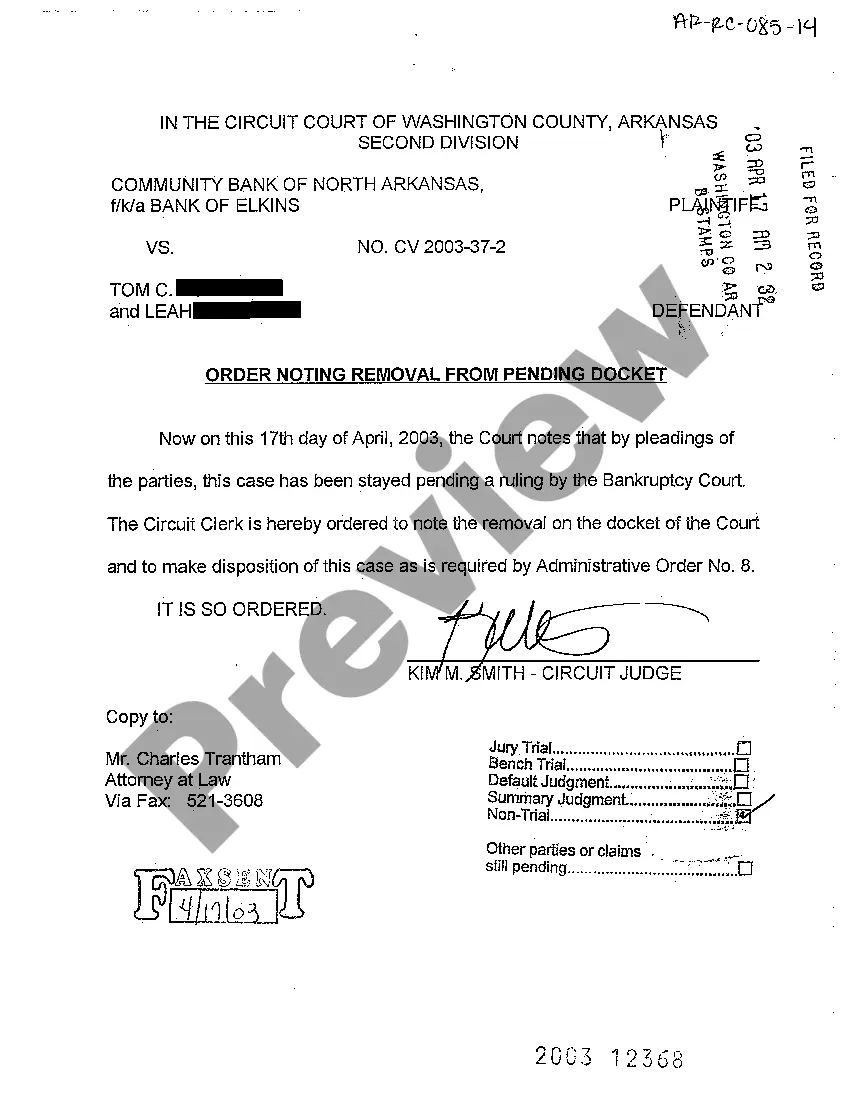

How to fill out Affidavit Of Defendant Spouse In Support Of Motion To Amend Or Strike Alimony Provisions Of Divorce Decree On Remarriage Of Plaintiff?

Managing legal documents and procedures can be a lengthy addition to your schedule.

Alimony Spouse Support Withholding and forms similar to it usually require you to locate them and comprehend how to fill them out proficiently.

Therefore, whether you are dealing with financial, legal, or personal issues, having a comprehensive and user-friendly online directory of forms at your disposal will be extremely beneficial.

US Legal Forms is the leading online platform for legal templates, offering over 85,000 state-specific forms and various resources to help you complete your documents effortlessly.

Is this your first time using US Legal Forms? Register and create an account in a few moments and you will gain access to the forms library and Alimony Spouse Support Withholding. Then, follow these steps to fill out your form: ✅ Ensure you have identified the correct form using the Review feature and reviewing the form details. ✅ Click Buy Now when prepared, and select the subscription plan that suits you best. ✅ Click Download then fill out, sign, and print the form. US Legal Forms has 25 years of experience helping clients handle their legal documents. Obtain the form you require now and streamline any process effortlessly.

- Explore the collection of relevant documents available with just a click.

- US Legal Forms supplies state- and county-specific forms accessible anytime for download.

- Safeguard your document management processes with a high-quality service that enables you to prepare any form in minutes without additional or concealed charges.

- Simply Log In to your account, locate Alimony Spouse Support Withholding and download it immediately from the My documents section.

- You can also access previously saved forms.

Form popularity

FAQ

Alimony is usually around 40% of the paying party's income. This number is different in different states and different situations.

To claim a tax deduction, the payor enters the total amount of spousal support payments they paid under all court orders and written agreements on line 22000 of their tax return. The recipient must report taxable support payments received under a court order or written agreement on line 12800 of their tax return.

As the recipient, you can deduct, on line 22100 of your tax return, legal and accounting fees incurred: to collect overdue support payments owing. to establish the amount of support payments from your current or former spouse or common-law partner.

Spousal support is usually taxable and deductible The spouse who receives them (the recipient) must report the support payments as taxable income to the Canada Revenue Agency. And they must pay income tax on the payments. The spouse who pays the support (the payor) can claim it as a deduction.

Your spousal support payments will always be deductible by you and taxable to the recipient, regardless of when your order or agreement was made, as long as all payments for child support are fully paid for current and prior years.