Closing Real Estate With Integrity

Description

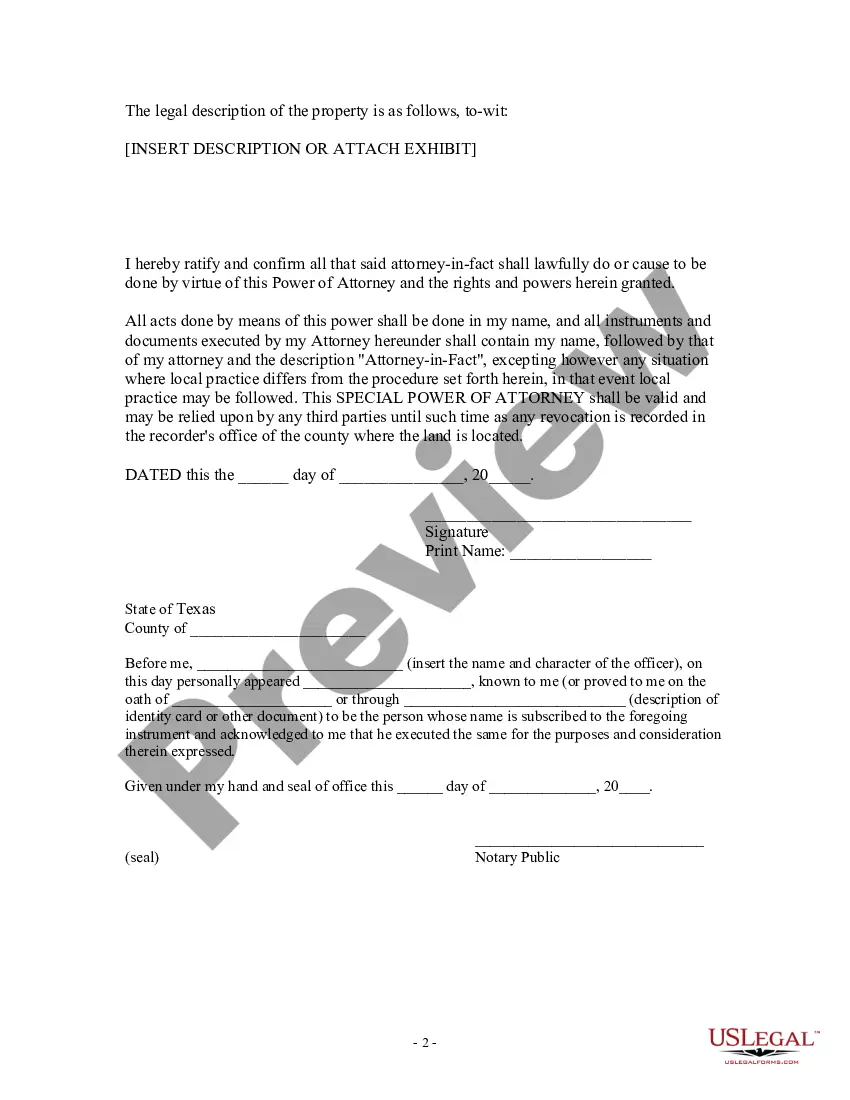

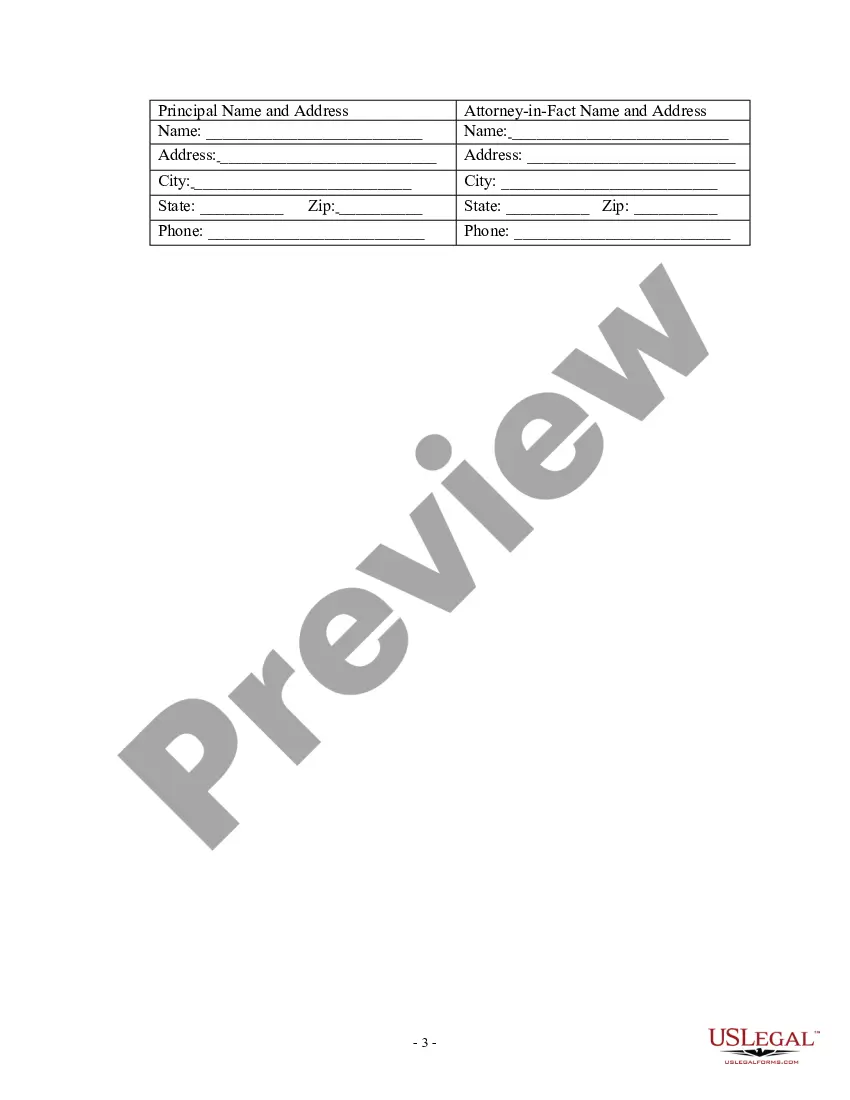

How to fill out Texas Special Or Limited Power Of Attorney For Real Estate Purchase Transaction By Purchaser?

It’s well known that you cannot become a legal specialist in a day, nor can you easily learn to draft Closing Real Estate With Integrity without possessing a relevant background.

Compiling legal documents is a lengthy task that demands specific training and expertise. Therefore, why not entrust the development of the Closing Real Estate With Integrity to the experts.

With US Legal Forms, one of the most extensive legal template collections, you can locate anything from judicial documents to templates for internal business communication. We understand how crucial compliance and adherence to national and regional laws are.

You can revisit your documents from the My documents tab at any moment. If you are an existing user, simply Log In, and retrieve and download the template from the same section.

Regardless of the reason for your documents, whether financial and legal or personal, our platform has you covered. Experience US Legal Forms today!

- Begin by using the search bar at the top of the page to discover the document you need.

- If available, preview it and review the accompanying description to determine if Closing Real Estate With Integrity is what you're looking for.

- If you require a different template, restart your search.

- Create a free account and choose a subscription plan to purchase the form.

- Click Buy now. After the payment is completed, you will be able to download the Closing Real Estate With Integrity, fill it out, print it, and send it to the necessary parties or organizations.

Form popularity

FAQ

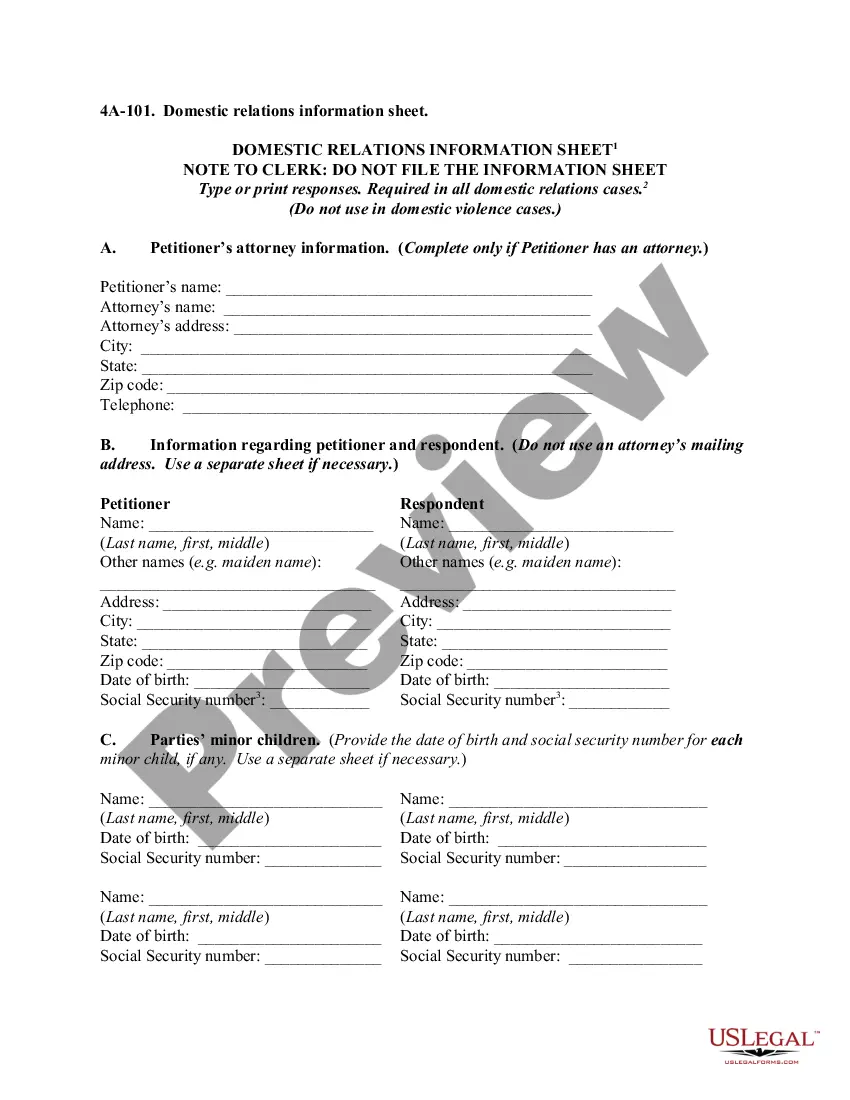

The settlement statement can be provided to the homebuyer and seller by the mortgage lender, settlement agent, title company or a real estate attorney. If you got your mortgage prior to October 2015, you received a HUD-1 settlement statement.

What Happens at Closing? On closing day, the ownership of the property is transferred to you, the buyer. This day consists of transferring funds from escrow, providing mortgage and title fees, and updating the deed of the house to your name.

Who prepares the settlement statement? Whoever is facilitating the closing ? whether it be a title company, escrow firm, or real estate attorney ? will be responsible for preparing the settlement statement.

The closing disclosure is a type of settlement statement that was created and is regulated for the mortgage lending market. The closing disclosure is provided by the lender, closing attorney or title company to a borrower about three days before the closing on real estate.

Any escrow funds required on the date of closing will also be listed, as well as any deposits ? such as earnest money ? the borrower has already made. The closing statement typically lists fees in two columns, one detailing the buyer's expenses and one detailing the seller's expenses.