Closing Real Estate With A View

Description

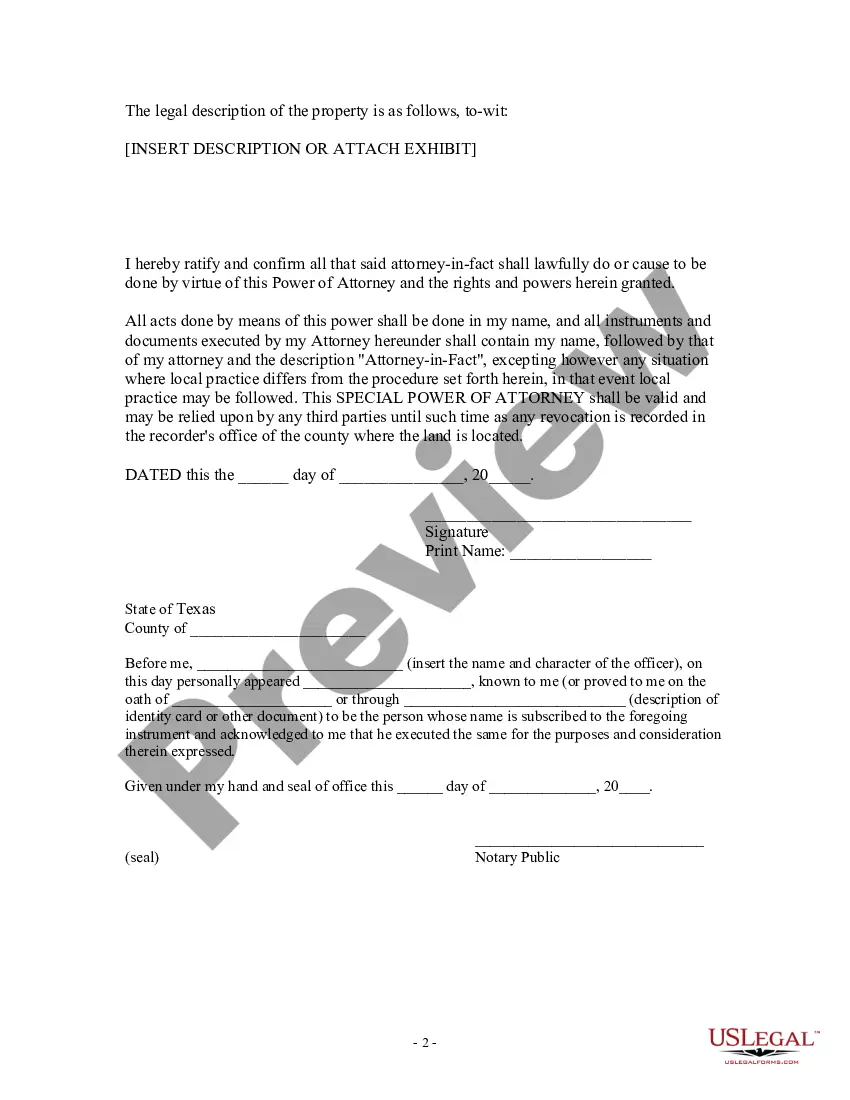

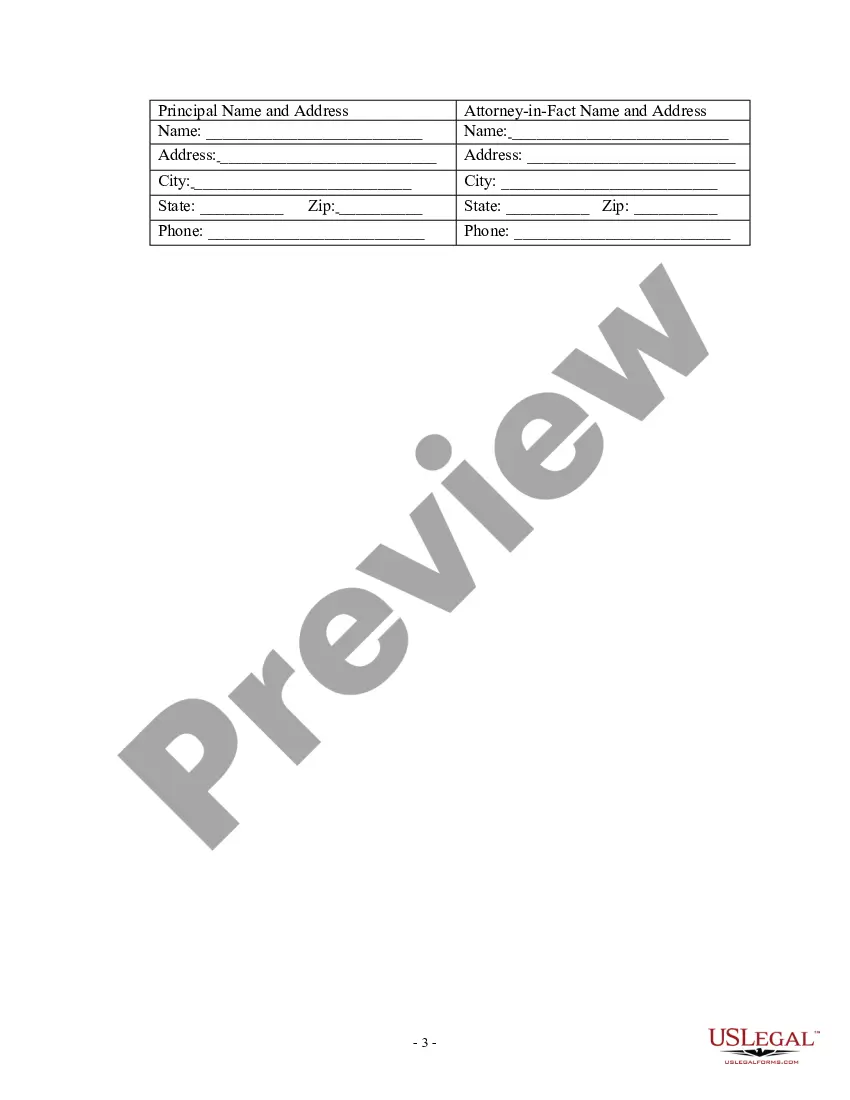

How to fill out Texas Special Or Limited Power Of Attorney For Real Estate Purchase Transaction By Purchaser?

The Concluding Real Estate Document With A View you observe on this site is a reusable legal framework created by expert attorneys in accordance with national and local regulations.

For over 25 years, US Legal Forms has supplied individuals, entities, and legal practitioners with more than 85,000 verified, state-specific documents for any business and personal event. It’s the fastest, simplest, and most dependable method to secure the documentation you require, as the service assures the utmost level of data security and anti-malware safeguard.

Register for US Legal Forms to have verified legal templates for all of life's situations at your fingertips.

- Search for the document you require and review it.

- Browse through the sample you searched and preview it or verify the form description to confirm it meets your needs. If it doesn’t, utilize the search bar to find the appropriate one. Click Buy Now when you have found the template you need.

- Subscribe and Log In.

- Select the pricing plan that works for you and set up an account. Use PayPal or a credit card for a swift transaction. If you already possess an account, Log In and verify your subscription to continue.

- Obtain the fillable template.

- Pick the format you desire for your Concluding Real Estate Document With A View (PDF, Word, RTF) and download the example onto your device.

- Complete and sign the documentation.

- Print out the template to fill it out manually. Alternatively, utilize an online versatile PDF editor to swiftly and accurately complete and sign your document with an electronic signature.

- Retrieve your documents one more time.

- Utilize the same document again whenever necessary. Access the My documents tab in your profile to redownload any previously downloaded documents.

Form popularity

FAQ

The final walk-through is one of the most important steps when buying a home. You're in the home stretch, and you finally get the chance to see your home as it will be when you get the keys. However, it's important to be prepared before the walk-through to ensure everything in the home is as it should be.

The closing statement typically lists fees in two columns, one detailing the buyer's expenses and one detailing the seller's expenses. The amount of cash the buyer must give the seller has its own entry at the bottom of the document.

The closing process involves four steps to make that happen. Close revenue accounts to Income Summary. Income Summary is a temporary account used during the closing process. ... Close expense accounts to Income Summary. ... Close Income Summary to Retained Earnings. ... Close dividends to Retained Earnings.

The closing statement typically lists fees in two columns, one detailing the buyer's expenses and one detailing the seller's expenses. The amount of cash the buyer must give the seller has its own entry at the bottom of the document.

Action steps Submit documents and answer requests from the lender. Schedule a home inspection. Shop for homeowner's insurance. Look out for revised Loan Estimates. Shop for title insurance and other closing services. Review documents before closing. Close the deal. Save and file your documents.