Texas Child Services Withholding Order

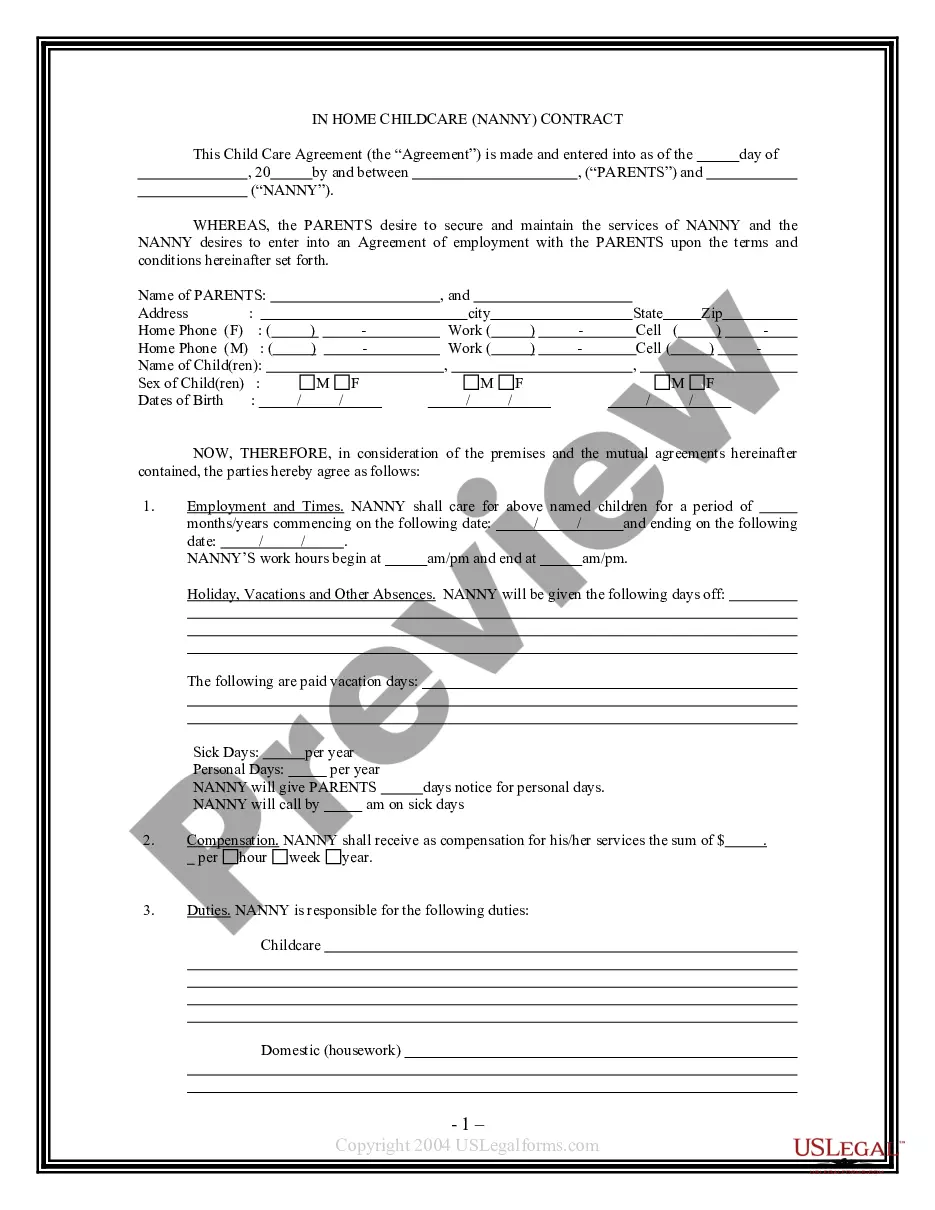

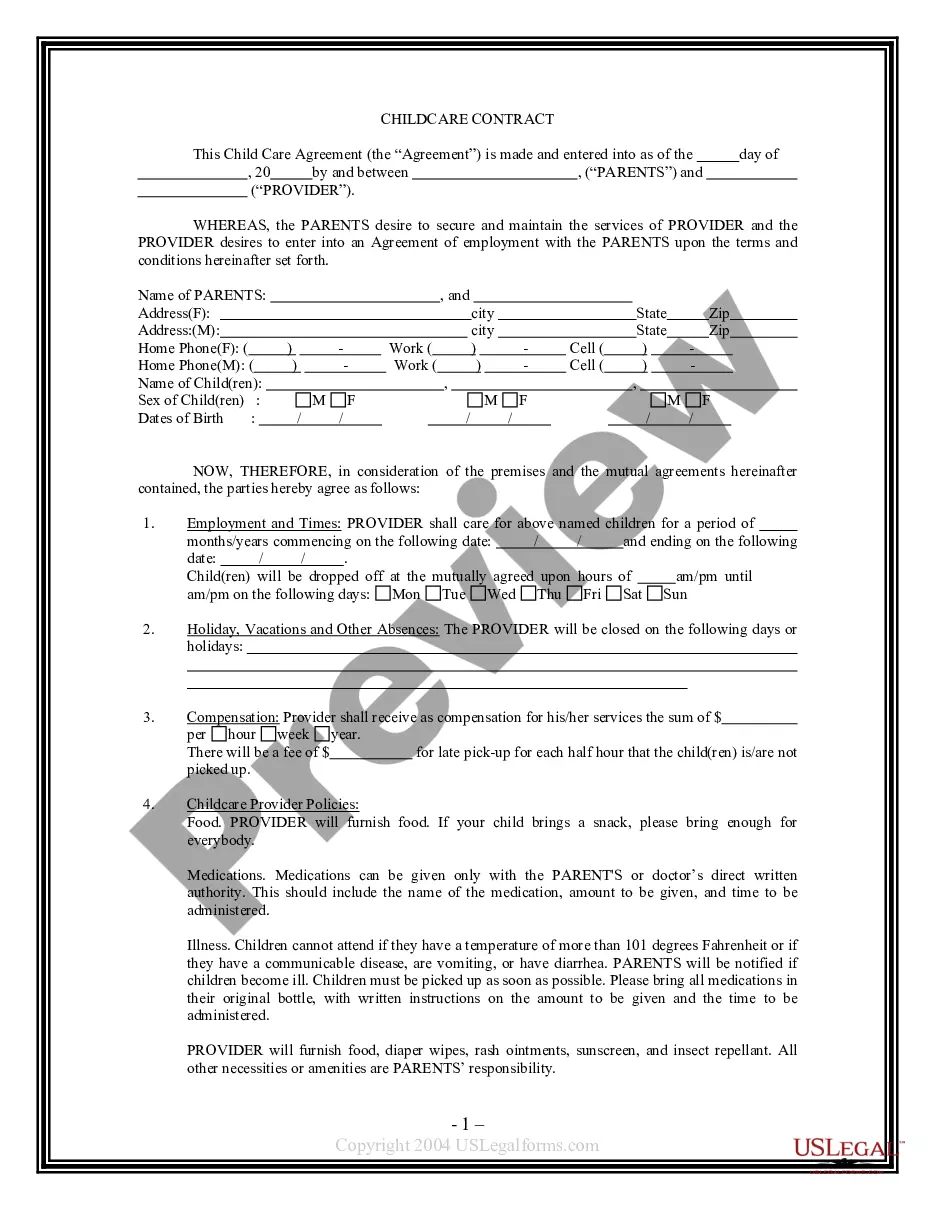

Description

How to fill out Texas Child Care Services Package?

Individuals often link legal documentation with something complex that only an expert can manage.

In a certain respect, it's accurate, as creating a Texas Child Services Withholding Order demands comprehensive understanding of subject criteria, encompassing state and local statutes.

However, with US Legal Forms, the process has become more user-friendly: pre-prepared legal templates for any life and business situation tailored to state legislation are gathered in a single online directory and are now accessible to everyone.

Print your document or upload it to an online editor for quicker completion. All templates in our collection are reusable: once purchased, they are stored in your account. You can access them anytime needed through the My documents tab. Explore all advantages of utilizing the US Legal Forms platform. Subscribe now!

- US Legal Forms provides over 85k contemporary forms categorized by state and field of application, so searching for a Texas Child Services Withholding Order or any other specific template only requires minutes.

- Existing users with a valid subscription must Log In to their account and select Download to retrieve the form.

- New users to the service will have to register for an account and subscribe before they can download any documentation.

- Here’s a step-by-step guide on how to acquire the Texas Child Services Withholding Order.

- Review the page content thoroughly to confirm it meets your requirements.

- Read the form description or check it through the Preview option.

- If the previous sample doesn’t meet your needs, search for another one using the Search bar above.

- Once the correct Texas Child Services Withholding Order is located, click Buy Now.

- Choose a pricing plan that aligns with your preferences and budget.

- Create an account or Log In to continue to the payment page.

- Complete your subscription payment via PayPal or with your credit card.

- Select your desired file format and click Download.

Form popularity

FAQ

The maximum child support amount in Texas is not a fixed dollar figure but rather a formula based on your income. However, there are caps for high earners, which can change periodically. To manage your child support obligations effectively, understand how Texas child services withholding orders calculate these amounts, or consider using resources like USLegalForms to assist with your inquiries.

The maximum rate of child support mandated by Texas law varies based on the number of children involved. For one child, the rate can be up to 20% of your net income. This percentage increases with additional children, which can directly impact the Texas child services withholding order that may apply to your income.

The process for an income withholding order in Texas usually takes about 30 days from the date it is issued until the first payment is deducted. The employer receives the order, and there may be some time for processing. It’s important to stay informed and communicate with your employer as well as the Texas child services to ensure a smooth experience.

In Texas, the maximum amount that can be withheld for child support under a Texas child services withholding order is determined by a percentage of your disposable income. Typically, this is 20% of your income for one child, 25% for two, and so on. It’s important to understand that what qualifies as disposable income can vary, so consulting with a legal expert may clarify your specific situation.

If someone is not paying child support in Texas, you can report them through the Texas Attorney General's Child Support Division. Start by gathering any relevant information, such as the parent’s details and payment history. You can file a report online or by contacting your local child support office. Utilizing a Texas child services withholding order can also help enforce payments and ensure that support is received.

If an employer fails to withhold child support as mandated by a Texas child services withholding order, consequences can arise for both the employer and the non-compliant parent. The state may impose penalties on the employer for not following the order. Moreover, the parent receiving child support might face delays in financial assistance. It's vital to communicate with your employer and consider using USLegalForms for guidance on enforcing your Texas child services withholding order.

The timeline for an income withholding order for child support in Texas typically varies by case. Once the court issues the order, it may take several days for the employer to process it and start withholding the specified amount. On average, you can expect the entire process to take about two to four weeks. It’s essential to follow up with your employer and the Texas child services to ensure proper handling of your Texas child services withholding order.

In Texas, the maximum withholding amount for child support generally aligns with the percentage of disposable income, which can be up to 50% for one obligation and 60% for multiple obligations. This is in place to ensure that support payments do not overly burden the noncustodial parent while still meeting the child's financial needs. Understanding these limits is crucial, and legal resources like uslegalforms can provide support in navigating these rules.

To file a motion to cancel child support in Texas, you need to fill out appropriate legal forms with details regarding your request. After gathering necessary documents and evidence, file this motion at your local family court. Make sure to notify the other involved parties, as they will need to be aware of your request and can respond accordingly. Using uslegalforms can help streamline your filing process.

Filing a motion to dismiss in Texas requires you to prepare a legal document that details your reasons for the dismissal. You can find the correct forms at local courts or legal websites. After completing the motion, submit it to the court and serve a copy to the involved parties. This will prompt a hearing where you can present your arguments for dismissal.