Texas Property Gift Deed Form

Description

How to fill out Texas Property Gift Deed Form?

Navigating through the red tape of formal documents and templates can be difficult, particularly when one does not engage in that professionally.

Even locating the correct template for the Texas Property Gift Deed Form will be labor-intensive, as it must be valid and precise to the last detail.

Nonetheless, you will need to invest significantly less time selecting a suitable template from the resource you can rely on.

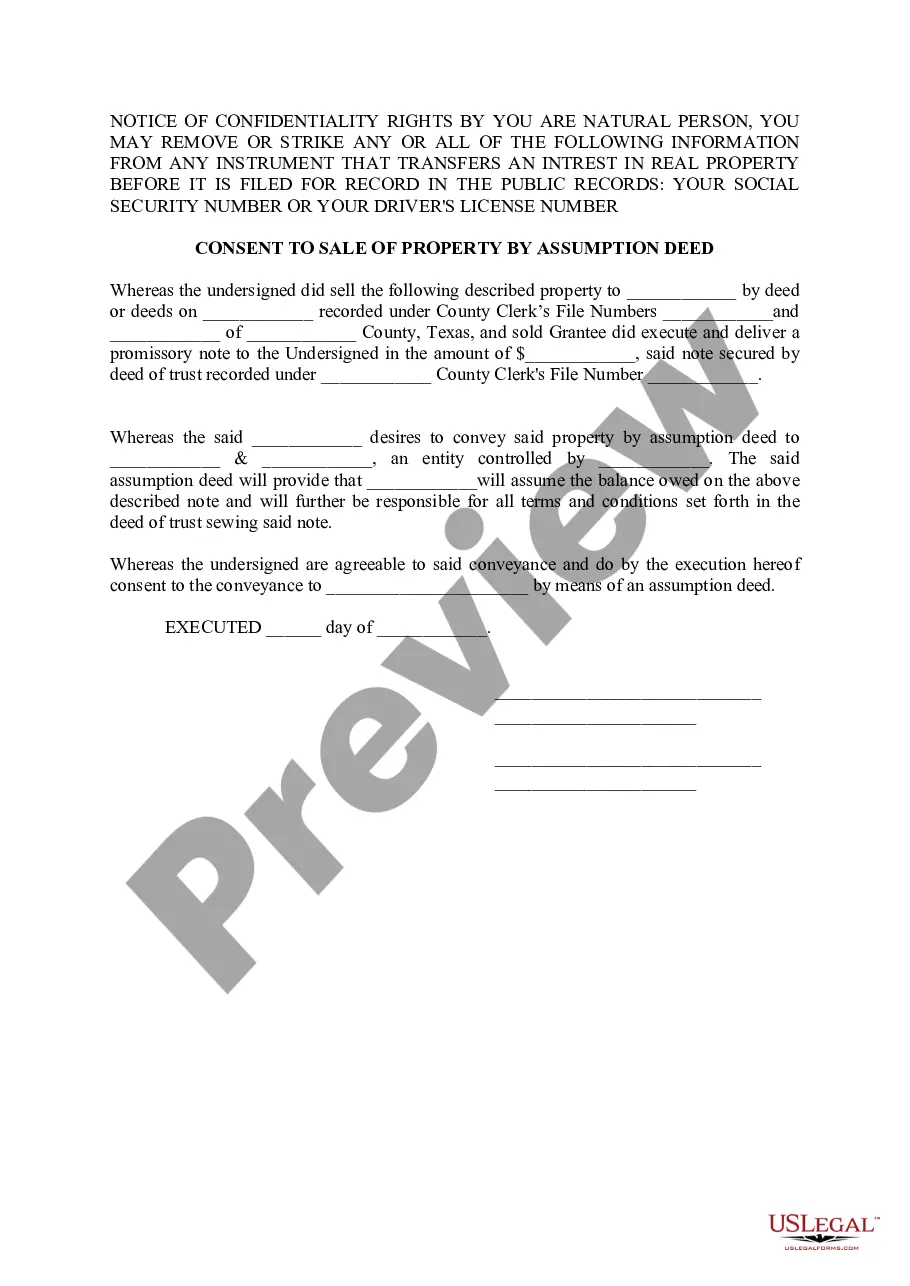

Obtain the correct form in a few simple steps: Enter the title of the document in the search field. Identify the right Texas Property Gift Deed Form among the results. Review the summary of the sample or view its preview. If the template meets your needs, click Buy Now. Proceed to select your subscription plan. Utilize your email and create a password to register an account at US Legal Forms. Choose a credit card or PayPal payment method. Save the template document on your device in your preferred format. US Legal Forms will save you time and effort in determining if the form you discovered online is appropriate for your needs. Create an account and gain unlimited access to all the templates you need.

- US Legal Forms is a platform that streamlines the process of finding the appropriate forms online.

- US Legal Forms is the singular destination you require to acquire the latest examples of documents, verify their usage, and download these examples to complete them.

- It is a repository with over 85K forms that apply in diverse fields.

- Seeking a Texas Property Gift Deed Form, you will not need to question its authenticity, as all the forms are validated.

- An account at US Legal Forms will guarantee you have all the required samples at your disposal.

- Store them in your records or add them to the My documents catalog.

- You have access to your saved forms from any device by simply clicking Log In at the library website.

- If you still lack an account, you can always search again for the template you need.

Form popularity

FAQ

To write a gift deed in Texas, begin by including the names and addresses of both the donor and the recipient. Next, add a clear legal description of the property being gifted. Use a Texas property gift deed form for proper structure and compliance with Texas law. Finally, ensure all parties sign the deed and file it with the appropriate county authority.

To create a valid gift deed in Texas, certain requirements must be met. The deed must clearly identify the property being gifted and the donor's intention to make a gift. Both the donor and recipient must sign the deed, and it should be filed with the county clerk's office. Utilizing a Texas property gift deed form can simplify meeting all necessary legal requirements.

Using a gift deed may have some drawbacks, primarily concerning gift tax implications and loss of control over the property. Once you transfer the property, you cannot easily revoke the deed. Additionally, if the recipient faces financial issues, creditors might pursue the gifted property. It's important to weigh these considerations when deciding to use a Texas property gift deed form.

While it is not legally required to hire a lawyer to transfer a deed in Texas, it can be beneficial. A real estate attorney can ensure all documents, including the Texas property gift deed form, meet legal standards and protect your interests. If you feel uncertain about the process, consulting a professional helps secure a smooth transfer.

Gifting property in Texas can lead to various tax implications. Generally, the donor may need to report the gift if it exceeds the annual exclusion limit set by the IRS. However, recipients typically do not face income tax on the received property. To navigate these complexities, you might consider using a Texas property gift deed form for clear documentation.

To transfer ownership of a house to a family member in Texas, you can use a Texas property gift deed form. This form allows you to officially document the transfer and avoid potential complications in the future. Ensure that the deed is signed and notarized, and then file it with your local county records office to finalize the transfer and protect the rights of all parties involved.

Gifting a property deed in Texas involves filling out a Texas property gift deed form to legally transfer ownership. You must ensure the form is properly executed, including notarization, to make the transfer effective. It’s crucial to record the deed with the local county clerk's office to provide public notice of the change in ownership.

In Texas, you can generally avoid capital gains tax on inherited property due to the 'step-up in basis' rule. This rule adjusts the property’s basis to its fair market value at the time of the owner's death, potentially eliminating gains from taxation when you sell. A thorough understanding of the Texas property gift deed form can help you manage the inheritance process effectively and ensure you capitalize on tax benefits.

To avoid gift tax in Texas, you can utilize the annual exclusion, which allows you to gift up to $17,000 per individual without incurring any tax. Additionally, if the gift is directly used for medical expenses or education, these are generally exempt from gift tax. Using a Texas property gift deed form can also simplify the process of documenting these gifts, ensuring compliance with tax regulations.

To transfer a property deed to a family member in Texas, prepare a Texas property gift deed form and include all necessary details. Both you and the recipient must sign the document, and it must be notarized. Afterward, file it with the county clerk’s office to record the deed and finalize the transfer.