SR-22 Financial Responsibility Insurance Certificate Formula is a legal requirement for certain individuals who have had their driver's license suspended or revoked due to specific traffic violations or DUI (driving under the influence) charges. The SR-22 form serves as proof that the person has adequate auto insurance coverage to meet their state's minimum liability requirements. The SR-22 financial responsibility insurance certificate formula is a specific calculation used by insurance companies to determine the premium or cost associated with filing an SR-22 form on behalf of an individual. This formula takes into account various factors such as the individual's driving history, the reason for their license suspension, and their past insurance record. There are different types of SR-22 financial responsibility insurance certificate formulas, based on the type of coverage required by the state and the individual's specific circumstances. Some common types include: 1. Operator's Certificate: This type of SR-22 is for individuals who do not own a vehicle but still need to meet the state's insurance requirements. It provides liability coverage when operating a vehicle owned by someone else. 2. Owner's Certificate: This SR-22 is for individuals who own and operate their own vehicle(s). It provides liability coverage for both owned and non-owned vehicles. 3. Operator-Owner Certificate: This type of SR-22 combines the benefits of the operator's and owner's certificates, providing liability coverage for both owned and non-owned vehicles. 4. Broad Form Certificate: This SR-22 extends the liability coverage to any vehicle the individual operates, whether it is owned by them or not. It is essential to note that the specific requirements, terms, and cost associated with the SR-22 financial responsibility insurance certificate formula can vary from state to state. It is recommended to consult with an insurance agent or company licensed in your state to understand the exact requirements and associated costs for obtaining an SR-22 certificate.

Sr 22 Financial Responsibility Insurance Certificate Formula

Description

How to fill out Sr 22 Financial Responsibility Insurance Certificate Formula?

Legal managing may be mind-boggling, even for skilled professionals. When you are interested in a Sr 22 Financial Responsibility Insurance Certificate Formula and don’t have the a chance to commit in search of the correct and updated version, the operations may be demanding. A robust online form library might be a gamechanger for everyone who wants to handle these situations effectively. US Legal Forms is a market leader in web legal forms, with more than 85,000 state-specific legal forms available at any time.

With US Legal Forms, it is possible to:

- Access state- or county-specific legal and organization forms. US Legal Forms covers any requirements you may have, from individual to enterprise paperwork, all-in-one location.

- Use innovative tools to finish and deal with your Sr 22 Financial Responsibility Insurance Certificate Formula

- Access a resource base of articles, tutorials and handbooks and materials highly relevant to your situation and requirements

Help save time and effort in search of the paperwork you will need, and employ US Legal Forms’ advanced search and Review feature to find Sr 22 Financial Responsibility Insurance Certificate Formula and acquire it. In case you have a monthly subscription, log in in your US Legal Forms profile, look for the form, and acquire it. Take a look at My Forms tab to see the paperwork you previously downloaded as well as deal with your folders as you see fit.

Should it be the first time with US Legal Forms, register an account and get unlimited access to all benefits of the library. Listed below are the steps to take after accessing the form you need:

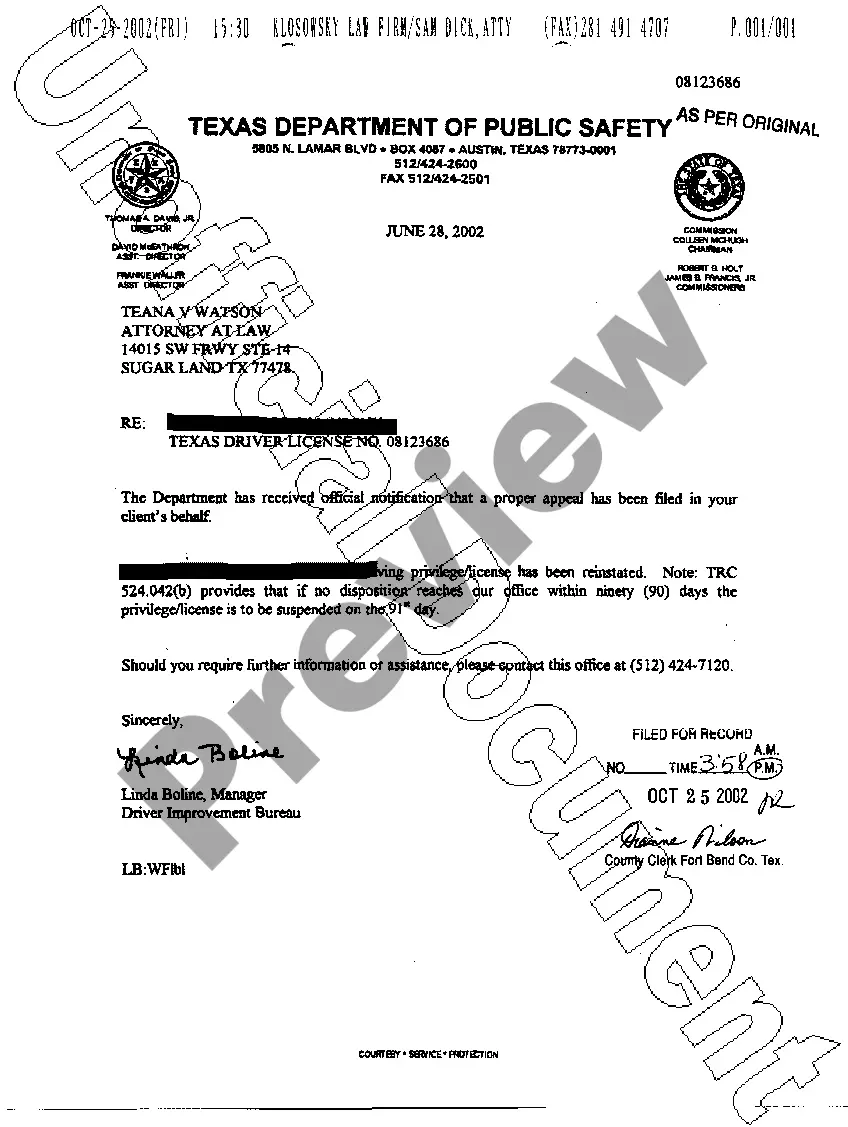

- Verify this is the correct form by previewing it and reading through its information.

- Be sure that the sample is recognized in your state or county.

- Choose Buy Now when you are all set.

- Select a subscription plan.

- Find the formatting you need, and Download, complete, sign, print out and send your papers.

Benefit from the US Legal Forms online library, backed with 25 years of expertise and stability. Transform your day-to-day papers administration in to a smooth and user-friendly process right now.

Form popularity

FAQ

What is a California SR-22? An SR22 is a certificate of insurance. Your auto insurance company files it with the California Department of Motor Vehicles in order to confirm that you meet the state's minimum insurance requirements for auto insurance liability coverage.

Typically you need to file the SR-22 for 3 years for DUI type violations and 4 years for accidents without insurance. These requirements can vary depending on your personal circumstances so be sure to ask the DMV for specifics that relate to your driver's license.

An SR-22 is a certificate of financial responsibility required for some drivers by their state or court order.

An SR22 must be obtained anytime you wish to reinstate your license following a DMV suspension or revocation. It is also necessary in order to continue driving with an ignition interlock device (IID) installed.

Editorial and user-generated content is not provided, reviewed or endorsed by any company. To file an SR-22 certificate in California, purchase at least the state's minimum liability car insurance coverage. The insurance company will file your SR-22 with the California DMV on your behalf.