The dissolution of a corporation package contains all forms to dissolve a corporation in Texas, step by step instructions, addresses, transmittal letters, and other information.

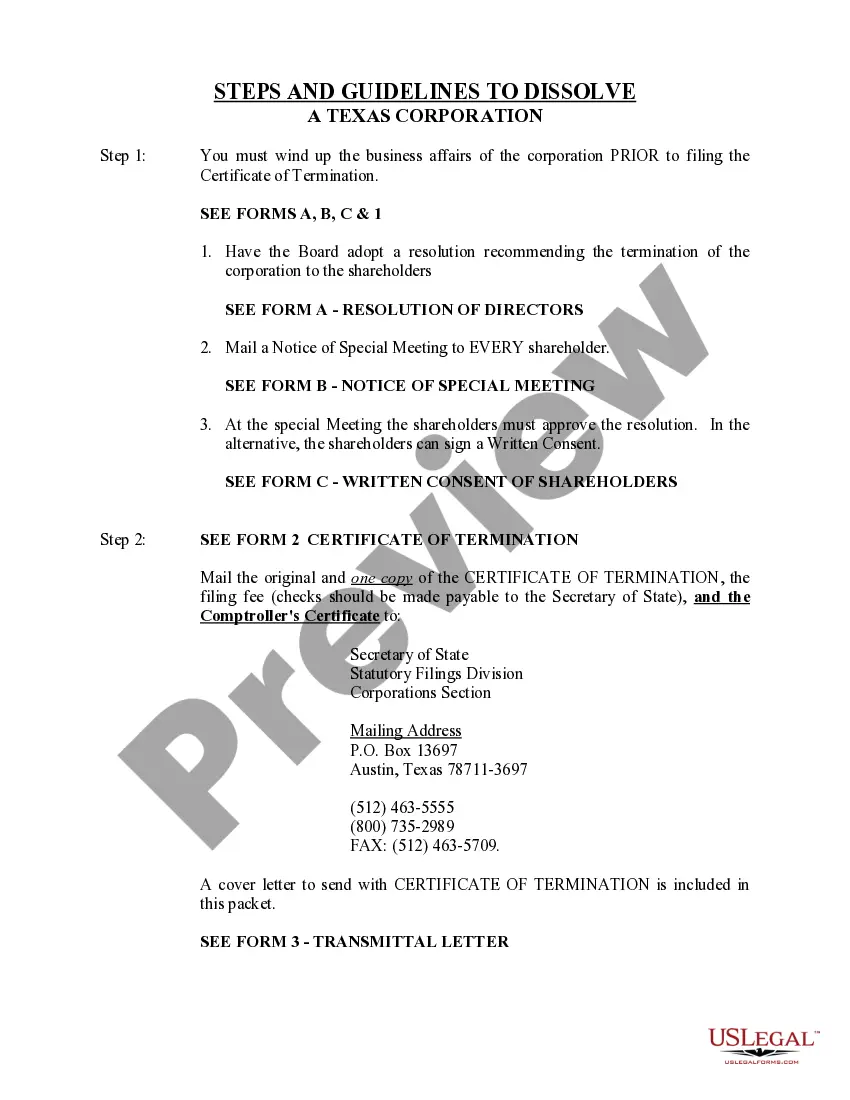

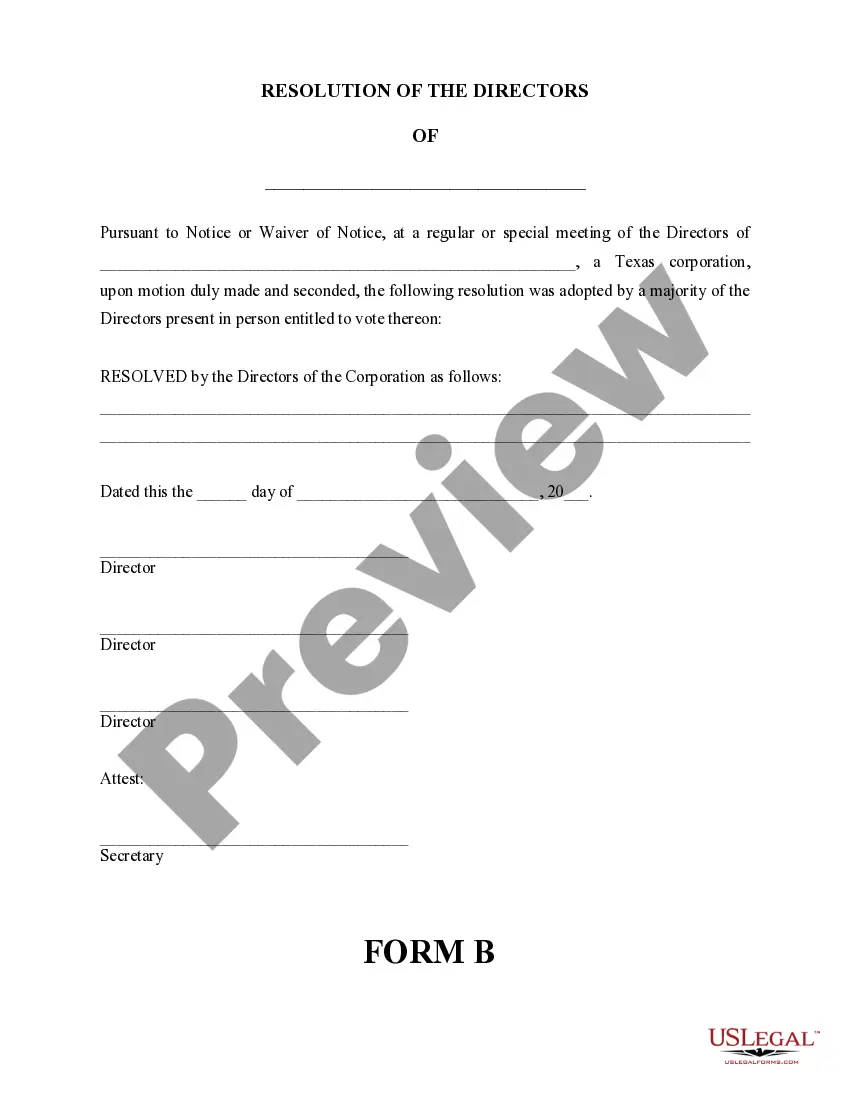

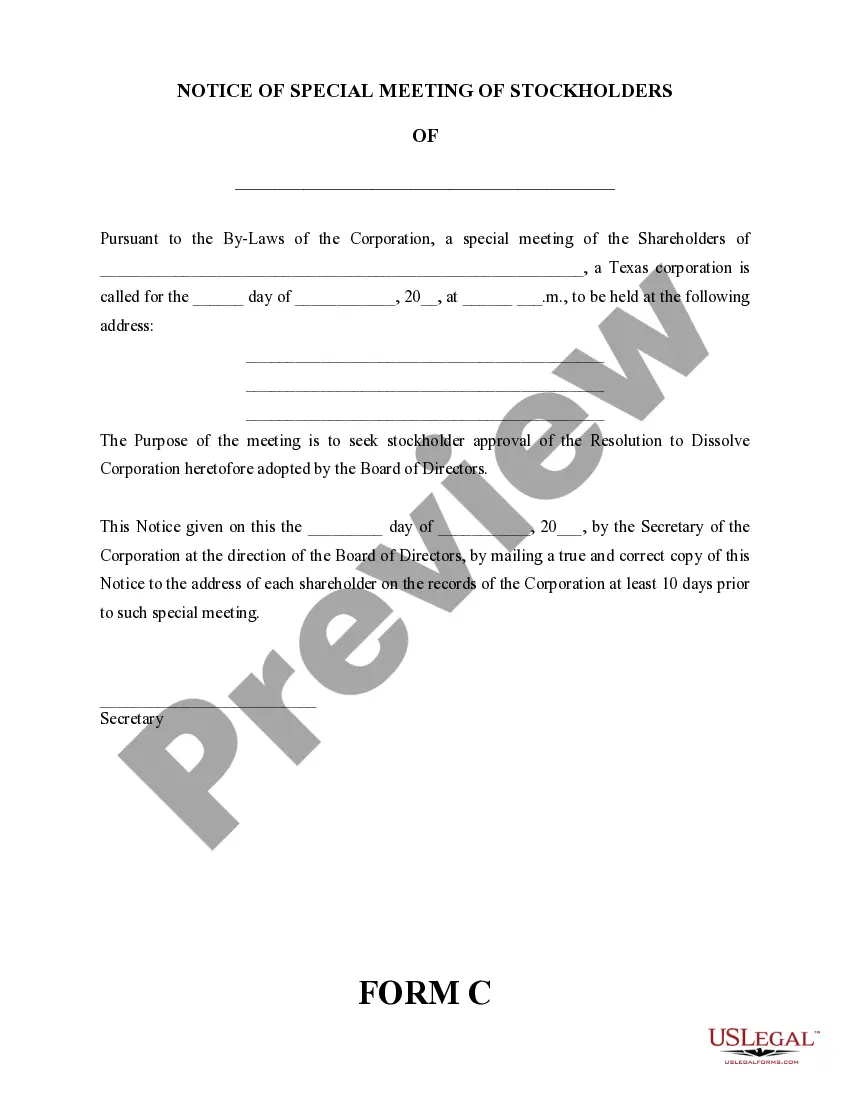

Texas dissolution of corporation refers to the process of legally terminating or winding up a corporation's existence in the state of Texas. When a corporation is dissolved, it ceases to carry on any business activities and its legal entity as a separate entity comes to an end. This dissolution process involves several steps and requirements that must be followed to ensure compliance with Texas state laws. The Texas Business Organizations Code (BOC) governs the dissolution of corporations in Texas. The BOC provides specific guidelines and procedures that a corporation must adhere to when initiating the dissolution process. It is crucial for corporations to understand these procedures to avoid any legal complications and to fulfill their obligations during the dissolution. There are several reasons why a corporation may choose to dissolve in Texas. These reasons can include the conclusion of the corporation's business objective, financial difficulties, shareholder disagreements, merger or acquisition, bankruptcy, or other legal requirements. Additionally, a corporation may voluntarily dissolve if the directors and shareholders pass a resolution approving the dissolution and meet any other requirements laid out in the BOC. The Texas dissolution process typically involves the following steps: 1. Preparation: The corporation's directors or shareholders must decide on the dissolution and obtain the necessary approval from the shareholders as required by the BOC. They may also need to consult with legal professionals to ensure compliance with all legal obligations during the dissolution process. 2. Filing Articles of Dissolution: The corporation must file Articles of Dissolution with the Texas Secretary of State. These articles contain information about the corporation, such as its name, date of incorporation, and a statement affirming the dissolution. Filing fees may be required. 3. Notice to Creditors: The corporation must give notice to its known creditors and publish a notice of the dissolution in a newspaper in the county where its principal place of business is located. This notice provides an opportunity for creditors to make any claims against the corporation before it is fully dissolved. 4. Handling Debts, Claims, and Assets: The corporation must settle all outstanding debts, pay off creditors, and distribute remaining assets to the shareholders or other parties entitled to receive them. This involves liquidating the corporation's assets and distributing the proceeds as per the BOC requirements. In Texas, there are various types of dissolution of corporations, which include: 1. Voluntary dissolution: This occurs when the directors and shareholders of a corporation initiate the dissolution process by passing a resolution approving the dissolution. It is the most common type of dissolution. 2. Administrative dissolution: The Texas Secretary of State may administratively dissolve a corporation if it fails to comply with certain legal requirements, such as maintaining a registered agent, filing annual reports and tax returns, or paying the required fees. 3. Judicial dissolution: In some cases, the court may order the dissolution of a corporation if it is proven to be engaging in fraudulent activities, oppressive actions towards shareholders, or illegal activities. 4. Involuntary dissolution: This typically occurs when a corporation fails to meet its legal obligations or acts against public policy. It can be initiated by the Texas Attorney General, shareholders, or creditors. In summary, Texas dissolution of corporation is a legal process involving the termination or winding up of a corporation's existence in Texas. Understanding the specific procedures and requirements outlined in the Texas Business Organizations Code is crucial for corporations to ensure a smooth and legally compliant dissolution. Whether it is a voluntary, administrative, judicial, or involuntary dissolution, corporations must carefully follow the necessary steps and fulfill their obligations to complete the process successfully.