Home Closing Statement Examples

Description

How to fill out Texas Closing Statement?

Legal documents administration can be perplexing, even for the most seasoned experts.

When you are looking for Home Closing Statement Samples and lack the time to search for the correct and updated edition, the process can be aggravating.

Gain access to a valuable resource library of articles, tutorials, guides, and tools that relate to your circumstances and needs.

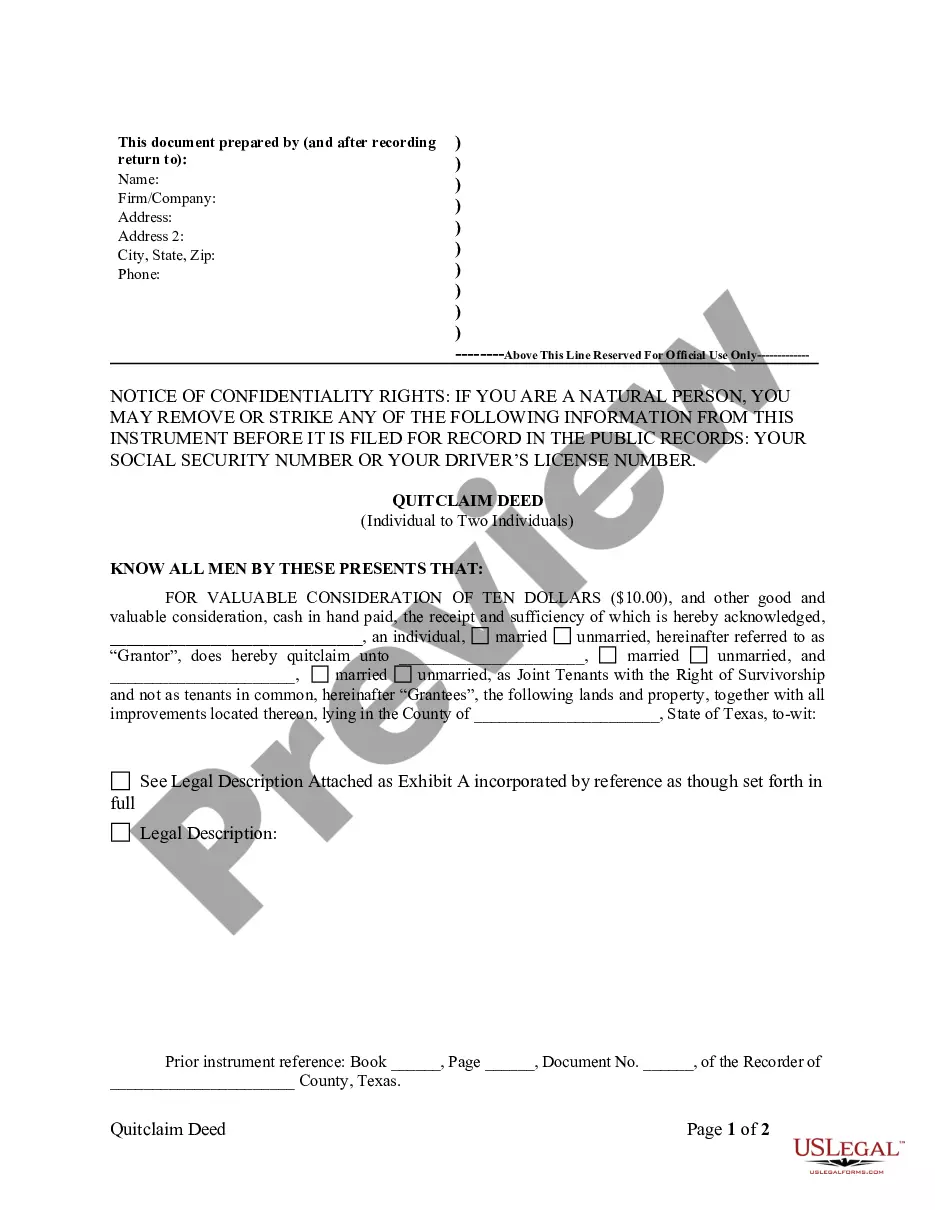

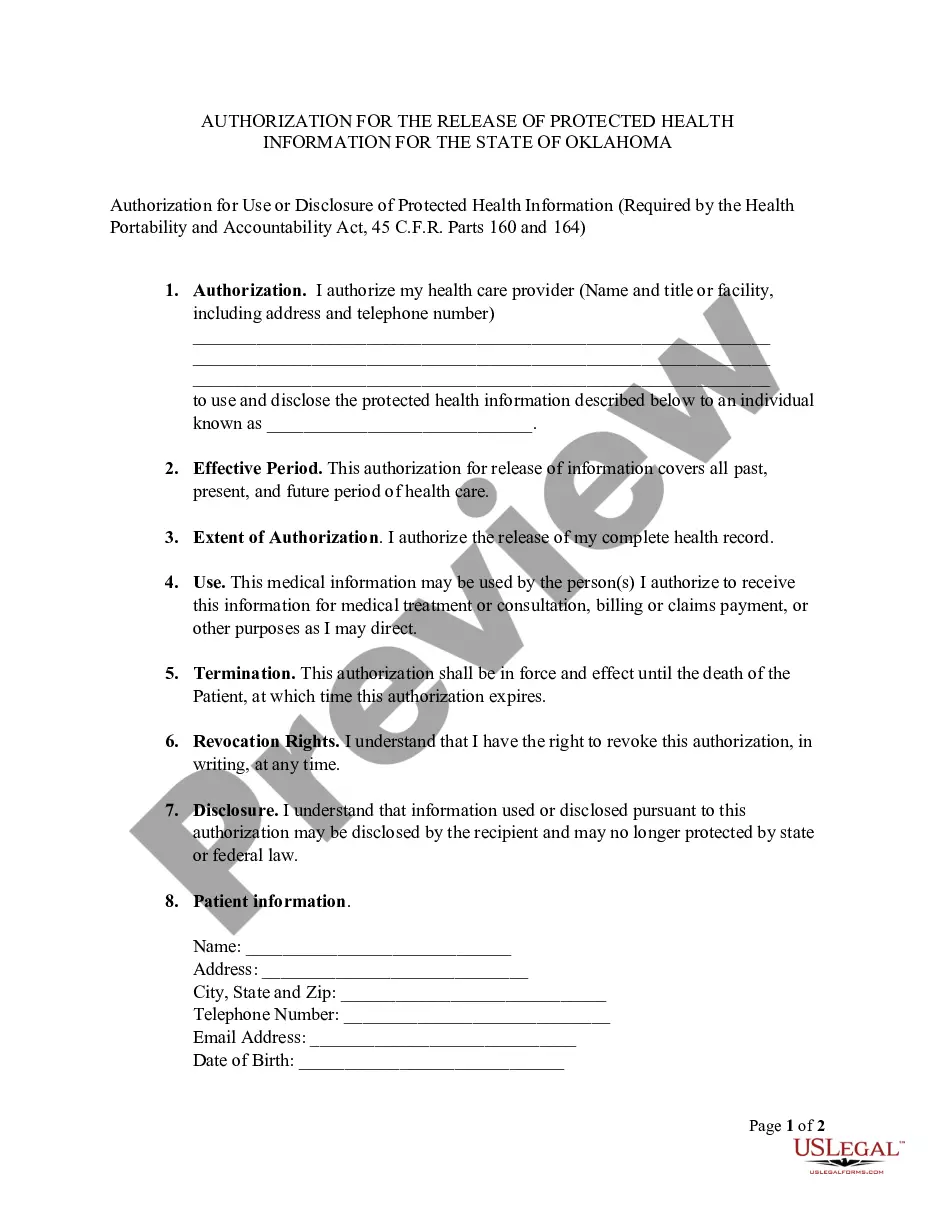

Save time and effort locating the paperwork you require, and utilize US Legal Forms’ sophisticated search and Preview functions to find Home Closing Statement Samples.

Make the most of the US Legal Forms online library, backed by 25 years of experience and reliability. Transform your everyday document management into a seamless and accessible process today.

- Log in to your US Legal Forms account, search for the form, and obtain it.

- Check your My documents section to see the documents you have previously saved and manage your folders as needed.

- If you are new to US Legal Forms, create an account and gain unlimited access to all the advantages of the library.

- After obtaining the desired form, confirm it is the correct one by previewing and reviewing the description.

- Verify that the sample is approved in your state or county.

- Click Buy Now once you are set.

- Select a subscription plan.

- Choose the file format you wish, and Download, fill it out, eSign, print, and send your documents.

- Access state- or county-specific legal and business documents.

- US Legal Forms meets all your needs, from personal to corporate papers, all in a single location.

- Use advanced tools to complete and manage your Home Closing Statement Samples.

Form popularity

FAQ

In most residential transactions, the closing statement is used to finalize the financial aspects of the sale. It provides a comprehensive overview of all costs involved in the transaction, ensuring that both the buyer and seller agree on the figures. This document plays a critical role in ensuring transparency and accountability for both parties. Explore home closing statement examples for insights into its typical use.

How To Read A Settlement Statement From Your Real Estate Closing YouTube Start of suggested clip End of suggested clip This first page also includes your principal. And interest payment for your loan. Including anyMoreThis first page also includes your principal. And interest payment for your loan. Including any escrows. So you'll see principal and interest underneath it'll say estimated escrows.

The answer is Closing Disclosure. The closing statement used for most residential closings is the Closing Disclosure prepared by the CFPB.

A closing statement is a form used in a real estate transaction that includes an itemized list of all the buying or selling costs associated with that transaction. It's a standard element of home sales, especially those that involve mortgages, and refinancings.

A Closing Disclosure is a five-page form that provides final details about the mortgage loan you have selected. It includes the loan terms, your projected monthly payments, and how much you will pay in fees and other costs to get your mortgage (closing costs).

The closing statement is the attorney's final statement to the jury before deliberation begins. The attorney reiterates the important arguments, summarizes what the evidence has and has not shown, and requests jury to consider the evidence and apply the law in his or her client's favor.