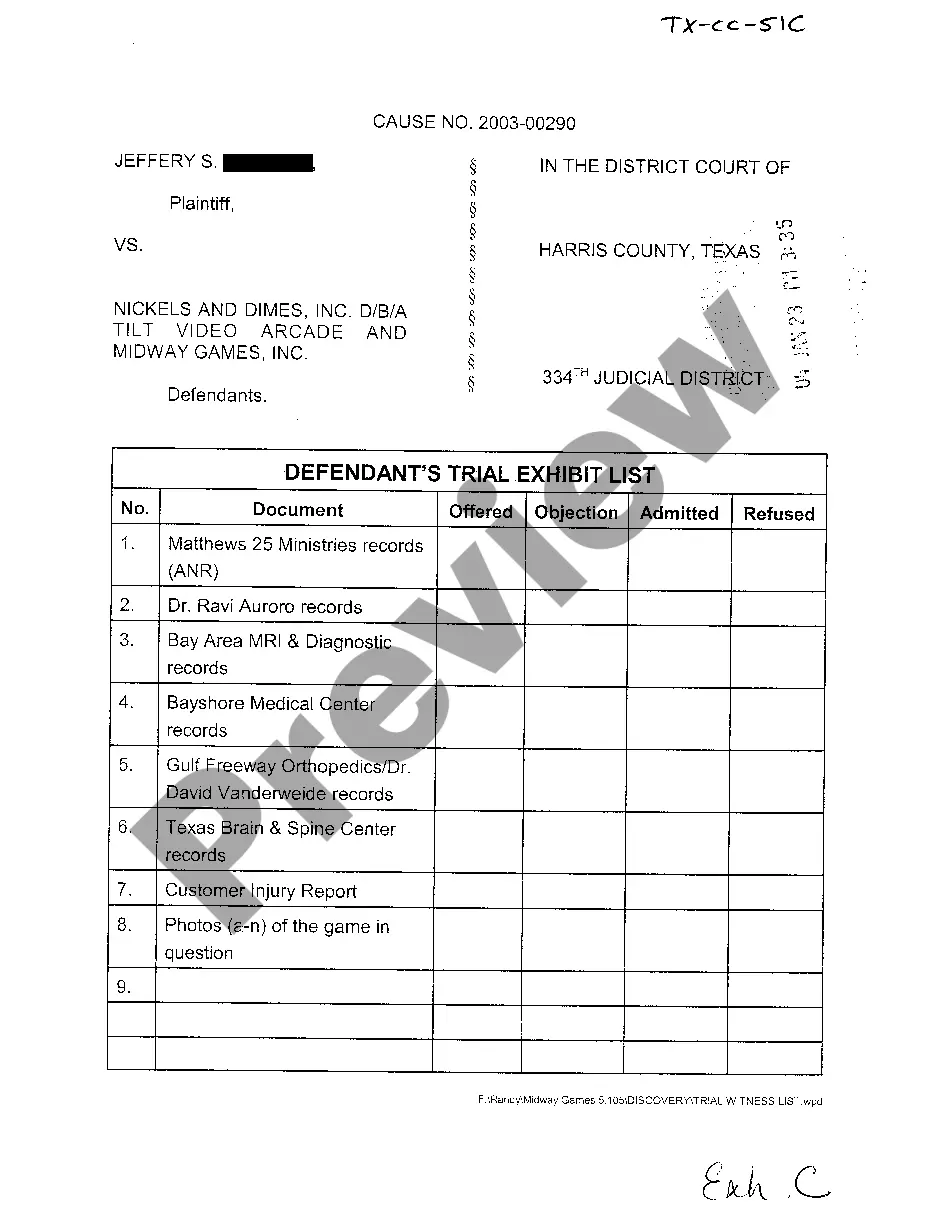

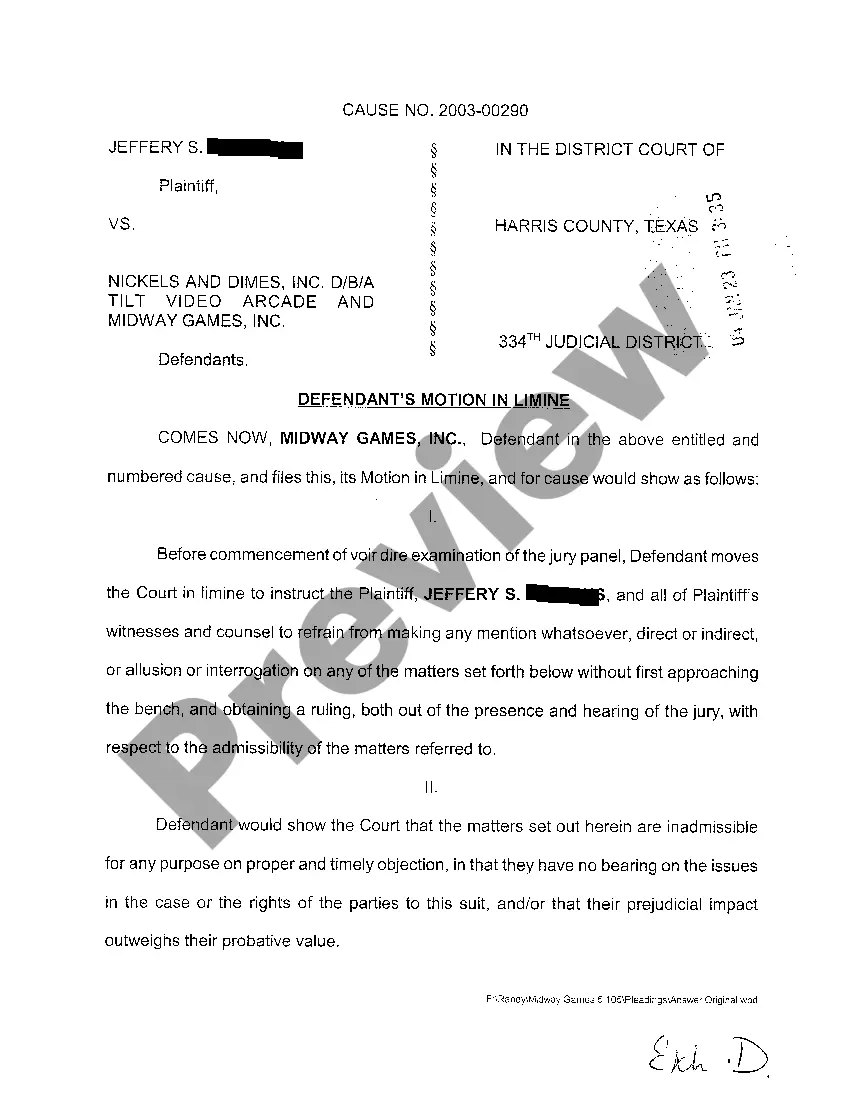

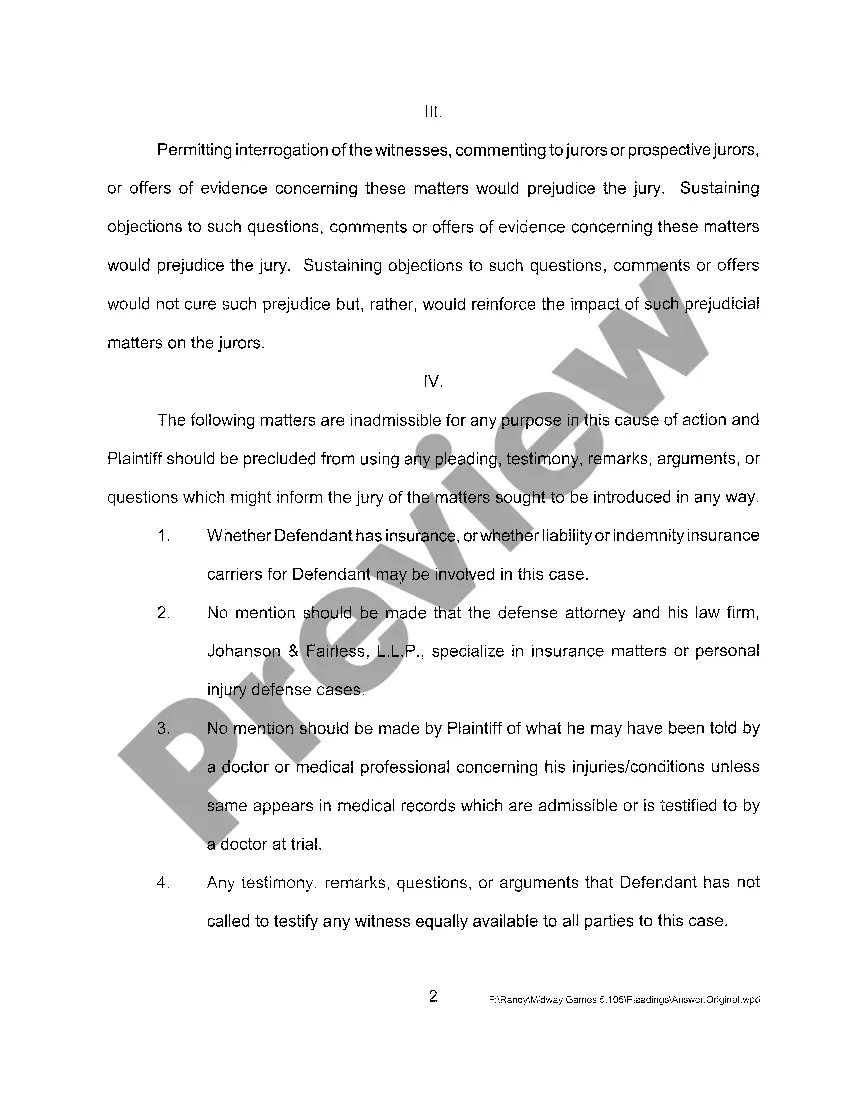

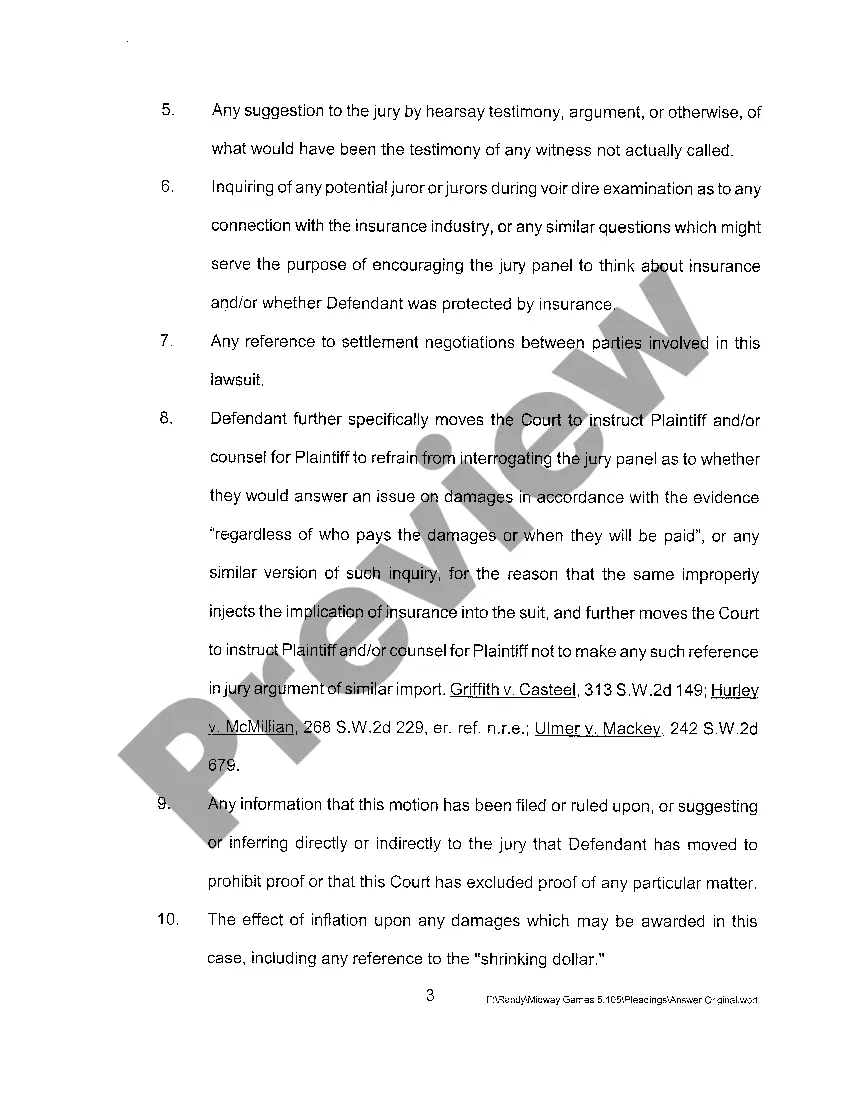

Exhibit List Example For Court

Description

How to fill out Texas Defendant's Trial Exhibit List?

Accessing legal documents that adhere to federal and local laws is crucial, and the internet provides a variety of choices to select from.

However, why squander time searching for the properly crafted Exhibit List Example For Court template online when the US Legal Forms digital library already offers such documents compiled in one location.

US Legal Forms is the premier online legal resource boasting over 85,000 fillable documents created by legal professionals for various business and personal scenarios.

Review the template using the Preview function or through the text outline to ensure it satisfies your requirements.

- They are easy to navigate with all forms categorized by state and intended use.

- Our team stays up-to-date with legal changes, so you can be assured your form is current and compliant when acquiring an Exhibit List Example For Court from our site.

- Obtaining an Exhibit List Example For Court is quick and straightforward for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the document sample you need in your desired format.

- If you are new to our site, follow the steps below.

Form popularity

FAQ

'Exhibit A' typically refers to the first exhibit introduced in a legal case, often used to highlight crucial evidence. Identifying exhibits by letters or numbers helps maintain clarity throughout proceedings. For clarity and organization, consider using an exhibit list example for court that outlines each item correctly.

FORM 20C-C Alabama Consolidated Corporate Income Tax Return. The Form 20C-C must be filed by or on behalf of the members of the Alabama affiliated group in ance with Alabama Code Section 40-18-39, when a Consolidated Filing elec- tion has been made pursuant to Code Section 40-18-39(c).

You MUST Use Form 40NR If: You are not a resident of Alabama and you received taxable income from Alabama sources or for performing services within Alabama and your gross income from Alabama sources exceeds the allowable prorated personal exemption. Nonresidents must prorate the personal exemption.

Individual Income FormMaking a PaymentCurrent Form 40A- Individual Income Tax Return (Short Form)Alabama Department of Revenue P. O. Box 2401 Montgomery, AL 36140 -0001Current Form 40NR ? Individual Income Tax Return (Nonresidents)Alabama Department of Revenue P. O. Box 2401 Montgomery, AL 36140 -00016 more rows

The Alabama Form 65 is similar to the federal Form 1065 in many ways. And, the Form 65 requires that an Alabama Schedule K-1 be completed for any entity that was a partner or owner during the taxable year.

Nonresidents must file a return if their Alabama income exceeds the allowable prorated personal exemption. Part year residents whose filing status is ?Single? must file if gross income for the year is at least $4,000 while an Alabama resident.

If you are required to file both returns, the total personal exemption ($1,500 or $3,000) and the dependent exemption ($300) must be claimed on the part year return (Form 40). No personal exemption or dependent exemption can then be claimed on the nonresident return (Form 40NR).

Form 2210AL is designed to calculate underpayment of estimated tax penalty as prescribed in Section 40-2A-11 and 40-18-80 of the Code of Alabama 1975. 2. 100% of your 2021 tax. (Your 2021 tax return must cover a 12-month period.)

Form 1040NR collects income tax from individuals who live or work in the U.S. for a significant part of the year, yet who do not possess a green card or U.S. citizenship. If you earn income in the U.S. and meet one of two ?days of presence? tests, then you may be required to file this form.