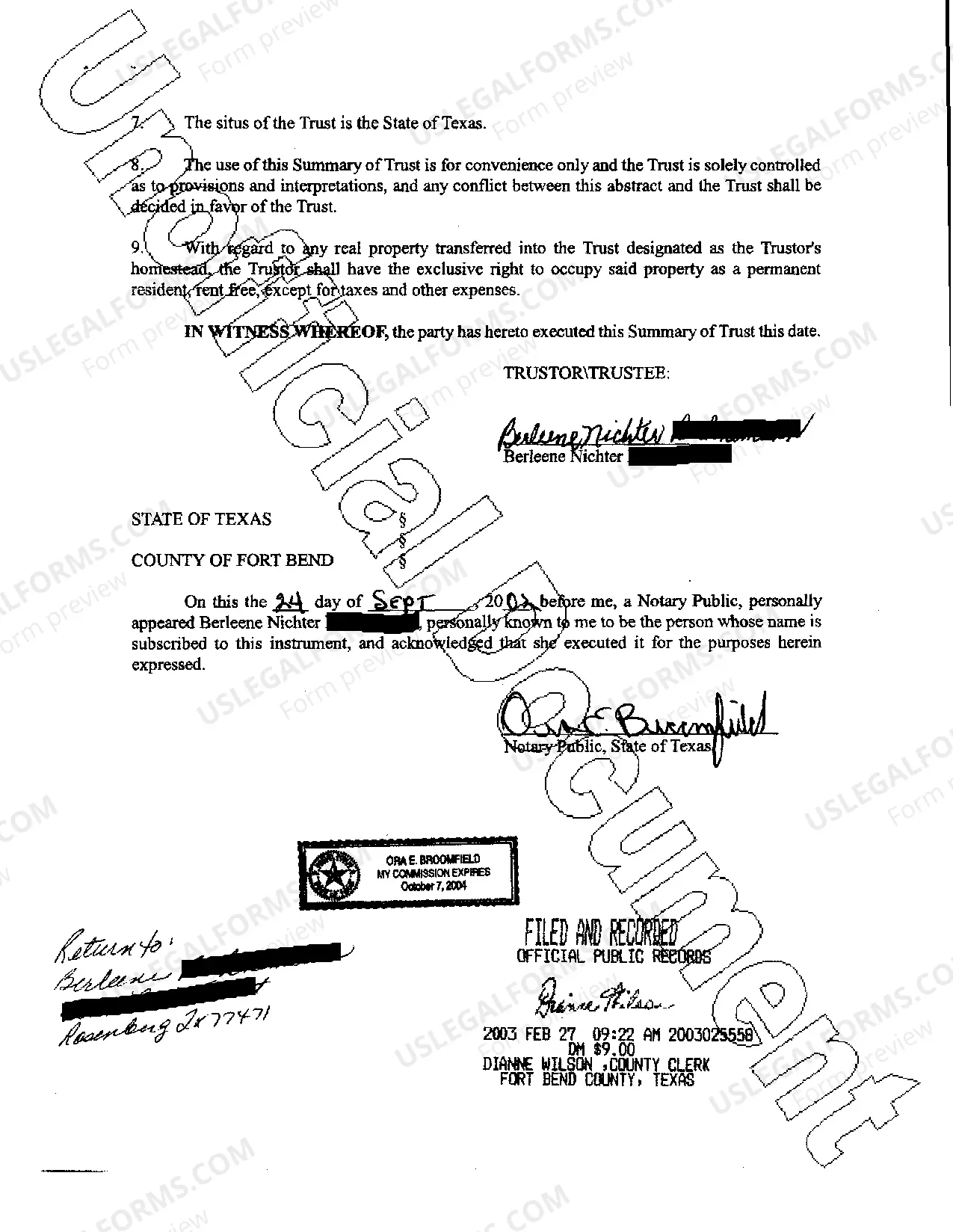

Texas Trust Agreement Form

Description

How to fill out Texas Trust Agreement?

There's no longer a requirement to dedicate hours searching for legal documents to fulfill your local state obligations.

US Legal Forms has compiled all of them in a single location and made their access easier.

Our platform offers over 85k templates for any business and personal legal matters categorized by state and purpose.

Use the search field above to find another sample if the previous one did not suit your needs. Click Buy Now next to the template name when you locate the appropriate one. Choose the preferred pricing plan and either register for an account or Log In. Process payment for your subscription using a card or via PayPal to continue. Select the file format for your Texas Trust Agreement Form and download it onto your device. Print your form to complete it by hand or upload the sample if you prefer to do it in an online editor. Generating official documents under federal and state laws is quick and easy with our library. Try US Legal Forms now to maintain your paperwork in order!

- All documents are properly drafted and confirmed for accuracy, allowing you to feel assured in acquiring a current Texas Trust Agreement Form.

- If you are acquainted with our service and already possess an account, you must verify your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all previously obtained documents at any time by accessing the My documents tab in your profile.

- If you have never used our service before, the process will involve additional steps to finalize.

- Here's how new users can locate the Texas Trust Agreement Form in our collection.

- Examine the page content thoroughly to confirm it includes the sample you need.

- To do this, utilize the form description and preview options if available.

Form popularity

FAQ

If you hire a lawyer, the cost of creating a living trust will depend on the fees the attorney charges. You could end up paying more than $1,000 to create a living trust.

In Texas a trust is not a legal entity. Rather, it is a legal relationship in which a trustee holds legal title for the benefit of another person called the beneficiary. Unlike a corporation, which is required to file a certificate of formation with the Secretary of State, there is no such requirement for a trust.

To make a living trust in Texas, you:Choose whether to make an individual or shared trust.Decide what property to include in the trust.Choose a successor trustee.Decide who will be the trust's beneficiariesthat is, who will get the trust property.Create the trust document.More items...

Creating a living trust in Texas is a matter of personal choice, but many people find the benefits worthwhile. Your trust keeps your personal business out of the public eye. Wills must go through probate and become public record. A trust is not probated and does not become public record.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.