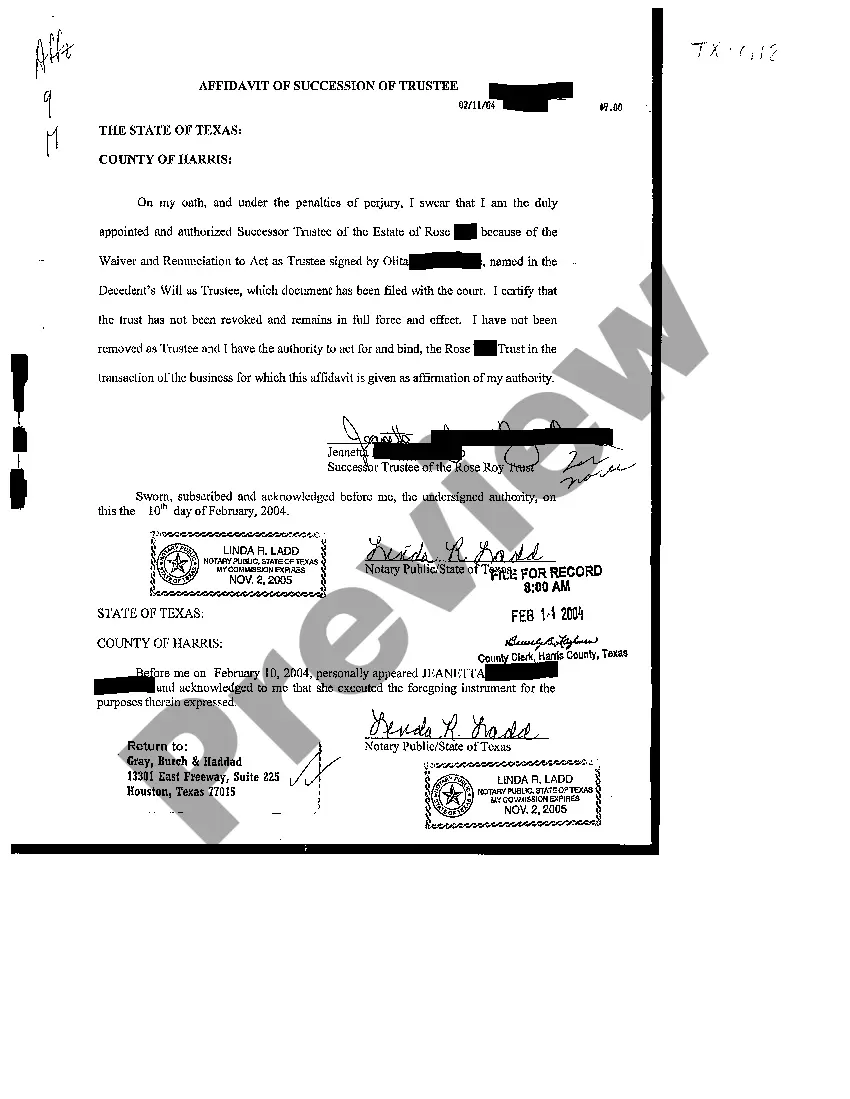

Certificate Of Trust In Texas

Description

How to fill out Texas Affidavit Of Succession Of Trustee?

Legal documents management can be overwhelming, even for the most proficient professionals.

When you need a Certificate Of Trust In Texas and cannot find the time to seek the appropriate and current version, the process may be stressful.

Utilize a valuable resource library of articles, how-to guides, and resources pertinent to your situation and needs.

Save time and energy searching for the documents you require, and use US Legal Forms’ enhanced search and Review feature to find Certificate Of Trust In Texas and obtain it.

Confirm that the template is recognized in your state or county. Choose Buy Now when you are ready. Select a monthly subscription plan. Choose the format you prefer, and Download, fill out, eSign, print, and distribute your documents. Enjoy the US Legal Forms online library, backed by 25 years of expertise and reliability. Streamline your everyday document management into a seamless and user-friendly process today.

- If you have a subscription, Log In to your US Legal Forms account, look for the document, and download it.

- Visit My documents section to see the documents you have stored and to manage your folders as needed.

- If this is your initial experience with US Legal Forms, create a free account for unlimited access to all benefits of the library.

- Here are the actions to take after you access the document you need.

- Verify it is the correct form by previewing it and reviewing its details.

- Access state- or county-specific legal and business documents.

- US Legal Forms meets any requirements you might have, from personal to business documents, in one location.

- Employ advanced tools to fill out and manage your Certificate Of Trust In Texas.

Form popularity

FAQ

To form a Wyoming S corp, you'll need to ensure your company has a Wyoming formal business structure (LLC or corporation), and then you can elect S corp tax designation. If you've already formed an LLC or corporation, file Form 2553 with the Internal Revenue Service (IRS) to designate S corp taxation status.

Owner employment: In an S corp, owners who work for the company must receive a reasonable salary and are subject to payroll taxes. In contrast, owners of an LLC can take profits without paying payroll taxes, although they are subject to self-employment taxes.

To form a Wyoming S corp, you'll need to ensure your company has a Wyoming formal business structure (LLC or corporation), and then you can elect S corp tax designation. If you've already formed an LLC or corporation, file Form 2553 with the Internal Revenue Service (IRS) to designate S corp taxation status.

Wyoming does not have any state taxes, as such has no need for S Corporations. If you want S Corporation status, you must file Form 2553 with the IRS, which is included in the corporate kit we send you, within 75 days from the date of formation of the company or by March 15th of any given tax year.

Wyoming charges a $102 filing fee for your Articles of Organization, but there may be add-ons and other costs that bump this amount up (such as fees for licenses or permits in your industry). You can opt for the online filing option or file your documents by postal mail.

Some jurisdictions?the District of Columbia, Louisiana, New Hampshire, New York City, Tennessee, and Texas?do not recognize the federal S corporation election and, for the most part, tax S corporations like other business corporations.

It costs $199 to incorporate your business in Wyoming for the first year. Subsequent years will require a $52 annual report and our $59 Wyoming registered agent service. Every $199 corporation includes: State Filing Fee.

Wyoming does not have any state taxes, as such has no need for S Corporations. If you want S Corporation status, you must file Form 2553 with the IRS, which is included in the corporate kit we send you, within 75 days from the date of formation of the company or by March 15th of any given tax year.