Eviction Process In Texas How Long Does It Take

Description

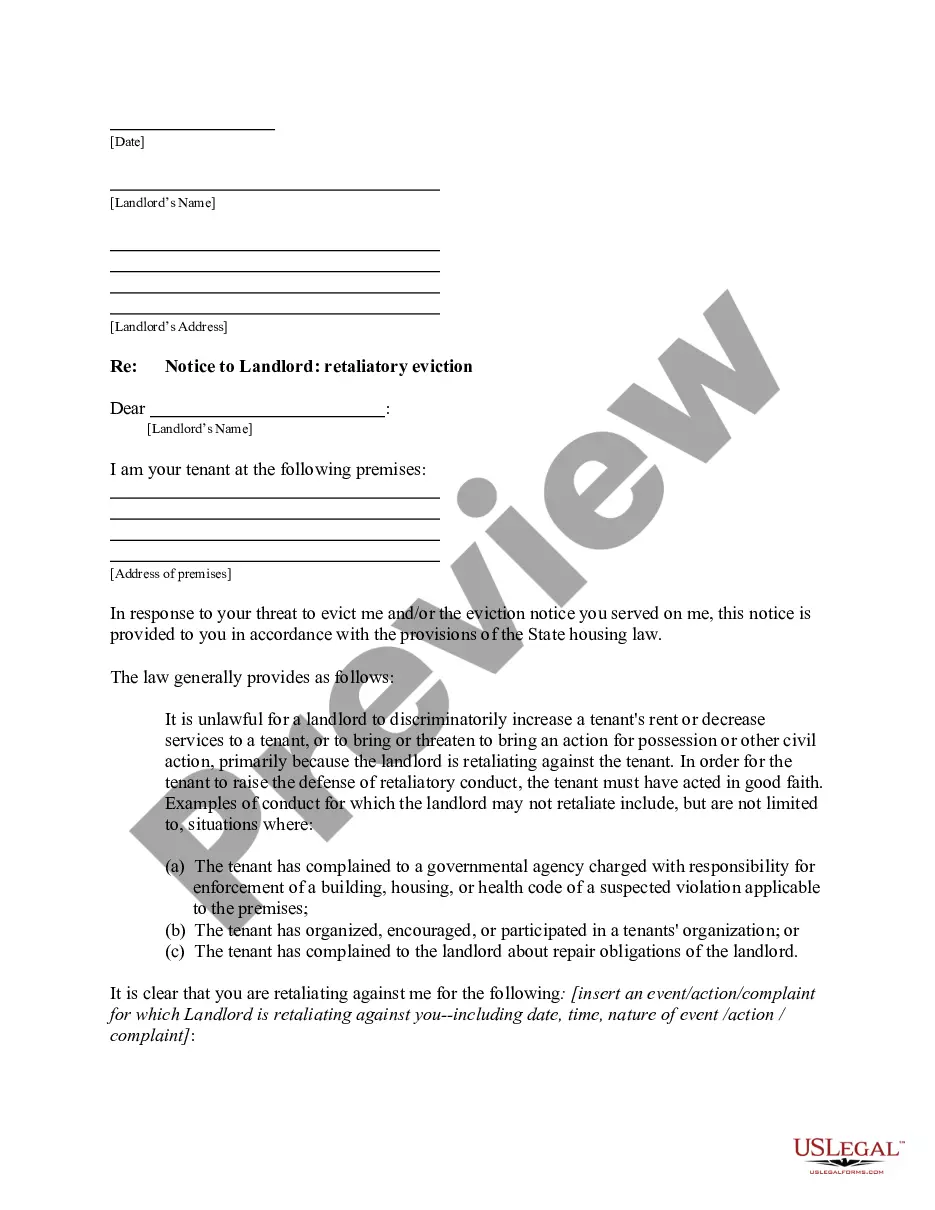

How to fill out Texas Letter From Tenant To Landlord Containing Notice To Landlord To Cease Retaliatory Threats To Evict Or Retaliatory Eviction?

The Eviction Procedure In Texas How Long Does It Require.

As presented on this page, this is a reusable formal template crafted by expert attorneys in compliance with federal and state statutes and regulations. For over 25 years, US Legal Forms has supplied individuals, businesses, and legal professionals with more than 85,000 validated, state-specific documents for any commercial and personal situation. It is the fastest, most straightforward, and most dependable method to acquire the paperwork you require, as the service ensures bank-grade data security and anti-malware safeguards.

Register for US Legal Forms to have verified legal documents for all of life’s situations readily available.

- Search for the document you require and evaluate it.

- Register and sign in.

- Obtain the editable template.

- Fill out and sign the document.

- Re-download your documents.

Form popularity

FAQ

A POA is required prior to the Department of Revenue Administration communicating with anyone other than the taxpayer regarding any issue relating to the taxpayer. All applicable items must be filled in to properly complete Form DP-2848 New Hampshire Power of Attorney (POA).

Payment may be made at the clerk's office counter, over the telephone, or by mail. Credit card payments made by mail should be accompanied by a Credit Card Payment Information Form. In addition, payment may be paid online via Pay.gov.

A New Hampshire durable statutory power of attorney form allows a person (?principal?) to transfer the handling of financial affairs to someone else (?agent?). The powers given can be limited or broad depending on the principal's preference.

Steps for Making a Financial Power of Attorney in New Hampshire Create the POA Using a Statutory Form, DIY program, or Attorney. ... Sign the POA in the Presence of a Notary Public. ... Store the Original POA in a Safe Place. ... Give a Copy to Your Agent. ... File a Copy With the Land Records Office.

To request the issuance of a tax certification for a withdrawal, cancellation, dissolution or good standing, the Form AU-22, Certification Request Form, must be completed in full and submitted with a non-refundable fee of $30.00 made payable to the State of New Hampshire.

To request forms, please email forms@dra.nh.gov or call the Forms Line at (603) 230-5001. If you have a substantive question or need assistance completing a form, please contact Taxpayer Services at (603) 230-5920.

(a) Form DP-10, interest and dividends tax return, shall be completed and filed by taxpayers subject to the interest and dividends tax to report their income to the department on the 15th day of the 4th month following the end of the taxable period.