Texas Tax Exempt Form For Resale

Description

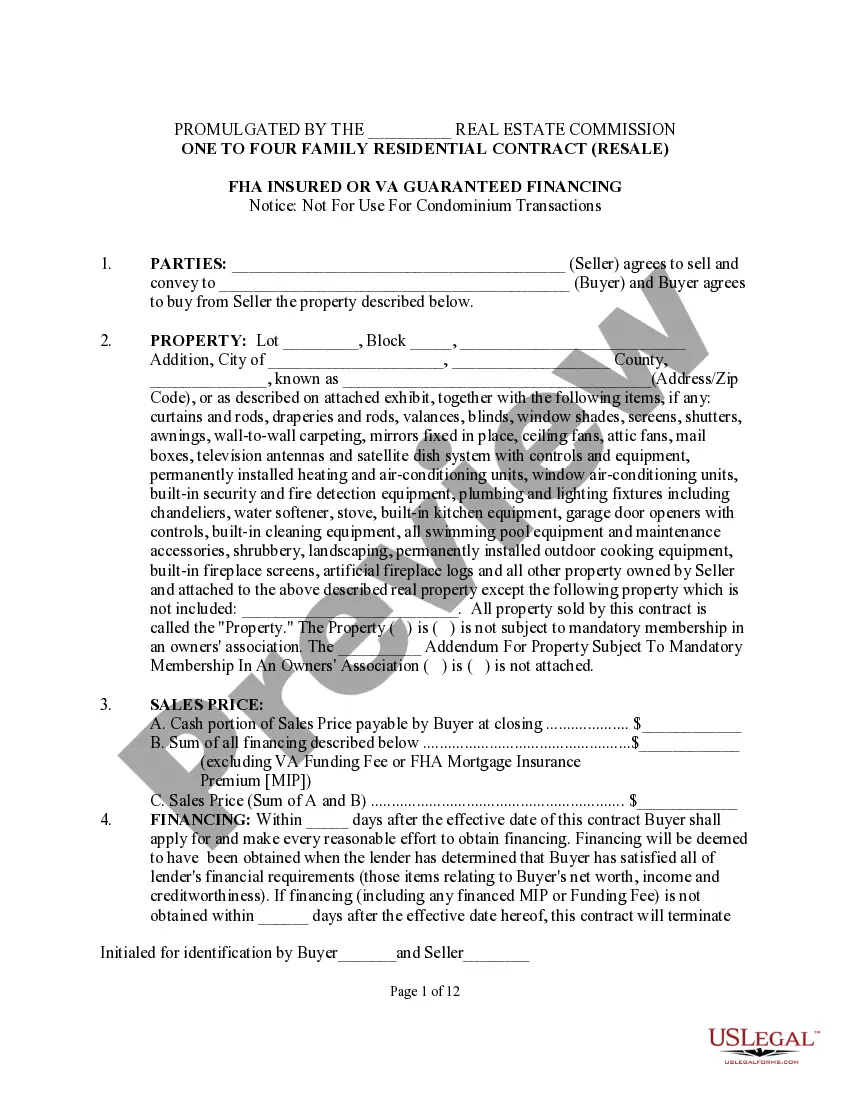

How to fill out Texas One To Four Family Residential Contract - Resale - All Cash, Assumption, Third Party Conventional Or Seller Financing?

- Log in to your US Legal Forms account if you're an existing user, and simply download the required template by clicking the Download button. Ensure your subscription is active.

- If you're a new user, begin by checking the Preview mode and form description on the website. Verify that you've selected the appropriate Texas tax exempt form that aligns with your needs.

- If adjustments are necessary, utilize the Search feature to find an alternate template that fits your criteria.

- Once you have the correct document, proceed to purchase it by clicking the Buy Now button and selecting your preferred subscription plan. Registration will be necessary for access.

- Provide your payment details to complete the transaction through credit card or PayPal.

- After purchase, download the Texas tax exempt form to your device. You can always access it later via the My Documents section of your account.

US Legal Forms empowers individuals and attorneys to efficiently manage legal documents with its vast library and user-friendly interface.

Start your journey towards seamless legal documentation today by accessing US Legal Forms!

Form popularity

FAQ

To obtain tax-exempt status for resale in Texas, you must complete the Texas tax exempt form for resale. Start by filling out the resale certificate accurately with your business details. Then, present this certificate to your vendors when making purchases. Utilizing platforms like uslegalforms can streamline the process, offering guidance and templates to ensure your application is correct and compliant.

When filling out a sales tax exemption certificate, start by collecting the required data, including your seller's permit number, which is important for the Texas tax exempt form for resale. Clearly articulate the reason for the exemption in the specified section of the form. After filling it out, review the information to ensure accuracy and completeness. Submit the signed certificate to your supplier to benefit from the tax exemption.

Filling out form ST3 requires basic company information, including your name and address, which is crucial for the Texas tax exempt form for resale. Clearly indicate the nature of the tax exemption and provide a short description of the goods you intend to resell. Ensure that all sections are completed thoroughly, as incomplete forms may delay the processing. After filling out the form, retain a copy for your records.

To fill out a tax exemption certificate, start by obtaining the correct form for your state, ensuring it is the Texas tax exempt form for resale. Accurately provide your business details, such as your name, address, and tax ID number. Next, specify the reason for your tax exemption, often related to resale purposes. Finally, sign and date the certificate before submitting it to your supplier.

To get a resale certificate in Texas, start by completing the Texas tax exempt form for resale. You can find this form on the Texas Comptroller's website or use uslegalforms for a user-friendly experience. After completing the form, present it to your suppliers, which enables you to buy products without incurring sales tax. Following these steps will help you seamlessly integrate the resale certificate into your purchasing process.

In Texas, the business that intends to make tax-exempt purchases typically pays for the resale certificate. This includes any fees related to obtaining the Texas tax exempt form for resale. It’s crucial that you ensure accurate filing to avoid any additional costs or issues in the future.

You can get a tax exempt form for resale from various sources. The Texas Comptroller's website offers downloadable forms directly. Additionally, platforms like uslegalforms simplify the process by providing easy access to the correct Texas tax exempt form for resale. This saves you time and ensures you have the latest version.

To obtain a resale tax exemption in Texas, you must complete and submit a Texas tax exempt form for resale to your supplier. This form allows you to make purchases without paying sales tax, provided you intend to resell the items. You can download the necessary form from the Texas Comptroller's website or use services like uslegalforms. Filling it out accurately ensures a smoother process.

To obtain tax-exempt status in Texas for resale, you must apply for a Texas resale certificate. This involves providing information about your business and ensuring you meet the legal requirements for resale. Utilizing platforms like US Legal Forms can simplify this process by offering templates and guidance for completing the Texas tax exempt form for resale accurately.

No, a tax-exempt form is not the same as a resale certificate. While both documents allow for the avoidance of sales tax, they are used in different circumstances. A resale certificate is used when buying inventory for resale, whereas a tax-exempt form is used for purchases that serve a non-profit purpose.