Texas Deed Form Withholding

Description

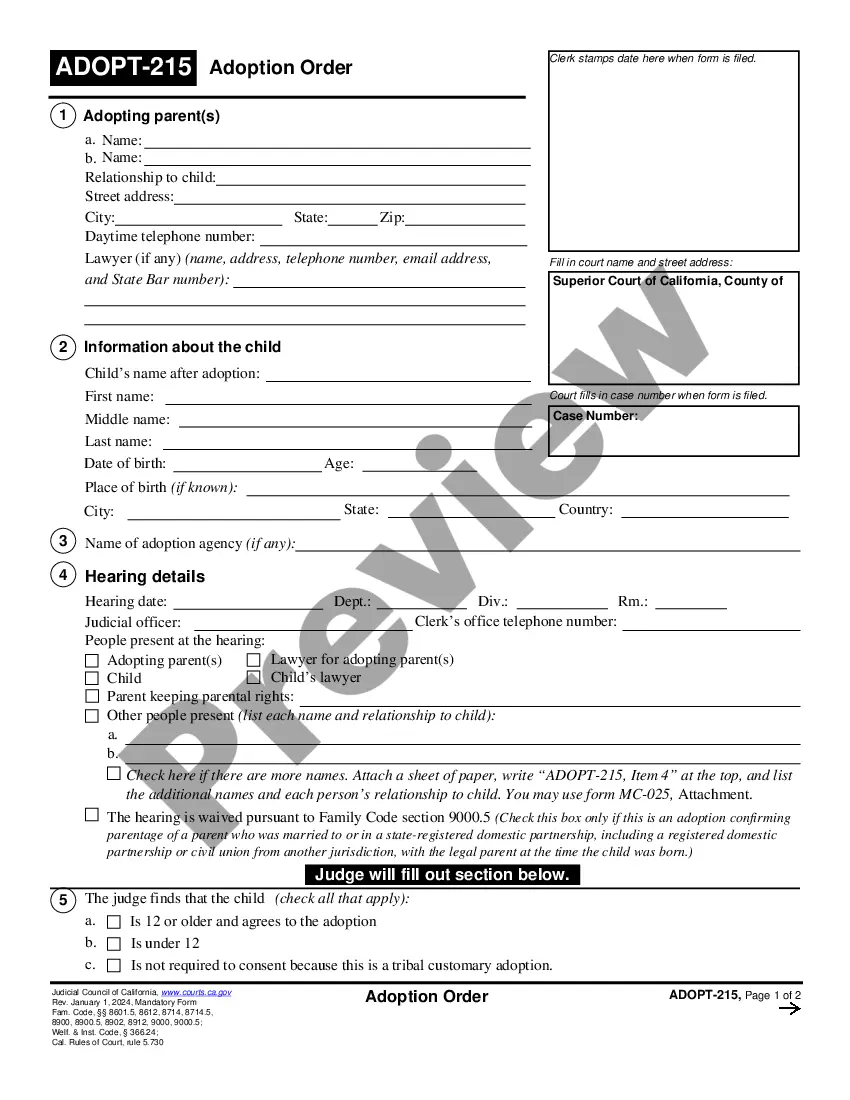

How to fill out Texas Correction Warranty Deed?

Creating legal documents from the ground up can frequently be daunting. Certain situations may require extensive research and significant financial commitment.

If you’re looking for a simpler and more economical method to generate Texas Deed Form Withholding or any other paperwork without unnecessary complications, US Legal Forms is always here to assist you.

Our online inventory of over 85,000 current legal documents covers nearly every facet of your financial, legal, and personal affairs.

With just a few clicks, you can swiftly obtain state- and county-compliant forms meticulously prepared for you by our legal experts.

Ensure the form you choose adheres to the regulations and laws of your state and county. Select the appropriate subscription option to obtain the Texas Deed Form Withholding. Download the form, then complete, sign, and print it. US Legal Forms boasts a solid reputation and over 25 years of experience. Join us today and make document execution a seamless and efficient process!

- Utilize our website whenever you require a dependable and trustworthy service to quickly find and download the Texas Deed Form Withholding.

- If you’re familiar with our services and have previously established an account with us, simply Log In to your account, find the template, and download it or re-download it anytime in the My documents section.

- Don’t have an account? No worries. It takes only a few minutes to create one and explore the library.

- Before rushing to download Texas Deed Form Withholding, consider these recommendations.

- Review the document preview and descriptions to ensure you have located the correct form.

Form popularity

FAQ

To avoid FIRPTA withholding, you can apply for a withholding certificate from the IRS before the sale closes. This certificate indicates that withholding is not necessary due to specific conditions or exemptions. It’s important to ensure all documentation is correct to facilitate this process. Using US Legal Forms can help you find the right information and forms needed to apply effectively.

Form 8288 is typically completed by the buyer or transferee of real estate when a foreign person sells property in the United States. This form ensures that the proper withholding tax is submitted to the IRS. It is important for the buyer to understand their responsibilities regarding this form. US Legal Forms can provide guidance on filling out Form 8288 correctly.

Yes, when you own residential property in Texas, you hold a title deed that serves as proof of ownership. This document is crucial for any legal transactions or inquiries regarding the property. It’s essential to keep this document safe and accessible. For managing your title and related forms, US Legal Forms offers a variety of resources tailored to Texas real estate.

To recover your FIRPTA withholding, you should file a federal tax return, typically using Form 1040NR for non-residents. You will also need to include Form 8288-B to request a refund or reduced withholding. Make sure to keep a copy of all submitted documents for your records. US Legal Forms can assist you in preparing these forms accurately.

To receive your withholding tax back, you must file the appropriate tax return for the year you experienced the withholding. This includes providing accurate information about the transaction and the amounts withheld. By filing correctly, you can ensure a smoother refund process. Consider using US Legal Forms to access the necessary documents and guidance.

To retrieve your withholding tax, you need to file an income tax return for the relevant tax year. This process includes submitting Form 1040NR if you are a non-resident or Form 1040 if you are a resident. Be sure to include all pertinent information related to your withholding. Using resources from US Legal Forms simplifies the gathering and submission of necessary forms.

Yes, Texas does have a state withholding form that must be completed when real estate transactions involve foreign sellers. This form is necessary to comply with state tax regulations. Ensure you gather all required information and submit the form timely to avoid penalties. US Legal Forms can provide you with the right templates to streamline this process.

To reclaim your FIRPTA withholding, you must file a federal income tax return for the year the withholding occurred. Include Form 8288-B, which allows you to request a reduced withholding amount or a full refund. It is crucial to ensure all necessary documentation is attached to expedite the process. Utilizing a reliable platform like US Legal Forms can help you navigate the required forms efficiently.

Texas does not impose a state deed transfer tax. However, local jurisdictions might have their own fees associated with property transfers. When you complete a Texas deed form withholding, ensure you are aware of any local charges that may apply. For detailed guidance, consider using US Legal Forms to navigate these requirements smoothly.

You can complete a quit claim deed yourself in Texas. It is essential to follow the correct procedures and include all necessary information. While doing it on your own is possible, using a Texas deed form withholding can provide you with a reliable framework and help you avoid common mistakes.