Texas Warranty To Foreclosed Homes

Description

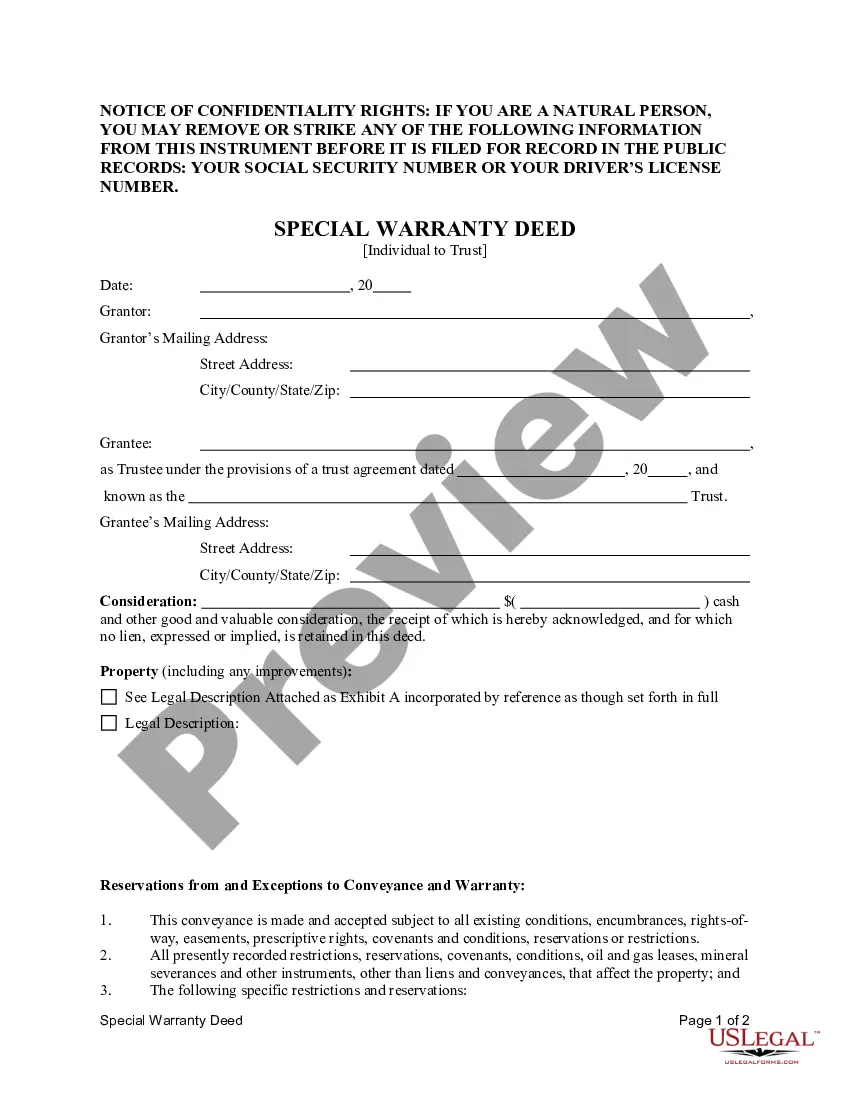

How to fill out Texas Special Warranty Deed From An Individual To A Trust?

- Log in to your existing US Legal Forms account to access your saved documents. Ensure your subscription is active for continuous access.

- Browse the extensive library and enter your specific criteria in the search bar to locate the correct form. Verify it meets all local jurisdiction requirements.

- If the desired document isn't available, utilize the search function to explore alternatives and ensure you find the most suitable form.

- Purchase your selected document by clicking on the Buy Now button. Choose a subscription plan that suits your needs and create an account for full access.

- Complete the payment process using a credit card or PayPal to finalize your subscription.

- Download the form and save it directly to your device for easy access anytime through the My Forms section on your profile.

Once you've downloaded the necessary documents, you're well on your way to securing a Texas warranty for your foreclosed home. US Legal Forms simplifies the process, making it easier for you to focus on what's important.

Start benefiting from US Legal Forms today, and empower yourself with the legal support you need to successfully navigate your real estate endeavors.

Form popularity

FAQ

The foreclosure law in Texas is governed by both state statutes and rules that outline the process lenders must follow in reclaiming a property. These laws provide a structured approach, including notice requirements and waiting periods, ensuring fairness for homeowners. If you are navigating these laws, the Texas warranty to foreclosed homes might offer essential protection and options to consider.

Yes, Texas has a statute of limitations regarding foreclosure, which typically lasts for four years from the time of default. After this period, lenders lose the right to initiate foreclosure. Homeowners should be aware of these timelines as they pertain to the Texas warranty to foreclosed homes, ensuring they can protect their interests.

The foreclosure timeline in Texas can vary but generally follows a specific sequence. After a homeowner defaults, lenders typically send a notice of default and allow 20 days for the homeowner to respond. If unresolved, they can schedule a foreclosure sale, usually occurring at least 21 days after notice. For those exploring the Texas warranty to foreclosed homes, being familiar with this timeline can help in making informed decisions.

The 120-day rule in Texas requires that lenders must wait at least 120 days after a homeowner misses a payment before initiating foreclosure proceedings. This rule is designed to give homeowners time to catch up on missed payments or negotiate modifications. Understanding the 120-day rule is vital for those looking into Texas warranty to foreclosed homes, as it impacts their rights.

In Texas, the redemption period allows homeowners to reclaim their foreclosed property for a certain time after the foreclosure sale. Typically, this period lasts for two years if the homeowner has not activated a formal bankruptcy process. It is crucial to be aware of your options as the Texas warranty to foreclosed homes provides certain protections for homeowners during this time.

To claim surplus funds from a foreclosure in Texas, you need to submit a formal claim to the court that oversaw the foreclosure sale. Begin by gathering necessary documentation, including proof of ownership and identity. After filing your claim, the court will process it, which may take time. For further clarity on the claiming process, US Legal Forms can offer templates and resources specific to Texas warranty to foreclosed homes.

Excess funds from a foreclosure in Texas may be considered taxable income. The IRS requires individuals to report any gains from the sale of property, including surplus proceeds. It's essential to consult a tax professional for guidance on how to report these funds properly. US Legal Forms offers useful tax resources to help you understand your obligations regarding Texas warranty to foreclosed homes.

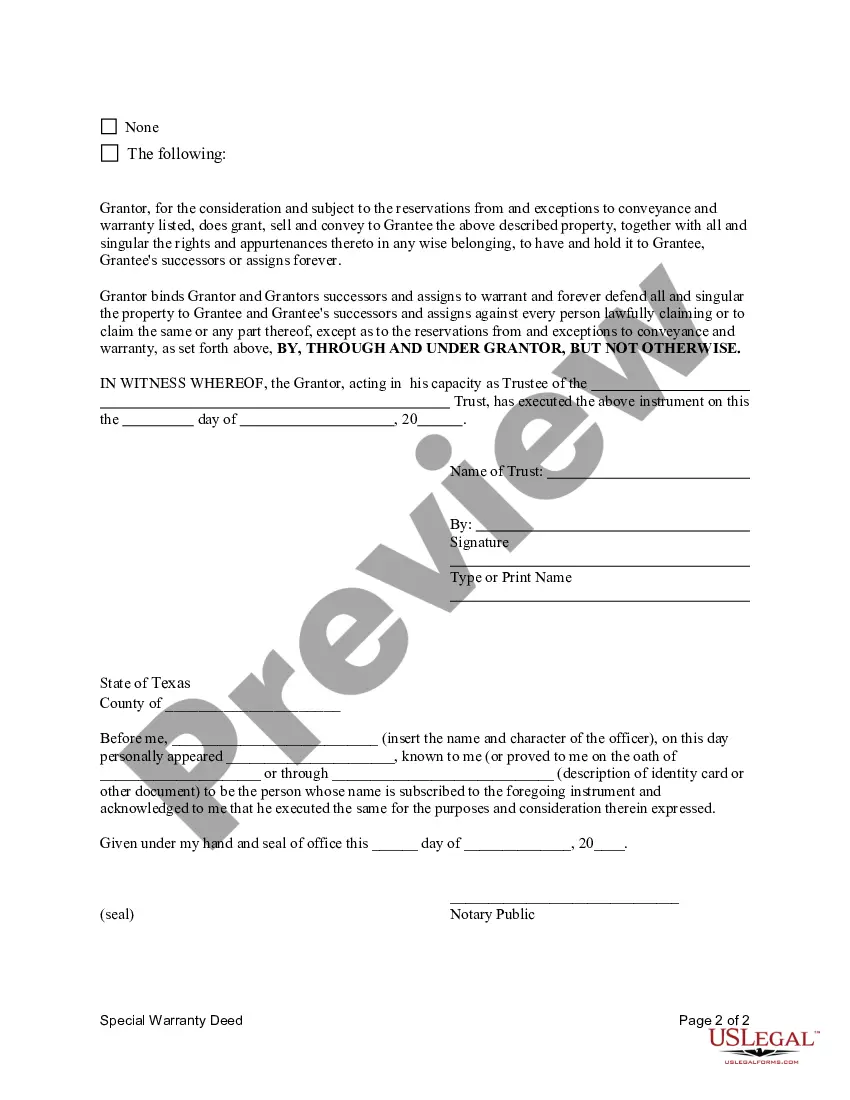

To file a warranty deed in Texas, you need to go to the county clerk's office in the county where the property is located. Ensure that you bring the completed warranty deed along with any required identification. The office will record your deed and update the public record accordingly. Utilizing services from US Legal Forms can help simplify the paperwork and ensure your deed is filed correctly.

Recovering surplus funds from foreclosures in Texas generally takes a few weeks to several months. Initially, you must file a claim with the appropriate court, which can involve documentation and verification. Once filed, the court will review your claim, approve it, and release the funds. For a smoother process, consider using resources like US Legal Forms that provide guidance on navigating these legal procedures.

A notary cannot prepare a warranty deed; their role is to notarize the signatures on the document. However, they can assist in confirming that the document is signed and executed in the proper manner. If you need help writing the deed itself, consider using US Legal Forms for guidance tailored to Texas warranty to foreclosed homes.