Divorce Case Rules

Description

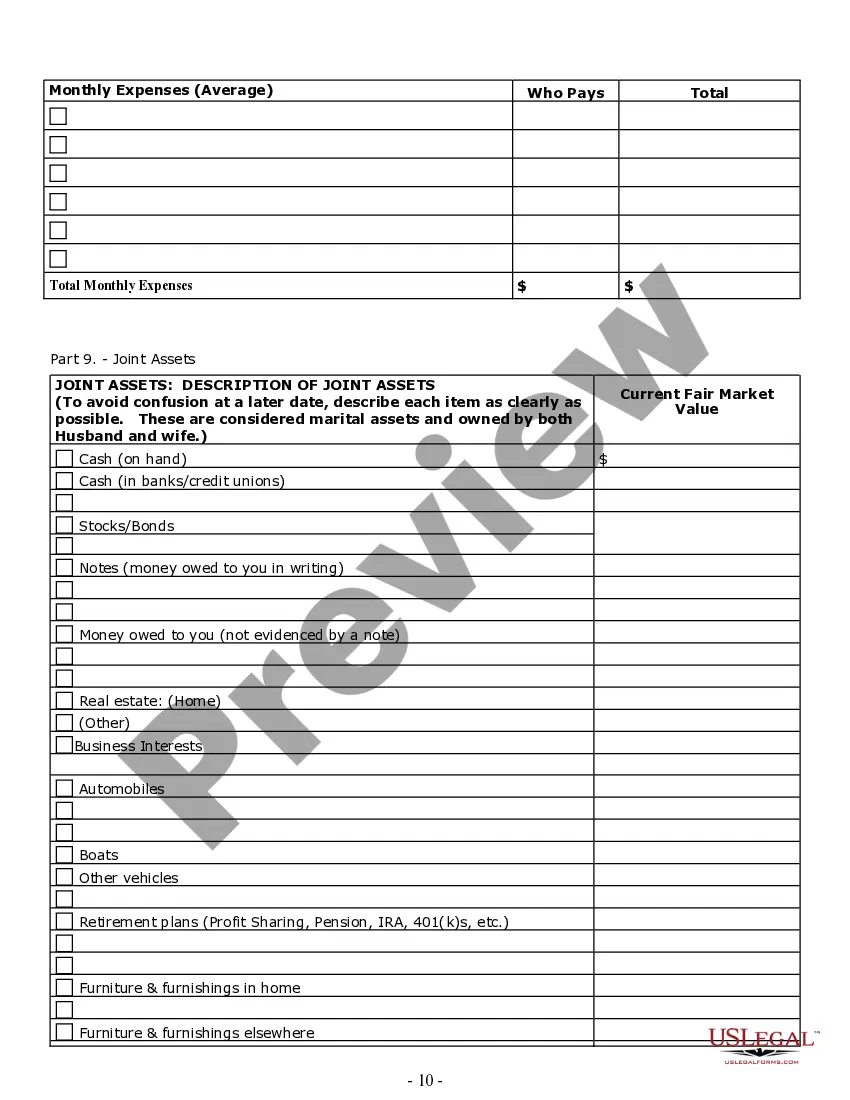

How to fill out Texas Divorce Worksheet And Law Summary For Contested Or Uncontested Case Of Over 25 Pages - Ideal Client Interview Form?

Creating legal documents from the ground up can occasionally be overwhelming.

Some situations could require extensive research and substantial financial investment.

If you’re seeking a simpler and more cost-effective solution for generating Divorce Case Rules or any other forms without unnecessary obstacles, US Legal Forms is always accessible to you.

Our online collection of over 85,000 current legal documents covers almost every aspect of your economic, legal, and personal matters.

Before diving into downloading Divorce Case Rules, keep these suggestions in mind: Review the form preview and descriptions to ensure it’s the document you need. Confirm the selected form meets your state and county's specifications. Select an appropriate subscription plan to acquire the Divorce Case Rules. Download the form, then fill it out, sign it, and print it. US Legal Forms has an impeccable reputation and over 25 years of experience. Join us today and make form completion easy and efficient!

- With a few clicks, you can promptly obtain state- and county-specific forms meticulously prepared by our legal experts.

- Access our site whenever you need a dependable and trustworthy service to easily locate and download the Divorce Case Rules.

- If you're familiar with our website and have set up an account before, just Log In to access your account, select the template, and download it or re-download it at any time from the My documents section.

- Not a member yet? No worries. Registering takes minimal time, and navigating the catalog is straightforward.

Form popularity

FAQ

The IRS requires businesses to report payment of nonemployee compensation of $600 or more on Form 1099-NEC instead of on Form 1099-MISC. Businesses also need to file Form 1099-NEC if the business withholds federal income tax from a nonemployee's compensation, regardless of the amount of the payment.

9s and 1099s are tax forms that are required when employers work with an independent contractor. Form 9 is completed by the independent contractor and provides details on who they are. Form 1099NEC is completed by the employer and details the wages paid to the contractor.

The law further states that independent contractor status is evidenced if the worker: (1) has a substantial investment in the business other than personal services, (2) purports to be in business for himself or herself, (3) receives compensation by project rather than by time, (4) has control over the time and place ...

The difference between 1099 vs W-9 is a straightforward one: the contractor fills out the W-9 form to provide information to the business they work for, and that business later reports the contractor's yearly earnings on the 1099 form.

Form 1099-MISC is used in the reporting of payments that are not subject to self-employment tax ? things like rents and prizes. Form 1099-NEC is used for reporting non-employee compensation that is most likely subject to self-employment tax.

A 1099 is not the same as Schedule C. A 1099 typically reports money exchanged between a payor and a payee. A copy of a 1099 usually goes to both the payee and the IRS. Depending on the type of income earned or 1099 received, you may report this on Schedule C or other Schedules of Form 1040.

IRS Tax Form 1099-NEC. The IRS Form 1099-NEC is the independent contractor tax form used by businesses to report payments to a contract worker in the previous tax year. This tax form for independent contractors is filed with the IRS and is also provided to the contractor for reporting income.

Independent contractors report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Also file Schedule SE (Form 1040), Self-Employment Tax if net earnings from self-employment are $400 or more.