Quit Claim Deed From Trust To Individual In Texas Form

Description

How to fill out Texas Quitclaim Deed From Individual To Trust?

Individuals frequently connect legal documentation with complexity that only an expert can manage.

In some respects, this is accurate, as creating a Quit Claim Deed From Trust To Individual In Texas Form necessitates considerable understanding of subject matter prerequisites, including state and county laws.

However, with US Legal Forms, accessibility has improved: ready-to-use legal templates for any life and business situation specific to state laws are compiled in a single online library and are now accessible to everyone.

Create an account or Log In to proceed to the payment page. Make your payment through PayPal or with your credit card. Select the desired format for your document and click Download. Print your document or upload it to an online editor for a quicker fill-out. All templates in our library are reusable: once obtained, they remain saved in your profile. You can access them anytime needed from the My documents tab. Discover all the benefits of using the US Legal Forms platform. Subscribe today!

- US Legal Forms has over 85,000 current forms sorted by state and area of use, making it easy to find the Quit Claim Deed From Trust To Individual In Texas Form or any other specific template in just a few minutes.

- Existing users with a valid subscription need to Log In to their accounts and click Download to receive the form.

- New users to the platform will first need to create an account and subscribe before they can save any documents.

- Here’s a detailed guideline on how to get the Quit Claim Deed From Trust To Individual In Texas Form.

- Examine the page content thoroughly to ensure it meets your requirements.

- Review the form description or look at it through the Preview feature.

- If the previous option does not fit your needs, find another sample using the Search field in the header.

- When you locate the correct Quit Claim Deed From Trust To Individual In Texas Form, click Buy Now.

- Choose a pricing plan that aligns with your preferences and budget.

Form popularity

FAQ

Yes, you can quit claim a property held in trust to one of the beneficiaries. To do this, you need to complete a quit claim deed form that specifies the transfer from the trust to the beneficiary. Ensure that the form is filled out accurately and signed by the trustee. Filing this document with the appropriate county office formalizes the transfer, clarifying the lawful ownership of the property.

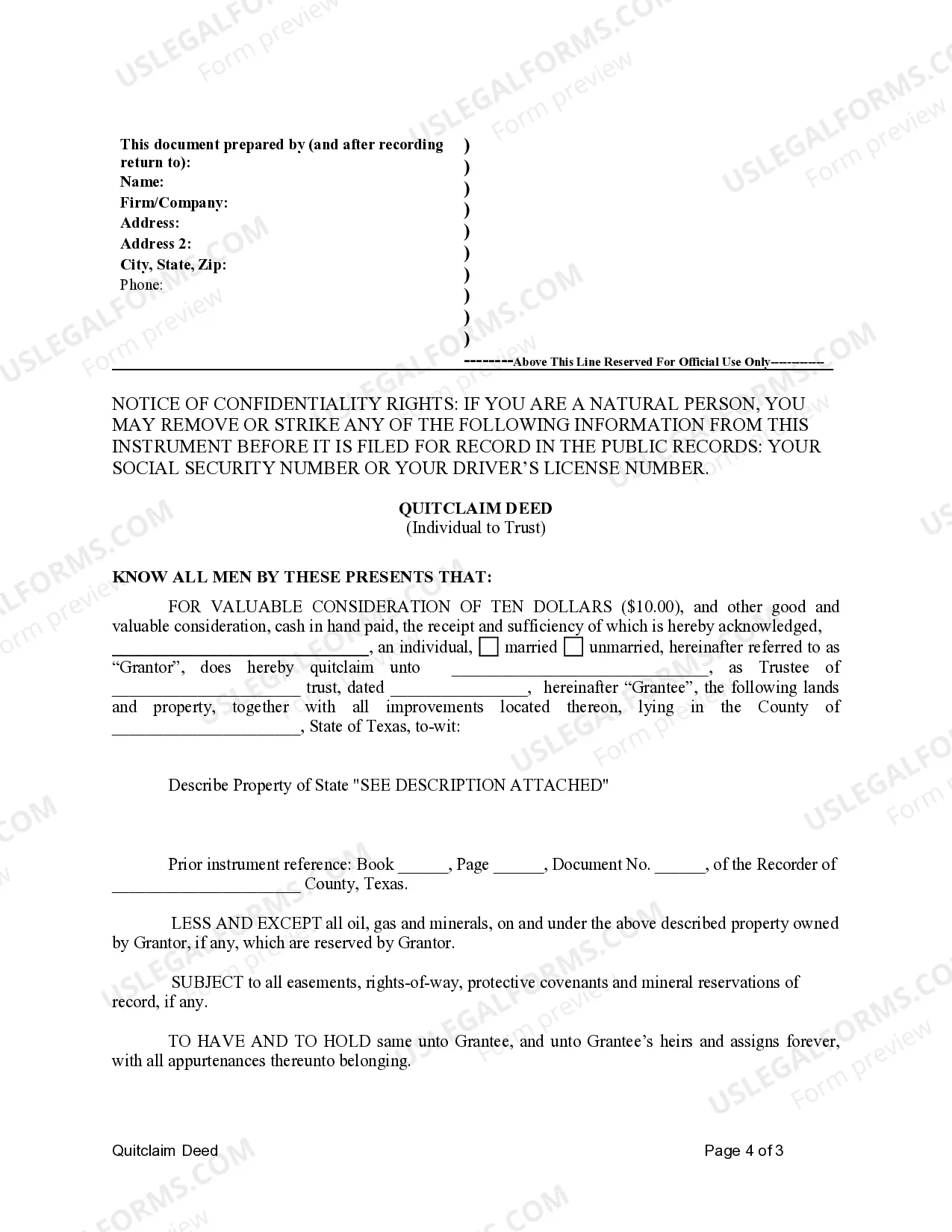

In Texas, filing a quitclaim deed involves obtaining the appropriate form, which is specific for quit claim deed from trust to individual in Texas form. After completing the form with accurate property description and parties' information, both parties should sign it. Finally, take the signed form to your local county clerk's office to record the deed officially. This process ensures that the property's title is updated to reflect the new owner.

To file a quit claim deed and transfer property to a relative, you will need to complete the Quit Claim Deed form. This form is available online and can be filled out with the relevant property details. Make sure both parties sign the form, then file it with your county clerk's office. This process simplifies the transfer and ensures that the deed is recorded properly, serving as a legal document evidencing the transfer.

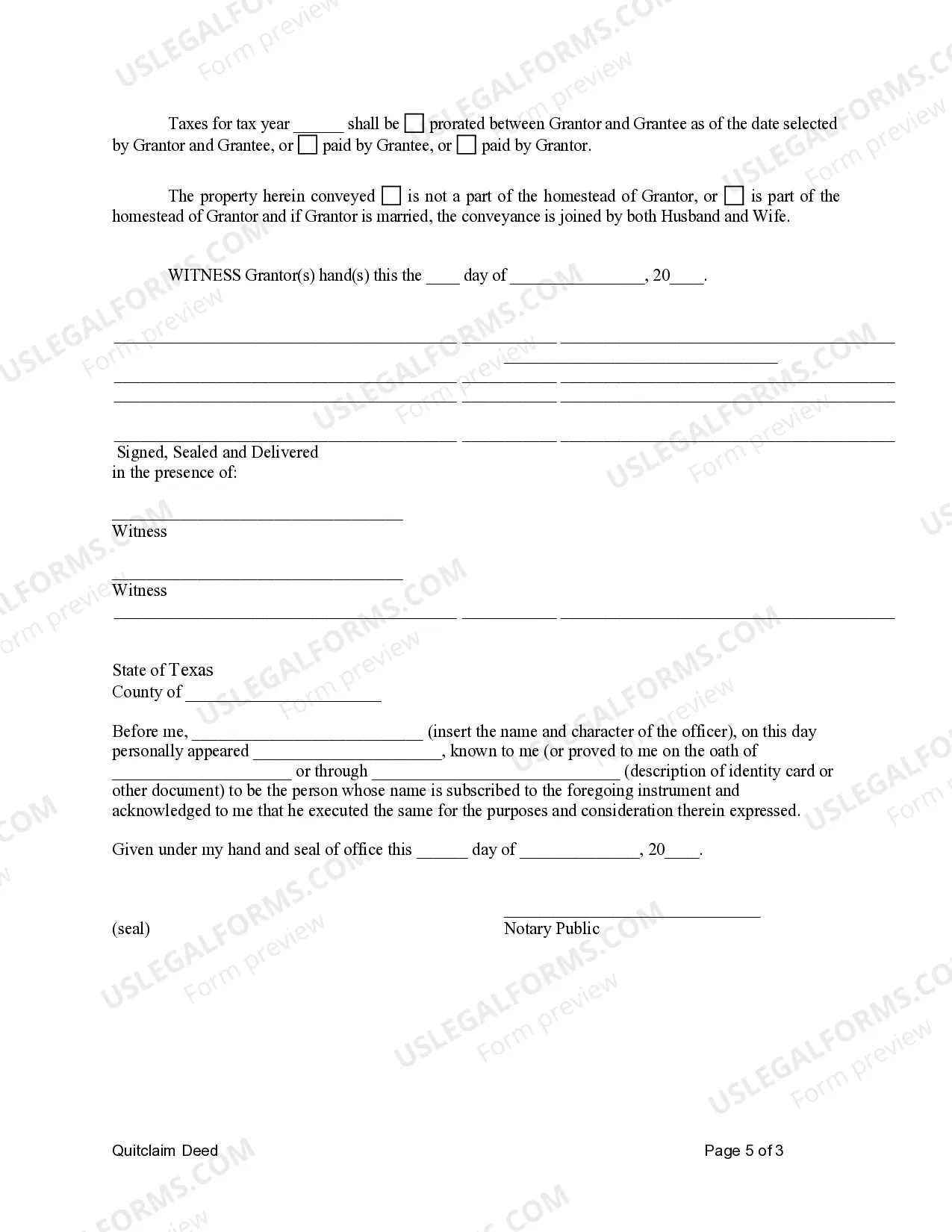

Yes, a quitclaim deed must be notarized in Texas to be legally binding. The notary public will verify the identities of the individuals signing the document, ensuring the transfer is executed correctly and legally. After notarization, you can proceed to file the quit claim deed from trust to individual in Texas form at the county clerk's office. Failing to notarize the deed can lead to issues with property ownership recognition down the line.

The primary beneficiaries of a quitclaim deed are often individuals looking to clarify property ownership, like those involved in divorce settlements or estate planning. This type of deed simplifies the transfer process, allowing for a quick resolution of property issues. Moreover, using a quit claim deed from trust to individual in Texas form can help avoid probate in some cases, which is beneficial for heirs and beneficiaries. It is essential to ensure both parties understand the implications of this transfer.

Yes, you can file a quitclaim deed in Texas. This legal document allows you to transfer property rights without guaranteeing the title's validity. To properly execute the quit claim deed from trust to individual in Texas form, make sure all parties involved understand their rights and responsibilities before proceeding. This option is often suitable for family transfers or other informal property arrangements.

To file a quitclaim deed in Texas, first, complete the necessary form that transfers property ownership. Next, sign the document in the presence of a notary public to ensure its validity. After notarization, file the quit claim deed from trust to individual in Texas form with the county clerk's office in the county where the property is located. This process secures your claim and updates public records appropriately.

To remove someone from a deed of trust in Texas, you will typically need their consent and to follow proper legal procedures. This process often involves executing a quit claim deed from trust to individual in Texas form, which allows the current owners to formally convey their interest in the property. Additionally, using U.S. Legal Forms can provide the necessary documentation and guidance for this transaction, ensuring compliance with state laws.

One of the main disadvantages of a quitclaim deed is that it does not guarantee any warranties or claims on the property's title. This means the grantee assumes the risk of any existing liens or issues with the title. Additionally, using a quit claim deed from trust to individual in Texas form does not provide the same level of buyer protection as other types of deeds, which can be a concern for individuals looking for secure transactions. Always consider the implications before proceeding.

In Texas, a quit claim deed is valid indefinitely once filed with the county clerk's office. It transfers ownership rights from the grantor to the grantee effectively and permanently. However, it is crucial to file the deed properly to protect your interests. Utilizing a quit claim deed from trust to individual in Texas form can help ensure that your transfer is valid and recognized by law.