Correction Deed Texas Property Code

Description

How to fill out Texas Correction Deed - Prior Deed From An Individual To An Individual?

Whether for commercial reasons or personal matters, everyone must confront legal issues at some stage in their lives. Completing legal documentation necessitates meticulous attention, starting with choosing the right form template.

For example, if you select an incorrect version of the Correction Deed Texas Property Code, it will be denied once you submit it. Thus, it is essential to acquire a trustworthy source of legal documents such as US Legal Forms.

With an extensive US Legal Forms catalog available, you never have to waste time searching for the correct sample across the internet. Utilize the library’s intuitive navigation to find the appropriate template for any situation.

- Locate the template you require by using the search bar or browsing the catalog.

- Review the form’s details to ensure it aligns with your circumstances, state, and region.

- Click on the form’s preview to inspect it.

- If it's not the correct form, revert to the search option to find the Correction Deed Texas Property Code template you need.

- Download the template when it corresponds to your needs.

- If you already possess a US Legal Forms account, just click Log in to access previously saved templates in My documents.

- If you do not yet have an account, you can purchase the form by clicking Buy now.

- Choose the suitable pricing option.

- Complete the account registration form.

- Select your payment method: either use a credit card or PayPal account.

- Select the document format you desire and download the Correction Deed Texas Property Code.

- Once saved, you can fill in the form using editing software or print it and complete it manually.

Form popularity

FAQ

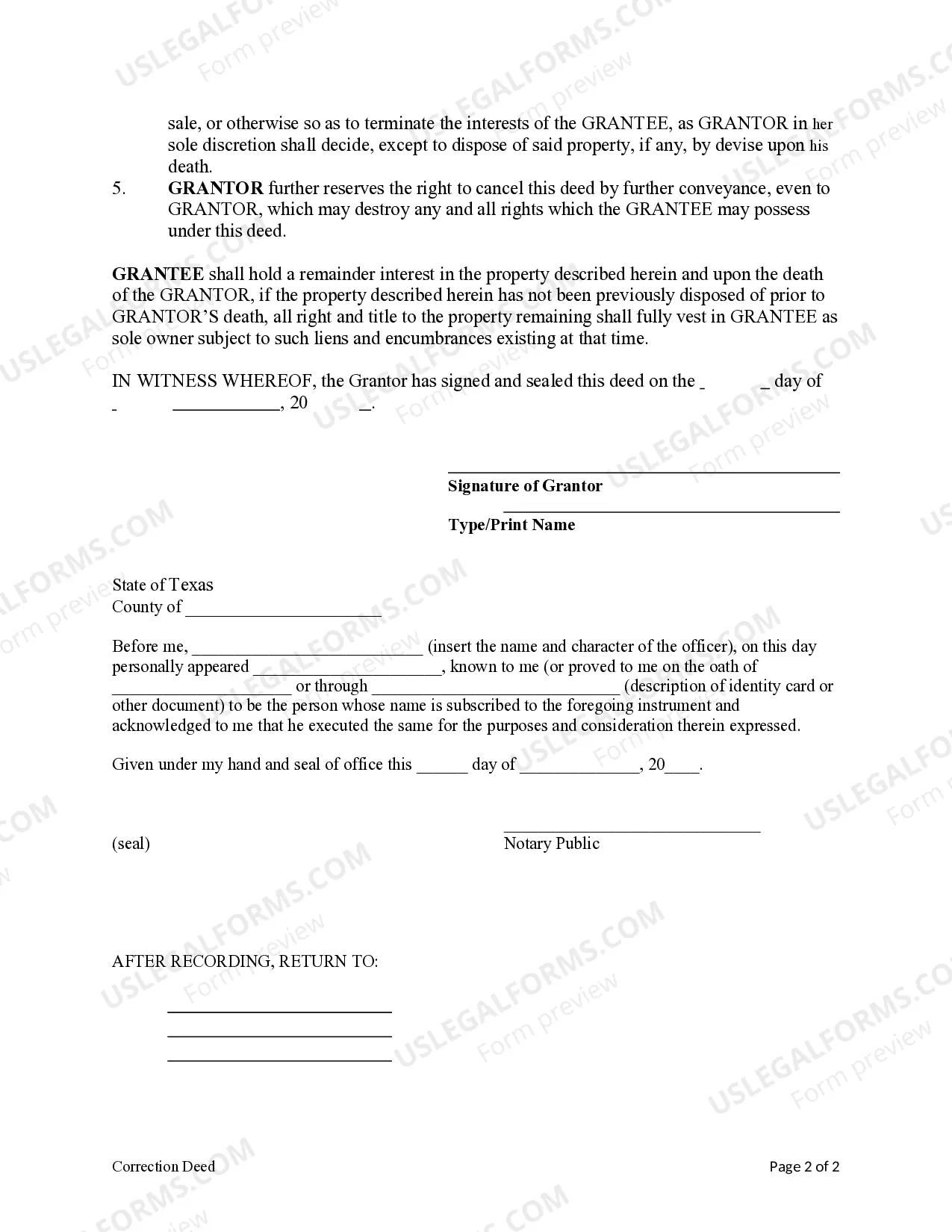

To file a corrective deed, you must complete the corrective deed form accurately, including details of the original deed. After signing, the form should be submitted to the county clerk’s office where the property is located. Using resources available from uslegalforms can simplify this process, ensuring compliance with the correction deed Texas property code.

Section 5.069 of the Texas property code addresses the necessity of filing a deed in a specific manner to ensure property descriptions are accurate. It aims to protect both buyers and sellers during property transactions. Familiarizing yourself with this section aids in the effective use of a correction deed Texas property code.

To correct a deed in Texas, property owners typically prepare a correction deed and file it with the county clerk's office. This document must clearly identify the original deed and specify the corrections made. When you use a correction deed Texas property code, you ensure that the changes are legally recognized and uphold the property's integrity.

Section 5.009 of the Texas property code outlines the required procedures for the execution and acknowledgment of deeds in Texas. This section helps ensure that property transactions are legally valid and enforceable. Understanding this section is crucial when dealing with a correction deed Texas property code, as it lays the groundwork for lawful corrections.

A correction instrument in Texas property code addresses errors or omissions in existing property documents. This instrument allows property owners to amend deeds to ensure accurate information is recorded. Utilizing a correction deed Texas property code helps clear any discrepancies and protects your property rights.

While you can draft your own deed, especially with resources available through platforms like USLegalForms, consulting a lawyer can be beneficial. A legal professional can ensure that your deed complies with the correction deed Texas property code and adequately protects your interests. They can also help navigate more complex issues, making the process smoother and more secure.

To correct a name on a deed in Texas, you should file a correction deed under the correction deed Texas property code. This document needs to specify the errors, including the incorrect name and the correct name. Once drafted, the corrective deed must be signed in front of a notary public and then filed with the county clerk where the property is located. This process ensures that all changes are legally recognized.

Certain legal mechanisms can override a deed, such as a court order or a subsequent deed that properly follows the correction deed Texas property code. Additionally, mortgages may impose certain rights that can affect ownership. In some cases, changes in property law or claims by government entities can also infringe upon a deed’s authority. Understanding these factors is crucial for any property owner.

To file a corrective deed under the correction deed Texas property code, first prepare the document by clearly stating the errors that need correction. After you complete the deed, you must sign it before a notary public. Then, file the corrected deed with the county clerk's office where the original deed was recorded. This ensures that the public record accurately reflects your property’s legal status.

The property code 5.007 in Texas pertains to the requirements for a correction deed. This code outlines the process and legal particulars necessary to amend a previously executed deed, ensuring accuracy in property records. Utilizing the Correction deed Texas property code allows for more straightforward correction of errors in real estate documents. Understanding this code can help you maintain clear and precise property ownership.