Texas Deed Corporation Forfeited Existence

Description

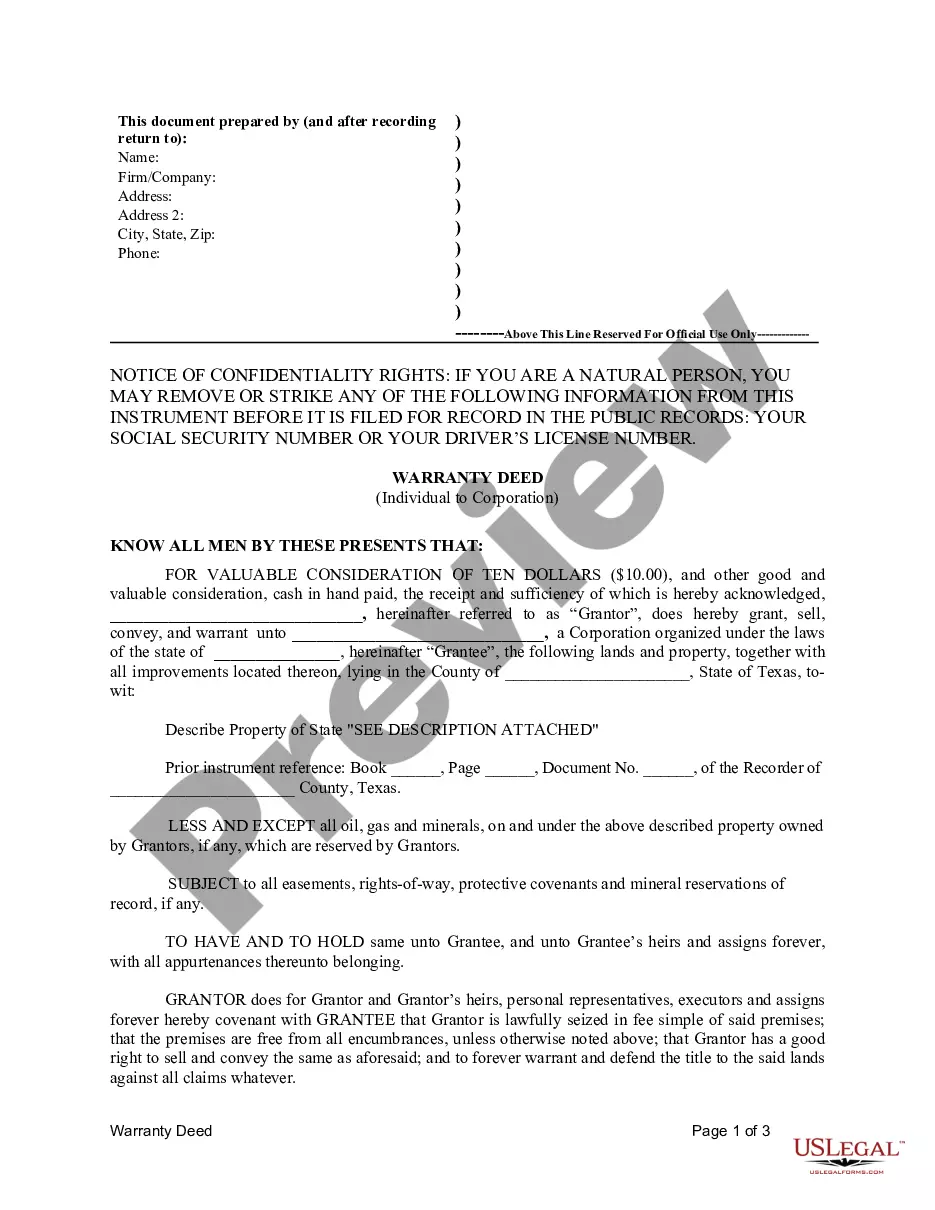

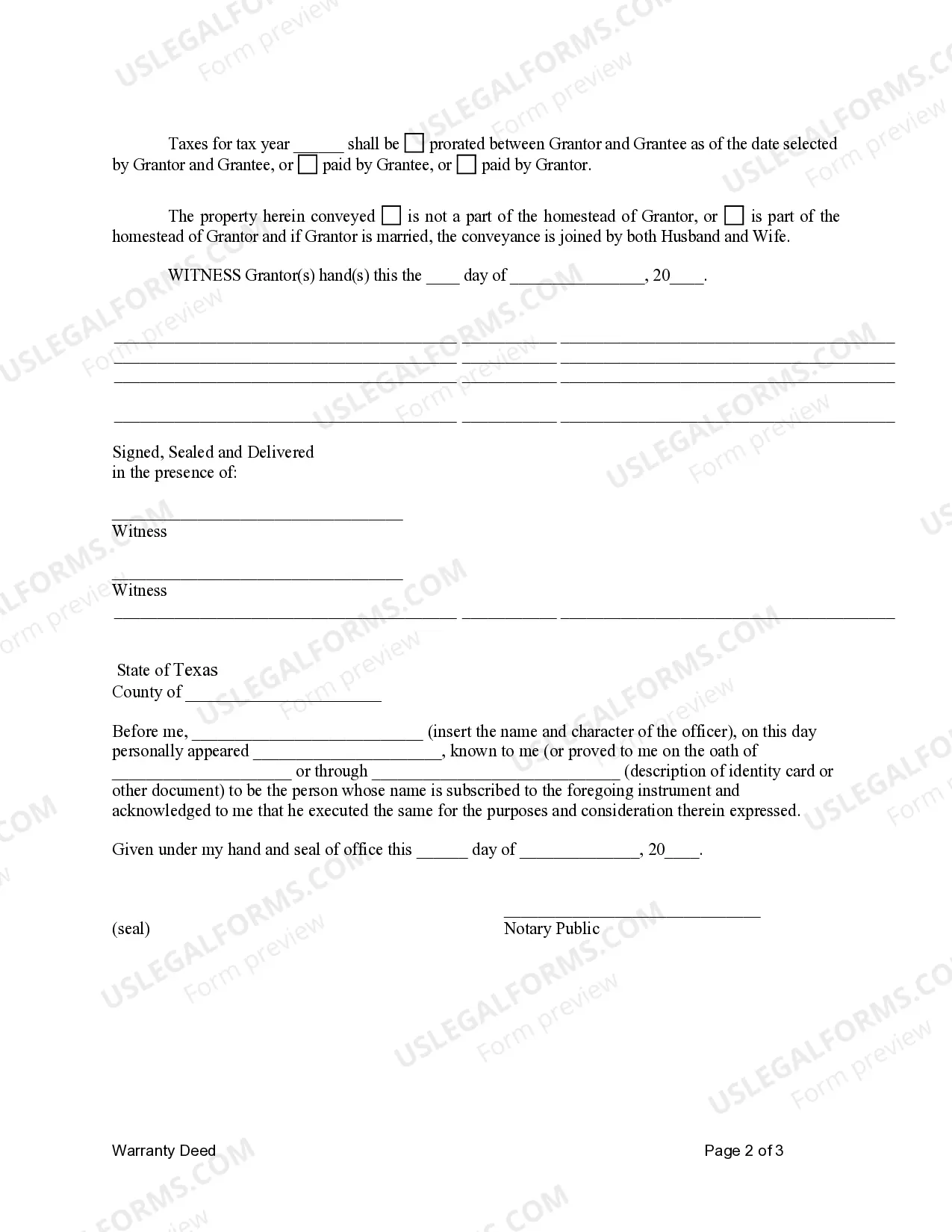

How to fill out Texas Warranty Deed From Individual To Corporation?

Regardless of whether you handle documentation frequently or need to send a legal file from time to time, it is crucial to obtain a valuable resource where all the samples are pertinent and current.

The first action you should take with a Texas Deed Corporation Forfeited Existence is to confirm that it is indeed the latest version, as it determines whether it can be submitted.

If you aim to streamline your quest for the latest document samples, search for them on US Legal Forms.

To acquire a form without an account, follow these steps: Use the search menu to locate the form you need. Examine the Texas Deed Corporation Forfeited Existence preview and description to make sure it is exactly the one you seek. After verifying the form, click Buy Now. Choose a subscription plan that suits you. Create an account or Log In to your existing one. Input your credit card information or PayPal account to finalize the purchase. Choose the file format for download and confirm it. Say goodbye to confusion when handling legal documents. All your templates will be organized and validated with an account at US Legal Forms.

- US Legal Forms is a repository of legal documents that contains almost any template example you might need.

- Look for the forms you need, immediately check their relevance, and learn more about their application.

- With US Legal Forms, you gain access to approximately 85,000 form templates across various disciplines.

- Retrieve the Texas Deed Corporation Forfeited Existence samples in just a few clicks and store them at any time in your account.

- A US Legal Forms account allows you to access all the samples you need with greater ease and less difficulty.

- Simply click Log In in the website header and navigate to the My documents section with all the forms at your disposal, eliminating the need to spend time searching for the appropriate template or verifying its authenticity.

Form popularity

FAQ

When an LLC is forfeited in Texas, it means that the corporation is no longer authorized to conduct business due to non-compliance with state regulations. This forfeiture can lead to legal and financial repercussions for the owners. Knowing your Texas deed corporation forfeited existence status allows you to take proactive steps to resolve it.

Yes, you can sue a forfeited corporation in Texas, but it may complicate the legal proceedings. A forfeited status limits the ability of the corporation to defend itself since it is considered inactive. If your Texas deed corporation forfeited existence poses a challenge, understanding the legal implications is essential for effective navigation.

Forfeited existence in Texas signifies that a company has lost its right to operate due to failure to fulfill legal obligations, such as filing reports or paying taxes. This status impacts the entity's ability to pursue legal action or defend itself in lawsuits. If you find your Texas deed corporation forfeited existence, you should seek reinstatement to regain compliance.

The status of forfeited existence in Texas indicates that your LLC is no longer authorized to conduct business within the state. This status typically arises from non-compliance with state requirements, such as tax obligations. If your Texas deed corporation forfeited existence is confirmed, it’s crucial to understand the necessary steps to restore your company’s active status.

To determine if your LLC is still active in Texas, you can utilize the Texas Secretary of State's online business entity search tool. By entering your LLC's name, you can quickly verify its status. If your Texas deed corporation forfeited existence is listed, you will need to take further steps to reinstate it.

Your LLC may be forfeited in Texas due to a failure to comply with state regulations, such as not filing required annual reports or paying franchise taxes. When your Texas deed corporation forfeited existence occurs, it essentially means the state has revoked your company's right to operate. Regularly checking compliance can help you avoid this issue.

Yes, you can reinstate a forfeited LLC in Texas. The process involves submitting the required paperwork and paying any outstanding fees to the state. It's vital to address any underlying issues that led to the Texas deed corporation forfeited existence to prevent future complications. UsLegalForms offers valuable resources and templates to assist you in navigating the reinstatement process effectively.