Texas Excess Proceeds List

Description

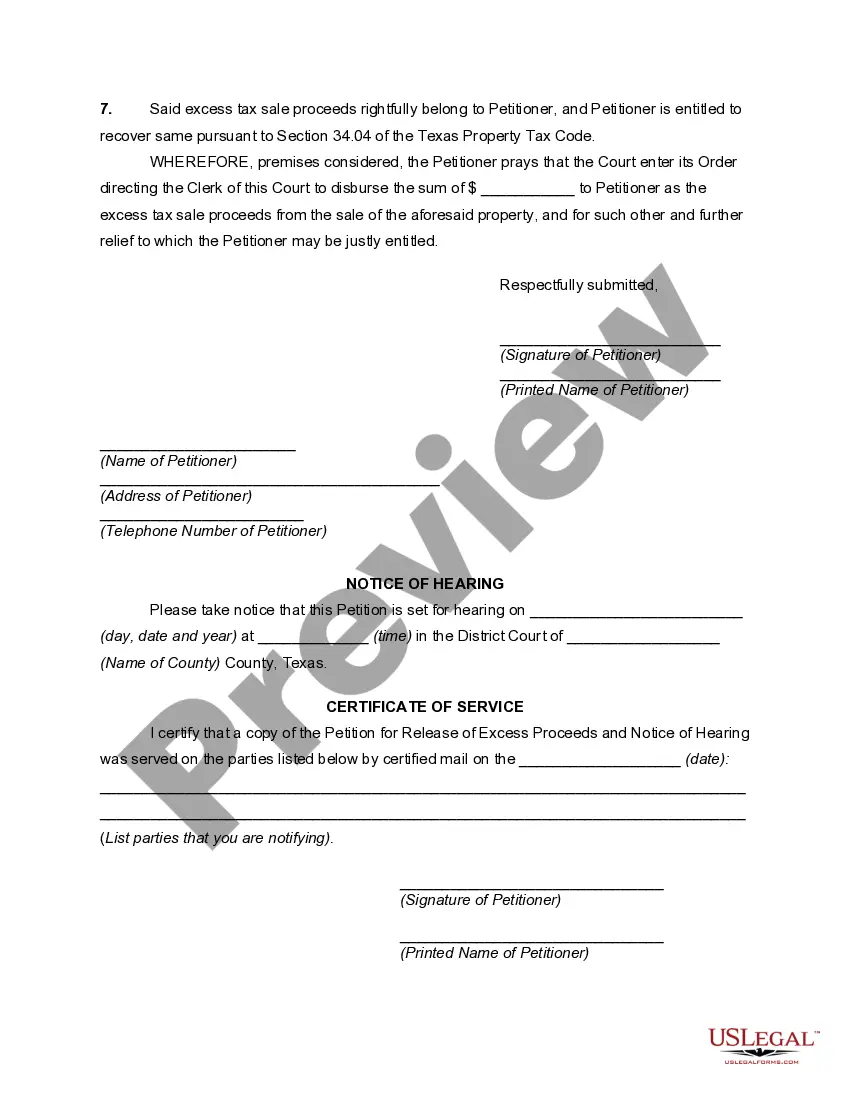

How to fill out Texas Petition For Release Of Excess Proceeds And Notice Of Hearing?

Utilizing legal document examples that adhere to federal and state statutes is essential, and the web presents numerous choices to choose from.

However, what’s the benefit in squandering time searching for the appropriately drafted Texas Excess Proceeds List example online when the US Legal Forms virtual library already has such templates gathered in one location.

US Legal Forms is the largest online legal database with over 85,000 customizable templates prepared by lawyers for any business and life situation.

Benefit from the most comprehensive and easy-to-use legal documentation service!

- They are simple to navigate with all documents organized by state and intended use.

- Our experts stay updated with legislative changes, so you can always be assured your form is current and valid when obtaining a Texas Excess Proceeds List from our platform.

- Acquiring a Texas Excess Proceeds List is straightforward and swift for both existing and new users.

- If you already possess an account with a valid subscription, Log In and download the document example you need in your preferred format.

- If you are unfamiliar with our website, follow the instructions below.

Form popularity

FAQ

The 10 rule for property taxes in Texas generally refers to specific provisions regarding how property taxes are assessed and collected. It often means that if a property owner's taxes remain unpaid for ten years, the property may be subject to forfeiture. Understanding your obligations, especially in relation to the Texas excess proceeds list, is critical for managing your property effectively. Utilizing resources from uslegalforms can provide you clarity and support.

In Texas, unpaid property taxes can lead to foreclosure within three years from the date they become delinquent. After this period, the county can auction the property to recover owed taxes. It’s vital to monitor your tax payments to avoid losing your home. Keeping track of the Texas excess proceeds list may help you recover funds if you face this situation, ensuring a smoother financial recovery.

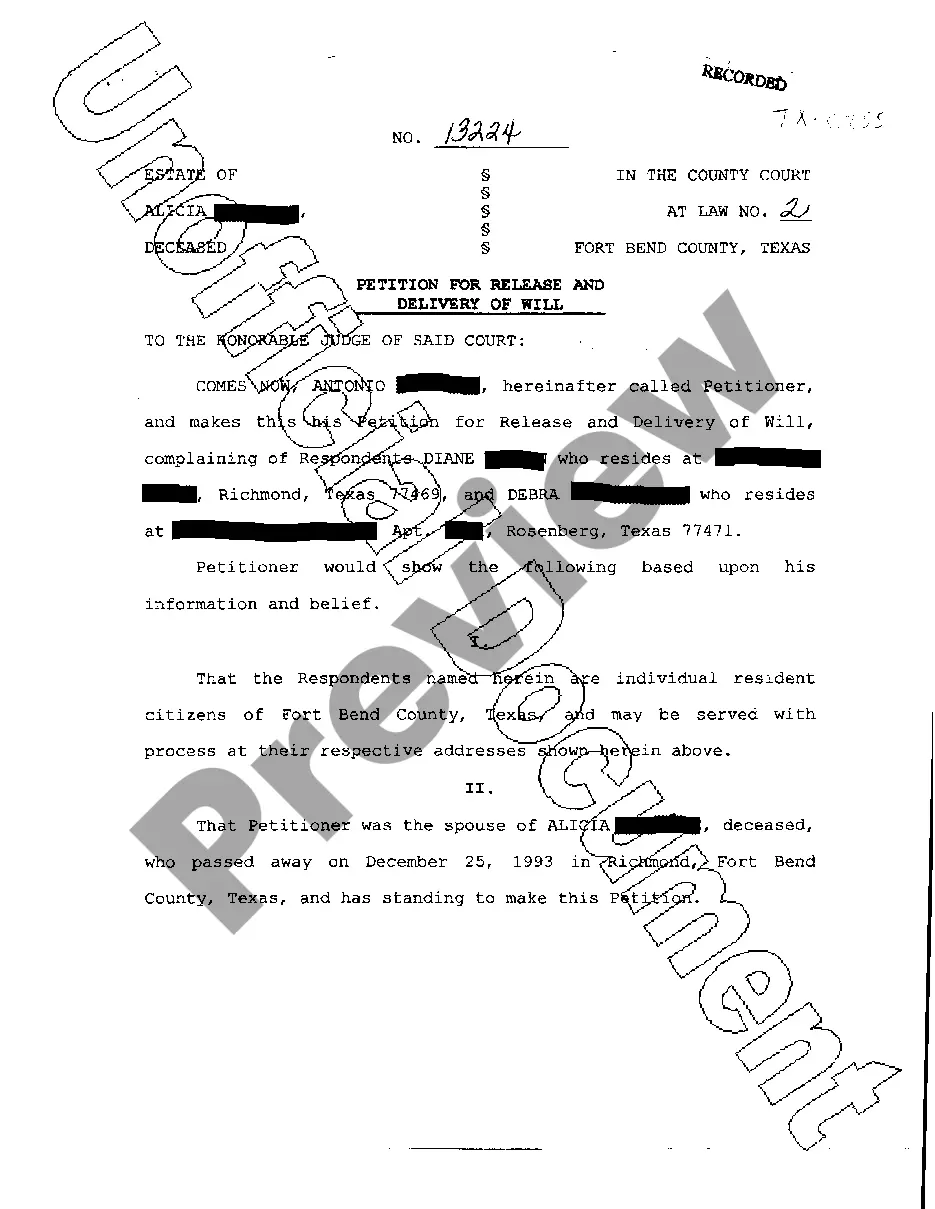

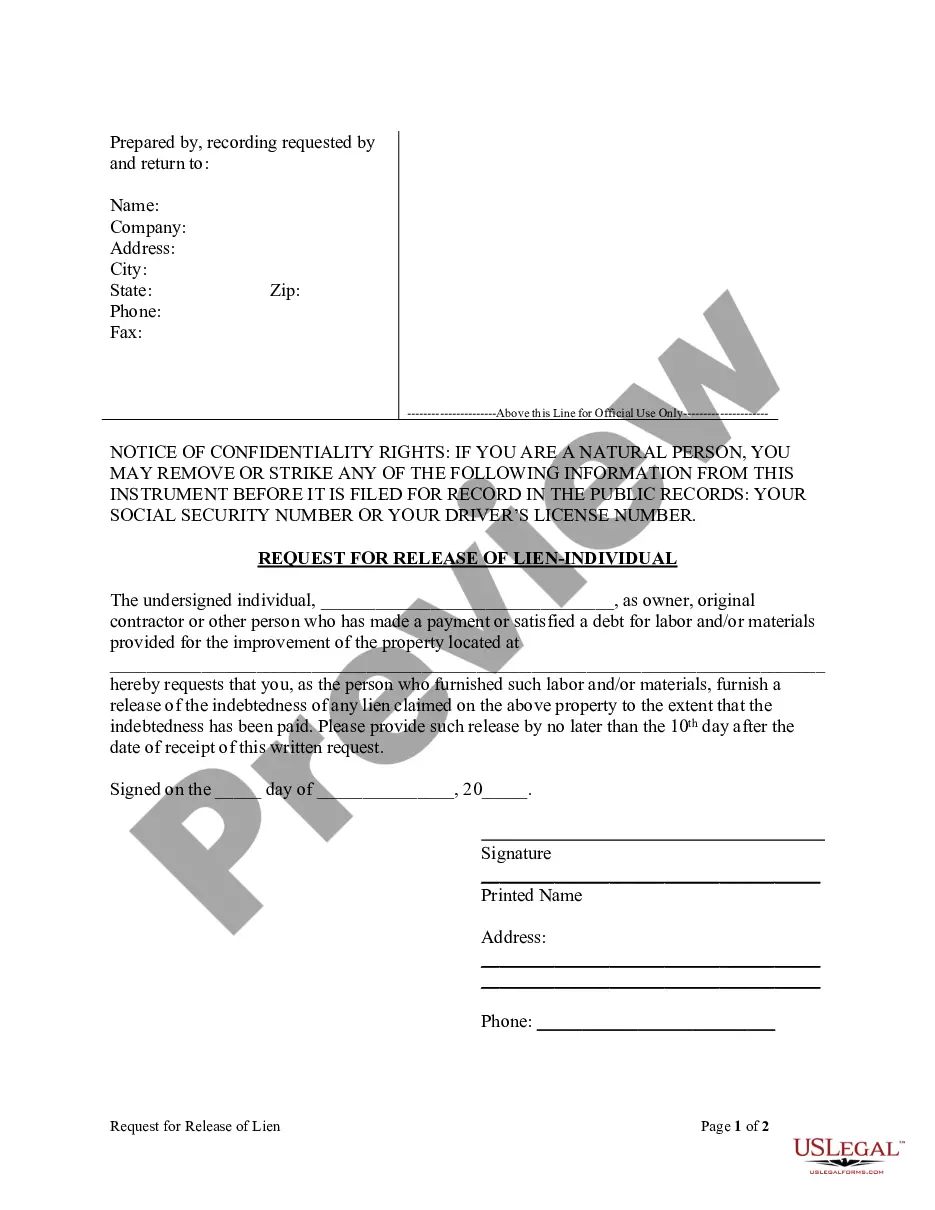

To claim excess proceeds in Texas, you should first verify your eligibility by checking the Texas excess proceeds list, which outlines any available funds from foreclosures or tax sales. You then need to fill out the appropriate forms and submit them to the county that handled the tax sale. Providing clear documentation and following deadlines is crucial to expedite the claim process. Uslegalforms provides useful templates that can assist you in this claim process.

In Texas, property taxes are generally considered overdue after January 31 of the year following the tax due date. If taxes remain unpaid, the taxing authority may take legal action, leading to potential foreclosure. Therefore, it's essential to stay informed about your obligations and keep an eye on the Texas excess proceeds list to check for any funds you might recover. Timely intervention can help you avoid losing your property.

Recovering surplus funds in Texas involves filing a claim with the appropriate county office where the foreclosure took place. You must provide sufficient documentation, including proof of ownership and identification. Using the Texas excess proceeds list can assist you in identifying and claiming available funds effectively. Uslegalforms offers tools and resources to help guide you through this process seamlessly.

In Texas, residents who are 65 years or older may qualify for an exemption from property taxes. This benefit helps senior citizens manage their finances better during retirement. Additionally, this exemption could apply to property owned by seniors, potentially benefiting their heirs. Therefore, reviewing the Texas excess proceeds list helps you understand how these exemptions impact your financial planning.

To get surplus funds from a foreclosure in Texas, begin by reviewing the Texas excess proceeds list to confirm your eligibility. Complete the necessary claim forms and submit them to the relevant court. Utilizing tools and guidance from US Legal Forms can help you navigate this process seamlessly and maximize your chances of obtaining your funds.

To avoid losing surplus funds, act promptly to claim your share as soon as you identify available proceeds. Make sure you understand the timelines and requirements associated with the Texas excess proceeds list. It can be beneficial to use resources from platforms like US Legal Forms to ensure the correctness of your claim submission and time-sensitive actions.

Repairing credit after a foreclosure can take several months, often extending up to a few years, depending on various factors such as your financial situation and actions you take. Regularly monitoring your credit report and disputing inaccuracies can help speed up recovery. While rebuilding credit takes time, being aware of your financial health is essential, especially if you plan to reclaim funds from the Texas excess proceeds list.

To claim excess proceeds in Texas, start by identifying your eligibility through the Texas excess proceeds list. Submit your claim to the designated court, ensuring you have all necessary supporting documents ready. Platforms like US Legal Forms offer guidance and resources to help you navigate the claims process effectively.