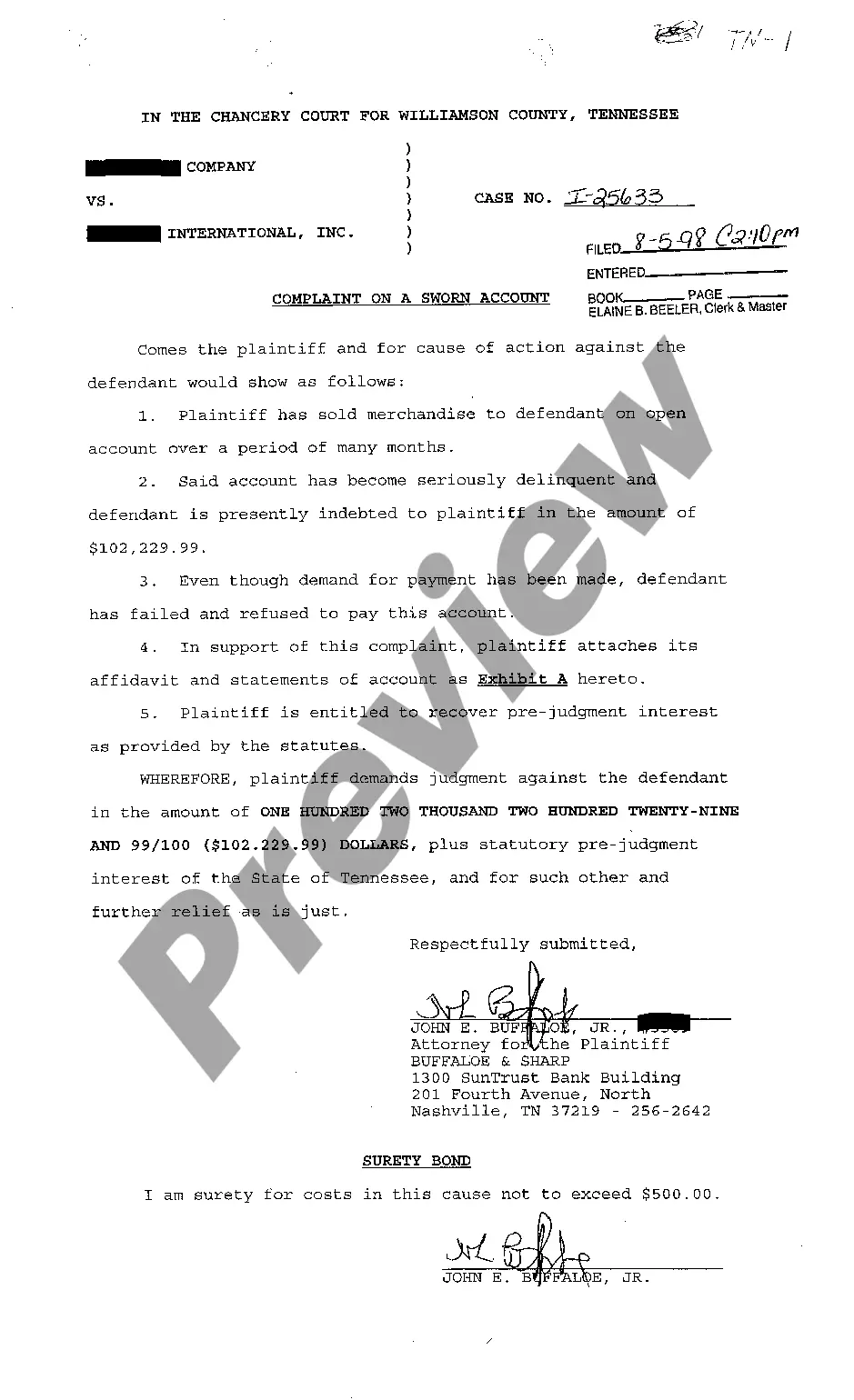

Sec. 34.04 of the Texas Tax Code provides in part as follows:

(a) A person, including a taxing unit, may file a petition in the court that ordered the seizure or sale setting forth a claim to the excess proceeds. The petition must be filed before the second anniversary of the date of the sale of the property. The petition is not required to be filed as an original suit separate from the underlying suit for seizure of the property or foreclosure of a tax lien on the property but may be filed under the cause number of the underlying suit.

(b) A copy of the petition shall be served, in the manner prescribed by Rule 21a, Texas Rules of Civil Procedure, as amended, or that rule's successor, on all parties to the underlying action not later than the 20th day before the date set for a hearing on the petition.

(c) At the hearing the court shall order that the proceeds be paid according to the following priorities to each party that establishes its claim to the proceeds:

(1) to the tax sale purchaser if the tax sale has been adjudged to be void and the purchaser has prevailed in an action against the taxing units under Section 34.07(d) by final judgment;

(2) to a taxing unit for any taxes, penalties, or interest that have become due or delinquent on the subject property subsequent to the date of the judgment or that were omitted from the judgment by accident or mistake;

(3) to any other lienholder, consensual or otherwise, for the amount due under a lien, in accordance with the priorities established by applicable law;

(4) to a taxing unit for any unpaid taxes, penalties, interest, or other amounts adjudged due under the judgment that were not satisfied from the proceeds from the tax sale; and

(5) to each former owner of the property, as the interest of each may appear.

(d) Interest or costs may not be allowed under this section.

(e) An order under this section is appealable.

Texas Eviction Notice Without Lease Agreement

Description

How to fill out Texas Petition For Release Of Excess Proceeds And Notice Of Hearing?

Whether for business purposes or for personal affairs, everybody has to manage legal situations at some point in their life. Filling out legal paperwork needs careful attention, beginning from choosing the appropriate form sample. For instance, when you select a wrong edition of a Texas Eviction Notice Without Lease Agreement, it will be declined once you submit it. It is therefore essential to have a reliable source of legal papers like US Legal Forms.

If you need to obtain a Texas Eviction Notice Without Lease Agreement sample, follow these easy steps:

- Get the sample you need by utilizing the search field or catalog navigation.

- Check out the form’s description to make sure it suits your situation, state, and region.

- Click on the form’s preview to see it.

- If it is the incorrect document, go back to the search function to find the Texas Eviction Notice Without Lease Agreement sample you need.

- Download the file if it meets your requirements.

- If you have a US Legal Forms account, click Log in to access previously saved documents in My Forms.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Pick the proper pricing option.

- Finish the account registration form.

- Pick your payment method: you can use a bank card or PayPal account.

- Pick the document format you want and download the Texas Eviction Notice Without Lease Agreement.

- Once it is downloaded, you are able to fill out the form by using editing applications or print it and complete it manually.

With a large US Legal Forms catalog at hand, you don’t have to spend time looking for the right sample across the web. Make use of the library’s straightforward navigation to get the right template for any situation.

Form popularity

FAQ

An eviction notice must always include a few important details such as the property the landlord is referring to and the tenant the notice is addressed to. More importantly, it must answer why the landlord is pursuing an eviction and must state a breach of the contract.

Unfortunately, Texas does not permit "self-help" evictions, meaning you may not simply remove your roommate by force. The process for evicting your roommate will depend on whether there is a written lease between the landlord and the roommate. If there is, they are treated as any other renter.

If you don't have a lease agreement, though, you can still evict a tenant as long as you follow Texas eviction laws. If there is no lease, a Texas landlord can evict a tenant without providing a reason. Simply give notice to vacate, and follow eviction proceedings if the tenant fails to leave.

So technically speaking, when a tenant brings in another person to reside on the apartment, they create a new ?lease,? and become a sort of ?landlord? themselves. Thus, to get your roommate out, you need to bring an eviction proceeding, the same way a landlord would.

Ing to Texas law, rent on the rental unit becomes late if it isn't paid within 2 full days once it's due. When rent is late, you must give the tenant the 3-Day Notice to Quit to kick start the eviction process.