Texas Delinquent Tax Foreclosure

Description

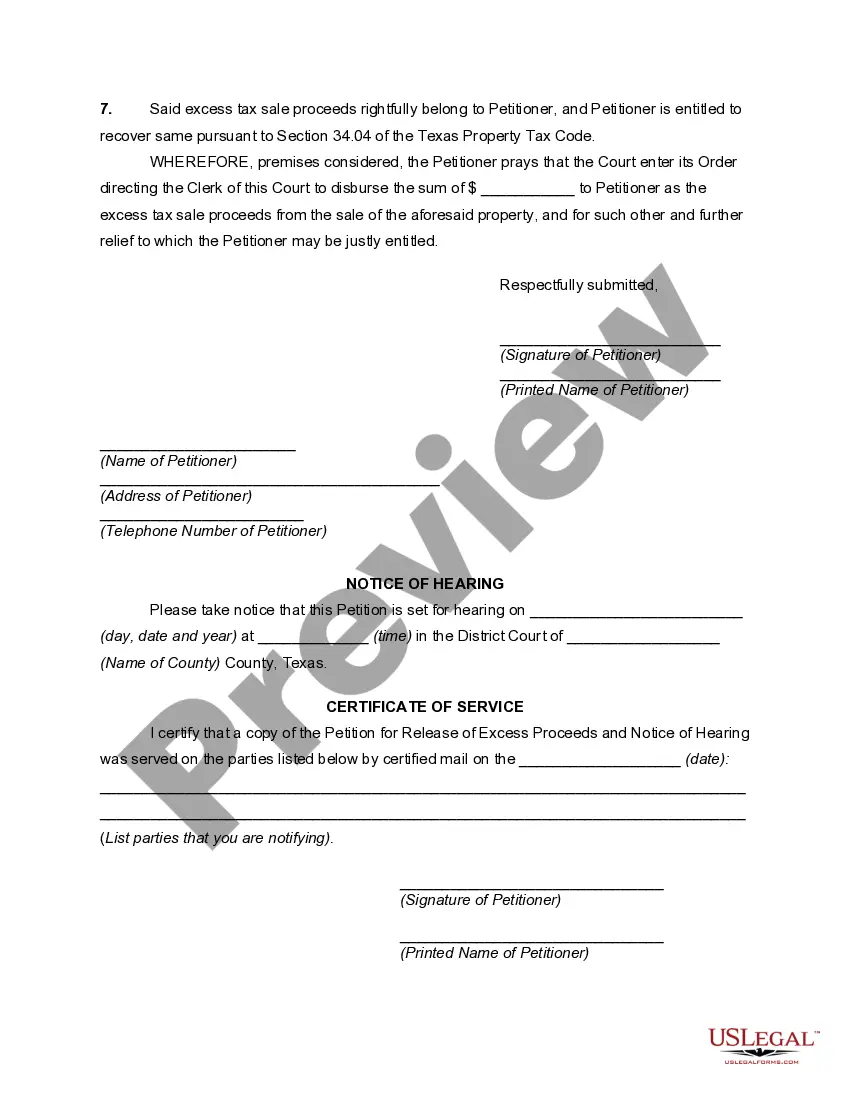

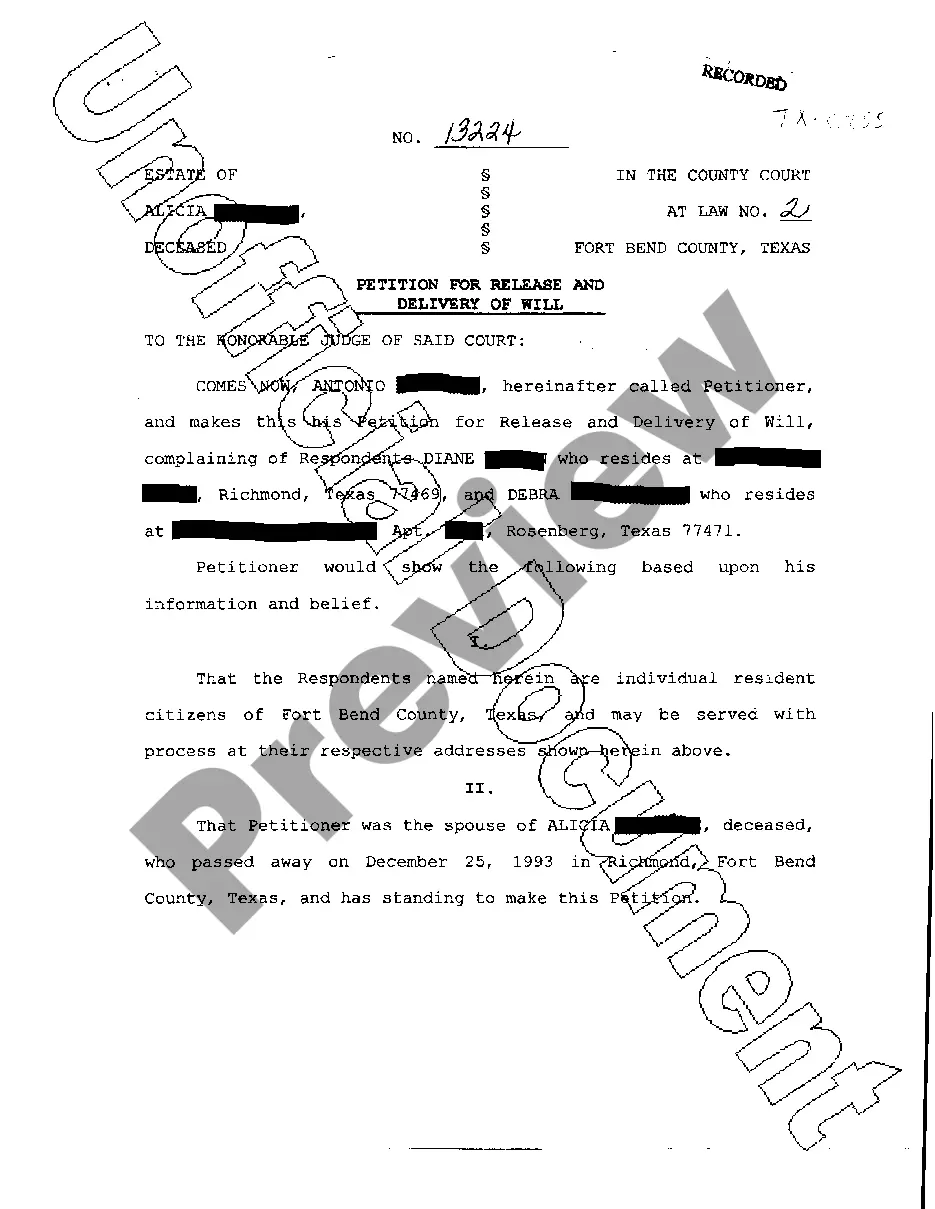

How to fill out Texas Petition For Release Of Excess Proceeds And Notice Of Hearing?

Obtaining legal document examples that adhere to federal and local laws is crucial, and the web provides numerous choices to select from.

However, what's the benefit of spending time searching for the accurately crafted Texas Delinquent Tax Foreclosure example online when the US Legal Forms digital library already has such templates compiled in one location.

US Legal Forms is the largest online legal directory with more than 85,000 fillable templates created by attorneys for any business and personal situation. They are simple to navigate with all documents organized by state and intended use. Our experts keep current with legislative changes, so you can always trust that your form is up to date and compliant when obtaining a Texas Delinquent Tax Foreclosure from our site.

Click Buy Now once you've located the correct form and select a subscription plan. Create an account or Log In and process payment via PayPal or a credit card. Choose the appropriate format for your Texas Delinquent Tax Foreclosure and download it. All templates obtained through US Legal Forms are reusable. To re-download and complete previously saved forms, access the My documents tab in your account. Enjoy the most comprehensive and user-friendly legal document service!

- Acquiring a Texas Delinquent Tax Foreclosure is straightforward and swift for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the document example you require in the appropriate format.

- If you are a newcomer to our site, follow the steps below.

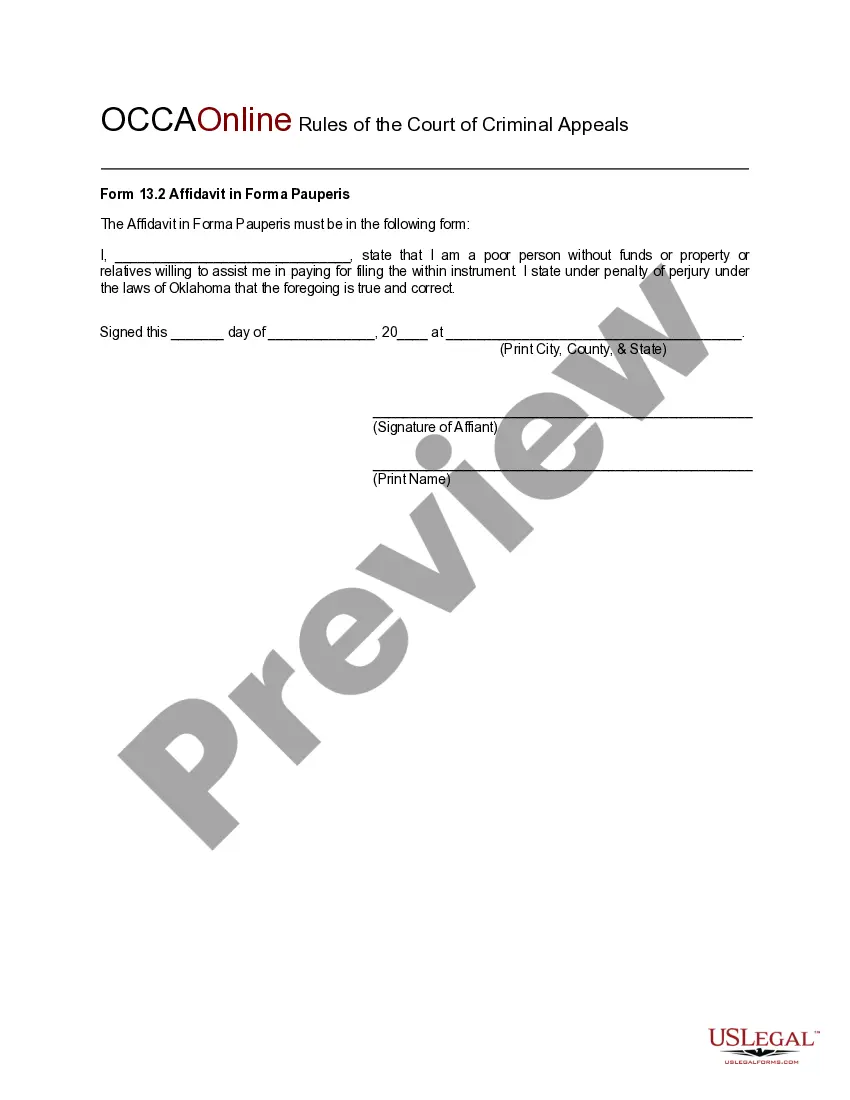

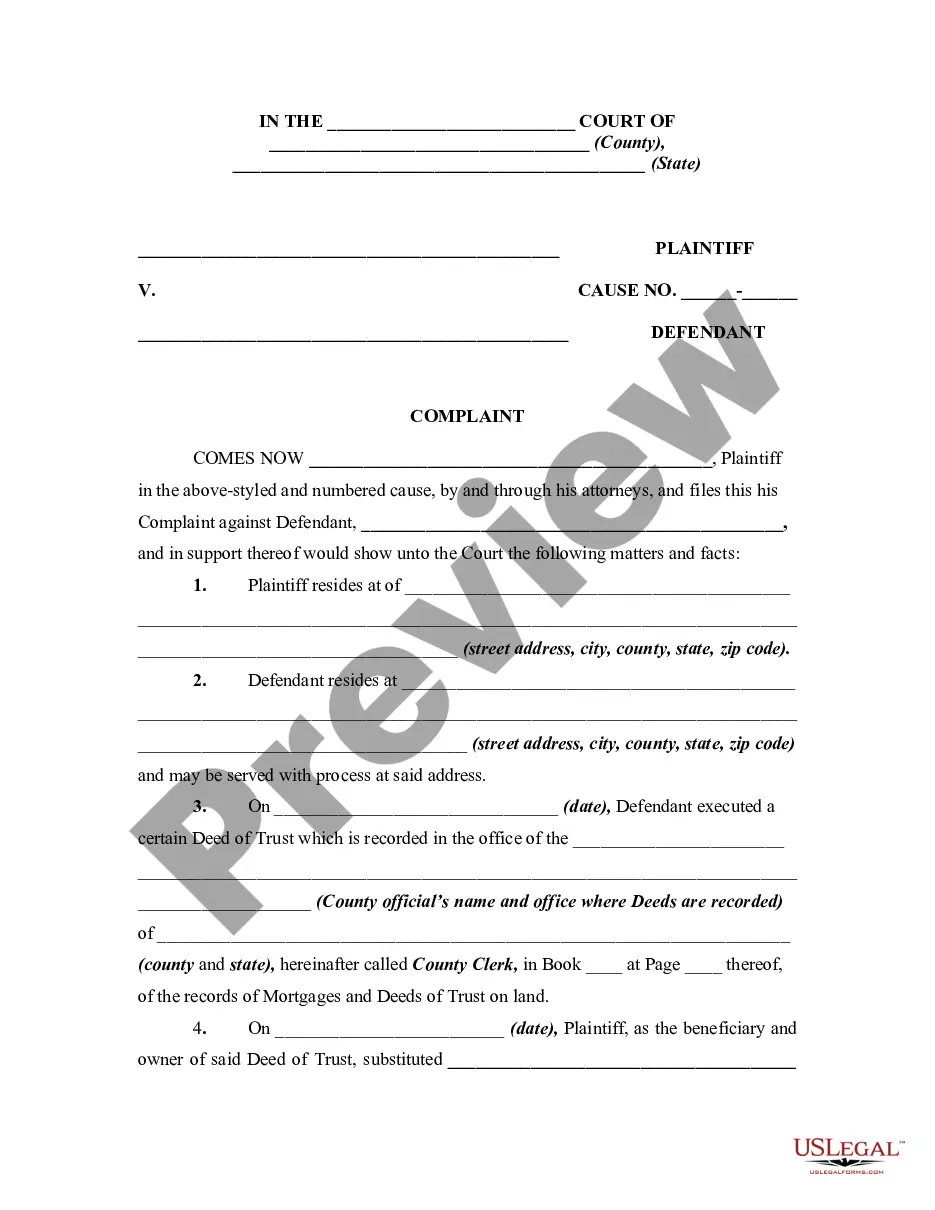

- Review the template using the Preview function or through the text outline to confirm it suits your requirements.

- Search for another example using the search feature at the top of the page if needed.

Form popularity

FAQ

How Does The County Foreclose a Tax Lien? In order to foreclose, the taxing authority must file a lawsuit against the owner of the property.

Although there is no specific timeframe for foreclosure, Texas delinquent property tax laws allow a tax lien on all properties as of January 1 of each year until the property taxes are paid. That lien allows the tax assessor to foreclose on a home if they believe the delinquent property taxes will not be repaid.

If the homeowner cannot pay off the overdue amount and does not have a valid defense against the foreclosure, then the property will be sold off at a property tax sale where the lien on the delinquent property is auctioned off to the highest bidder.

Delinquent tax property deeds are sold to the highest bidder. Bring acceptable for of payment ? cash or cashier's check before bidding on properties. An investor can win a bid by being highest bidder on delinquent tax property deed. The county will issue Sheriff's deed for the property to the highest bidder.

Delinquent tax property deeds are sold to the highest bidder. Bring acceptable for of payment ? cash or cashier's check before bidding on properties. An investor can win a bid by being highest bidder on delinquent tax property deed. The county will issue Sheriff's deed for the property to the highest bidder.