Texas Estate Individual With Pool

Description

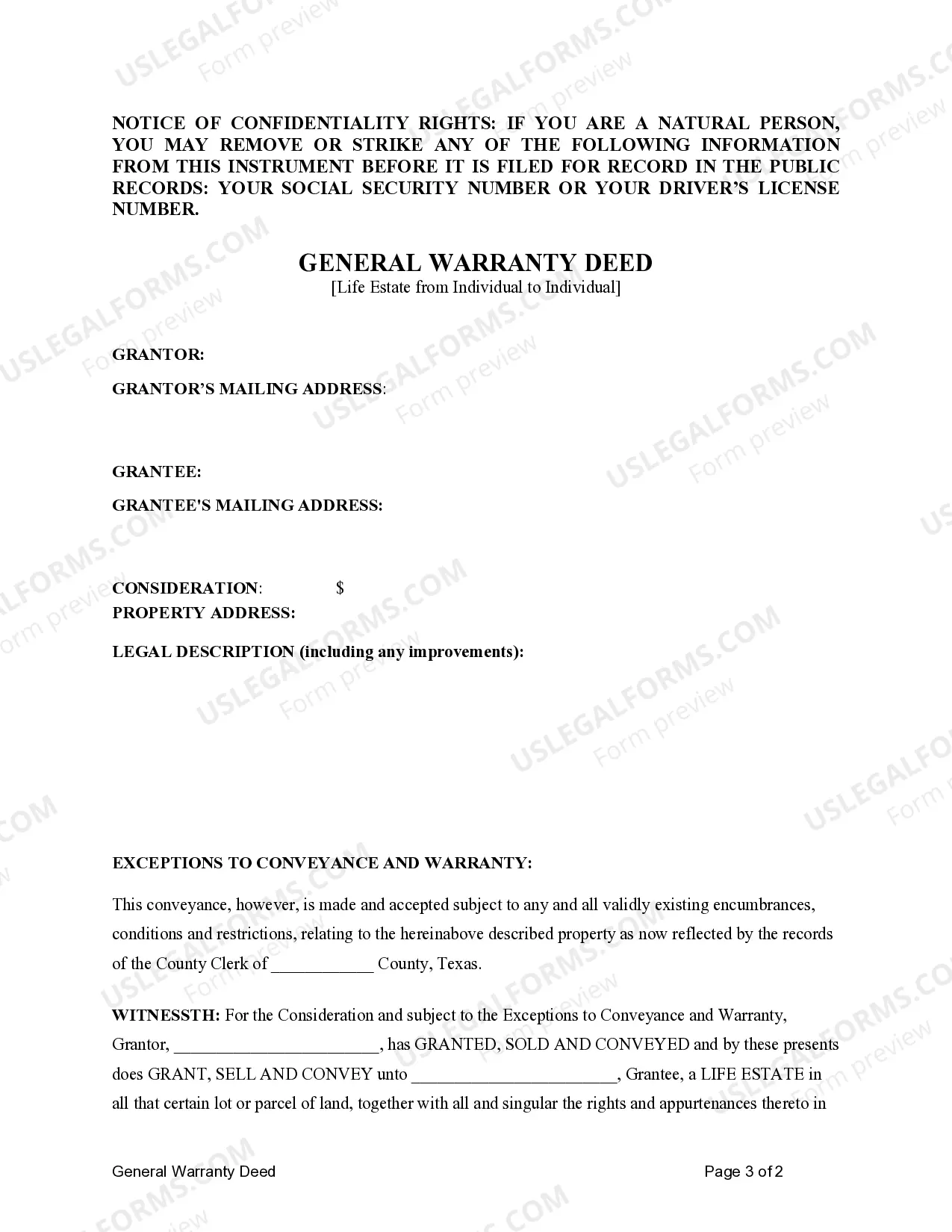

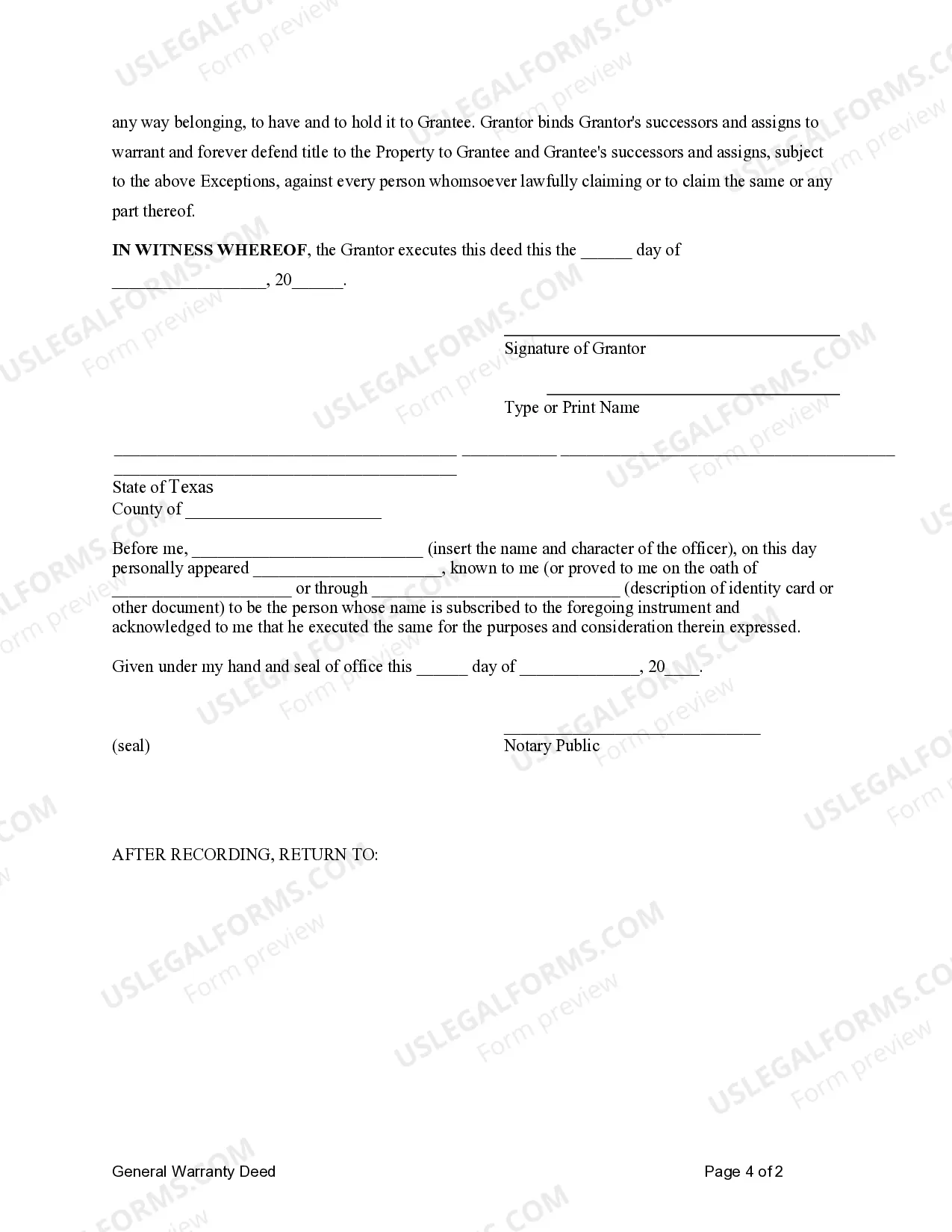

How to fill out Texas General Warrant Deed - Life Estate From Individual To Individual?

- Log in to your US Legal Forms account. If you’re a new user, create an account first.

- Browse through the form library. Use the search functionality to find the Texas estate individual with pool template that matches your requirements.

- Preview the selected form. Ensure it meets local jurisdiction standards. If not, return to the search bar for alternatives.

- Select the 'Buy Now' option. Choose the subscription plan that best fits your needs before proceeding.

- Enter payment information. You can provide credit card details or use PayPal for convenience.

- Download your form immediately after purchase. Access it anytime under 'My Forms' in your profile.

Having access to expert assistance enhances your experience and ensures accuracy in your legal documents. With US Legal Forms, you're not just buying templates; you're gaining a reliable partner in your legal journey.

Get started today and simplify your Texas estate individual with pool documentation process with US Legal Forms!

Form popularity

FAQ

Typically, the affiant is responsible for preparing the affidavit of heirship, especially if they are familiar with the deceased's family structure and estate. Often, legal professionals may assist to ensure compliance with Texas laws. Using platforms like USLegalForms simplifies this process by providing templates that walk you through the preparation, making it suitable for anyone navigating a Texas estate individual with pool.

When completing an affidavit of heirship in Texas, begin by stating the names of the deceased and the affiant. Include details regarding the property, such as its location and any additional relevant assets in the estate. With solutions like USLegalForms, you can find templates that help you organize this information efficiently, ensuring you meet legal requirements for a Texas estate individual with pool.

To fill out an affidavit of inheritance, collect relevant information about the deceased's estate, including assets, debts, and the identities of heirs. You should clearly outline the distribution plan, reflecting the deceased's wishes if known. USLegalForms offers resources that provide structured formats, making it easier for individuals handling Texas estates with pools to complete these documents correctly.

Filling out an affidavit of heirship in Texas requires you to start by gathering essential information about the deceased and their heirs. You must include details like names, relationships, and dates of birth. If you utilize USLegalForms, you can simplify this process with user-friendly templates that guide you through each step, ensuring all necessary information is captured accurately.

In a Texas estate individual with pool, the affiant is the person who swears to the truth of the information contained in the affidavit. This individual often has firsthand knowledge of the deceased's heirs and their relationship to the decedent. The affiant typically signs the affidavit in front of a notary public, making the document legally binding.

An executor can be disqualified in Texas for reasons such as having a felony conviction or failing to meet legal competency standards. Additionally, if an executor is proven to have acted improperly or in bad faith while managing the estate, they may be removed. For a Texas estate individual with a pool, maintaining trust in the chosen executor is key to a smooth estate administration.

In Texas, anyone with a felony conviction or those who are legally declared incompetent cannot serve as an executor. Additionally, individuals who are non-residents may also be disqualified unless they are relatives of the deceased. Carefully selecting an executor is crucial, particularly in cases involving a Texas estate individual with a pool, to ensure effective estate management.

Several factors can disqualify a person from serving as an executor in Texas, including felony convictions or being declared mentally incompetent by a court. Additionally, individuals who have a conflict of interest may also face disqualification. Choosing the right executor is essential, especially for a Texas estate individual with a pool, as they will need to act in the best interest of all beneficiaries.

To become an executor for an estate without a will in Texas, you must petition the court to be appointed as the administrator of the estate. This requires submitting necessary documents, including an application and sometimes an inventory of the deceased’s assets. Engaging with platforms like UsLegalForms can simplify this process by providing the right forms and guidance to manage a Texas estate individual with a pool.

In Texas, if a person dies without a will, their property transfers through intestate succession laws. This process determines how assets are distributed among surviving relatives, typically starting with children and spouse. For a Texas estate individual with a pool, navigating this process can be complex, so legal guidance may be necessary to ensure correct distribution.