Gift Deed For Property Transfer Texas

Description

How to fill out Texas Gift Deed Gift Deed From Husband And Wife, Or Two Individuals, To Husband And Wife, Or Two Individuals.?

- Log in to your US Legal Forms account if you are a returning user, and click the Download button to retrieve the necessary form template.

- If you're a new user, start by browsing the Preview mode to find the correct gift deed template that aligns with your local laws and requirements.

- If the selected form doesn’t meet your needs, utilize the Search tab to explore additional options until you find the appropriate template.

- Click the Buy Now button, select a subscription plan that suits your needs, and create an account to unlock the comprehensive library.

- Complete your purchase by providing payment details via credit card or PayPal.

- Download the finalized form directly to your device, which will also be accessible in the My Forms section of your profile.

US Legal Forms offers significant advantages, including a vast collection of over 85,000 easily editable legal documents, making it a preferred choice for users looking to complete legal forms meticulously.

Start your property transfer journey today with US Legal Forms for reliable and efficient processing. Don’t hesitate—visit us now to get started!

Form popularity

FAQ

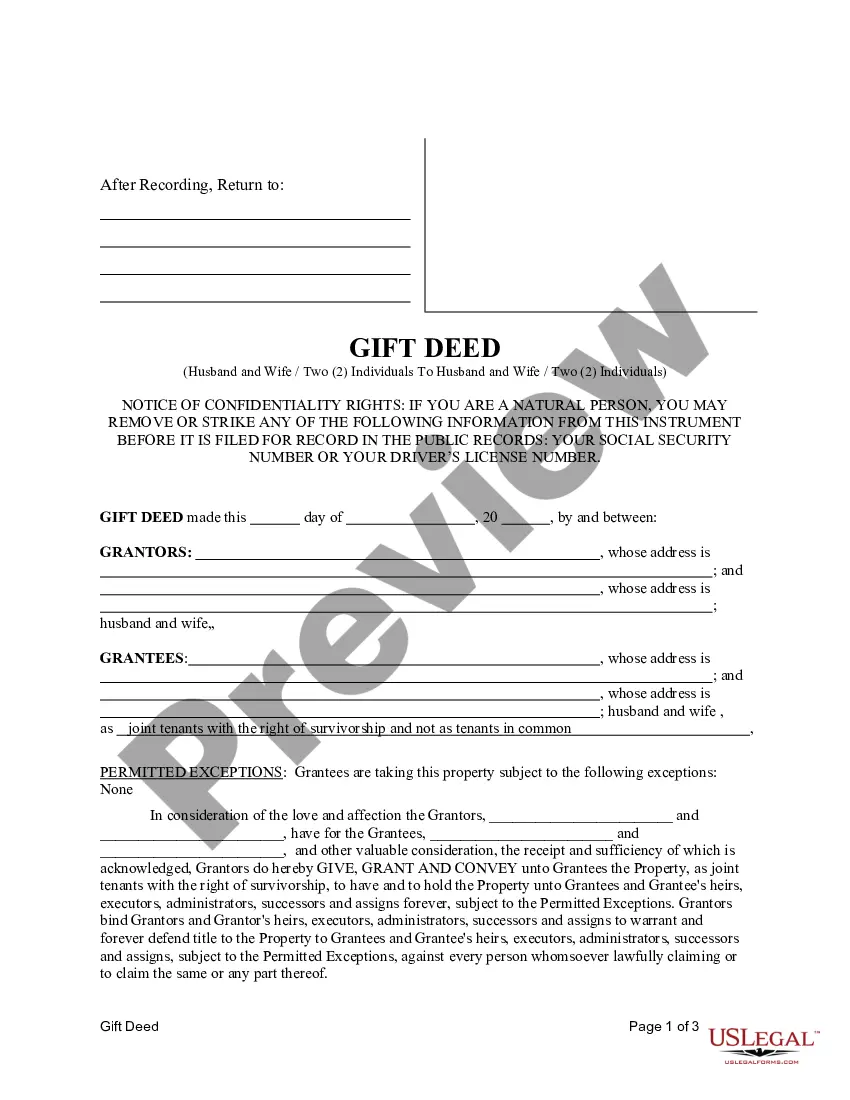

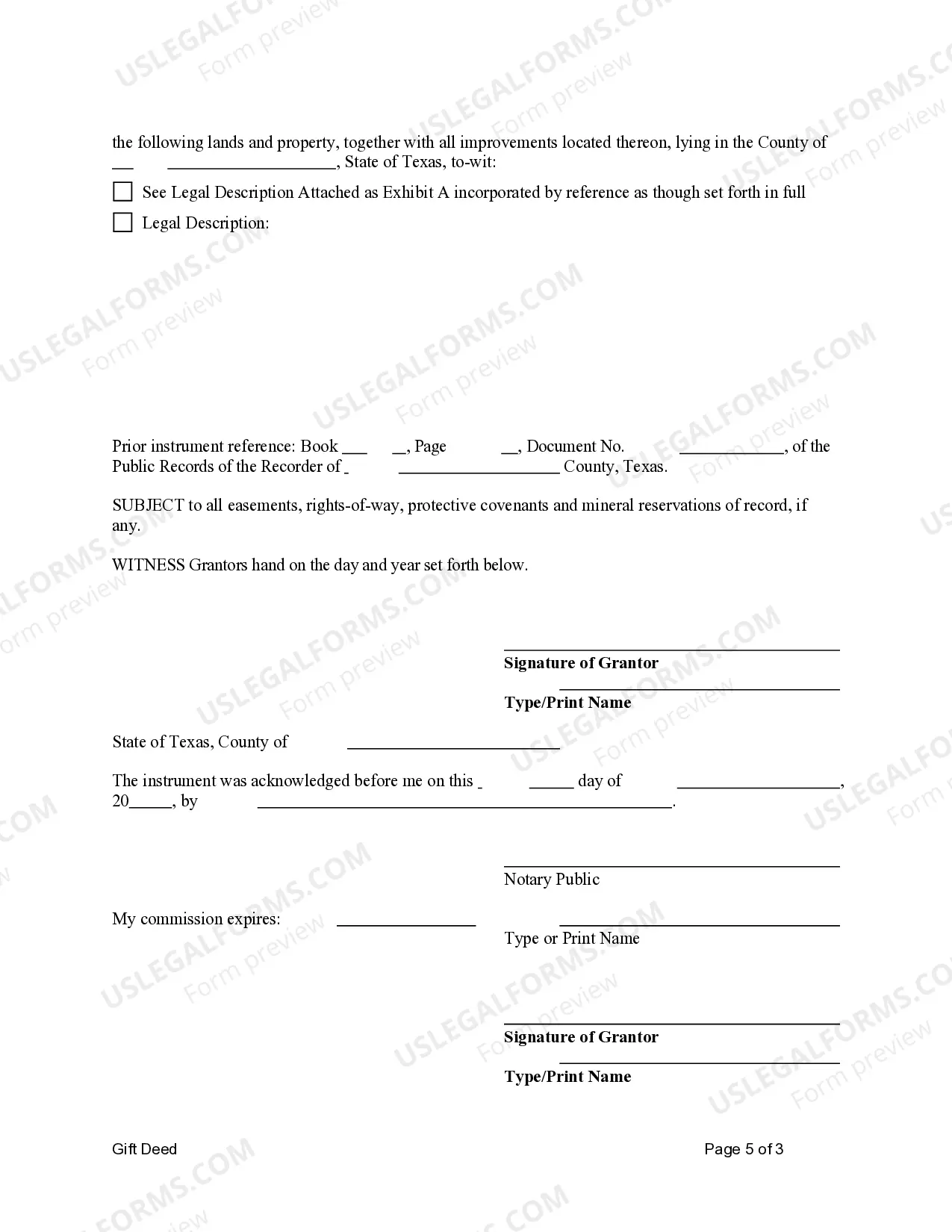

To file a gift deed in Texas, you need to complete a gift deed form that includes all necessary details about the property and the parties involved. After filling out the gift deed for property transfer in Texas, you must sign it in front of a notary public. Finally, file the completed deed with the local county clerk's office to make the transfer official. This process ensures that your gift deed is recognized legally and protects your family’s interests.

Using a gift deed is often considered the best way to transfer property title between family members. It clearly outlines the transfer of ownership without requiring monetary compensation, making it simple and straightforward. When you choose a gift deed for property transfer in Texas, you help ensure that your intentions are clear and legally recognized. Consider consulting a professional to assist with the proper filing and documentation.

The most common way to transfer ownership of property is through a sale or gift deed. For many families, utilizing a gift deed for property transfer in Texas is a preferred option as it simplifies the process and helps avoid taxes associated with a sale. This method facilitates a smooth transfer while maintaining family harmony. Always consider documenting the transfer clearly to protect all parties involved.

While it's not mandatory to hire a lawyer to transfer a deed, having legal guidance can be beneficial. A lawyer can help ensure that the gift deed for property transfer in Texas is correctly prepared and filed. This support can prevent future disputes and ensure compliance with state laws. Ultimately, the decision depends on your comfort level and the complexity of your situation.

Yes, both parties typically need to be present for a title transfer in Texas to sign the necessary documents. This ensures that the transfer is voluntary and understood by both the giver and recipient. However, if one party cannot attend, a power of attorney can be designated to sign on their behalf. Utilizing a gift deed for property transfer in Texas can clearly outline the terms of the transfer, making the process smoother.

Obtaining a gift deed in Texas is relatively straightforward. You can find a template online or use a service like USLegalForms to ensure you have the correct format. Fill out the gift deed with details about the property and the parties involved, then sign it in front of a notary. Lastly, file the completed gift deed with the county clerk to make the transfer official, ensuring compliance with Texas law.

A quitclaim deed transfers ownership rights without guaranteeing the property's title, often used between familiar parties where trust exists. In contrast, a gift deed explicitly conveys property as a gift, ensuring that the giver relinquishes all rights without expectation of compensation. Both documents serve unique purposes in property law in Texas, but using a gift deed for property transfer guarantees the intent to gift is clearly delineated and legally enforceable.

Transferring ownership of a house to a family member in Texas involves creating a gift deed, ensuring that both parties agree to the transfer. You'll need to complete the gift deed form, which includes details about the property and the relationship between the giver and recipient. Once completed, file the gift deed with the county clerk's office, ensuring the transfer is official and recognized. Consider using USLegalForms to streamline this process and ensure compliance with all regulations.

To create a valid gift deed for property transfer in Texas, certain requirements must be met. The deed must be in writing, signed by the donor, and must specify the property being transferred. It is also necessary to have the deed notarized and recorded in the county where the property is located. Utilizing platforms like USLegalForms can simplify the process of drafting a gift deed for property transfer in Texas.

In Texas, a gift deed for property transfer must be drafted clearly to convey the donor's intent. The donor must be of sound mind and voluntarily give the property without expectation of anything in return. Additionally, the recipient or donee must accept the gift for the deed to be valid. Following these rules ensures that the gift deed for property transfer in Texas is legally recognized.