Legal managing can be overpowering, even for the most knowledgeable experts. When you are looking for a Texas Motion Order Tx Withholding Tax and don’t have the a chance to devote in search of the appropriate and up-to-date version, the processes may be demanding. A robust web form library might be a gamechanger for anybody who wants to deal with these situations successfully. US Legal Forms is a industry leader in web legal forms, with more than 85,000 state-specific legal forms accessible to you anytime.

With US Legal Forms, you are able to:

- Access state- or county-specific legal and organization forms. US Legal Forms handles any demands you could have, from individual to enterprise paperwork, in one place.

- Utilize innovative tools to complete and manage your Texas Motion Order Tx Withholding Tax

- Access a useful resource base of articles, guides and handbooks and materials highly relevant to your situation and needs

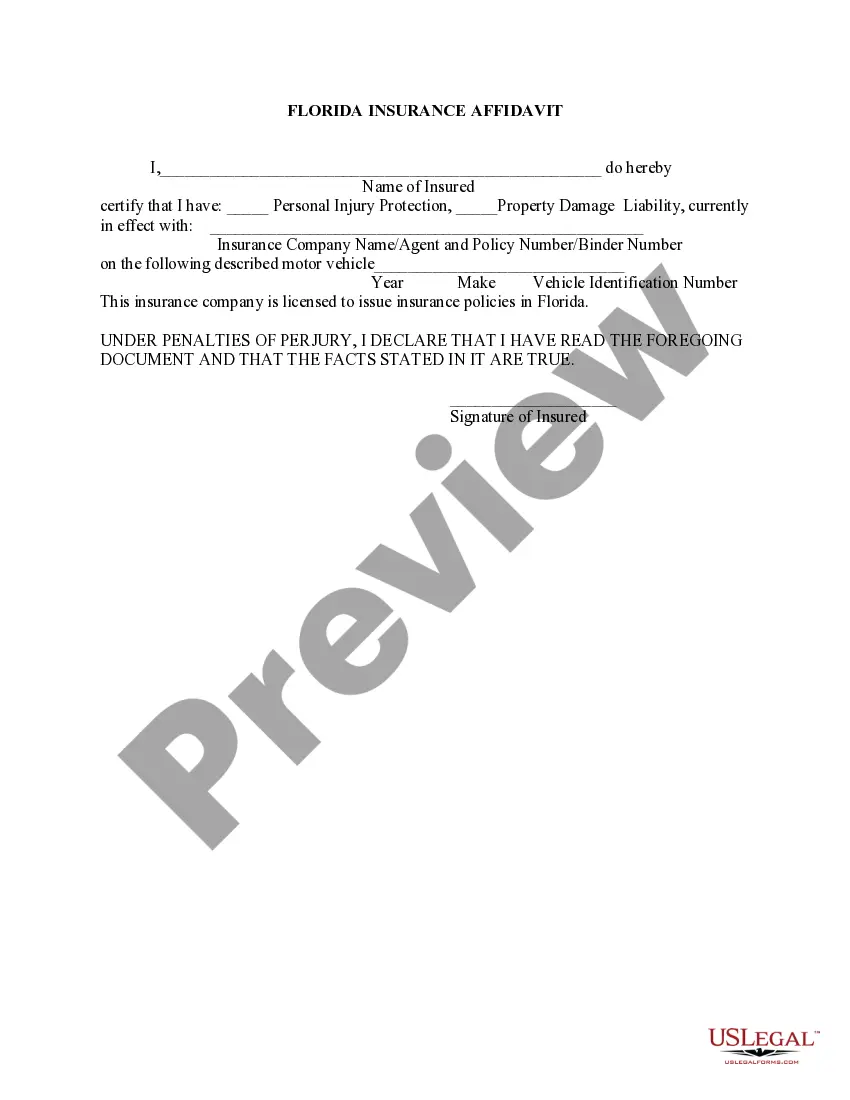

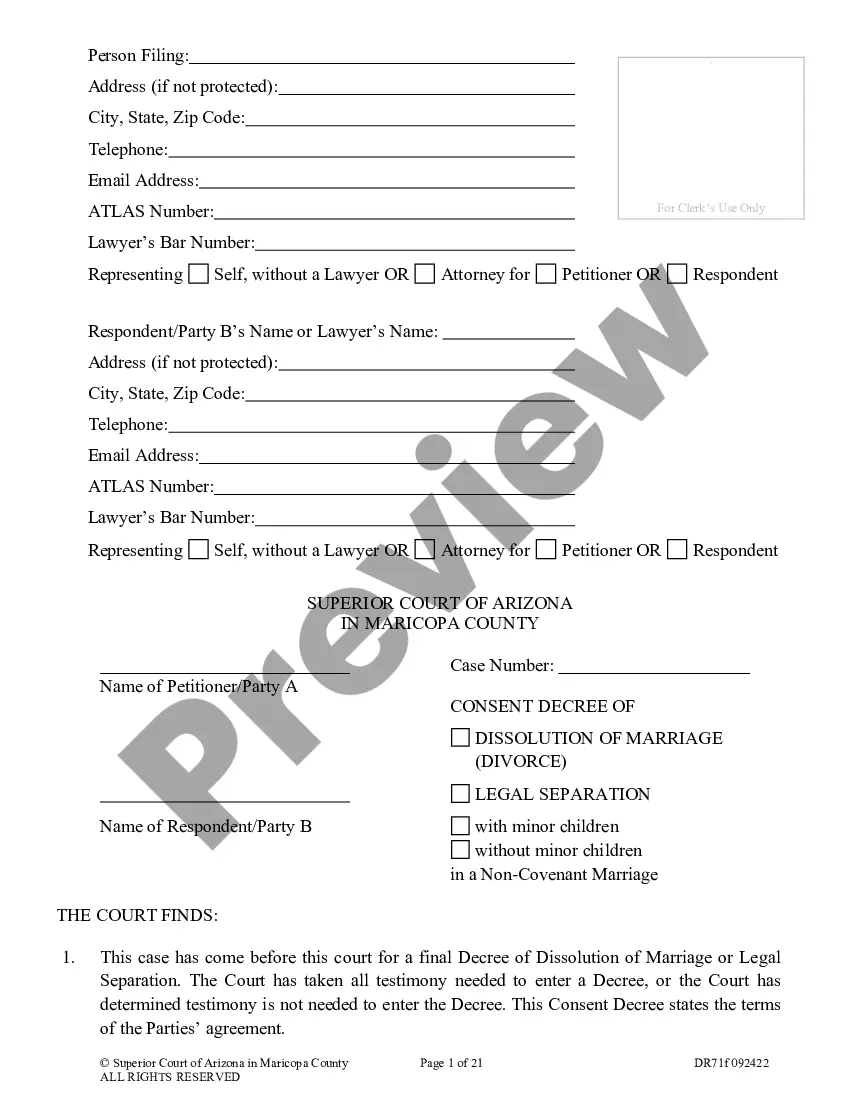

Save effort and time in search of the paperwork you will need, and employ US Legal Forms’ advanced search and Preview tool to discover Texas Motion Order Tx Withholding Tax and download it. For those who have a subscription, log in in your US Legal Forms profile, search for the form, and download it. Take a look at My Forms tab to view the paperwork you previously downloaded as well as to manage your folders as you see fit.

Should it be the first time with US Legal Forms, register an account and have unrestricted use of all benefits of the platform. Here are the steps to consider after downloading the form you want:

- Confirm this is the correct form by previewing it and looking at its information.

- Be sure that the sample is acknowledged in your state or county.

- Choose Buy Now once you are ready.

- Choose a monthly subscription plan.

- Pick the file format you want, and Download, complete, eSign, print and send your document.

Benefit from the US Legal Forms web library, backed with 25 years of expertise and trustworthiness. Change your everyday document managing in a easy and user-friendly process right now.