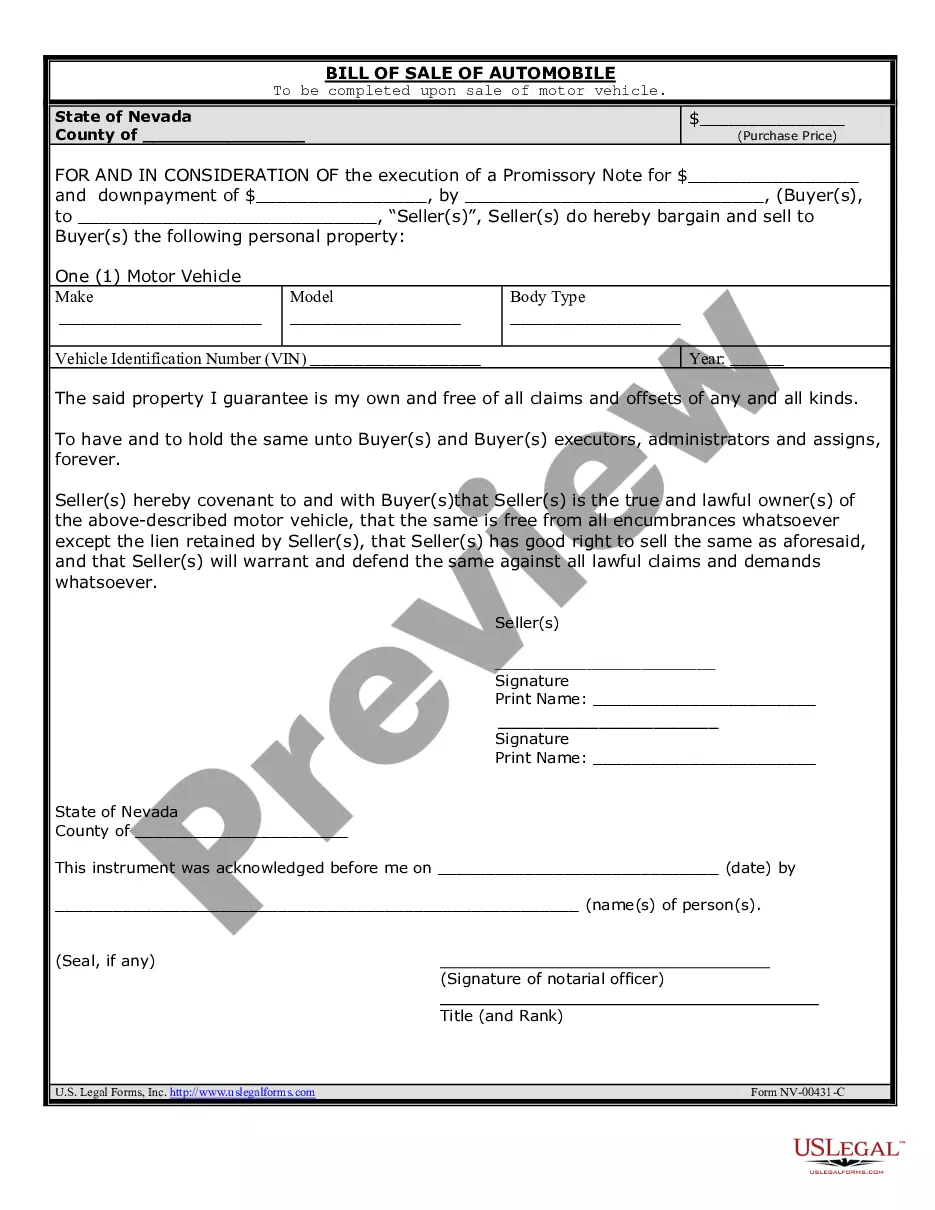

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

Automobile Bill Of Sale Texas Without

Description

How to fill out Texas Promissory Note In Connection With Sale Of Vehicle Or Automobile?

Individuals often link legal documents with complexities that only an expert can manage.

In some respects, this is accurate, as composing an Automobile Bill Of Sale Texas Without requires considerable knowledge of relevant subject matter, encompassing state and local laws.

Nonetheless, with US Legal Forms, everything has been made simpler: an assembly of ready-to-use legal templates for every life and business occasion, tailored to state regulations, is compiled in one online repository and is now open to everyone.

You can print your document or upload it to an online editor for quicker completion. All templates in our collection are reusable: once bought, they remain accessible in your profile, allowing you to reach them whenever necessary through the My documents tab. Discover all the advantages of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85,000 current documents categorized by state and purpose, making it easy to find the Automobile Bill Of Sale Texas Without or any other specific template in just minutes.

- Returning users with an active subscription must Log In to their account and click Download to access the form.

- New users will need to first create an account and subscribe before downloading any documentation.

- Here’s a step-by-step guide on how to obtain the Automobile Bill Of Sale Texas Without.

- Carefully review the page content to ensure it aligns with your requirements.

- Examine the form description or verify it using the Preview option.

- If the previous sample doesn’t meet your criteria, find another one using the Search field above.

- Click Buy Now when you locate the appropriate Automobile Bill Of Sale Texas Without.

- Select a subscription plan that fulfills your requirements and budget.

- Create an account or Log In to continue to the payment page.

- Complete payment for your subscription through PayPal or with your credit card.

- Choose the format for your document and click Download.

Form popularity

FAQ

The requirements for a Texas vehicle bill of sale include the seller's name, county of residence, and the selling price of the motor vehicle; the buyer's name and driver's license number; the year, make, model, and VIN of the vehicle; and the seller must sign and date the form in front of a notary public.

Though standard form bill of sales are available online and from your local county tax collector's office, it's also perfectly acceptable to write your own.

You will need to have a valid license, along with some sort of proof that you own the car. That would be the bill of sale you got when you purchased the car originally, providing the proof that you need to be able to sell the car without registration.

Can You Trade A Car You Just Bought? Yes you can trade in a vehicle that you just bought, however you may lose some money in the process. Depending on your urgency of getting a different vehicle than the one you purchased, this may be worth it to you.

The state does not require the document to be notarized, but it does suggest1 that both parties jointly visit the county tax office when the seller is signing over the title of the vehicle.