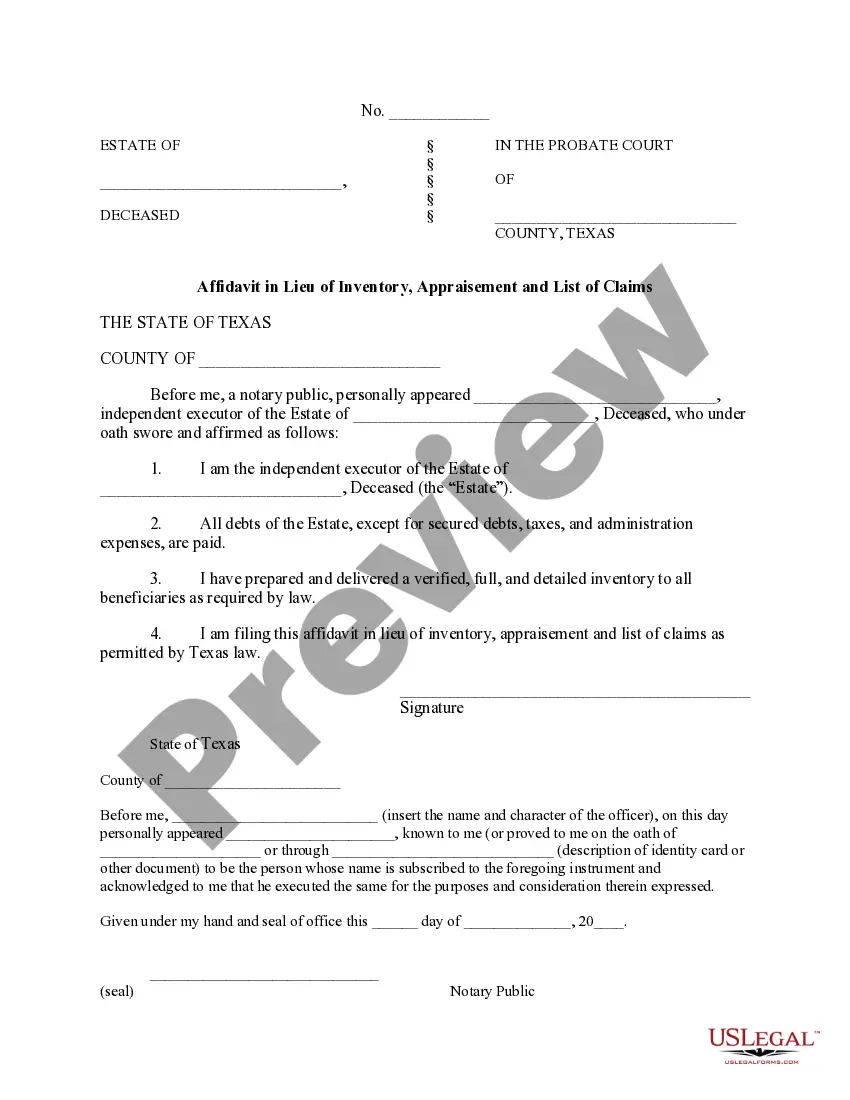

Affidavit In Lieu Of Inventory Withdrawal

Description

How to fill out Texas Affidavit In Lieu Of Inventory, Appraisement And List Of Claims?

Red tape requires meticulousness and precision.

If you do not manage completing documents like Affidavit In Lieu Of Inventory Withdrawal daily, it might result in some misunderstanding.

Choosing the correct sample from the outset will guarantee that your document submission will proceed smoothly and avert any hassles of resending a document or starting entirely anew.

Finding the suitable and current samples for your paperwork takes just a few minutes with an account at US Legal Forms. Steer clear of bureaucratic issues and enhance your efficiency with forms.

- Locate the necessary template via the search feature.

- Ensure the Affidavit In Lieu Of Inventory Withdrawal you found is valid for your state or district.

- Inspect the preview or read the description detailing the specifics on the utilization of the template.

- If the result meets your search, click the Buy Now button.

- Select the suitable choice among the proposed subscription options.

- Log In to your account or set up a new one.

- Complete the purchase using a credit card or PayPal account.

- Download the document in your preferred format.

Form popularity

FAQ

Edited by pricelawfirm. When a person dies with less than $150,000 of assets, there is a procedure to transfer the assets of his or her estate to his or her heirs without going to probate court.

Within 90 days of qualifying as executor or administrator, you must file an inventory with the court. If you need extra time, the court will usually let you have it. The inventory lists all the assets which pass under the decedent's will or estate.

California Small Estate Affidavit InstructionsObtain and complete the California small estate affidavit. You must obtain the form used by the probate court in the county where the deceased was a resident.Include attachments.Obtain other signatures.Get the documents notarized.Transfer the property.

The Affidavit of Heirship form you file must contain:The decedent's date of death.The names and addresses of all witnesses.The relationships the witnesses had with the deceased.Details of the decedent's marital history.Family history listing all the heirs and the percentage of the estate they may inherit.

California Small Estate Affidavit InstructionsObtain and complete the California small estate affidavit. You must obtain the form used by the probate court in the county where the deceased was a resident.Include attachments.Obtain other signatures.Get the documents notarized.Transfer the property.