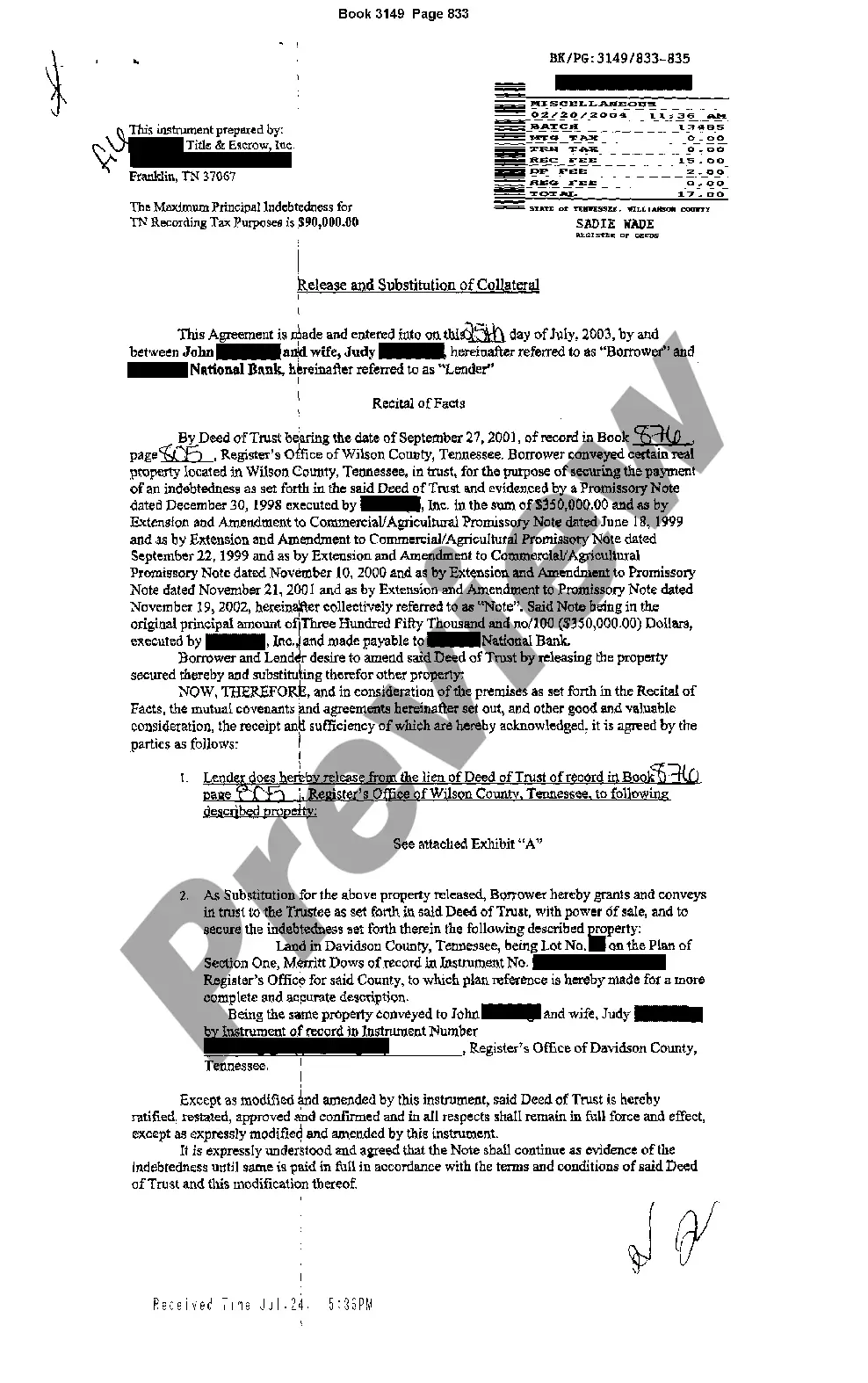

The Substitution of Collateral Auto Form for Loan is a legal document that allows a borrower to replace their existing collateral with a new one while keeping the loan agreement intact. This form is commonly used in situations where the borrower wishes to change the vehicle used as collateral for an auto loan. By submitting this form, the borrower notifies the lender of the intention to substitute the current collateral with a different vehicle. Keywords: Substitution of collateral, auto form, loan, legal document, borrower, collateral, vehicle, loan agreement. Different types of Substitution of Collateral Auto Forms for loans: 1. Vehicle Substitution Form: This form allows a borrower to replace the current vehicle used as collateral with another vehicle of equal or higher value. The borrower must provide the necessary details of the new vehicle, including its make, model, year, identification number, and registration information. 2. Collateral Exchange Form: This form is used when the borrower wants to exchange the currently held collateral with a different type of collateral, such as transferring the auto loan from a vehicle to another valuable asset like a boat or motorcycle. The borrower needs to provide detailed information about the new collateral being offered, including its description, estimated value, and any additional documentation required. 3. Collateral Release and Substitution Form: This form is utilized when the borrower wishes to release the current collateral while substituting it with a new one. It is often used in refinancing situations where the borrower wants to replace the existing vehicle with another vehicle or asset. The form requires information about both the collateral being released and the new collateral being offered, along with any necessary supporting documentation. It is essential for borrowers to carefully fill out this Substitution of Collateral Auto Forms to ensure all required information is provided accurately and completely. It is recommended to consult a legal professional or financial advisor when dealing with such forms to ensure compliance with specific lender requirements and state laws.

Substitution Of Collateral Auto Form For Loan

Description

How to fill out Substitution Of Collateral Auto Form For Loan?

The Substitution Of Collateral Auto Form For Loan you see on this page is a multi-usable formal template drafted by professional lawyers in accordance with federal and state regulations. For more than 25 years, US Legal Forms has provided individuals, organizations, and attorneys with more than 85,000 verified, state-specific forms for any business and personal occasion. It’s the fastest, simplest and most reliable way to obtain the documents you need, as the service guarantees bank-level data security and anti-malware protection.

Obtaining this Substitution Of Collateral Auto Form For Loan will take you only a few simple steps:

- Search for the document you need and review it. Look through the file you searched and preview it or check the form description to verify it suits your needs. If it does not, use the search bar to get the right one. Click Buy Now once you have located the template you need.

- Sign up and log in. Select the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to proceed.

- Obtain the fillable template. Choose the format you want for your Substitution Of Collateral Auto Form For Loan (PDF, Word, RTF) and download the sample on your device.

- Fill out and sign the document. Print out the template to complete it by hand. Alternatively, use an online multi-functional PDF editor to rapidly and precisely fill out and sign your form with a legally-binding] {electronic signature.

- Download your papers again. Make use of the same document again whenever needed. Open the My Forms tab in your profile to redownload any previously purchased forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s scenarios at your disposal.

Form popularity

FAQ

Under paragraph 10.2 of the confirmed Chapter 13 Plan (doc. __), Debtor has the option of substituting collateral by purchasing a replacement vehicle. Debtor states that the Substitute Collateral has a value equal to or greater than the balance currently owed to the Creditor on its allowed secured claim.

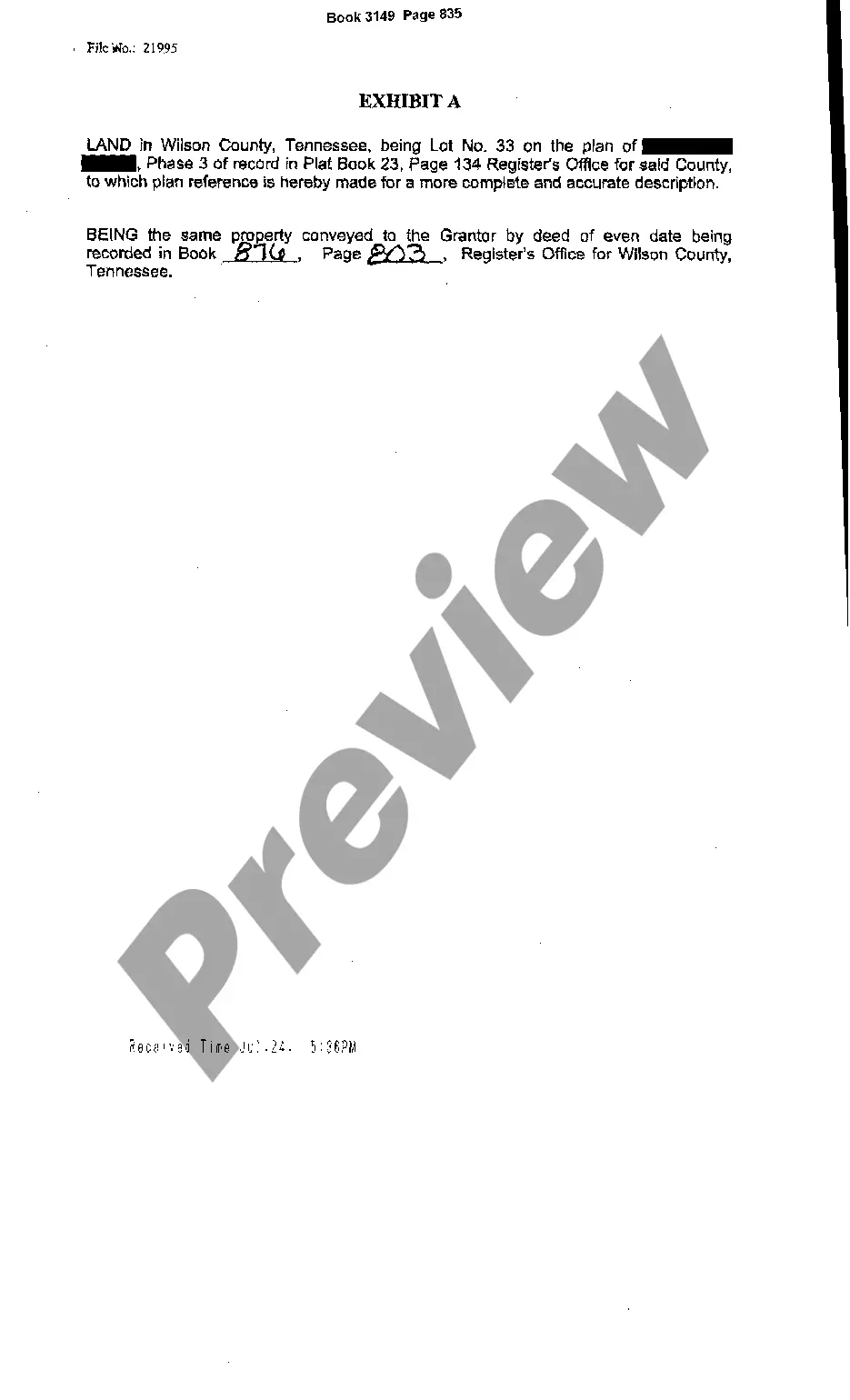

Substitution is a method of moving a lien from one property (collateral) to another. Let's suppose you own an improved property worth $100,000 with a $65,000 first mortgage. You also own a free and clear vacant lot worth $65,000.

Collateral form (plural collateral forms) (linguistics) A synonymous but not identical, coexisting form (variation) of a word, such as an accepted alternative spelling.

A collateral exchange refers to one vehicle being substituted for another vehicle for a customer. In most states, this agreement does not change any other aspect of the original Retail Installment Contract. Also, any payment history on the previous vehicle remains the same.

Substitution of collateral can be used to free one property from use as collateral. The holder of the note will have to agree to allow the release of property #1 and put property #2 in its place as collateral.