Rules For Annulment In Tn

Description

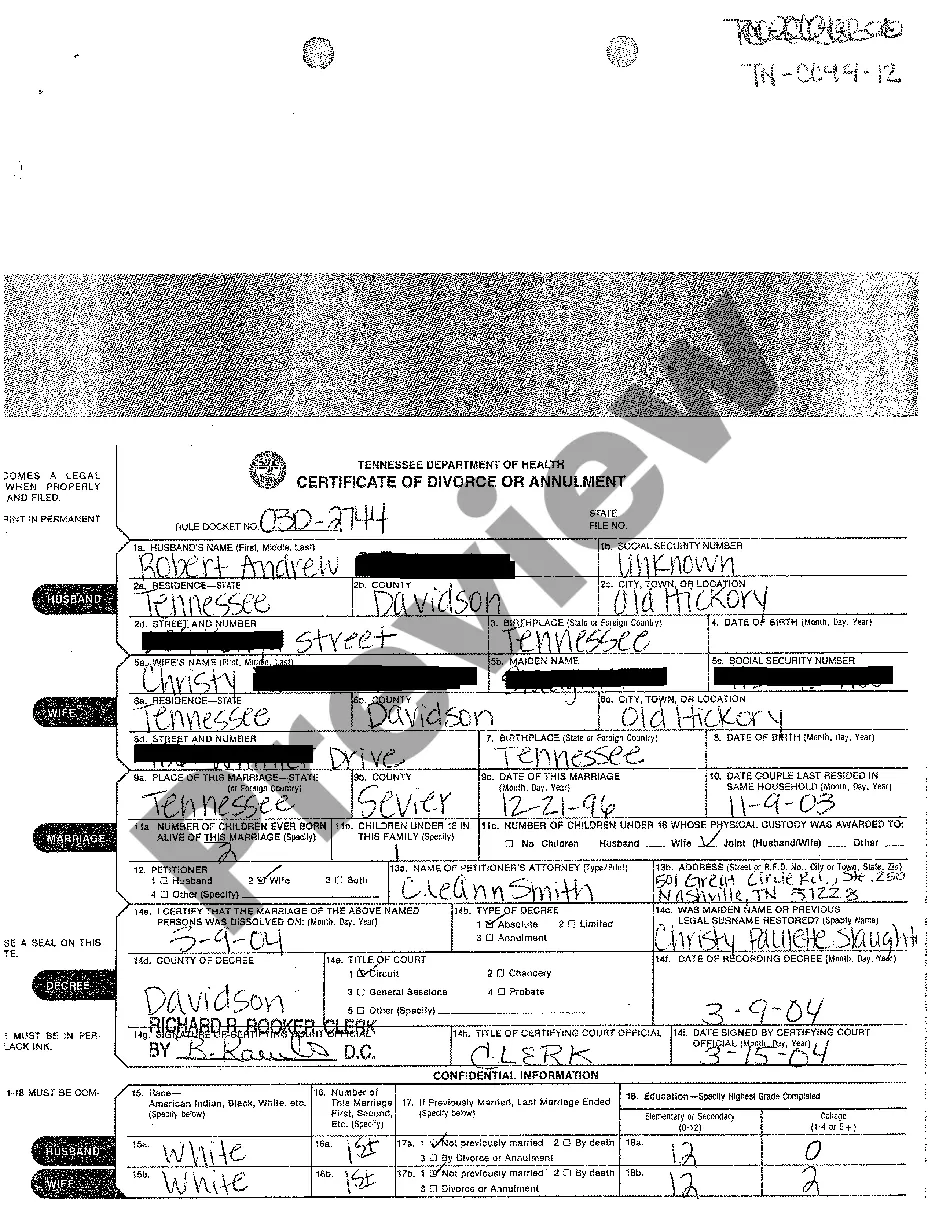

How to fill out Tennessee Certificate Of Divorce Or Annulment?

Obtaining legal document samples that align with federal and state regulations is essential, and the web provides numerous alternatives.

However, why squander time hunting for the appropriate Rules For Annulment In Tn sample online when the US Legal Forms digital repository already consolidates such templates in one location.

US Legal Forms is the largest virtual legal library featuring over 85,000 editable templates created by lawyers for any business and personal scenario.

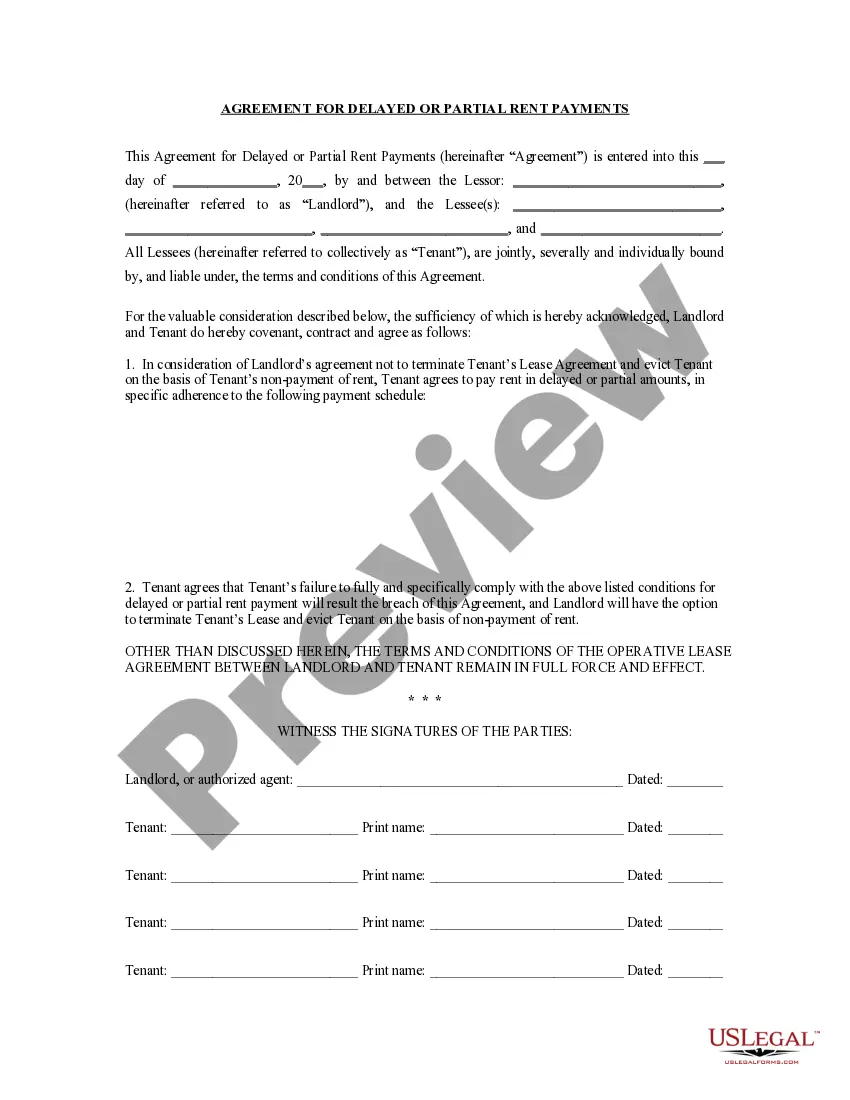

Review the template using the Preview feature or through the text outline to confirm it satisfies your needs.

- They are straightforward to navigate, with all documents categorized by state and intended use.

- Our experts monitor legislative updates, ensuring that you can always be confident that your form is current and compliant when obtaining a Rules For Annulment In Tn from our platform.

- Acquiring a Rules For Annulment In Tn is quick and easy for both existing users and newcomers.

- If you possess an account with an active subscription, Log In and download the document sample you need in your chosen format.

- If you are unfamiliar with our website, follow the outlined steps below.

Form popularity

FAQ

Mississippi considers a seller to have physical nexus if you have any of the following in the state: Owns an office or place of business. Has employees or agents of the business who service customers in Mississippi or solicit or accept orders for merchandise.

Every partnership, LLC, or LLP, domestic or foreign, deriving income from property owned within the State of Mississippi or business, trade, profession or occupation carried on within the state must file a return.

Step 1: Name Your Mississippi LLC. ... Step 2: Choose a Registered Agent. ... Step 3: File the Mississippi LLC Certificate of Formation. ... Step 4: Create an Operating Agreement. ... Step 5: File Form 2553 to Elect Mississippi S Corp Tax Designation.

PTE election and qualifications Only qualified entities may make a Pass-Through Entity (PTE) election to pay the entity-level elective tax.

The PTE tax is computed at a flat 5% rate, but in 2022 the state reduced the individual income tax rate by eliminating the 4% tax bracket and enacting scheduled reductions of the top 5% rate to 4% by 2026.

A corporation, including one that is taxed as an S corporation, must always file its initial tax return with the Internal Revenue Service, even if it had no business activity to report. For an S corporation, this initial return and all subsequent returns are prepared on Form 1120S ? which is an informational return.

PTE tax allows an entity taxed as a partnership or S Corporation to make a tax payment on behalf of its partners. The business pays an elective tax of 9.3% of qualified net income to the Franchise Tax Board.

The Mississippi (MS) PTE election is made by filing Form 84-381. Greater than 50% of voting owners must consent for the entity to make the election, which would apply to all owners, and cannot be made on an individual-by-individual basis. The election is applicable every year unless it is revoked.