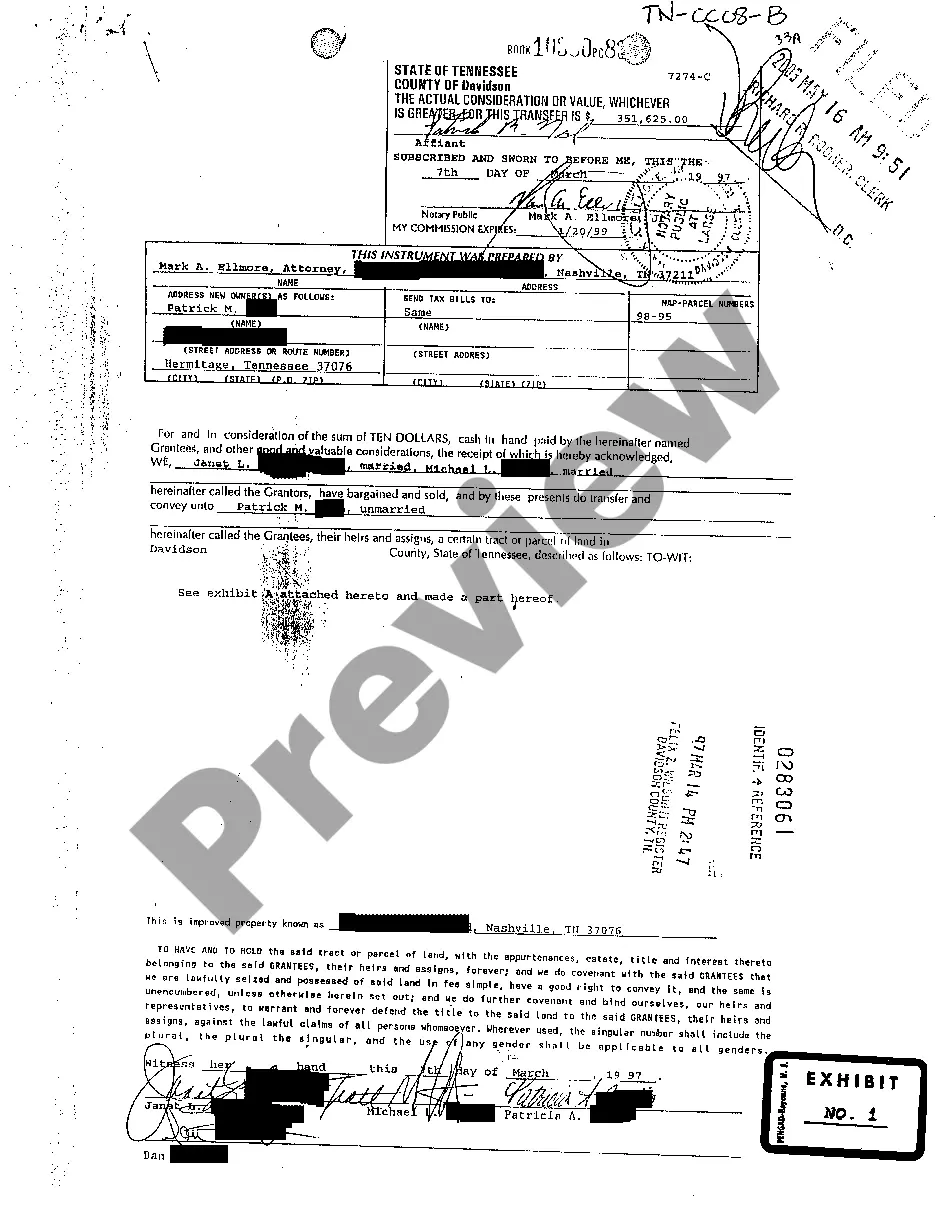

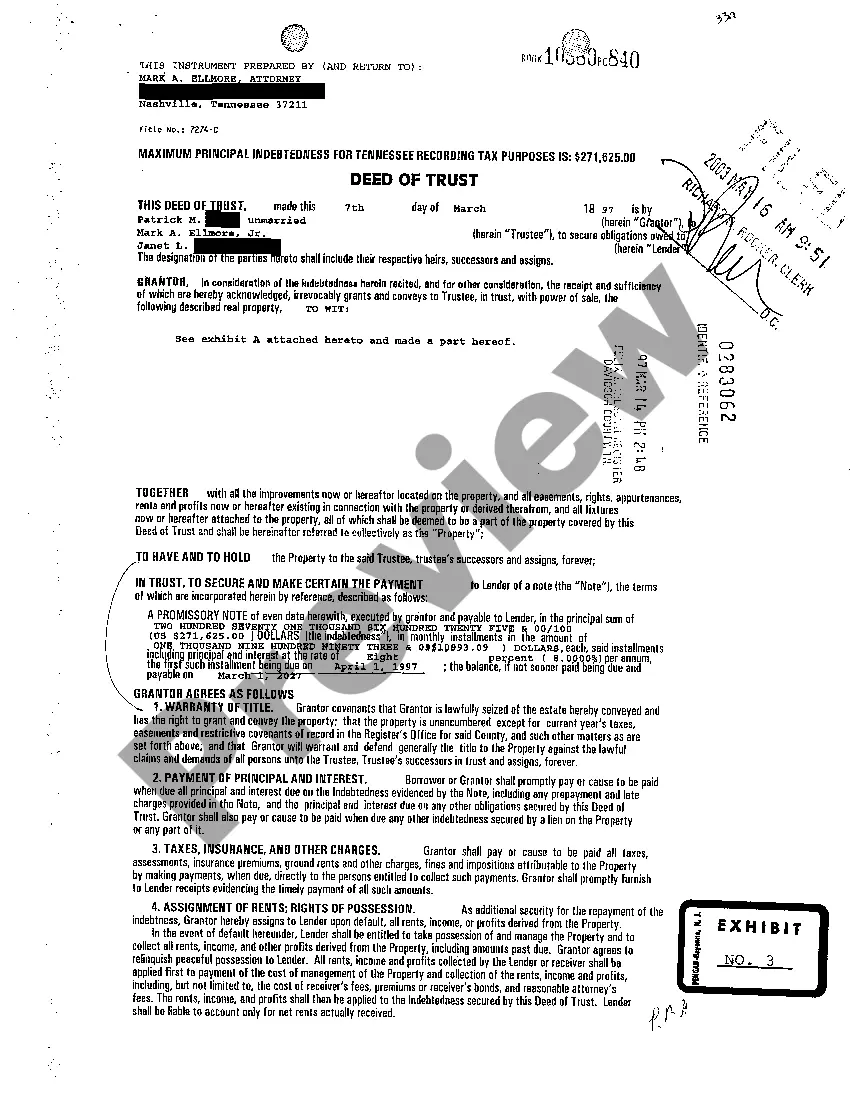

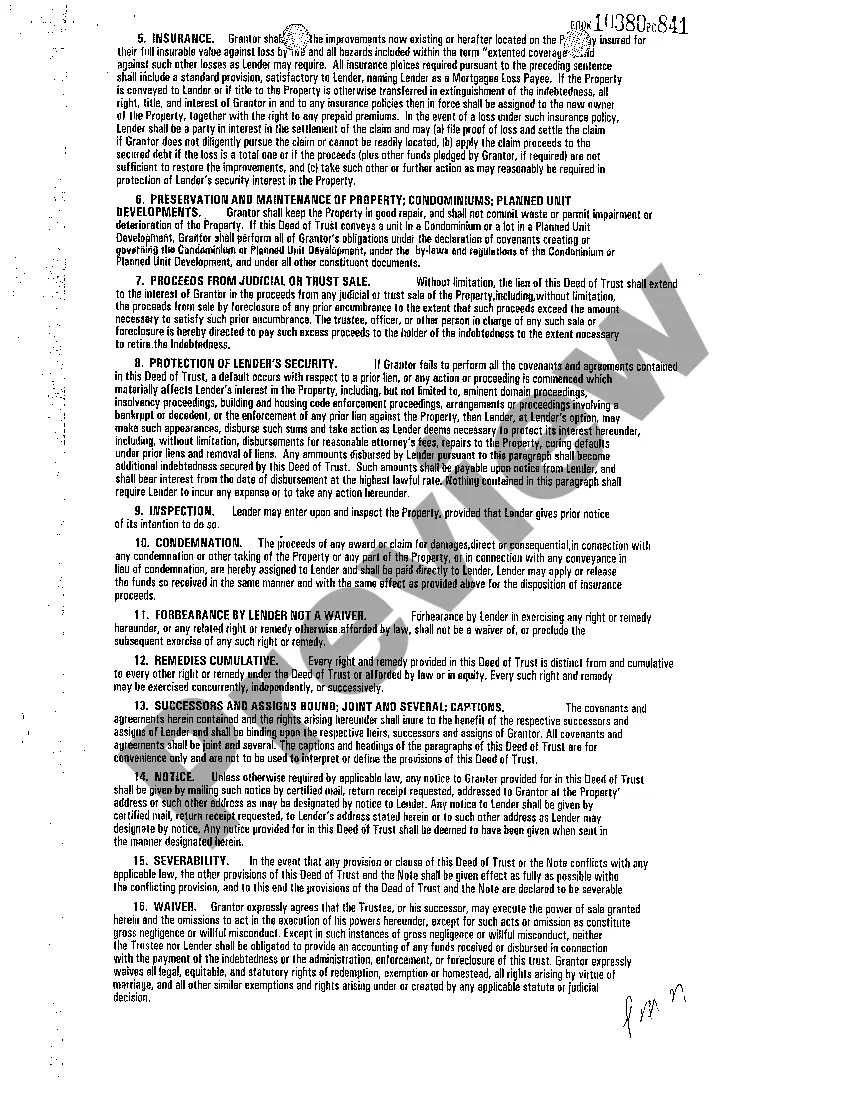

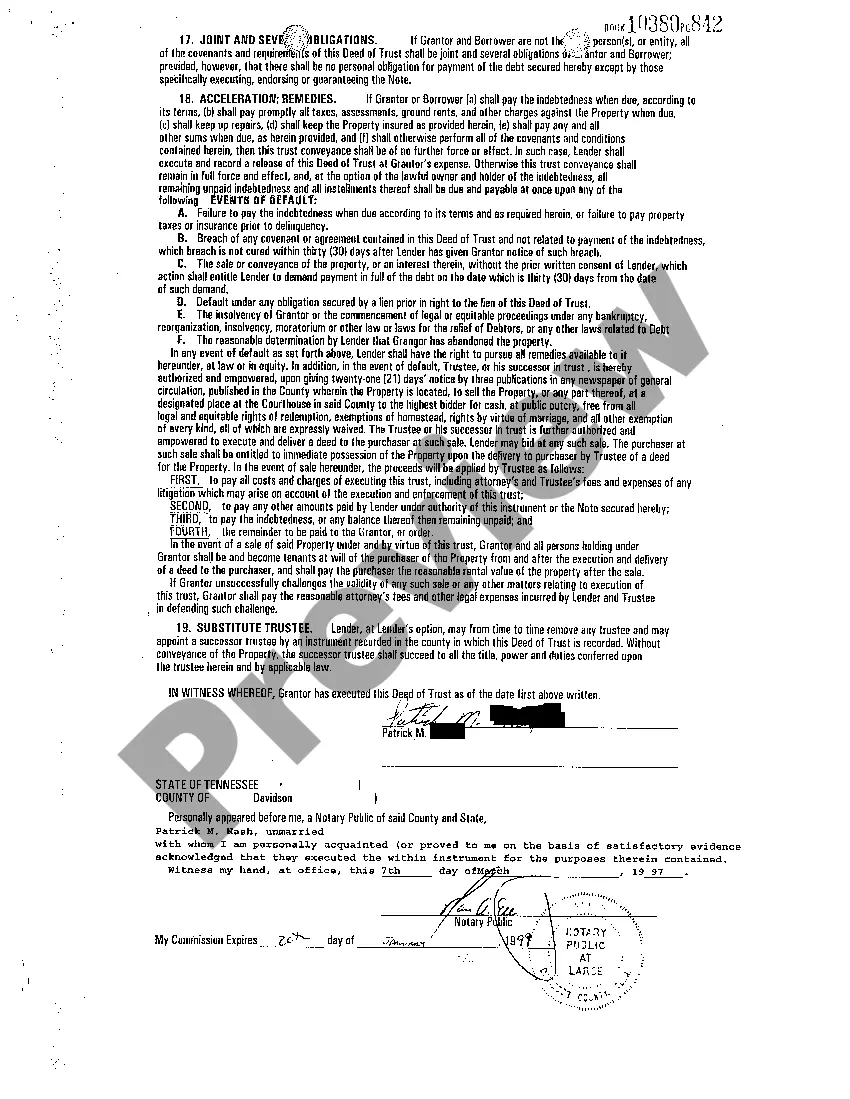

Deed Transfer To Llc

Description

How to fill out Deed Transfer To Llc?

Maneuvering through the red tape of official documents and forms can be challenging, particularly if one does not engage in such activities professionally.

Even selecting the appropriate template for a Deed Transfer To LLC can be laborious, as it must be valid and accurate to the very last detail.

Nonetheless, you will need to dedicate considerably less time obtaining a suitable template from a trustworthy source.

Acquire the correct form in a few simple steps: Enter the name of the document in the search bar, find the appropriate Deed Transfer To LLC from the results list, review the outline of the sample or open its preview. If the template suits your requirements, click Buy Now. Then, choose your subscription plan, use your email to establish a secure password for your US Legal Forms account, select a credit card or PayPal payment method, and save the template document on your device in your desired format. US Legal Forms will save you considerable time in verifying the suitability of the form you found online. Create an account and enjoy unlimited access to all the templates you need.

- US Legal Forms is a platform that streamlines the process of locating the correct forms online.

- US Legal Forms serves as a single destination for discovering the latest document samples, consulting their usage, and downloading these samples for completion.

- This is a compilation of over 85,000 forms applicable in various domains.

- When searching for a Deed Transfer To LLC, you won’t have to question its applicability since all forms are validated.

- An account with US Legal Forms ensures you have all necessary samples at your disposal.

- You can store them in your history or add them to the My documents collection.

- Retrieve your saved forms from any device by simply clicking Log In at the library site.

- If you haven’t created an account yet, you can always search for the template you require.

Form popularity

FAQ

To transfer property title between family members, you can use a Quitclaim Deed or a Warranty Deed, depending on the level of protection you want to offer. Clearly specify the names of both parties, and verify that all signatures are properly notarized. After signing, promptly file the deed with the local authority to make the transfer official. A deed transfer to LLC might also facilitate smoother transactions in the future while providing asset protection for family properties.

The fastest way to transfer a deed is to complete a Quitclaim Deed, which allows the current owner to transfer their interest in the property without extensive paperwork. Ensure that you accurately describe the property and have it signed in front of a notary. After that, file the deed with the local county clerk's office. For those seeking to optimize their transactions, consider a deed transfer to LLC, which may offer further benefits.

To transfer LLC ownership in Texas, start by reviewing your LLC operating agreement for specific guidelines. Generally, you will need to complete a Membership Interest Transfer form, and have it signed by the current members. Additionally, ensure that you file any necessary updates with the Texas Secretary of State. This process can be simplified through a deed transfer to LLC, ensuring that ownership interests are clearly documented.

To transfer a property title to an LLC in California, you need to draft and file a grant deed with the appropriate county recorder's office. Be prepared to provide necessary documents, such as the LLC's formation papers and an operating agreement, to confirm the legitimacy of the transfer. For a smooth deed transfer to LLC, utilize the templates and guidance offered by USLegalForms to navigate this process effectively.

Transferring property to an LLC in California usually results in property tax implications and potential income tax consequences. Generally, the transfer itself may not incur immediate income tax, but your taxable gain may be recognized if the LLC sells the property later. To minimize issues during a deed transfer to LLC, consider professional assistance to understand all ramifications.

An LLC may avoid property tax reassessment in California through certain exemptions, especially if the property transfer meets specific conditions. For example, if the ownership change qualifies under Proposition 13, it may not trigger reassessment. Utilizing our resources at USLegalForms can guide you on managing the deed transfer to LLC while adhering to these rules.

To avoid LLC tax in California, you should explore different business structures and deductions available for your LLC. Depending on your income and expenses, you might qualify for lower tax rates or exemptions. Additionally, consider consulting with a tax professional who can provide tailored advice on potential strategies, particularly when it comes to the deed transfer to LLC.