Owner Any Paid For This Document

Description

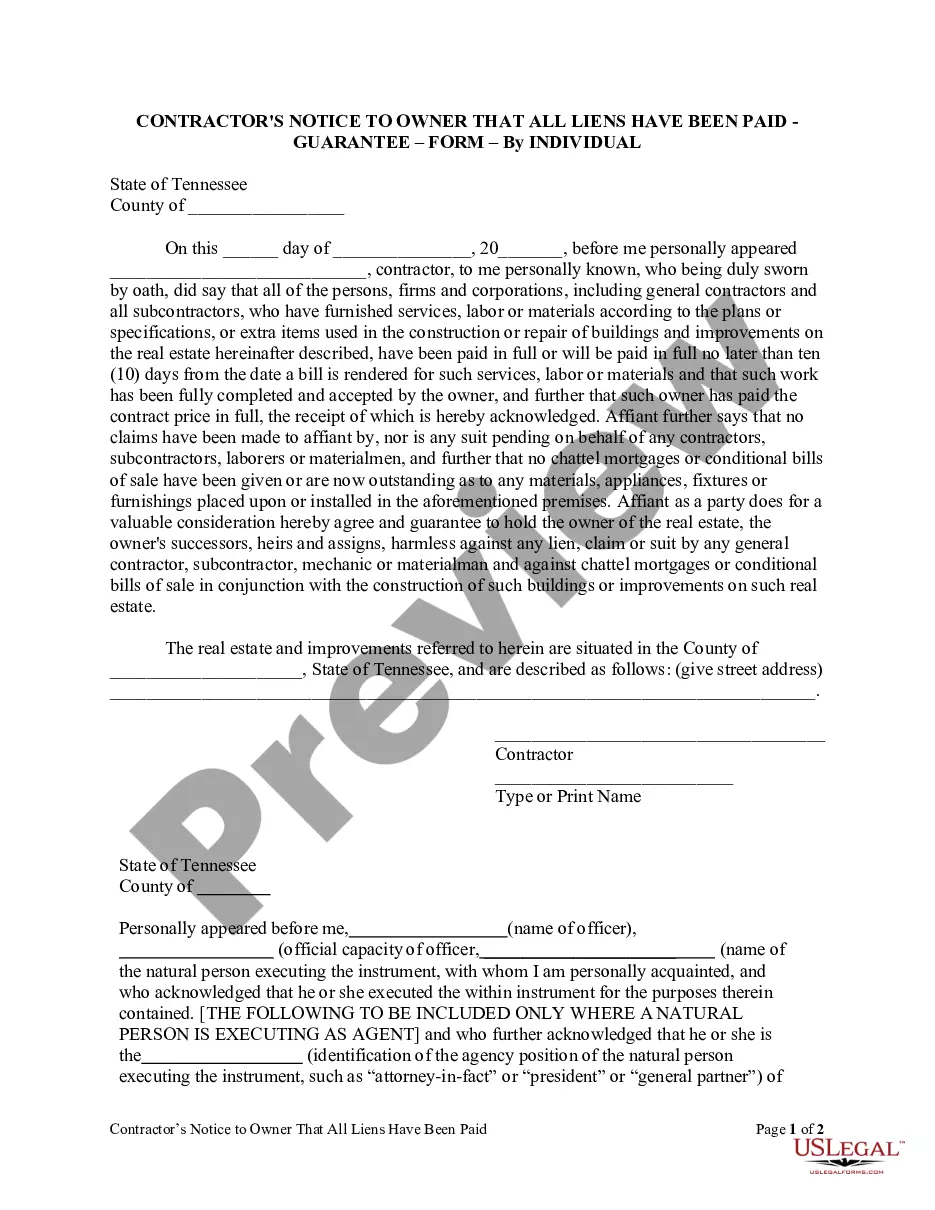

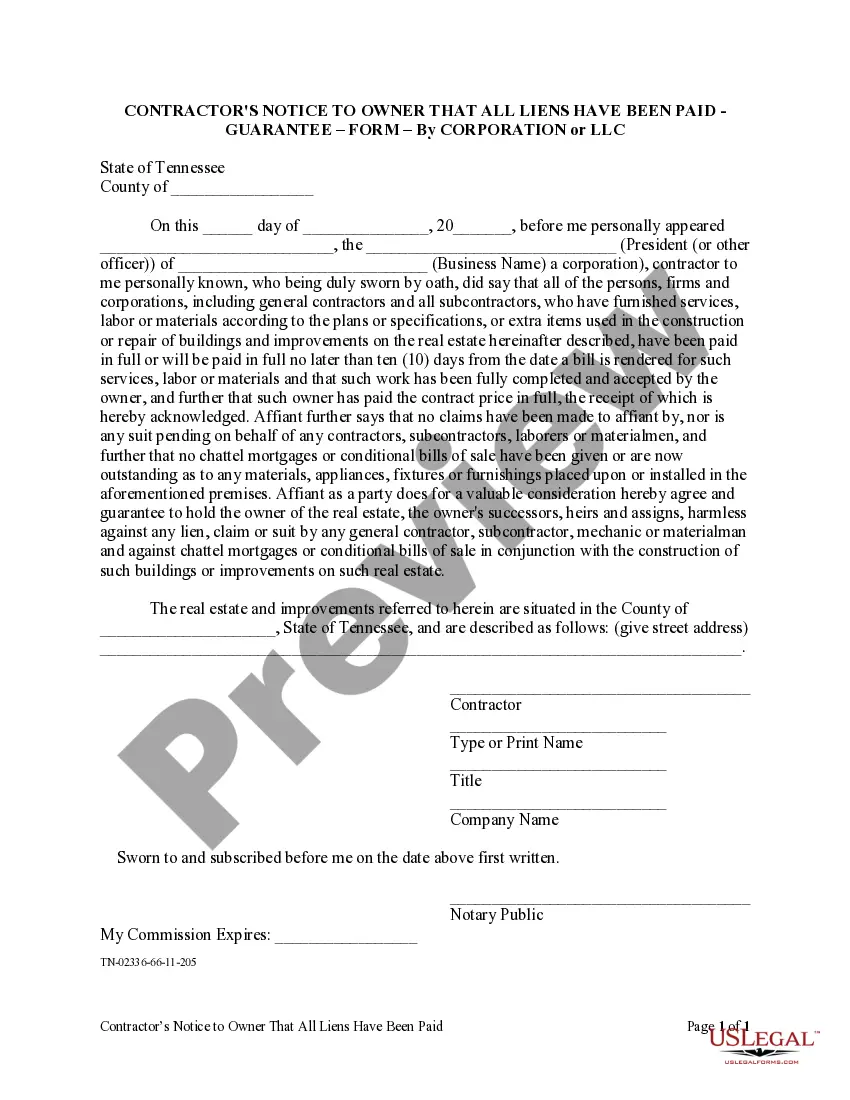

How to fill out Tennessee Contractor's Notice To Owner That All Liens Paid In Full - Corporation?

- Begin by previewing your desired form. Check its description to ensure it meets your requirements and complies with your jurisdiction.

- If you notice any discrepancies or need a different template, utilize the search feature to find the appropriate document.

- Once you have the correct form, proceed by clicking the 'Buy Now' button. Select a subscription plan that aligns with your legal needs.

- Complete your purchase by entering your payment information, whether it’s via credit card or PayPal.

- Finally, download the necessary form and save it to your device. You can also access it later through the 'My Forms' section of your account.

With US Legal Forms' robust collection of forms and access to premium legal expertise, obtaining the right legal documents has never been easier. Ensure you have everything you need at your fingertips.

Don't wait! Visit US Legal Forms today to start streamlining your legal document process.

Form popularity

FAQ

If your name is on the mortgage but not the deed, you may not have the same ownership rights as a listed owner. In such cases, the individual whose name is on the deed is considered the official owner. You may still have financial responsibilities related to the mortgage. To ensure clarity about your rights, consider consulting legal resources or using platforms like US Legal Forms to obtain the necessary documents.

Documents that prove ownership are commonly known as 'title documents' or 'deeds.' They serve as official records that establish legal rights to a property. These documents solidify your status as the owner, outlining your responsibilities and rights concerning the property. For quick access to these legal documents, consider exploring options available through platforms like US Legal Forms.

A document owner refers to the individual or entity that holds legal rights to a specific document, primarily in terms of ownership. In real estate, this individual is typically the person whose name appears on the deed. Thus, if someone asks about the document owner, they are inquiring about who has the formal rights and responsibilities associated with that document. This designation is crucial for any legal processes related to property ownership.

The term for an ownership document is often referred to as a 'deed.' It is a legal document that establishes your rights over a property. In essence, the deed serves as proof that you, as the owner, possess legal title to the property. For those who may not have a deed readily available, platforms like US Legal Forms offer services to help you obtain your document easily.

The lender typically holds the deed to your house while you are paying off your mortgage. This arrangement serves as a sort of insurance for the bank. However, you remain the owner of the property as evidenced by your rights as a borrower. Once you finish paying off the mortgage, the bank will release the deed, solidifying your ownership.

To record an owner's draw, create a clear record in your accounting system noting the amount taken and the date. This step ensures that you maintain accurate financial statements and keep your business accounting in order. Regularly updating this record is crucial for tracking your overall business finances effectively. For templates and guidance on documenting your owner’s draw, consider using the resources offered by uLegalForms.

When showing an owner's draw on taxes, it's essential to understand that this amount is not considered a salary for tax purposes. Instead, it is treated as a distribution of profits from the business. You should record it on your tax return in the appropriate section. To learn more about accurately reporting this on your taxes, uLegalForms provides useful materials that simplify the process and hold you accountable.

Choosing between an owner's draw and salary depends on your individual circumstances and goals. Owner’s draw allows you to access profits without the formalities of a salary. If long-term financial stability is crucial, a salary may provide more predictable income and benefits. To better understand these options, consider consulting with uLegalForms to see how their documents can assist you in making informed choices.

When deciding between distributions and salary, consider your financial needs and tax implications. A salary provides a regular income, while distributions offer more flexibility based on your business profits. Managing your finances efficiently may require a combination of both. For guidance on this topic, use the resources available through uLegalForms to comprehend the best strategy for your situation.

The creator or owner of a file is typically the user who created it within the system. Ownership confers control over the file’s access and permissions. Understanding file ownership is vital for effective file management and collaboration. If you need documentation to clarify ownership status, consider using US Legal Forms to obtain the necessary legal documents.