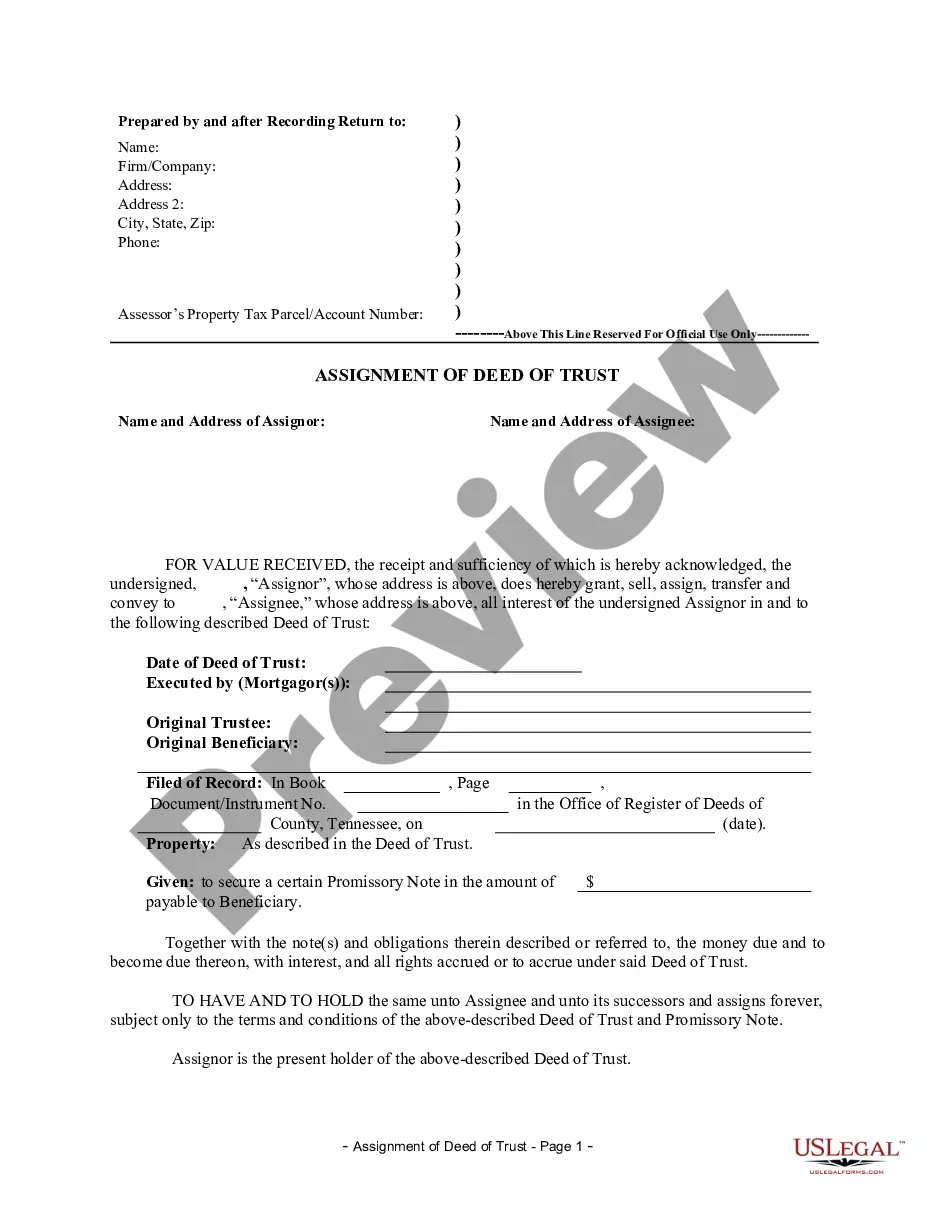

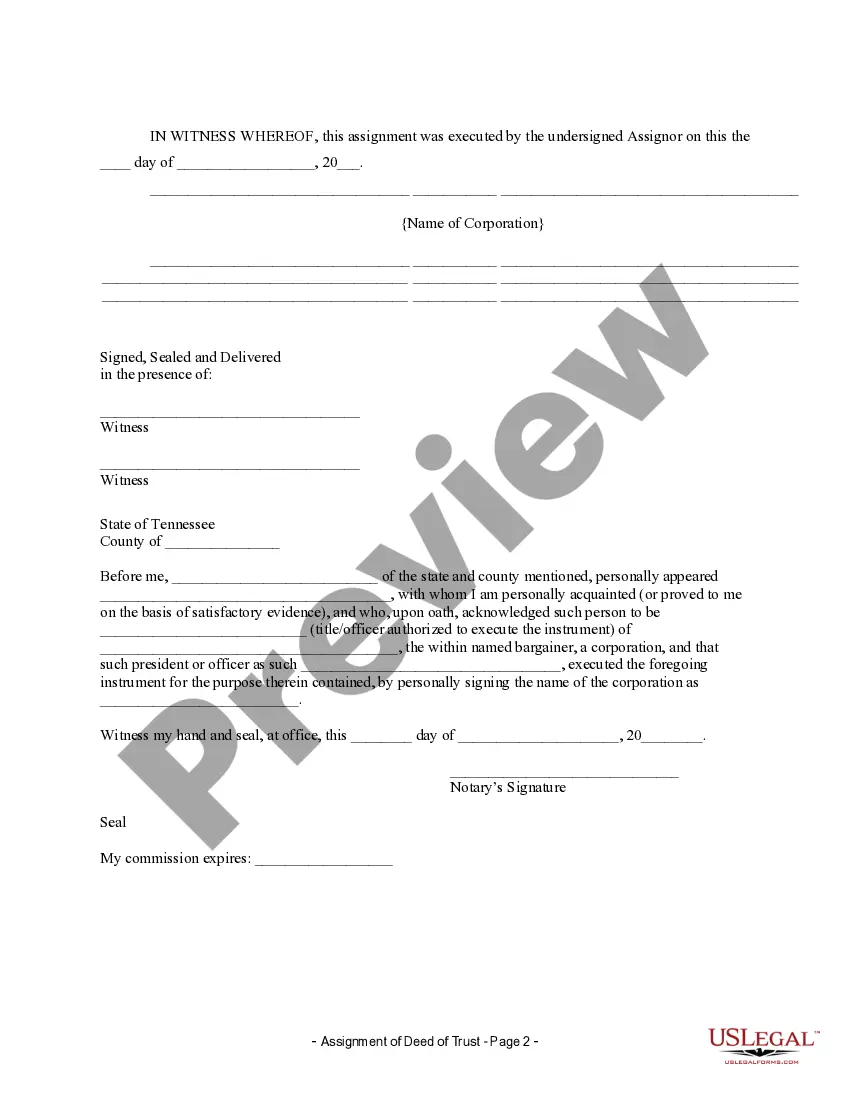

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Tn Deed Of Trust Form

Description

How to fill out Tn Deed Of Trust Form?

Properly formulated official documents are one of the core assurances for preventing complications and legal disputes, but acquiring them without a lawyer's support may require time.

Whether you need to swiftly locate an updated Tn Deed Of Trust Form or any other templates for work, family, or business matters, US Legal Forms is always ready to assist.

The process is even more straightforward for existing users of the US Legal Forms library. If your subscription is active, you just need to Log In to your account and click the Download button next to the chosen document. Additionally, you can access the Tn Deed Of Trust Form at any time later, as all documents ever acquired on the platform remain available within the My documents tab of your profile. Save time and money on preparing official documentation. Explore US Legal Forms today!

- Ensure that the document fits your circumstance and locale by reviewing the description and preview.

- Search for another example (if required) through the Search bar in the page header.

- Click Buy Now when you find the appropriate template.

- Choose the pricing option, sign into your account or create a new one.

- Select your preferred payment method to purchase the subscription plan (using a credit card or PayPal).

- Pick either PDF or DOCX file format for your Tn Deed Of Trust Form.

- Click Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

To record a deed in Tennessee, first, complete the necessary document, such as a quit claim deed or Tn deed of trust form. Then, file it with the Register of Deeds in the county where the property is located. Providing all required information and paying the associated fees ensures that your deed is properly recorded.

A deed of trust serves as a security instrument for loans. Borrowers agree to the property serving as collateral, allowing lenders to take action in the event of non-payment. The Tn deed of trust form protects both the borrower and lender throughout the transaction.

In Tennessee, the transfer tax for a quitclaim deed is generally $0.37 per $100 of the property's value. This tax helps fund local government services. When filling out your Tn deed of trust form, remember to account for this transfer tax in your calculations.

To transfer a property deed in Tennessee, you must prepare a new deed showing the change of ownership, which includes filling out a TN deed of trust form if applicable. The current owner should sign this deed, and it must be notarized. Finally, file the new deed with the county register to finalize the transfer legally.

Yes, it is necessary to register a deed in Tennessee to ensure its validity and enforceability. Recording the TN deed of trust form with the local county register makes the document part of the public record, protecting your rights as an owner. Failure to register could result in legal complications down the line.

In Tennessee, if property is held jointly, both spouses typically need to be on the deed. This is especially true if the property is considered marital property. Even if one spouse is the primary borrower, it can be wise to include the other's name on the TN deed of trust form to protect overall ownership rights.

In Tennessee, a deed must include specific information such as the names of the parties involved, a legal description of the property, and the signatures of the involved parties. Moreover, the TN deed of trust form must be recorded with the local county register to provide notice of ownership to the public. This protects the rights of the grantee.

A deed must include several key components to be valid. It should identify the grantor and grantee, describe the property, and contain the grantor's signature. Additionally, the TN deed of trust form may require notarization and witnesses to ensure its legality in Tennessee.

To obtain a trust deed in Tennessee, you can start by contacting a lending institution or a legal professional. They can provide the necessary TN deed of trust form and guide you through the process. Ensure that you include all required information to create a valid agreement. Additionally, platforms like US Legal Forms can simplify the process by offering templates and resources to help you.

In Tennessee, a mortgage is commonly referred to as a deed of trust. This term reflects the legal structure used in the state for securing loans. Essentially, a deed of trust serves the same purpose as a mortgage by protecting lenders while allowing borrowers to obtain financing. Completing a proper TN deed of trust form is crucial for this process.