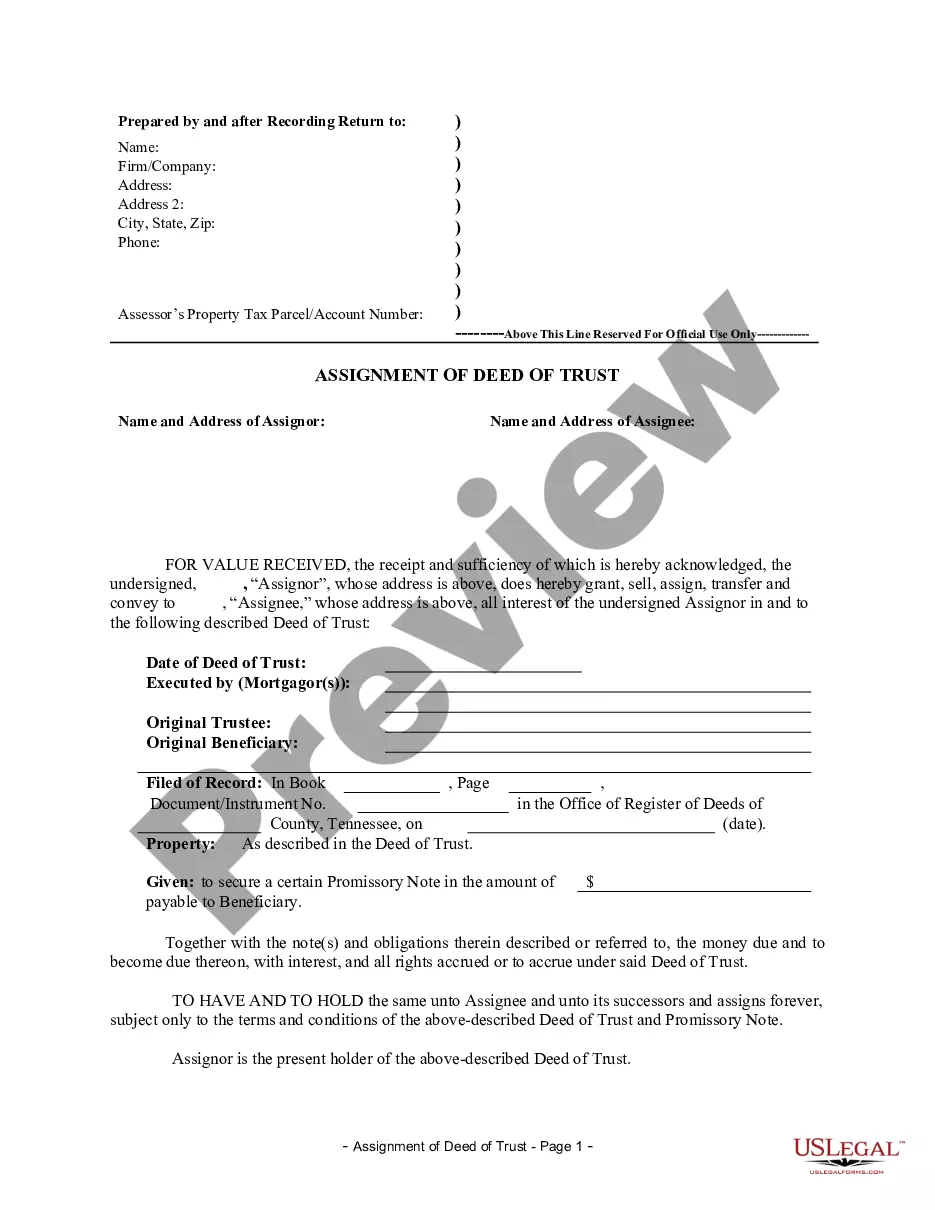

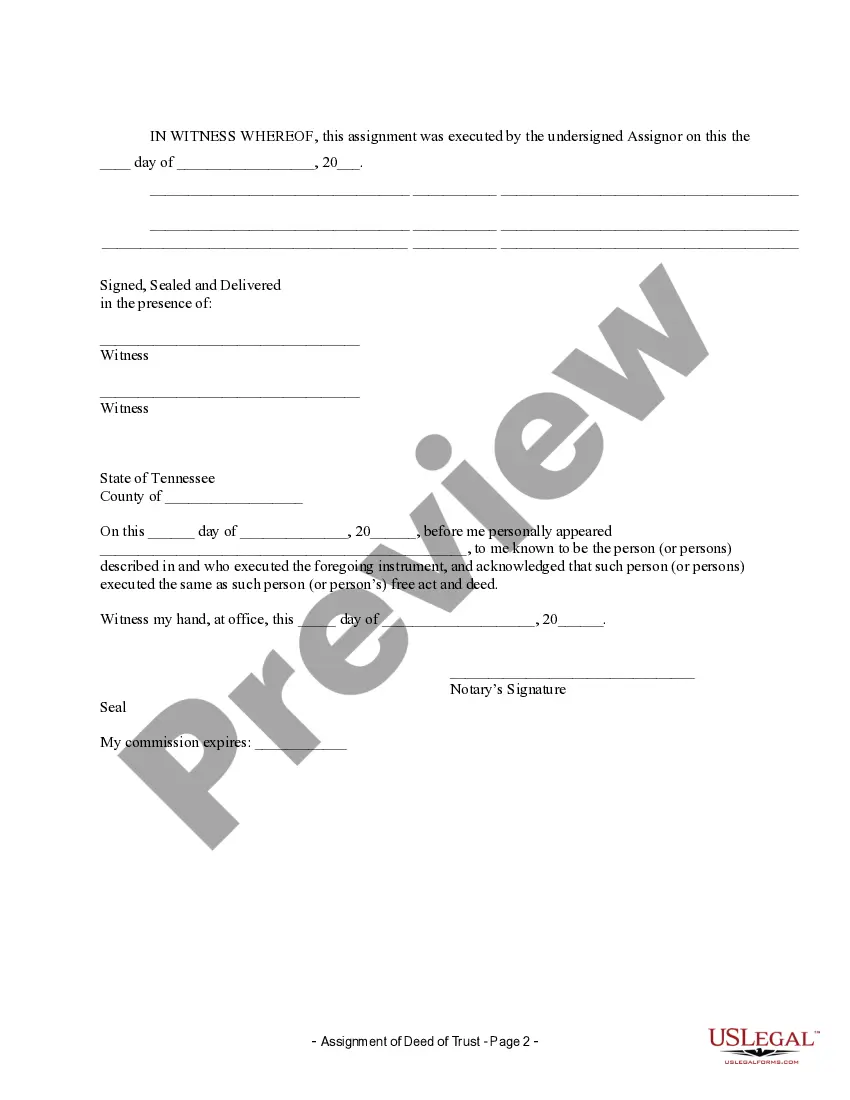

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

Tennessee Deed Of Trust Maturity Date

Description

How to fill out Tennessee Assignment Of Deed Of Trust By Individual Mortgage Holder?

Whether you handle documents frequently or only sometimes submit a legal document, it's essential to have a resource where all the samples are pertinent and current.

The first step you need to take using a Tennessee Deed Of Trust Maturity Date is to verify that it is indeed the most recent version, as this determines if it can be submitted.

If you wish to simplify your search for the most recent document examples, look for them on US Legal Forms.

To acquire a form without creating an account, follow these instructions: Use the search menu to locate the desired form. Review the preview and summary of the Tennessee Deed Of Trust Maturity Date to confirm it is the one you want. After verifying the form, just click Buy Now. Select a subscription plan that suits you. Create an account or Log In to your existing one. Enter your credit card details or PayPal information to finalize the purchase. Choose the document format for download and confirm it. Say goodbye to the confusion surrounding legal documents. All your templates will be organized and validated with an account at US Legal Forms.

- US Legal Forms is a repository of legal documents that includes nearly any document example you may seek.

- Look for the templates you require, check their relevance instantly, and learn more about their application.

- With US Legal Forms, you gain access to approximately 85,000 form templates across various fields.

- Retrieve the Tennessee Deed Of Trust Maturity Date samples with just a few clicks and save them in your profile.

- A profile on US Legal Forms will enable you to access all the samples you need with greater ease and less hassle.

- Simply click Log In at the top of the website and navigate to the My documents section, where all the forms you require will be readily available, eliminating the need for time-consuming searches for the best template or its relevance.

Form popularity

FAQ

Yes, in Tennessee, a lien can be placed on your house for your spouse's debt under certain circumstances, especially if you both hold the property jointly. Understanding how this impacts the Tennessee deed of trust maturity date is vital, as it may influence your financial obligations. Consulting resources like USLegalForms can clarify your rights and help you navigate potential lien situations effectively. Knowledge is power when managing shared debts.

Yes, judgments do expire in Tennessee. Generally, a judgment remains active for ten years, after which it must be renewed if the creditor wishes to keep it enforceable. Knowing the Tennessee deed of trust maturity date can help you determine the best strategy for handling outstanding financial obligations. Keep track of judgment timelines to avoid surprises that could affect your property.

In Tennessee, a mechanics lien is typically valid for one year from the filing date unless it is enforced in court. It is crucial to act within this timeframe to protect your rights. Understanding the Tennessee deed of trust maturity date can also play a role in how you manage any associated debts. Awareness of these timelines helps maintain property ownership without unexpected encumbrances.

Yes, liens can expire in Tennessee. Generally, a lien will become inactive after a certain period if a creditor does not take action to enforce it. For example, a mechanics lien has a specific duration, making it important to understand how the Tennessee deed of trust maturity date influences this timeline. Always consider your options to resolve any outstanding debts before the lien expires.

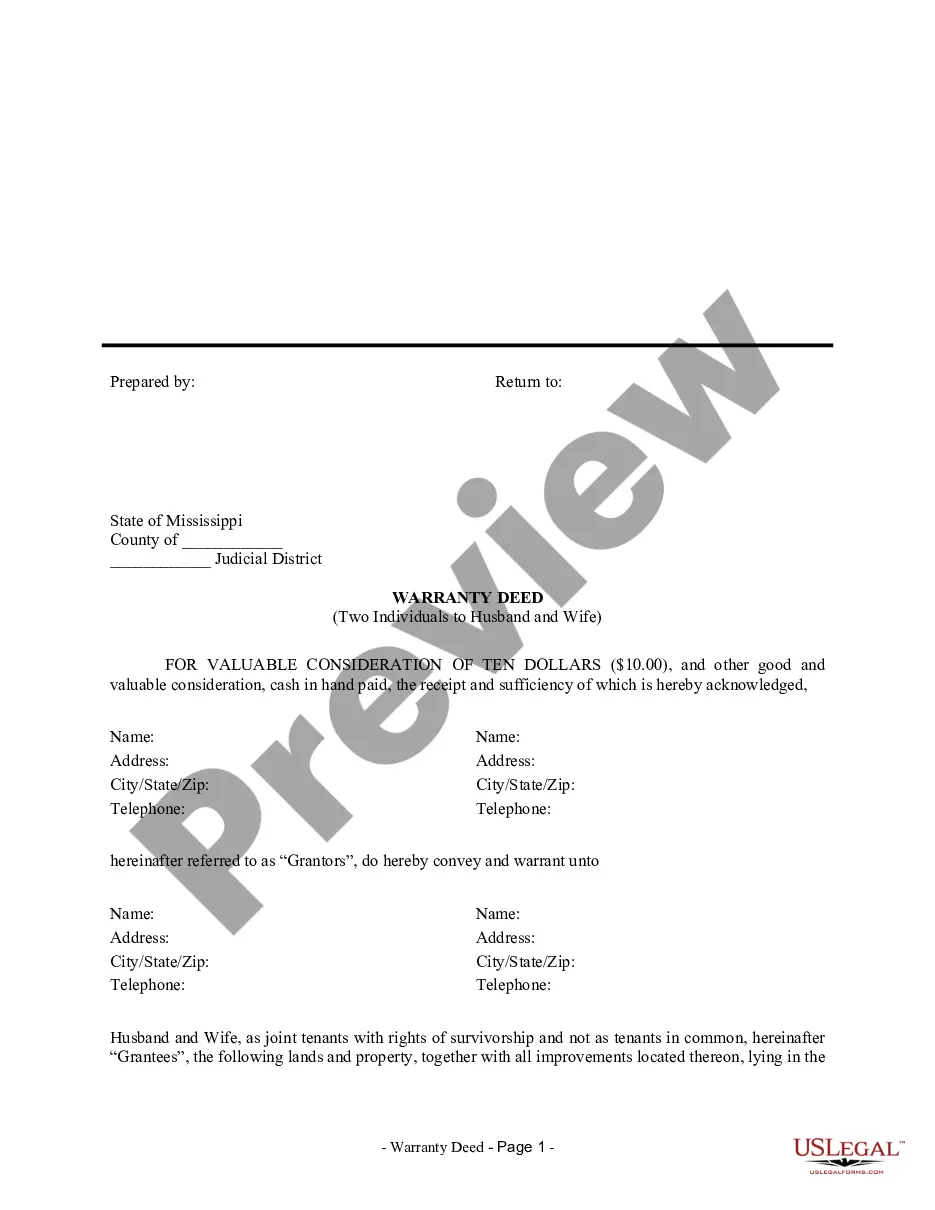

A deed in Tennessee must include several essential elements, such as the names of the parties involved, a legal description of the property, and the signature of the grantor. Additionally, any deed must be notarized and recorded with the county register to be enforceable. For those considering their options, knowing these requirements can help ensure clarity regarding the Tennessee deed of trust maturity date.

The statute of limitations on a tax lien in Tennessee is generally ten years. This means that after ten years, the state can no longer collect on the lien if no actions have been taken. This timeframe is crucial for property owners who want to understand their rights and obligations. Always consider how the Tennessee deed of trust maturity date interacts with any tax obligations you may have.

In Tennessee, the statute of limitations on property disputes generally lasts up to seven years. This timeframe may vary depending on the nature of the dispute, but it is essential to act within this period. Understanding the limitations can protect your rights regarding property ownership. Keeping an eye on the Tennessee deed of trust maturity date is also crucial for resolving any related legal matters.

The redemption period for tax liens in Tennessee typically lasts one year. After the sale of the property due to unpaid taxes, the owner has the right to reclaim the property during this period. This gives property owners a chance to clear their debts and avoid losing their home. Always consider how the Tennessee deed of trust maturity date may affect your ability to reclaim your home.

In Tennessee, liens can expire after a specific period if not enforced. Generally, a lien must be enforced within five years for it to remain valid. If a lienholder does not act within this timeframe, the lien loses its power. Staying aware of the Tennessee deed of trust maturity date can help you understand when your obligations might end.

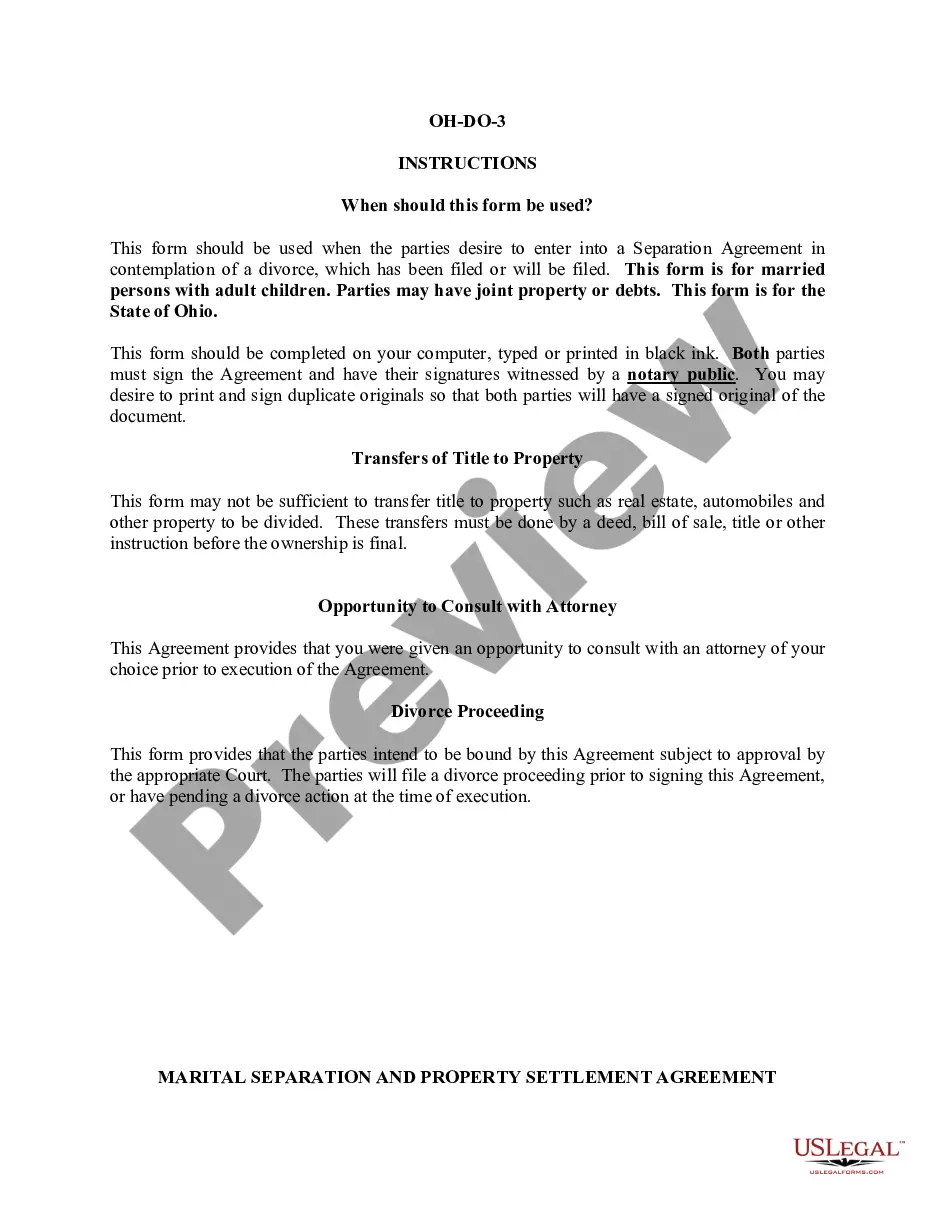

To file a quit claim deed in Tennessee, start by completing the quit claim deed form accurately, ensuring all parties involved are clearly identified. Next, sign the deed in the presence of a notary public, as this step is crucial for validation. After notarization, you must file the deed with the local county register's office. This process ensures proper documentation and protection regarding any potential disputes over titles, particularly when considering elements like the Tennessee deed of trust maturity date.