Tennessee Llc Operating Agreement With Profits Interest

Description

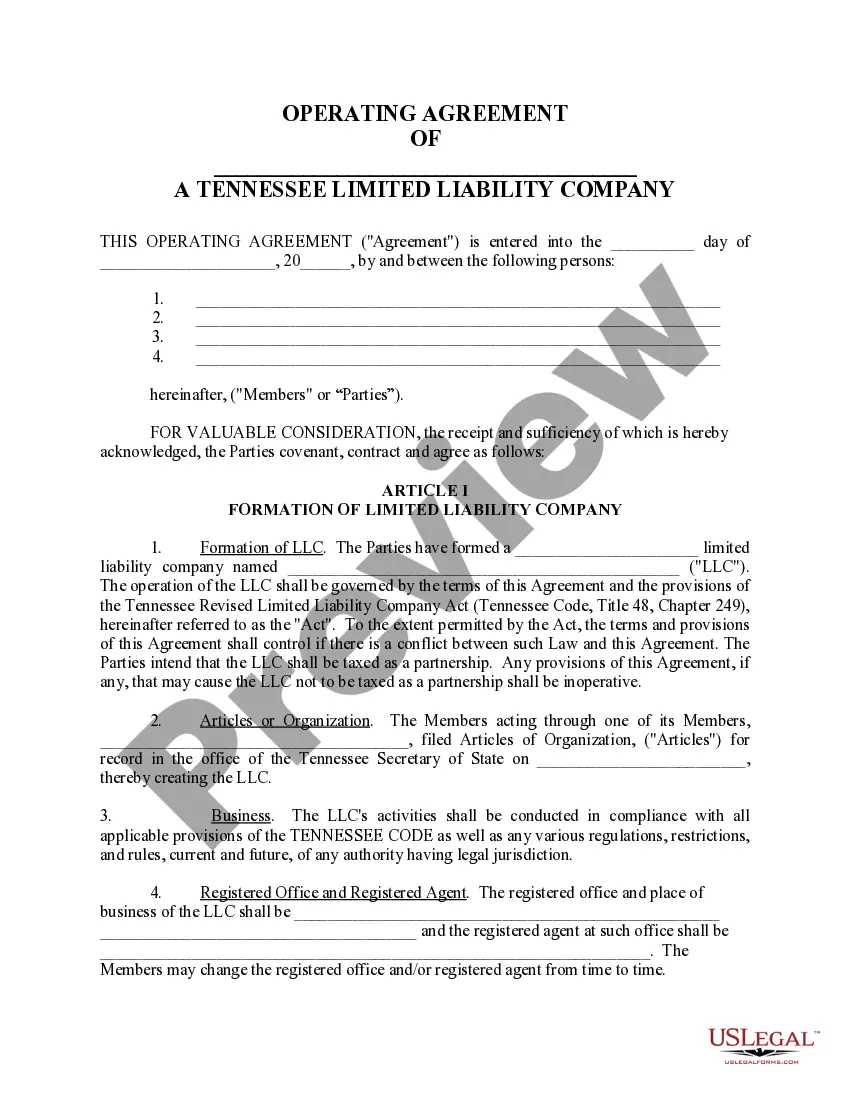

How to fill out Tennessee Limited Liability Company LLC Operating Agreement?

Whether for business purposes or for individual matters, everybody has to deal with legal situations sooner or later in their life. Filling out legal papers requires careful attention, beginning from choosing the correct form sample. For example, if you pick a wrong edition of the Tennessee Llc Operating Agreement With Profits Interest, it will be turned down when you send it. It is therefore essential to have a dependable source of legal files like US Legal Forms.

If you have to obtain a Tennessee Llc Operating Agreement With Profits Interest sample, follow these easy steps:

- Get the sample you need by utilizing the search field or catalog navigation.

- Check out the form’s description to make sure it fits your situation, state, and county.

- Click on the form’s preview to see it.

- If it is the wrong document, get back to the search function to locate the Tennessee Llc Operating Agreement With Profits Interest sample you require.

- Download the template when it matches your requirements.

- If you have a US Legal Forms account, just click Log in to gain access to previously saved documents in My Forms.

- If you do not have an account yet, you can obtain the form by clicking Buy now.

- Pick the correct pricing option.

- Finish the account registration form.

- Pick your payment method: use a credit card or PayPal account.

- Pick the document format you want and download the Tennessee Llc Operating Agreement With Profits Interest.

- When it is downloaded, you are able to complete the form by using editing software or print it and complete it manually.

With a vast US Legal Forms catalog at hand, you do not need to spend time seeking for the appropriate sample across the internet. Take advantage of the library’s straightforward navigation to find the appropriate template for any occasion.

Form popularity

FAQ

It costs $300 to form an LLC in Tennessee. This is a fee paid for the Articles of Organization. You'll file this form with the Tennessee Secretary of State. And once approved, your LLC will go into existence.

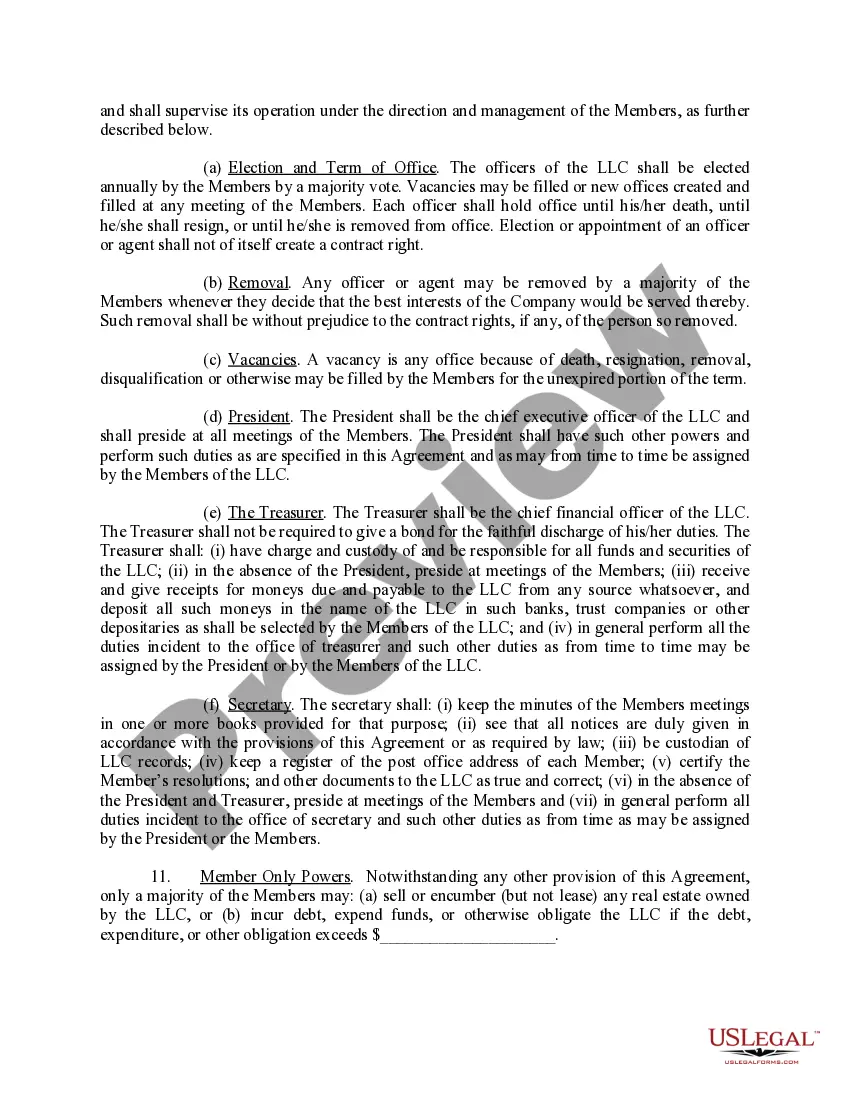

While Tennessee does not require LLCs to have an operating agreement, it is highly recommended to create one. An operating agreement is an internal document that outlines the management structure, member roles, voting procedures, and other essential operating rules for your LLC.

How to start an LLC in Tennessee Choose a business idea for your LLC. Name your Tennessee LLC. Create a business plan. Get an employer identification number (EIN) and a state sales tax number. File Tennessee articles of organization. Choose a registered agent in Tennessee. Obtain a business license and permits.

The main benefits of forming a LLC in Tennessee are: No state income tax on limited liability companies. Asset protection and limited liability. LLC assets are safe from personal liabilities. Charging order protection extended to single member LLC's.

Tennessee requires LLCs to file an annual report and pay a franchise tax. The annual report is due on or before the first day of the fourth month following the close of the LLC's fiscal year. The filing fee is $50 per member, with a minimum fee of $300 and a maximum fee of $3000.