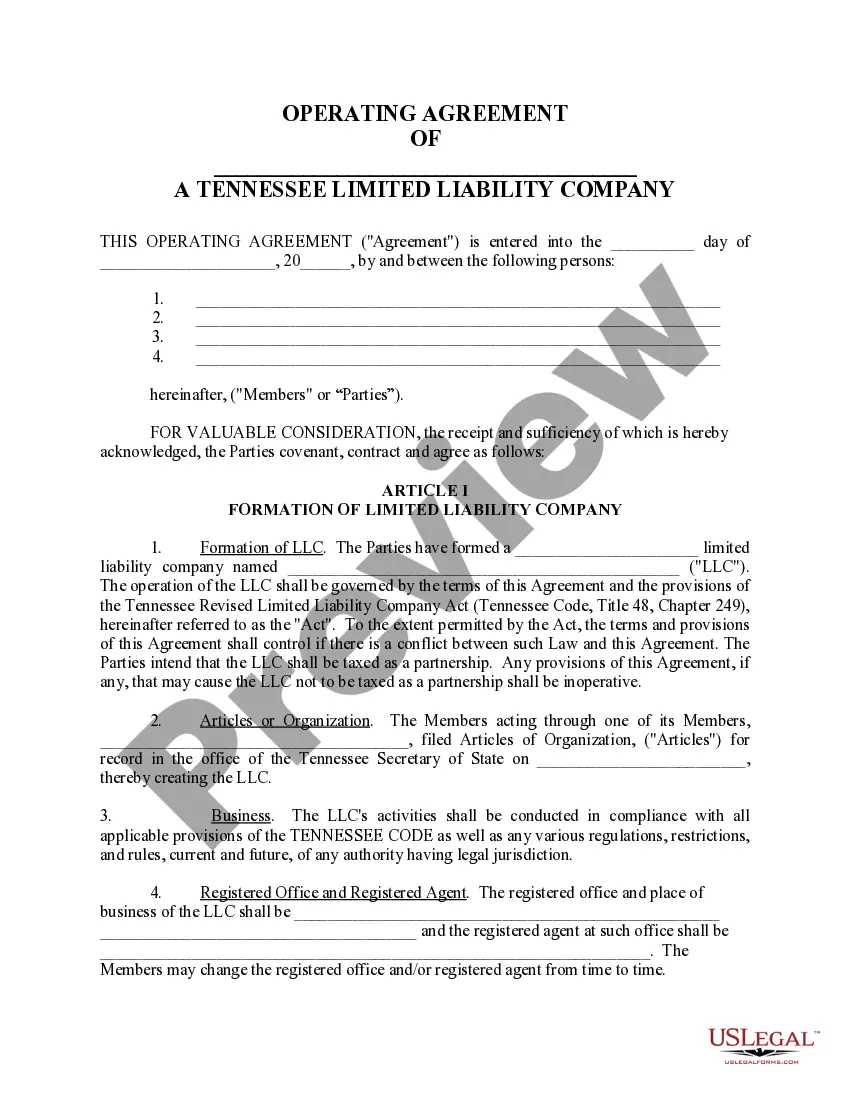

Tennessee Llc Operating Agreement With Board Of Directors

Description

How to fill out Tennessee Limited Liability Company LLC Operating Agreement?

Handling legal documents and operations could be a time-consuming addition to the day. Tennessee Llc Operating Agreement With Board Of Directors and forms like it often require that you look for them and understand the best way to complete them correctly. Consequently, regardless if you are taking care of financial, legal, or individual matters, using a comprehensive and convenient online catalogue of forms on hand will help a lot.

US Legal Forms is the top online platform of legal templates, featuring more than 85,000 state-specific forms and a number of resources to assist you to complete your documents quickly. Explore the catalogue of relevant documents accessible to you with just one click.

US Legal Forms gives you state- and county-specific forms offered by any time for downloading. Safeguard your document management operations by using a top-notch services that allows you to put together any form within a few minutes without having additional or hidden cost. Simply log in to the account, identify Tennessee Llc Operating Agreement With Board Of Directors and download it straight away within the My Forms tab. You can also gain access to formerly saved forms.

Would it be your first time using US Legal Forms? Register and set up up an account in a few minutes and you’ll have access to the form catalogue and Tennessee Llc Operating Agreement With Board Of Directors. Then, adhere to the steps listed below to complete your form:

- Make sure you have found the proper form by using the Preview feature and looking at the form information.

- Pick Buy Now once all set, and choose the monthly subscription plan that meets your needs.

- Choose Download then complete, eSign, and print out the form.

US Legal Forms has 25 years of experience supporting consumers handle their legal documents. Get the form you require today and enhance any operation without breaking a sweat.

Form popularity

FAQ

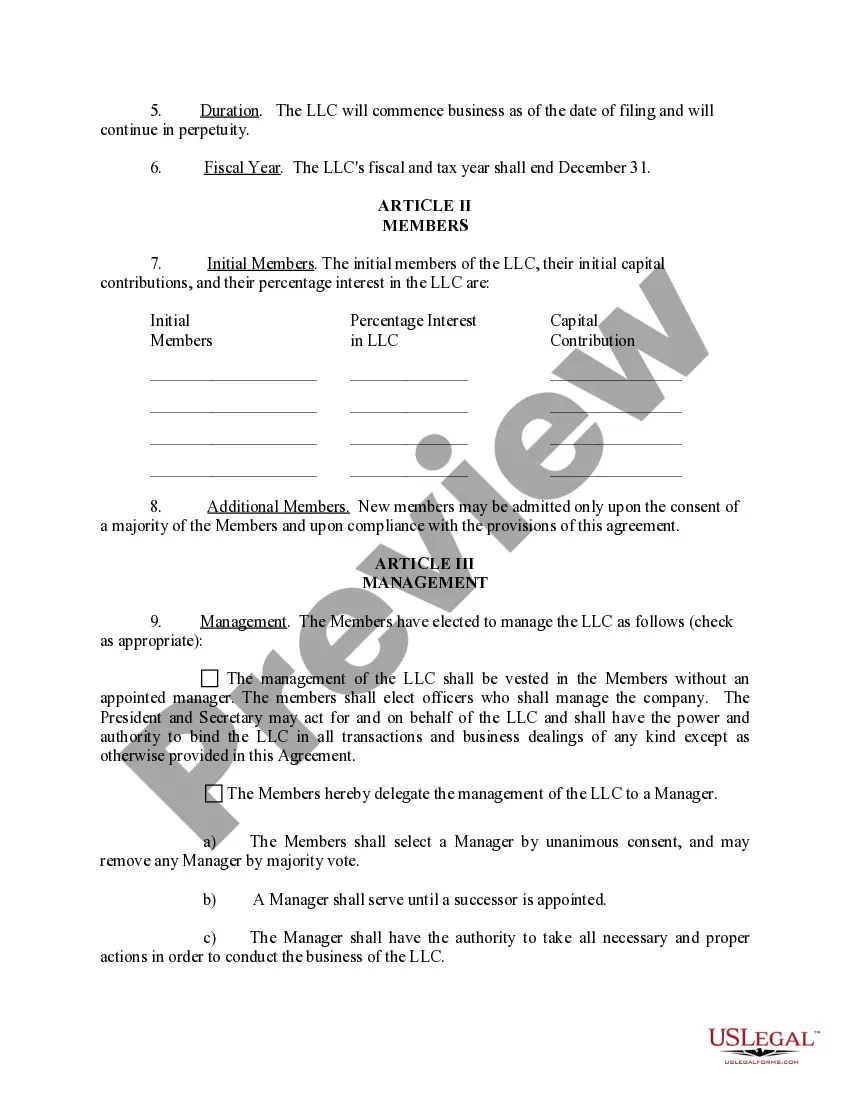

LLC operating agreements usually provide much more information, and almost all the provisions for how the business will be managed, and the rights, duties, and liabilities of members and managers are contained in the operating agreement. An operating agreement is a private document.

Nope, Tennessee law doesn't require you to file your operating agreement with the state. Your operating agreement is an internal document your LLC should keep on record.

Tennessee requires LLCs to file an annual report and pay a franchise tax. The annual report is due on or before the first day of the fourth month following the close of the LLC's fiscal year. The filing fee is $50 per member, with a minimum fee of $300 and a maximum fee of $3000.

A Tennessee single-member LLC operating agreement is a legal document that is provided specifically for use by a sole proprietor who would like to establish the policies, procedures, daily activities among other aspects of their company.

The annual report fee for LLCs is $300 minimum up to a maximum of $3000. The fee increases by an additional $50 per member for every member over 6 members up to a maximum of $3,000.