South Carolina Closing Foreclosures

Description

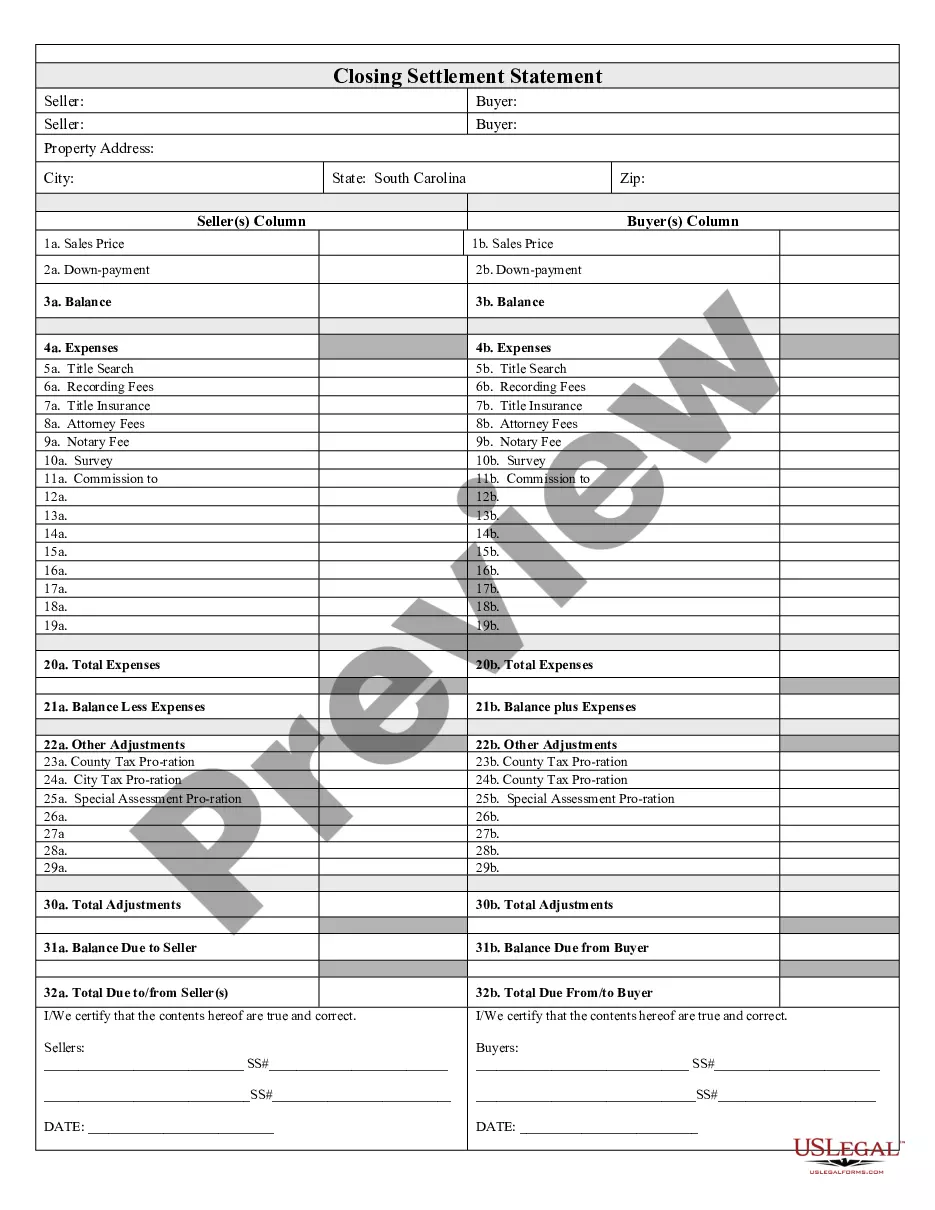

How to fill out South Carolina Closing Statement?

Obtaining legal document samples that adhere to federal and local laws is crucial, and the internet provides a myriad of options to select from.

However, what's the purpose of wasting time looking for the appropriate South Carolina Closing Foreclosures template online if the US Legal Forms virtual library has already compiled such templates in one location.

US Legal Forms is the largest online legal directory with more than 85,000 fillable forms created by attorneys for various business and personal situations. They are easy to navigate, with all documents organized by state and intended use. Our specialists stay informed about legislative changes, ensuring that you can trust your form to be current and compliant when acquiring a South Carolina Closing Foreclosures from our site.

Once you find the right form, click Buy Now, choose a subscription plan, create an account or Log In, and proceed with payment using PayPal or a credit card. Select the format for your South Carolina Closing Foreclosures and download it. All documents you discover through US Legal Forms are reusable. To re-download and complete previously purchased forms, navigate to the My documents tab in your profile. Make the most of the largest and most user-friendly legal document service!

- Getting a South Carolina Closing Foreclosures is fast and straightforward for both existing and new users.

- If you already possess an account with an active subscription, Log In and retrieve the document sample you require in your desired format.

- If you are unfamiliar with our website, follow these steps.

- Review the template using the Preview option or the text description to confirm it matches your needs.

- Search for another sample using the search bar at the top of the page if necessary.

Form popularity

FAQ

Foreclosing on a house in South Carolina typically takes anywhere from a few months to over a year, depending on various factors. The timeline can vary based on the lender's actions, court schedules, and any potential delays from the borrower’s responses. Understanding the lengthy process of South Carolina closing foreclosures allows homeowners to prepare accordingly and seek alternatives if needed. Always consider reaching out to professionals who specialize in this area for guidance.

The five stages of a foreclosure action in South Carolina include pre-foreclosure, filing of the lawsuit, court ruling, sale of the property, and post-foreclosure period. Initially, the lender gives the borrower notice of default, followed by filing a lawsuit if no resolution occurs. After the court rules in favor of the lender, the property goes to auction. It's crucial to be familiar with South Carolina closing foreclosures, as each stage presents different options and outcomes for homeowners.

The foreclosure process in South Carolina involves several key steps. First, lenders will send notices to borrowers who have defaulted on their mortgage payments, informing them of their potential foreclosure. Next, if the borrower does not respond, the lender will file a lawsuit, which ultimately leads to a court hearing. Understanding the nuances of South Carolina closing foreclosures can help homeowners navigate this challenging phase more effectively.

To buy a foreclosed home, a credit score of at least 620 is often recommended for conventional loans, though some programs may accept lower scores. Lenders also consider your debt-to-income ratio and employment history. Therefore, focus on improving your credit score and stabilizing your finances before pursuing South carolina closing foreclosures. This preparation can enhance your buying power in the competitive market.

To buy a foreclosed home in South Carolina, first, locate listings of available properties through real estate websites or local auctions. Next, secure financing or get pre-approved for a mortgage to strengthen your offer. Once you find a suitable property, attend the auction or submit a bid through the lender’s process. Remember, understanding South carolina closing foreclosures can give you a significant advantage during this process.

If you do nothing after you are served with the Summons and Complaint, you likely will have at least four months from the date you are served. If you request Foreclosure Intervention or contest the foreclosure by asserting legal defenses you have, this can extend the length of the foreclosure process.

In South Carolina, the lender must sue the borrower and prove the lender is entitled to foreclose. The homeowner (defendant) has the right to defend the foreclosure by conducting discovery, raising defenses, and filing counterclaims (that is, suing the lender under various causes of action).

How long does foreclosure take in South Carolina? If the foreclosure sale is uncontested, foreclosure generally takes four to six months.

When buying South Carolina foreclosed homes, buyers must to submit a bid for the properties they wish to purchase. In South Carolina, foreclosure auctions actually remain open for 30 days following the public sale. During this time, it is possible for other interested buyers to submit bids.

Ways to Stop Foreclosure in South Carolina Declare Bankruptcy. Yes, bankruptcy is a way through which foreclosure can be stopped. ... Applying for Loan Modification. ... Reinstating Your Loan. ... Plan for Repayment. ... Refinancing. ... Sell Out Your Home. ... Short Sale. ... Deed In Lieu of Foreclosure.