Closing Disclosure For Mortgage

Description

How to fill out South Carolina Closing Statement?

Whether for commercial reasons or personal issues, everyone must handle legal matters at some point in their lives.

Filling out legal paperwork requires meticulous attention, beginning with selecting the correct form template.

Complete the profile registration form, choose your payment method: either a credit card or PayPal account, select the file format you desire, and download the Closing Disclosure For Mortgage. After downloading, you can fill out the form using editing software or print it and fill it out manually. With a vast US Legal Forms catalog available, you won't need to waste time searching for the correct template online. Utilize the library’s straightforward navigation to find the right form for any need.

- For example, if you choose an incorrect version of the Closing Disclosure For Mortgage, it will be rejected when you present it.

- Consequently, it is crucial to have a reliable source of legal documents like US Legal Forms.

- If you need to acquire a Closing Disclosure For Mortgage template, follow these simple steps.

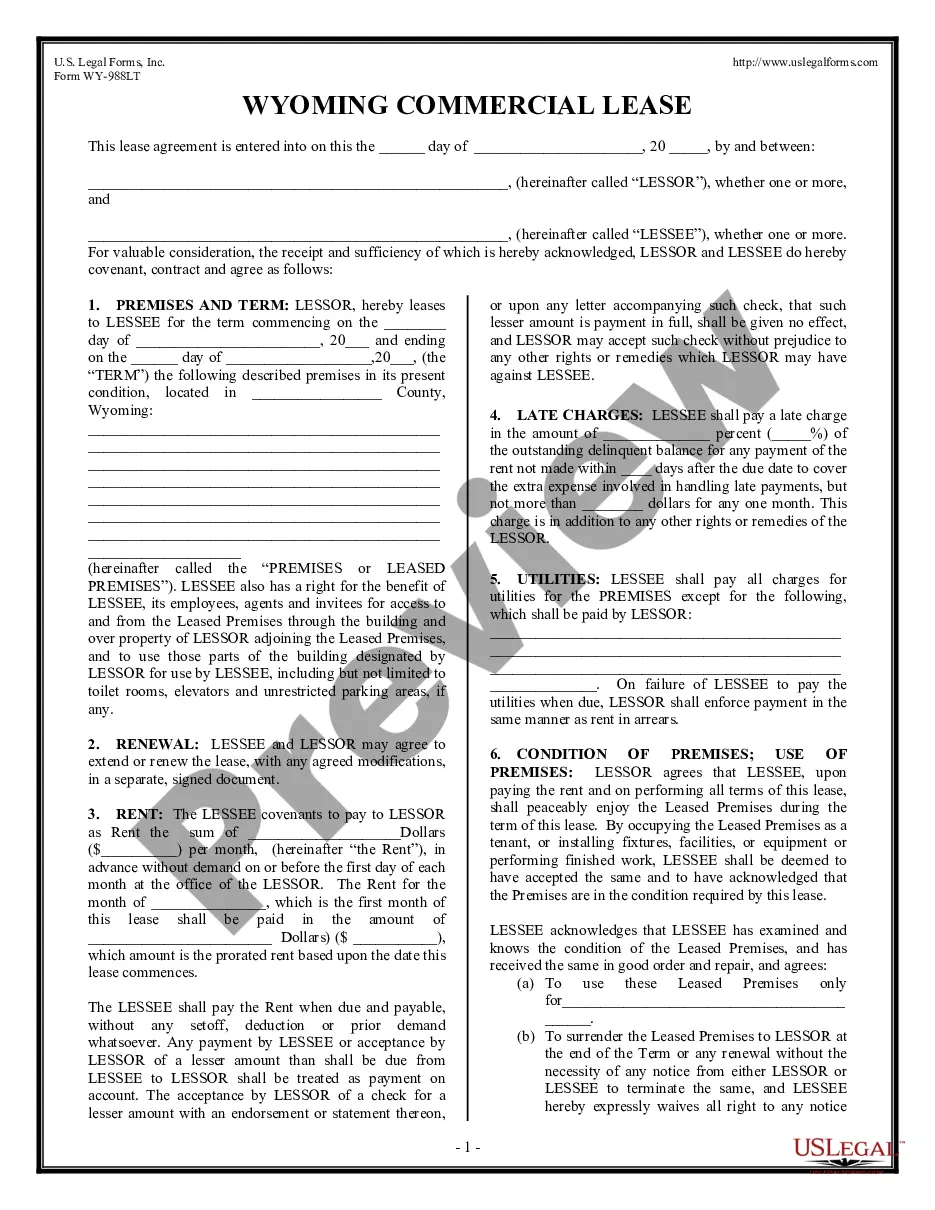

- Obtain the template you require using the search bar or catalog navigation.

- Review the form’s description to confirm it aligns with your case, state, and locality.

- Click on the form’s preview to inspect it.

- If it is the inaccurate form, return to the search function to find the Closing Disclosure For Mortgage example you require.

- Acquire the template when it fulfills your requirements.

- If you possess a US Legal Forms profile, simply click Log in to access previously saved templates in My documents.

- If you lack an account yet, you can obtain the form by clicking Buy now.

- Select the appropriate pricing option.

Form popularity

FAQ

A closing disclosure for mortgage may be provided in person if you schedule a meeting with your lender or closing agent. This can be a valuable opportunity for you to ask questions and seek clarification on any part of the document. Getting the disclosure in person can also expedite the process and help ensure all parties are on the same page. If you choose this option, ensure you come prepared with any questions you have regarding your mortgage.

Are articles of incorporation public? The answer is yes. These documents, which are filed with the Secretary of State or similar agency to create a new business entity, are available for public viewing.

File Your Illinois LLC Articles of Organization Determine and submit the name of your LLC. Include your business's principal address. Select Effective Date. Registered Agent information. Complete Purpose Clause. Manager and member information. Provide an Organizer signature.

In Illinois, you can request a regular or certified copy of articles of incorporation for a small fee from the Secretary of State's business services division. Delaware makes annual reports and articles of incorporation available for a modest photocopying fee.

Obtaining a copy of your Articles of Incorporation If you have misplaced your articles of incorporation, you can find a copy on the Department or Secretary of State website for the state under which your company is filed. This is done through a business entity search.

You can file the document online or by mail. The Articles of Incorporation cost $150 to file (plus a $4 online processing fee). Once filed with the state, this document formally creates your Illinois corporation. However, to actually ready the corporation to do business, you must complete several additional steps.

While most states call this document articles of incorporation, some, including Delaware and New York, refer to it as a certificate of incorporation. Although the title of the document may vary, the content of the document is generally the same.

Yearly Requirements and Fees for Illinois companies ? Within 15 days after the Secretary of State mails your filed Articles of Incorporation, you must record it with the Office of the Recorder of Deeds of the County in which the registered office of your corporation is located.

Articles of Incorporation in Illinois ask for: Name. ... Initial Registered Agent's Name, Address, and Mailing Address. ... Purpose (optional) ... Authorized shares. ... Directors (optional) ... Estimated Values (optional) ... Other Provisions (optional) ... Name and address of incorporator(s)

To purchase a copy of a corporation's Articles of Incorporation, please visit the Illinois Secretary of State Department of Business Services website - - and scroll to the section titled Obtain a Corporation Annual Report or Articles of Incorporation.