Closing Costs With New Construction

Description

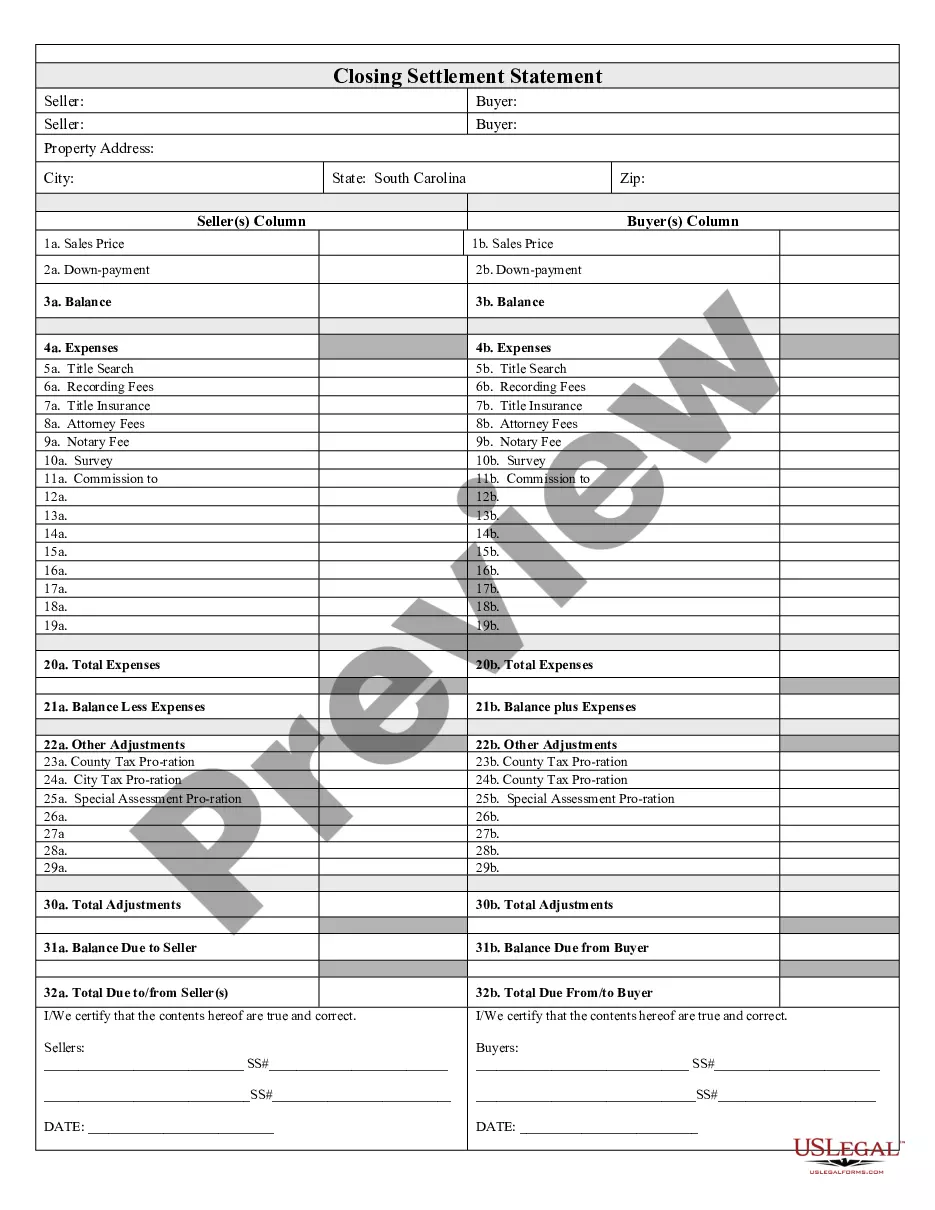

How to fill out South Carolina Closing Statement?

Handling legal documents can be overwhelming, even for experienced professionals.

If you are interested in Closing Costs With New Construction and lack the time to search for the correct and current version, the tasks can become burdensome.

Obtain state- or county-specific legal and business forms. US Legal Forms caters to all demands you may have, from personal to business documents, all in one place.

Utilize advanced tools to complete and manage your Closing Costs With New Construction.

Here are the steps to follow after obtaining the form you need: Validate that it is the correct form by previewing and reviewing its details. Ensure that the template is accepted in your state or county. Select Buy Now when you are ready. Choose a monthly subscription option. Select the format you prefer, and Download, complete, sign, print, and send your documents. Take advantage of the US Legal Forms online library, backed by 25 years of expertise and reliability. Transform your everyday document management into a seamless and user-friendly process today.

- Access a valuable resource library of articles, guides, and materials pertinent to your situation and needs.

- Save time and effort while searching for the forms you require, and use US Legal Forms’ sophisticated search and Review tool to find Closing Costs With New Construction and download it.

- If you possess a subscription, Log In to your US Legal Forms account, search for the document, and download it.

- Check your My documents tab to review the documents you saved earlier and organize your folders as needed.

- If it's your first encounter with US Legal Forms, register for an account and gain unlimited access to all platform benefits.

- A comprehensive online form library could revolutionize the way anyone manages these situations.

- US Legal Forms stands as a frontrunner in providing online legal forms, boasting over 85,000 state-specific legal documents accessible at any time.

- US Legal Forms enables you to.

Form popularity

FAQ

You can generally expect the total to be between 1 and 5% of the price you are paying to buy your home. Payment for closing costs can sometimes be financed with your loan, in which case it will be subject to interest charges. Alternatively, you can pay your closing costs in cash, similar to your down payment.

Closing costs are typically 3% ? 6% of the loan amount. This means that if you take out a mortgage worth $200,000, you can expect to add closing costs of about $6,000 ? $12,000 to your total cost. Closing costs don't include your down payment, but you may be able to negotiate them.

How Much Are Closing Costs in Texas? In Texas, the average closing costs for buyers are typically 2?6% of the home's purchase price. Sellers can expect to pay around 6?10% of the home's purchase price (including real estate agent commissions).

Here are 7 negotiating strategies to help lower your closing costs, whether you're buying a home or refinancing. Comparison shop from your loan estimate. ... Don't overlook lender fees. ... Understand what the seller pays for. ... Consider a no-closing-cost option. ... Look for grants and other help. ... Try to close at the end of the month.

Let's say your monthly income is $5,000. Multiply $5,000 by 0.28, and your total is $1,400. If you abide by this rule, you can afford to spend up to $1,400 per month on your house, including your mortgage, interest, property taxes, homeowners insurance, and homeowner's association dues.