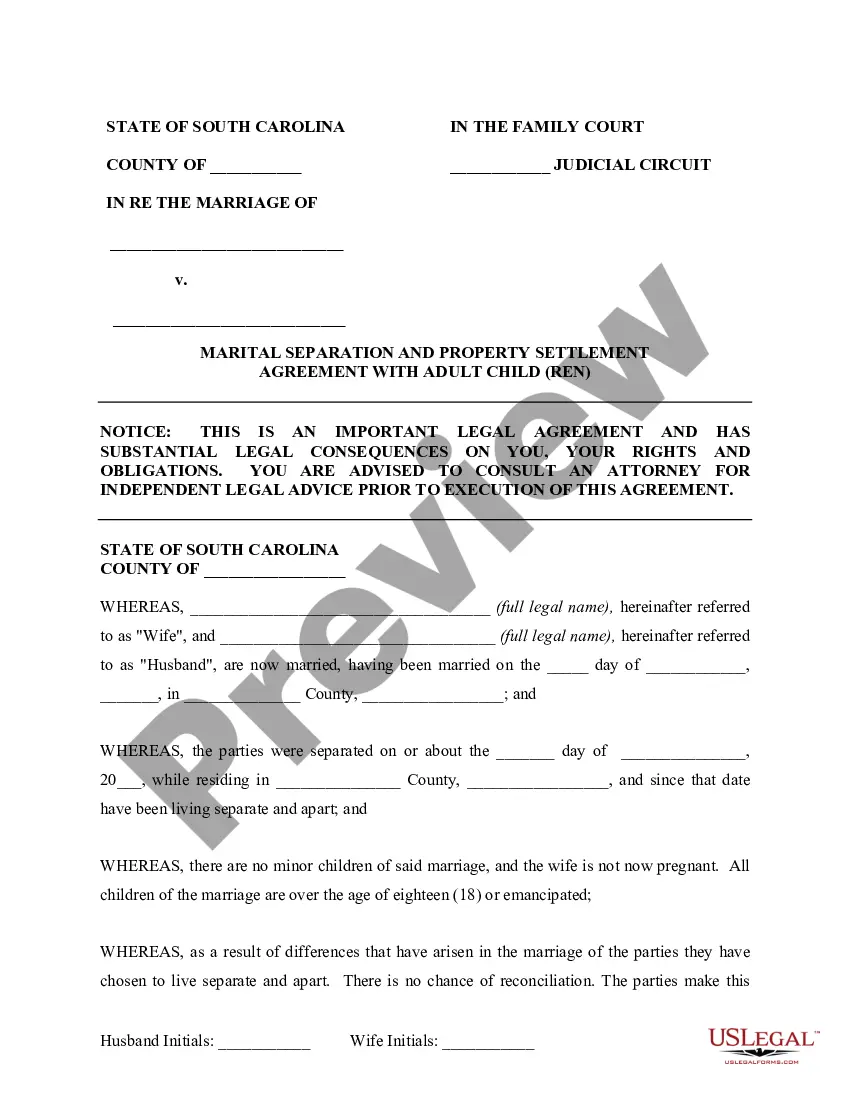

South Carolina Separation Agreement Template For Divorce

Description

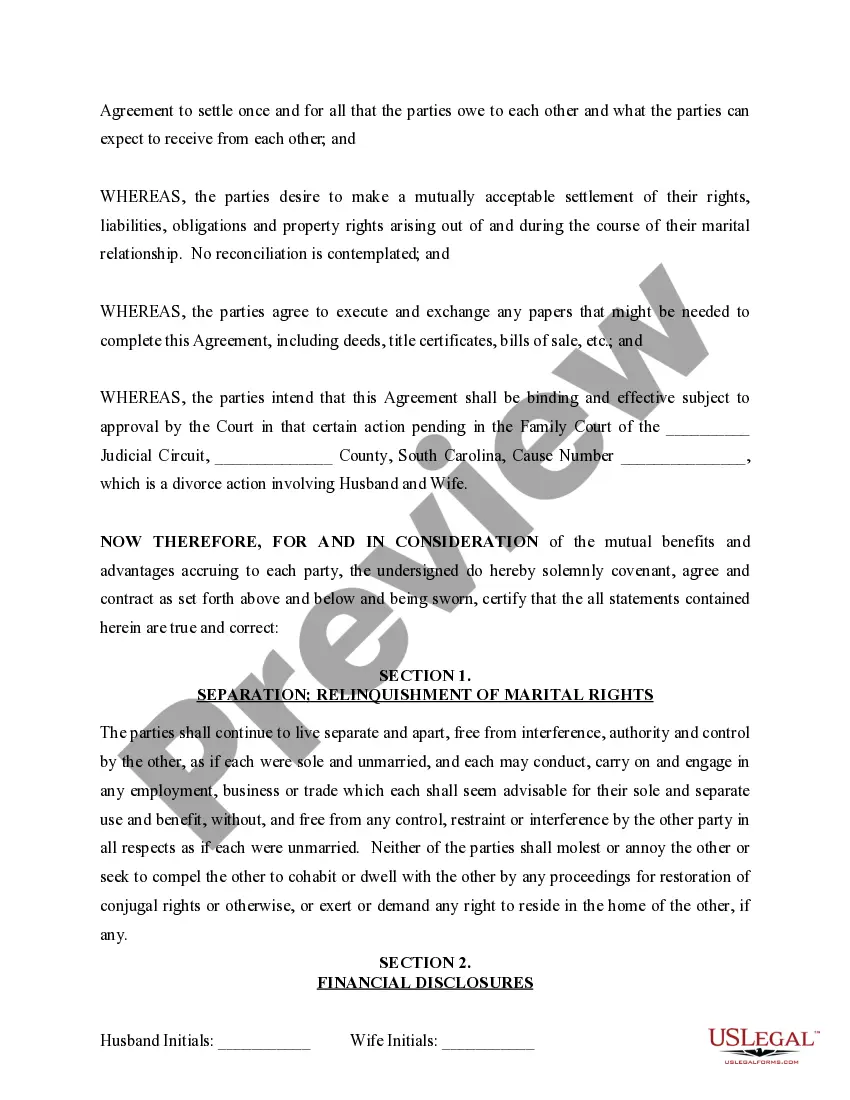

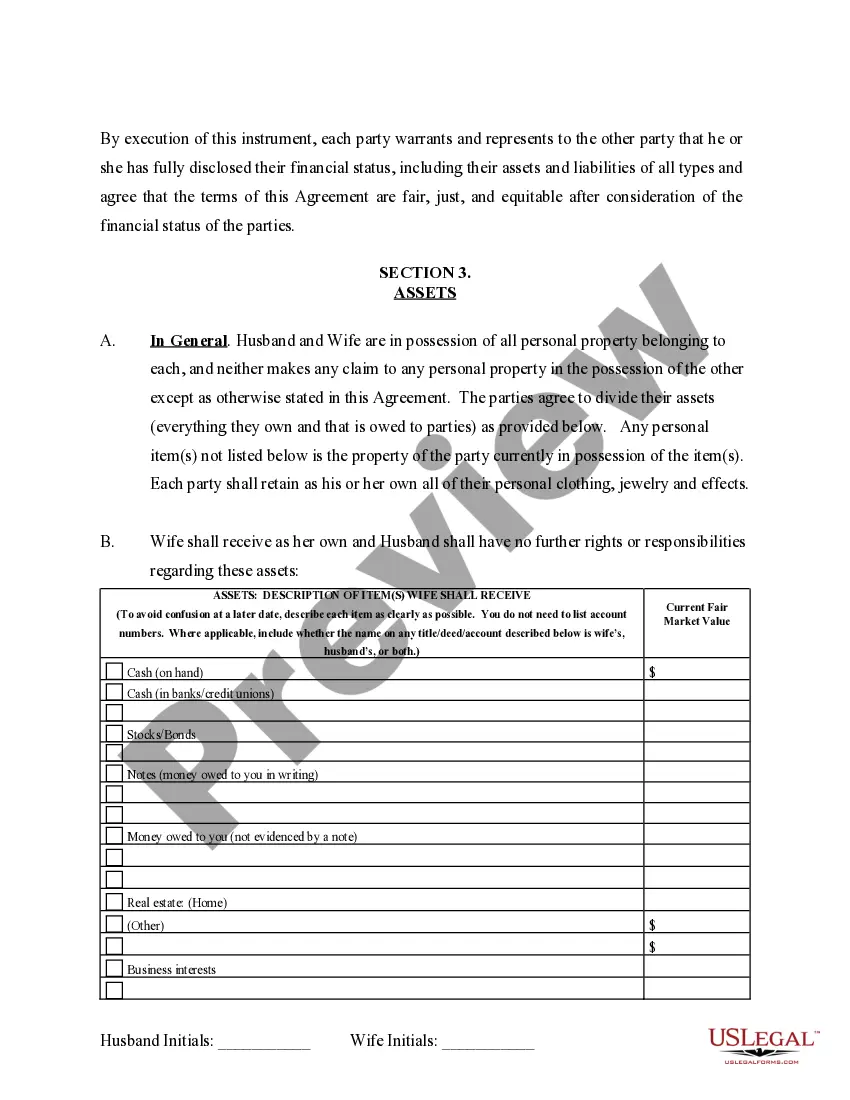

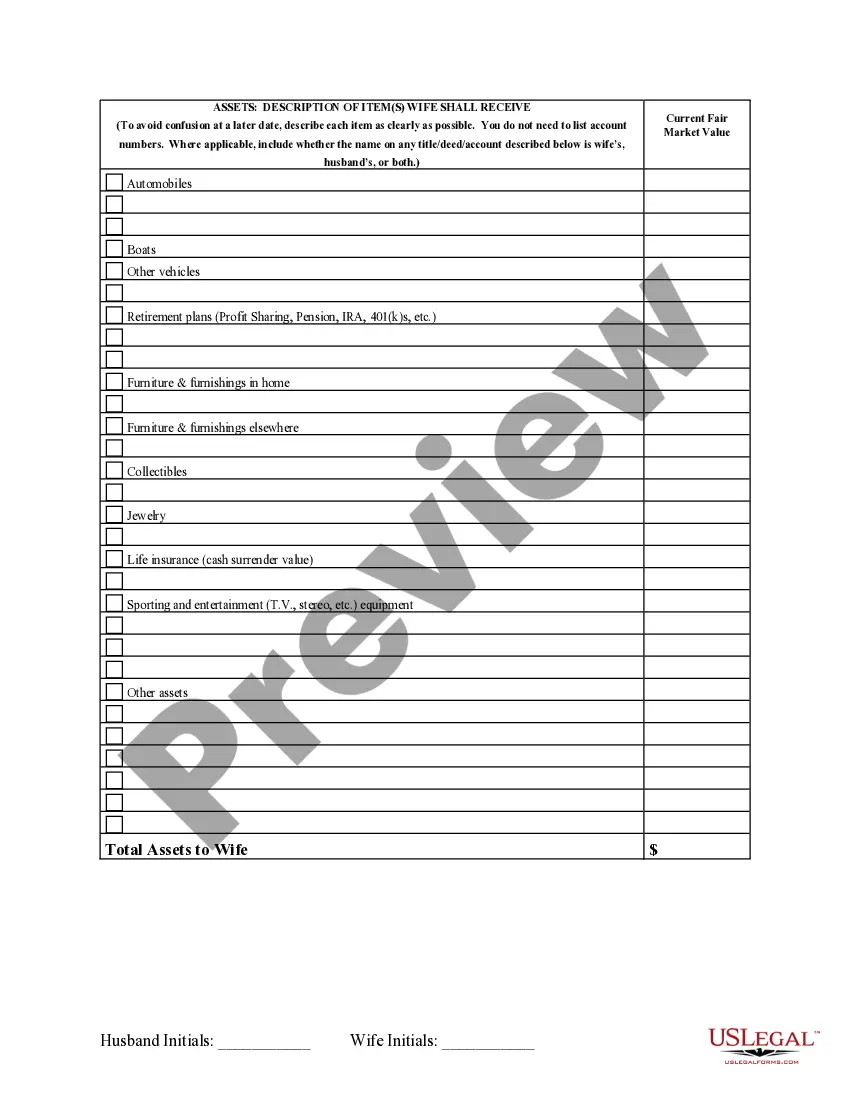

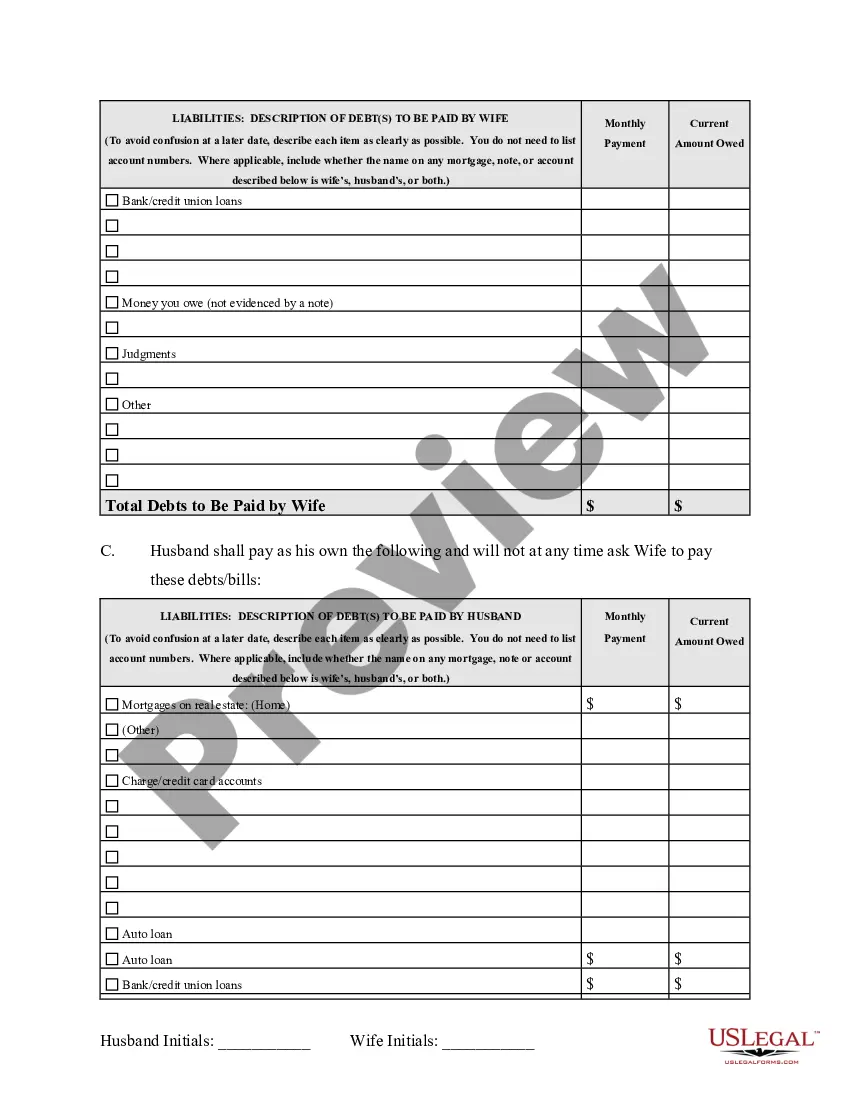

How to fill out South Carolina Marital Domestic Separation And Property Settlement Agreement Adult Children?

Managing legal documents and procedures can be a lengthy addition to your day.

South Carolina Separation Agreement Template for Divorce and similar forms typically necessitate you to seek them out and figure out how to fill them out correctly.

For this reason, whether you are addressing financial, legal, or personal issues, utilizing a comprehensive and efficient online repository of forms will greatly assist you.

US Legal Forms stands as the leading online resource for legal templates, featuring more than 85,000 state-specific documents and various tools to expedite the completion of your paperwork.

Is it your first time using US Legal Forms? Register and create your account in a few moments to gain access to the form library and South Carolina Separation Agreement Template for Divorce. Then, follow the steps outlined below to finalize your document.

- Browse the collection of relevant documents available to you with just a click.

- US Legal Forms provides you with state- and county-specific forms available for download at any time.

- Secure your document management processes with a reliable service that enables you to generate any form within minutes without any extra or concealed fees.

- Simply Log In to your account, find South Carolina Separation Agreement Template for Divorce, and obtain it instantly from the My documents section.

- You can also access previously saved documents.

Form popularity

FAQ

A Utah Tax Power of Attorney (Form TC-737) is a required submission when you seek to hire a professional tax accountant or attorney and allow this entity to directly represent your interests with the Utah Tax Commission.

Executing a power of attorney under Utah law The power of attorney document must be signed by the principal before a notary public.

You can write a POA in two forms: general or limited. A general power of attorney allows the agent to make a wide range of decisions. This is your best option if you want to maximize the person's freedom to handle your assets and manage your care.

A power of attorney shall be signed by the principal or in the principal's conscious presence by another individual directed by the principal to sign the principal's name on the power of attorney before a notary public or other individual authorized by the law to take acknowledgments.

Durable Power of Attorney This is the most common type of POA?it gives your agent the power to make decisions relative to some issues if you are incapacitated. It also empowers your agent to act on your behalf in legal matters and other vital matters during a time when you can't be present.

One major downfall of a POA is the agent may act in ways or do things that the principal had not intended. There is no direct oversight of the agent's activities by anyone other than you, the principal. This can lend a hand to situations such as elder financial abuse and/or fraud.

New York's new POA law requires that the principal's signature be notarized in addition to the POA being signed with two witnesses present (note that the notary can be one of your witnesses). New York's old power of attorney law also required POAs to be notarized, but didn't require them to be witnessed.

This person is called your "agent" or "attorney-in-fact." In order to make sure that this person can act on your behalf if you become incapacitated, you need to make sure that the power of attorney is a "durable" power of attorney. Otherwise, a power of attorney ends if you become incapacitated.